Enterprise Products Partners: 25% Discounted From Graham P/E

Summary

- Midstream stocks face unique risks and are not suitable for every investor.

- The thesis here is to argue that Enterprise Products Partners L.P. is the least risky member in the midstream sector according to the guidelines developed by Benjamin Graham.

- It meets all the criteria that Benjamin Graham developed for picking defensive stocks.

- Furthermore, Enterprise Products Partners L.P. is currently trading at a P/E multiple that is about 25% discounted from the Benjamin Graham P/E.

- I do much more than just articles at Envision Early Retirement: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Pavel Muravev

Thesis

Recently, both the energy sector and crude oil prices have witnessed large fluctuations. And such large fluctuations create good entry points for investors seeking some exposure to the midstream sector. Note that my overall impression is that this sector industry is not suitable for every investor given its sensitivity to commodity prices and geopolitical risks. However, the thesis here is that Enterprise Products Partners L.P. (NYSE:EPD) is the least risky member in the midstream sector in my view.

Actually, I would go a step further to argue that Benjamin Graham would share the same view. And in the rest of this article, I will analyze EPD against the checklist that Benjamin Graham developed for picking "defensive stocks." This checklist is detailed in his classic entitled The Intelligent Investor and also detailed in our earlier article. A brief recap is provided here for ease of reference.

- Is the company large, prominent, and conservatively financed? The specific metrics to look for are stable financial strength, consistent capital structure, and a long record of continuous dividend payments.

- Especially the dividend record. Graham emphasized countless times the importance of dividend records - for good reasons. In his own words, he thinks "a record of continuous dividend payments for the last 20 years or more is an important plus factor in the company's quality rating".

- Has the company demonstrated an adequate level of Earnings Growth in the past? For defensive investors, growth is not the key and "adequate" is enough. In Graham's mind, a minimum increase of at least one-third in per-share earnings in the past ten years is adequate enough.

- Finally, are the valuation multiples moderate? As a value investor to the core, he also recommended a series of methods for investors to gauge the price they should pay. And also, being fully aware of the uncertainties in his own method, he emphasized that you should always leave a safe margin of safety.

The remainder of this article will explain why I view Enterprise Products Partners L.P. as a large, prominent, conservatively financed company with a superb dividend record (it is a dividend champ). I will also explain why EPD has a good growth prospect and its valuation is discounted by about 25% from the Graham P/E.

EPD: A large, prominent, and conservatively financed company

There is little need to analyze Enterprise Products Partners L.P.'s prominence and leading position in the midstream sector. Its key assets include an extended network of 50,000 miles of pipelines and 260 MMBbls of storage capacity for liquids and 14 Bcf for natural gas. It is an indispensable part of our country's, or even the world's, energy infrastructure.

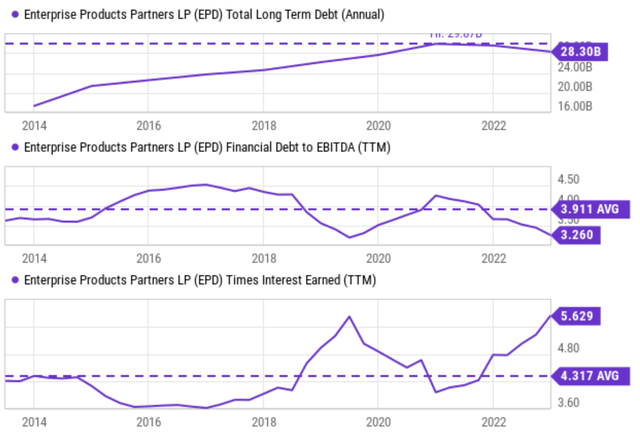

Its financial strength is worth a bit more scrutiny, especially for investors new to midstream stocks (or more precisely units), who might be concerned about its debt level (see the top panel of the chart below). Indeed, its debt has been increasing over the years and now hovers around a high level of $28B.

However, a bit more context would be helpful here. First, midstream companies are typically more leveraged than the overall economy. Second, in the midstream sector, EPD has maintained one of the most stable and strong financial positions the way I see things, as evidenced by the mid and bottom panels of the following chart.

