East 72 - SBM: A Unique Investment In The Ultra-Rich With Operating Leverage And Growth

Summary

- Societe des Bains de Mer et du Cercle des Etrangers a Monaco SA (SBM) is a unique global investment.

- SBM has made two significant capital gains – over €680million - from backing early-stage gaming entrepreneurs and concepts.

- We have looked at SBM on a sum of the parts basis but in a different way to ascertain at prevailing share prices what we are paying for earnings from luxury rental accommodation.

- We believe at the prevailing share price of €91.80, we are paying below 6x forecast FY23 EV/EBITDA for the residential and commercial portfolio.

OK_Gaffer/iStock via Getty Images

The following segment was excerpted from this fund letter.

Société Anonyme des Bains de Mer et du Cercle des Étrangers à Monaco (BMRMF)

Watch any old footage of the Monaco F1 Grand Prix – the blue-riband event since 1955[1] on the world’s biggest travelling circus[2] – and you see signage for “SBM Monte Carlo”. Unless you have been to the Principality, the world’s second smallest country, you may wonder what SBM actually is. Well, it’s effectively the country.

SBM – Societe des Bains de Mer et du Cercle des Etrangers a Monaco SA[3] is a unique global investment since it encapsulates the key activities of a country with an area of only 2. 1sq.kilometres and a population of 38,000 – making it the world’s most densely populated. The key activities: renting (living), partying and gaming. Yet with some irony, it is an investment made by SBM outside of Monaco, partly crystallized in June 2022, which has placed SBM in an even more advantageous position.

Before advancing further, it needs to be acknowledged that there are no broker reports on SBM and only two detailed reports (with one update) published on the company by “Undervalued Shares” and its author, Swen Lorenz[4]. I am a subscriber and have access to the reports which I have used as valuable background, and have tried manfully not to plagiarize Swen’s fantastic work which provides a brilliant background to the company’s history.

SBM is controlled by the Monegasque Government and its ruling family, the Grimaldi family, who hold 64.2% of the capital (and votes). However, the company has “absence of concerted action” pledges from two 5% shareholders both of whom acquired shares from the State of Monaco after the State’s underwriting of the March 2015 rights issue: LVMH and Galaxy Entertainment, a listed Macau based casino owner.

A further 5% of the shares – not subject to restriction - are owned by SCI Esperanza, who crossed that threshold in September 2020. This company is controlled by J.B Pastor et Fils, who own 15 property businesses in Monaco [5] and whose matriarch – the richest woman in Monaco - was murdered in 2014[6][7]. So SBM is a double rarity – you will rarely find assets of this quality in one company, but just under 80% of the shares are tied up in the hands of four holders who either have concert party agreements or who are unlikely sellers. With 24.517million shares on issue at a current price of €91.80/share, SBM has an equity capitalization of €2.25billion of which only €450m is in the public domain. At 30 September 2022, SBM has net cash of €445million plus a single stock investment currently priced at €404million. Hence, SBM has an enterprise value of only €1.4billion – before adjustments for working capital – which seems inherently cheap against such a special real asset base.

The history of SBM dates back to 1863 and its foundation by sovereign order to Francois Blanc to “exploit the rights and privileges granted by: the Ordinance of HSH the Prince of Monaco of April 2, 1863…(and various amendments)7” – in other words, gambling rights in the Principality and the associated activities.

Reflecting the boom-and-bust periods of the first half of the twentieth century, SBM (and Monaco) went through various ups and downs, but by the early 1950’s had lost its glamour and the various properties and facilities were not being properly maintained. The Greek shipping magnate, Aristotle Onassis arrived in Monaco in 1951 to establish part of his shipping empire in the Principality. He discovered SBM was a public company, with no controlling shareholder and trading at a significant discount to his evaluation. Onassis used 48 different shell companies based in tax havens and by 1953 had over one third of the shares, eventually growing to 52% by 1966.

Initially friendly, Onassis and Prince Rainier III eventually fell out over their differing visions for the SBM businesses – Onassis to retain them as exclusive, Rainier to expand to combat a boycott of Monaco by then French President deGaulle, based around Monaco’s tax haven status.

The solution to this conflict can still be seen in SBM corporate documentation today, with part of the share capital being 6,000,000 shares “belonging to the Monegasque State, inalienable under Monegasque Law #807 of June 23, 1966”[8] These are the 600,000 shares (after a 10:1 stock split) issued – when the capital was still only 1.2million shares as it had been for decades - to be permanently held by the state to dilute Onassis down to ~30%. Onassis sold his shares to the state in 1967.

