Crocs: Is It Still Worth Buying The Stock After The Run Up?

Summary

- In 2022, Crocs' profitability and efficiency, along with its liquidity, deteriorated.

- Macroeconomic headwinds, including elevated inflation, low consumer confidence and volatile energy prices, along with the acquisition of HEYDUDE have all contributed to this deterioration.

- While Crocs' profitability is still relatively high, and the deleveraging efforts are progressing as planned, we are turning more cautious on the stock at the current price.

- We downgrade our rating to "hold".

morgan23

Crocs, Inc., (NASDAQ:CROX) together with its subsidiaries, designs, develops, manufactures, markets, and distributes casual lifestyle footwear and accessories for men, women, and children worldwide.

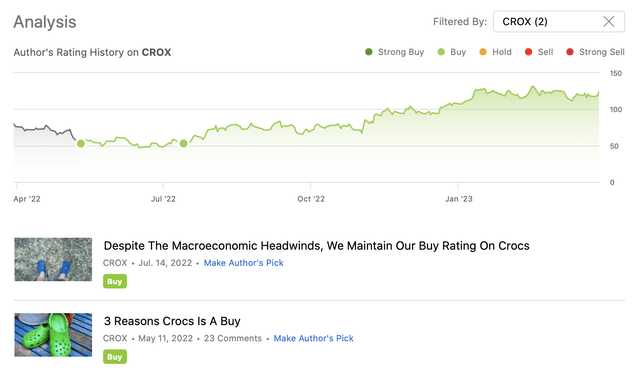

Last year, we published two articles on Crocs on Seeking Alpha, rating CROX stock as a "buy" both times.

Analysis history (Author)

Since our writings, the stock price has more than doubled, substantially outperforming the broader market.

Today, we will be looking at the firm from a different angle than in our previous articles. We will be analysing the firm's profitability and efficiency to gauge, whether the stock price after the run up could be still attractive to start a new position, or to add to an existing one.

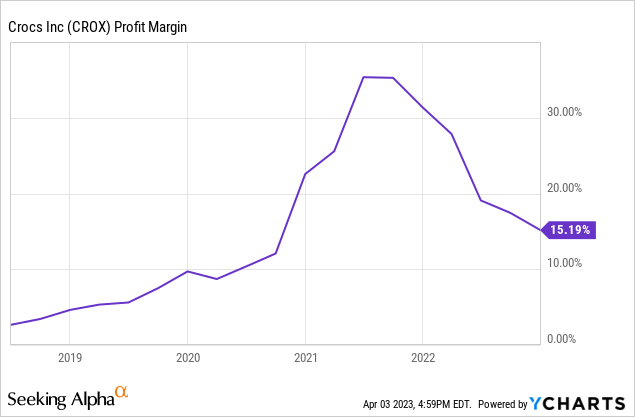

Net profit margin

Net profit margin is a widely used profitability measure. It is essentially the ratio of the net profit and the revenue.

The following chart depicts Crocs' net profit margin over the past 5 years.

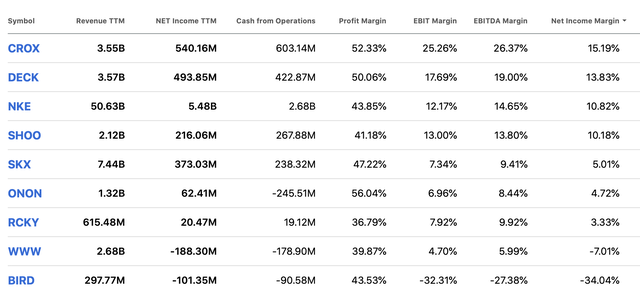

While the company's profit margin is higher than it was in 2019, it has fallen significantly from its highs in 2021. Despite the decline however, Crocs' net profit margin is still one of the best in the industry.

Comparison (Seeking Alpha)

To understand what to expect going forward with regards to the margin development, we have to take a look at several factors.