To wit, the mid panel shows its debt/EBITDA ratio. As seen, the ratio currently sits around 3.26x, close to the lowest level in the past 10 years and far below its average of 3.9x. To further evaluate its ability to service its debt, the bottom panel shows its interest coverage. As seen, its interest coverage ratio hovers around 5.6x, the highest level in a decade. Interest coverage of 5.6x means that EPD only needs about 17% of its earnings to service its debt, a quite conservative level both in absolute and relative terms.

EPD: Does it have a strong dividend track record?

The answer is a definitive Yes. Enterprise Products Partners L.P. is a member of the dividend champion club (those who have consistently increased their dividend payout for at least 25 consecutive years). So its record is even stronger than Graham's requirement for "a record of continuous dividend payments for the last 20 years."

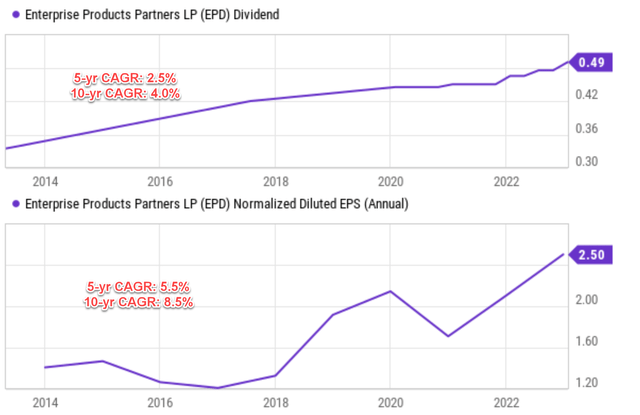

More specially, as shown in the top panel of the chart below, in the past decade, its dividend payouts have grown at a CAGR of 4.0%. And even in the past 5 years, most of which oil prices stayed near historical bottom levels, EPD has maintained a dividend increase of 2.5% CAGR. Its EPS growth rates are even more impressive, as seen in the bottom panel of the chart. To wit, its EPS has grown at a CAGR of 8.5% over the past 10 years and 5.5% in the past 5 years.

As previously mentioned, one of Graham's mandates is that a defensive stock should be able to grow its earnings by at least a one-third over a 10-year period. This requirement translates into a CAGR of about 2.89%. My overall assessment is that EPD's historical growth, whether measured by dividends or EPS, easily meets this requirement.

Next, I will move on to its future growth and valuation.

Source: author based on Seeking Alpha data.

EPD: Future growth and valuation

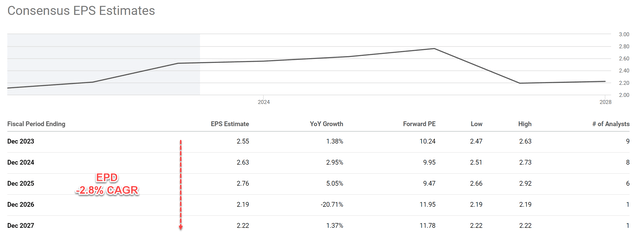

Looking ahead, consensus estimates project a decline in its EPS over the next few years (from $2.55 in 2023 to $2.22 in 2027, translating into an annual growth rate of -2.8%). In my opinion, these estimates are overly pessimistic considering the growth catalysts and EPD's proven track record of historical growth as just mentioned above.

I view the Enterprise Products Partners L.P. business model to be robust and well-diversified. EPD is not only the largest, but also the most diversified, MLP the way I see things. The partnership is involved in about every segment of the energy market. Moreover, it also doesn't operate in just one or two regions, as it is involved in just about every major domestic shale play. This leaves the partnership less vulnerable to any issues that could arise in a specific area or a segment of the energy market. In the meantime, I also expect its natural gas liquid ("NGL") exports to remain robust as the Russian/Ukraine war continues and Europe has to reduce its imports from Russia.

All told, I am expecting the EPS growth to at least keep pace with inflation, say 2.5%. Actually, as argued in my earlier article, I expect its long-term growth rates to be about ~4% based on a return on capital employed near 15%, a reinvestment rate near 10%, and an inflation escalator of about 2.5%.