With accommodative bankers, including the Monegasque Government and two significant gaming related capital gains, it is stunning that SBM has only raised new capital once since World War II: a 7-20 rights issue in March 2015 to raise €220million (6.356m new shares at €34.60/share) underwritten by the State of Monaco, who sold a part of the shortfall in LVMH and Galaxy, but with “concert party” restrictions. This is despite some hefty capital expenditures on the assorted properties and new builds (below).

Two big Wynns in gaming

SBM has made two significant capital gains – over €680million - from backing early-stage gaming entrepreneurs and concepts. In June 2003, SBM subscribed US$45million for 3million shares of Wynns, the (then) new venture of Steve Wynn, with a view to investigating gaming opportunities in Monaco. These opportunities amounted to nothing; however, SBM progressively sold the Wynns shares carefully over a nine-year period and racked up a capital gain of at least €220million (as well as dividends) with stock sales as high as ten times their entry price to recoup upwards of €280million on a €38m investment.

More problematic, since the Wynns shares had already doubled within a year of entry, was the initial €70m investment in Betclic (then Mangas), initiated in May 2009 alongside Stephane Courbit. Betclic became the largest on-line gaming/sports betting company in France. Alongside this, Courbit also founded Banijay, the production company, with high quality outside investment from Exor and Groupe Arnault amongst others. Not many better partners to have.

SBM was forced to subscribe to additional capital and guarantee (plus make loans) to Betclic, notably around 2012. In one of the few successful SPAC deals, the merged Betclic/Banijay – called FL Entertainment – raised €250m of new money via a PIPE arrangement, and listed FL Entertainment on the Amsterdam exchange in July 2022.

In total, we believe SBM invested some €240m in Betclic – which it substantially impaired until Betclic started to make intermittent profits round 2015. By end FY2022 (March 2022), the value in SBM’s books was only around €18million, having taken a dividend (€45m) and stock sale (€54m) in cash in FY2022

On completion of the SPAC deal, SBM’s investment in FL Entertainment was valued at €850million enabling them to take €425m in cash off the table, making SBM net cash positive and retaining 42.5m shares of FL Entertainment at €10 – the IPO price. FLE currently trades at ~ €9.50/share.

The SBM Businesses

Other than the cash and investments (see valuation table) SBM is made up of three businesses:

- Rental with rental income from the ownership of shops and offices (commercial) together with extremely high-end residential complexes, notably Sporting (24 apartments), Balmoral (7 apartments) and One Monte-Carlo (42 residences) plus other incidental properties.

- Gaming via operating Casino de Monte-Carlo under a long term licensing and leasehold agreement which currently expires in 2027; the lease has previously been renewed and there is no reason to believe it will not be once more, but in the event it is not, the building reverts back to the Government for zero cost; SBM also operates Café de Paris Monte Carlo which is predominantly a venue for EGM’s (420 out of SBM’s 566); and

- Hospitality through ownership of five hotels encompassing 1,254 rooms if fully available; together with 25 restaurants and bars within Monaco including four with Michelin stars and ancillary activities mainly within the hotel group.

One of the attractions of SBM shares is the fact that two massive pools of capital expenditure have been made in recent times, from which shareholders now benefit, and which have effectively been financed by two spectacular investments in the gaming sector, one of which is only partly realized. SBM spent €284million on a “deep” refurbishment of Hotel de Paris, the flagship 202 room property in Casino Square over the six years to 2020; this was followed by the €395m development of One Monte-Carlo which is a game changer for the whole group.

Rental

Most assessments of SBM would put gaming up the top; it is famous and easily visible. However, the real story of SBM in recent years is the growth in the rental portfolio to provide the underpinning of the asset value within SBM. More potently, it has been the engine of profit growth – even through COVID – due to the completion of new complexes, notably the six One Monte-Carlo buildings. Rental represents the real difference between the SBM of ((say)) ten years ago, with a revenue base in that business of €25million per annum and today – approaching €130million – 19%pa compound growth. The new buildings comprise both commercial and residential arrangements providing growth for both.

SBM’s main residential buildings in Monaco are:

Sporting | 2005 | 4,037m2 | 24 rental apartments, 57 car spots, 25 cellars |

Balmoral | 2012 | 2,596m2 | 7 apartments, 26 car spots, 8 cellars |

Sporting Villas | 2015 | 3 villas with private swimming pools | |

One Monte-Carlo | 2019 | 37 apartments, 6 triplexes, 350 car spots, nine floors offices, 24 retail outlets |

Sporting generates an average rent of €1,600/m2 (excluding taxes and charges which add a further ~40% to tenant costs!) so a 66m2 studio would cost around €2,200 a week to rent (€9,500 per month). Larger apartments in the vicinity of Casino Square – with 2 bedrooms rent at €13,000 per month (+charges).