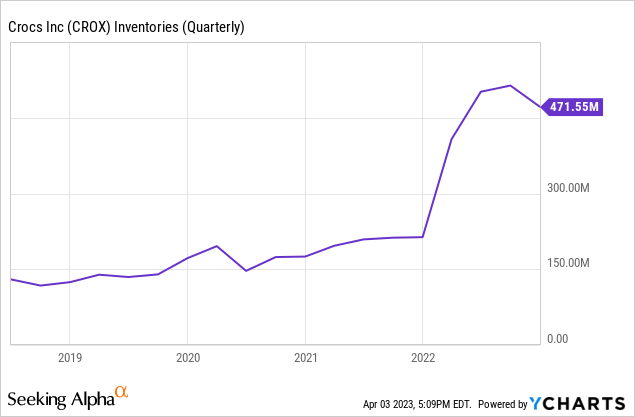

First, inventory levels have skyrocketed in 2022. Before investing in Crocs' business at the current price levels, one needs to understand how much of this increase has been driven by the recently acquired HEYDUDE, and how much has been driven by the macroeconomic headwinds. If the inventory levels are to be reduced, significant discounting may be needed, which could lead to further margin contraction.

In fact, in the latest earnings presentation, management has already referred to the negative impacts of promotional activity on the margins.

[The contraction in the margins] have been driven by ~340 basis points of promotions, 180 basis points of inflationary costs, and ~180 basis points of higher freight and inventory handling costs. Currency negatively impacted gross margin by 70 basis points.

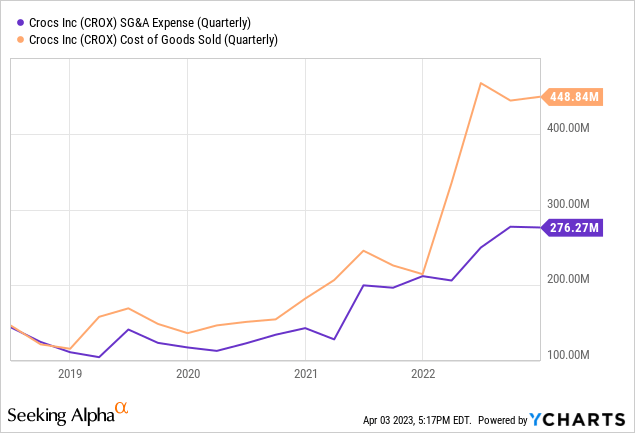

Considering this statement, we also have to highlight how the COGS and the SG&A expenses have changed. Both of these figures have increased dramatically over the past year.

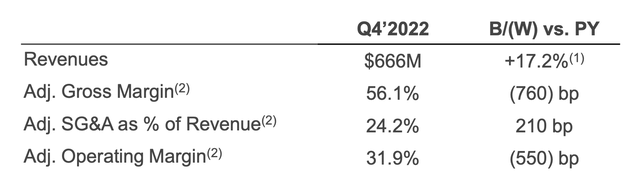

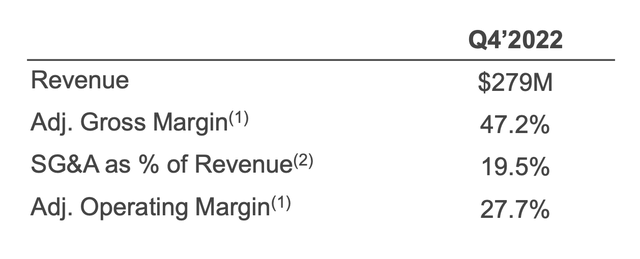

To understand how the HEYDUDE and the Crocs brands compare in terms of revenues and margins, we have to look at the tables below, sourced also from the firm's latest earnings presentation.

Crocs Brand Q4 highlights (CROX)

HEYDUDE Q4 highlights (Crocs)

While HEYDUDE' SG&A expenses as a percentage of revenue is lower than that of Crocs, both its gross margin and operating margin are lower than Crocs'. Meaning that the acquisition, at least for now, is one of the reasons for the overall margin contraction of the business.