Source: author based on Seeking Alpha data.

Now onto valuation, as also mentioned earlier,

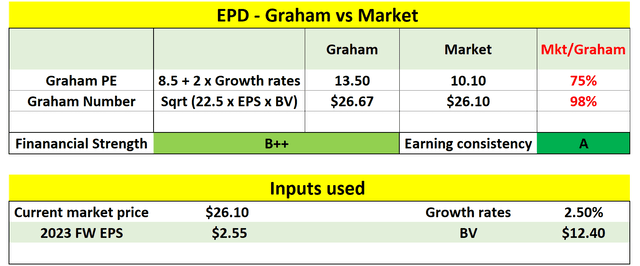

As a value investor, Graham recommended investors to always gauge the price they should pay and leave a margin of safety. He recommended the P/E for a defensive stock should be around 8.5 plus twice the expected annual growth rate, which I call the Graham P/E.

As seen in the table below, even assuming a 2.5% growth rate, the Graham PE/ would be 13.50x (which equals 8.5 + 2 * 2.5). Compared to its market P/E of 10.1x, its market valuation is still about 25% discounted from the Graham P/E.

Source: author based on Seeking Alpha data.

Risks and final thoughts

Investment in Enterprise Products Partners L.P. entails risks. I've mentioned a few of them earlier (sensitivity to commodity prices and geopolitical risks). It also faces regulatory risks and interest rate uncertainties. These risks have been discussed in other Seeking Alpha articles extensively already (including my own earlier articles). As such, here I would just focus on one of the risks that is more specific to the analysis in this article: its valuation uncertainty. Graham himself is very conscious of the valuation uncertainties in his P/E estimate above). To gauge such uncertainties, he recommended cross-checking by other methods. For example, another method he developed, the so-called Graham Number, provides another valuation method based on different financial data (the book value).

In general, Graham cautions against paying a price of more than 15x times earnings or more than 1.5x times the book value ("BV"). However, a PE multiple above 15x could be justified if the P/BV ratio is lower than 1.5x. And vice versa. And as a result, the Graham number considers both the 15x PE limit and the 1.5x P/BV limit. More specifically, the Graham number is the square root of A) 22.5 (which equals 15 times 1.5), B) the EPS, and C) the book value.

My estimate of the Graham number for EPD is shown in the table above too. As seen, the Graham number for Enterprise Products Partners L.P. turned out to be about $26.7 based on its most recent book value data, only about 2% discount from its market price.

To conclude, the energy sector, especially the midstream sub-sector, offers unique opportunities and risks. And investment in this sector is definitely not suitable for every investor, especially those who are more conservative. The thesis here is that Enterprise Products Partners L.P. is the least risky member in this sector. It meets all the criteria that Benjamin Graham listed for a defensive stock. And it is currently valued at a discount, although bear in mind that the amount of the discount involves some uncertainties.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.

This article was written by

** Disclosure: I am associated with Sensor Unlimited.

** Master of Science, 2004, Stanford University, Stanford, CA

Department of Management Science and Engineering, with concentration in quantitative investment

** PhD, 2006, Stanford University, Stanford, CA

Department of Mechanical Engineering, with concentration in advanced and renewable energy solutions

** 15 years of investment management experiences

Since 2006, have been actively analyzing stocks and the overall market, managing various portfolios and accounts and providing investment counseling to many relatives and friends.

** Diverse background and holistic approach

Combined with Sensor Unlimited, we provide more than 3 decades of hands-on experience in high-tech R&D and consulting, housing market, credit market, and actual portfolio management. We monitor several asset classes for tactical opportunities. Examples include less-covered stocks ideas (such as our past holdings like CRUS and FL), the credit and REIT market, short-term and long-term bond trade opportunities, and gold-silver trade opportunities.

I also take a holistic view and watch out on aspects (both dangers and opportunities) often neglected – such as tax considerations (always a large chunk of return), fitness with the rest of holdings (no holding is good or bad until it is examined under the context of what we already hold), and allocation across asset classes.

Above all, like many SA readers and writers, I am a curious investor – I look forward to constantly learn, re-learn, and de-learn with this wonderful community.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.