Larger apartments in the One Monte-Carlo are on a different planet, given the exceptional location. They rent at ~€3,420/m2 per annum, or €150,000 per month (including parking space!)

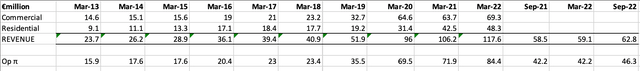

One Monte-Carlo has been the game-changer for SBM given it contains 13,000m2 of residential space together with the retail and commercial space. The table below of the rental business over ten years shows clearly the jump in revenue and high margin profits through the past three years since On Monte-Carlo opened:

What would you pay for a property portfolio let to the ultra-rich, with legal [9] and space constraints? We believe at prevailing prices it is below €900million or <6x EV/EBITDA.

Gaming

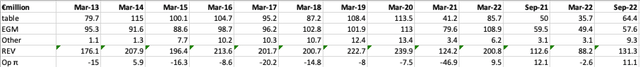

It may be glamourous, but the gaming business is NOT the money-spinner it would be perceived from the outside. Operating profits and revenues for the gaming business are shown for the past 10 full years and recent half in the table below

The impact of COVID is obvious to see with the 2021 loss including a €7m closure provision for Sun Casino. The casino has suffered from significant volatility in its table games with occasional materially adverse runs against the house (SBM does not publish “theoreticals” unlike Australian listed casino stocks).

The casino is also very seasonal – like the hospitality sector with the summer April to September period significantly outstripping the cooler months; it also includes the Grand Prix (usually May). The EGM’s have an average turnover of €204k per annum which is in line with those in Australian gaming areas[10] but appear to be less profitable.

To attempt to value the casino operations, we have the benefit of a recent corporate acquisition in the global sector being that of Crown Limited, based in Melbourne by Blackstone in May 2022 for A$8.9billion (€5.9billion) equity value. Crown was an amalgam of three sets of casino + hotel + entertainment properties in Melbourne, Perth and Sydney which required the Independent Expert (Grant Samuel) opining on the Scheme of Arrangement[11] to conduct a detailed sum of the parts assessment. Crown holds 2,628 EGM’s (4.6 times that of SBM) and 540 tables (>6x that of SBM’s 86 in the two operating casinos).

In trying to value the two casino operations, it is material that as with certain of the Las Vegas casinos, Casino de Monte-Carlo effectively operates on a “lease” basis rather than physical ownership of the building, whereas Café de Paris is owned by SBM. Valuations for casino operators with lease type obligations are much lower than those who own the underlying property.

Based on EV/EBITDA multiples of ~7x and assuming a recovery in earnings plus a renewal in 2027, the casino operations (excluding the Café de Paris property) could be valued at just over €100million. Surprisingly low.

Hospitality

There are 8 high-end hotels in Monaco, of which SBM owns 4 as follows:

Hotel de Paris (208 rooms); Hermitage (277) Monte Carlo Beach (40); Monte Carlo Bay Resort (332) and Le Meridien Beach (managed - 397)

SBM do not provide occupancy statistics on a half year basis but it is quite clear from the first six months of FY23 that occupancy has been extremely high in tandem with vastly higher prices; prorating the H1 FY23 accommodation revenues suggests revenue per night of ~€515 across the portfolio, against only €211 on a revenue per available (rather than occupied) room in FY22. In tandem with increased visitation, catering revenues across the hotels and 25 restaurants exceeded the whole of FY22 in the first six months of FY23. Ancillary revenues – laundry etc. – also rose in proportion to nearly match FY22 in the first six months of FY23.

We are well aware that hotel economics just reflects an aircraft bolted to the ground with double leverage of occupancy and price. The other common issue is the need for renewal and refurbishment, which in SBM’s portfolio, given the required standards of opulence, is not a discretionary item. One of the major attractions for SBM is the level of depreciation charged off (~€80million per annum) of which half is in the hospitality sector.

In the Crown documentation, the independent expert valued the hotel/resort properties at an average of just over 10x EV/EBITDA with a premium for the immature Sydney property[12]

Applying this multiple to annual EBITDA in the area of €80m – allowing for improvement as well as seasonality would provide a valuation of ~€800m for the portfolio. That appears too low given the premium and oligopoly aspects of the portfolio of premises. In any event, as discussed, the Hotel de Paris was refurbished for€240m and the construction cost for Monte Carlo Bay (on reclaimed land) was over €200m twenty years ago. In many cases, the properties have other development potential with some adjacent land, which we note in the rental sector, provides a massive uplift in value versus construction costs.