Asset turnover

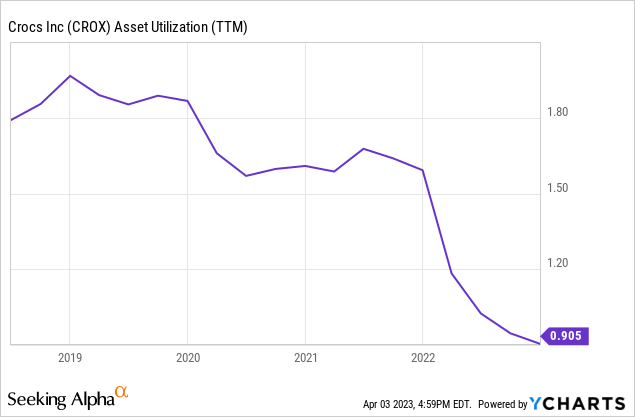

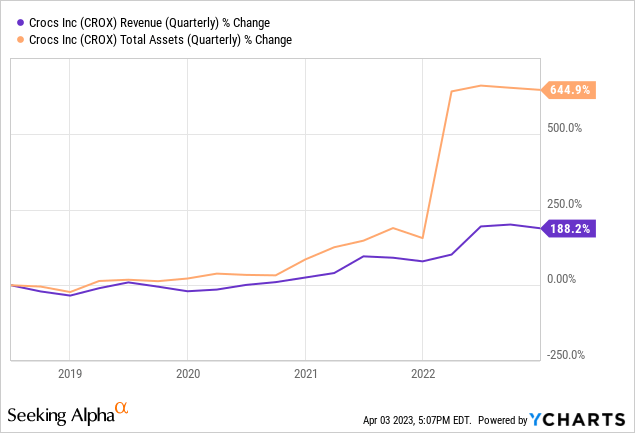

Asset turnover (=asset utilisation) is an efficiency measure. It measures how effectively the firm is using its assets to generate sales. In 2022, this measure has also fallen significantly.

With the acquisition of HEYDUDE, the total assets have dramatically increased, while the growth in sales has been much lower, leading to a declining turnover.

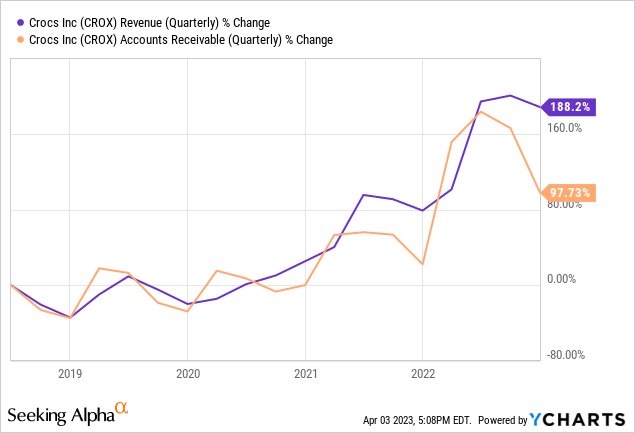

On a positive note, we have to mention, that Crocs does not appear to be manipulating or inflating its sales, by selling on credit. The growth in sales has been substantially higher in the recent quarters than in accounts receivable.

Liquidity and leverage

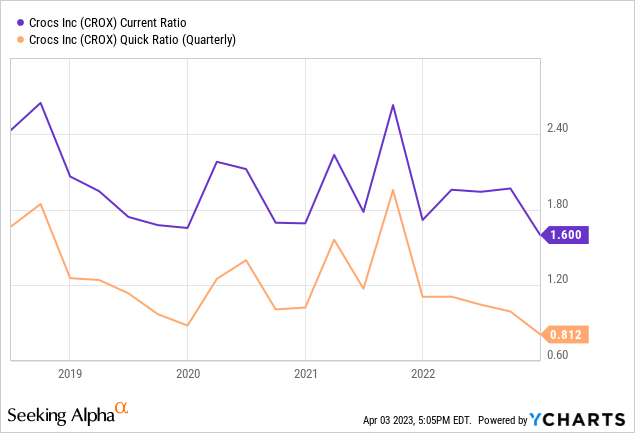

After the acquisition of HEYDUDE, the firm also looks much less attractive from a leverage and liquidity point of view.

First of all, both the current- and the quick ratio have declined, with the latter falling even below 1. A quick ratio below 1 means that the firm's current assets (excluding inventory) are not sufficient to cover the current liabilities, which may not be too appealing for investors in the current market environment. This also reduces the financial flexibility of the firm.

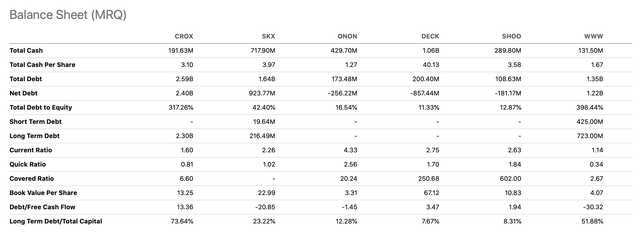

These ratios also compare unfavourably to Crocs' peers. The following table compares selected balance sheet items across 6 firms in the industry.

Comparison (Seeking Alpha)

What is important to highlight however, is that the firm is actively working on deleveraging. They have been focusing on reducing the leverage and they have so far stayed on track with their initiative. They are expected to reach their goal of being below 2.0x gross leverage by mid-2023. Until the goal is reached, the share repurchase program is being put on hold.

Deleveraging (Crocs)

Valuation

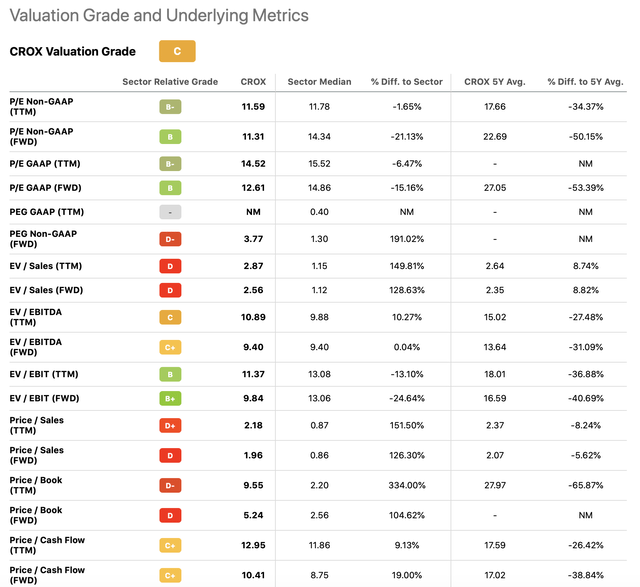

Since our last writing, the stock's valuation has gone up significantly. Currently Crocs is trading in line with/ or even at a premium to the sector median, according to most of the traditional price multiples.

Valuation metrics (Seeking Alpha)

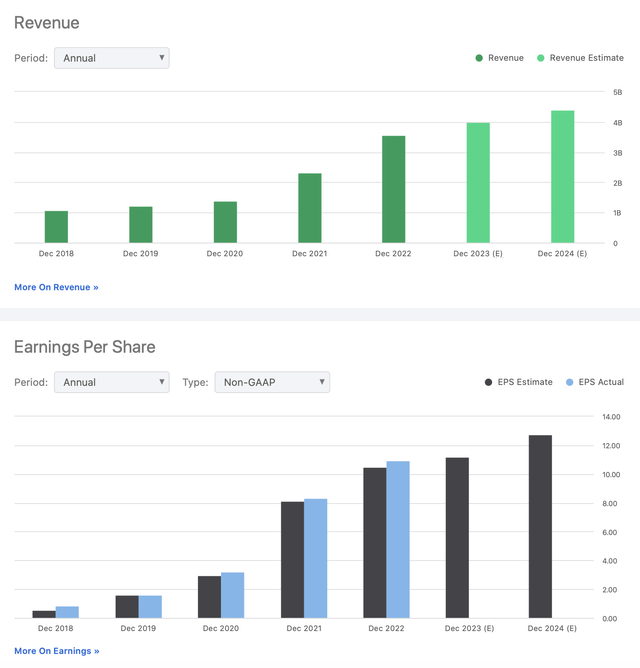

Despite the forecasted sales and EPS growth, we do not believe that the stock at the current share price is a clear buy.

Revenue and EPS estimates (Seeking Alpha)

The continuing macroeconomic headwinds, including volatile energy prices, low consumer confidence levels, elevated inflation, are leading to downward pressure on the margins. The acquisition of HEYDUDE and the associated costs with it are also impacting Crocs negatively for now. Efficiency, profitability and liquidity measures have all deteriorated since our last writing. While the deleveraging is in focus, and the firm is working effectively towards its goal, we would like to see improvement across the other metrics as well to rate the stock as a "buy" once again.

For now, we downgrade the stock to "hold".

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.