Hence, we view a 15x EV/EBITDA multiple to be more appropriate and value the division at €1150m.

Valuation analysis

We have looked at SBM on a sum of the parts basis but in a different way to ascertain at prevailing share prices what we are paying for earnings from luxury rental accommodation, given its sale value is the most difficult comparable of the divisions. We believe at the prevailing share price of €91.80, we are paying below 6x forecast FY23 (to 31 March 2023 so just ended) EV/EBITDA for the residential and commercial portfolio as follows:

Asset/area | €million |

Equity capitalization: 24.517m at €91.80 | €2,251 |

Cash | (569) |

FL Entertainment shares (42.5m at €9) | (404) |

Working capital ((net)) | 297 |

Debt | 124 |

Casino | (100) |

Hospitality | (1,150) |

Capitalized group overhead (12x EBIT charge of $37million pa) | 444 |

IMPLIED VALUE OF PROPERTY | 893 |

Forecast EBITDA FY23 (includes €23m of depreciation) | 150 |

EV/EBITDA rental portfolio | 5.9x |

If even part way accurate, this analysis suggests significant potential upside on a post-COVID recovery as the rentals are revalued. We view a more appropriate valuation as closer to €150/share for the group.

In this respect, it is noteworthy that in 2008 (fifteen years ago) Qatari Diar (the property arm of Qatar Investment Authority) sought to acquire 30% of SBM at €725/share (€72.50 spilt adjusted) but pulled away when SBM sought to limit the stake to 10%. Given the massive additions to value since that time, an increase in perceived equity value of only ~ 30% seems spartan. Not a word that can be applied in any context within SBM.

DisclaimerThis communication has been prepared by Andrew Brown and East 72 Management Pty Limited (E72M) (ACN 663980541); E72M is Corporate Authorised Representative 001300340 of Westferry Operations Pty Limited (AFSL 302802) of which Andrew Brown is a Responsible Manager. While E72M believes the information contained in this communication is based on reliable information, no warranty is given as to its accuracy and persons relying on this information do so at their own risk. E72M and its related companies, their officers, employees, representatives and agents expressly advise that they shall not be liable in any way whatsoever for loss or damage, whether direct, indirect, consequential or otherwise arising out of or in connection with the contents of an/or any omissions from this report except where a liability is made non-excludable by legislation. Any projections contained in this communication are estimates only. Such projections are subject to market influences and contingent upon matters outside the control of E72M and therefore may not be realized in the future. This update is for general information purposes; it does not purport to provide recommendations or advice or opinions in relation to specific investments or securities. It has been prepared without taking account of any person’s objectives, financial situation or needs and because of that, any person should take relevant advice before acting on the commentary. The update is being supplied for information purposes only and not for any other purpose. The update and information contained in it do not constitute a prospectus and do not form part of any offer of, or invitation to apply for securities in any jurisdiction. The information contained in this update is current as at 31 March 2023 or such other dates which are stipulated herein. All statements are based on E72’s best information as at 31 March 2023. This presentation may include forward-looking statements regarding future events. All forward-looking statements are based on the beliefs of E72M management, and reflect their current views with respect to future events. These views are subject to various risks, uncertainties and assumptions which may or may not eventuate. E72M makes no representation nor gives any assurance that these statements will prove to be accurate as future circumstances or events may differ from those which have been anticipated by the Company. |

Footnotes[1] The Monaco GP has been run since 1929 was in the F1 (equivalent) in 1950 but has been on the calendar each year since 1955 [2] The Country That Becomes a Racetrack explains how Monaco is transformed from a country to a racetrack [3] Translates to “The Society of Bathers and Circle of Foreigners in Monaco” [4] Swen has written two major pieces on SBM: in 2004 and August 2019 plus a quick update in September 2022 after the partial Betclic monetization [5] History of the Group - Pastor [7] .3.7.1 Corporate Purpose Page 207 Universal Registration Document 2021/2022 [8] 7.1.1.1 Capital Breakdown Page 204 Universal Registration Document 2021/2022 [9] To be resident in Monaco requires a bank account with minimum €500,000 deposit to be opened, advance rent, one year lease, proof of ability to pay etc. [10] NSW Department of Enterprise, Investment and Trade Gaming machine revenue, compiled by East 72 assuming 15% return to player. [11] Crown Limited Scheme Booklet 30 March 2022 [12] Crown Limited Scheme Booklet 30 March 2022 p183-184 |

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.