Adriatic Metals: One Of Few Outperformers Lately

Summary

- The Vares project continues to be on track for the first production in Q3-23.

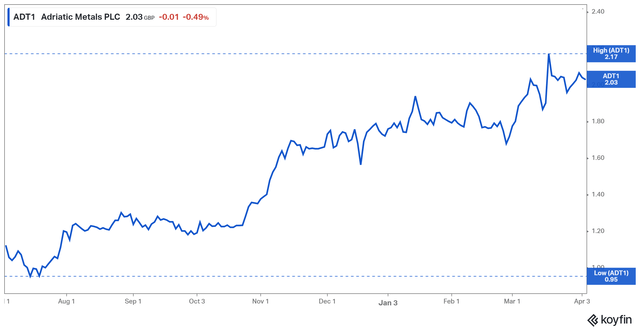

- The stock price has more than doubled from the lows in 2022, which is far better than most comparable mining companies.

- The risk-reward looks relatively attractive despite the recent strong stock price performance.

- Looking for a portfolio of ideas like this one? Members of Off The Beaten Path get exclusive access to our subscriber-only portfolios. Learn More »

Alex Potemkin/E+ via Getty Images

Investment Thesis

Adriatic Metals (OTCPK:ADMLF) is a polymetallic development company, with about 50% of projected revenues coming from precious metals, that is in the process of commissioning its Vares mine in Bosnia and Herzegovina in 2023. The company is listed in Australia, UK, and has an OTC listing in the U.S.

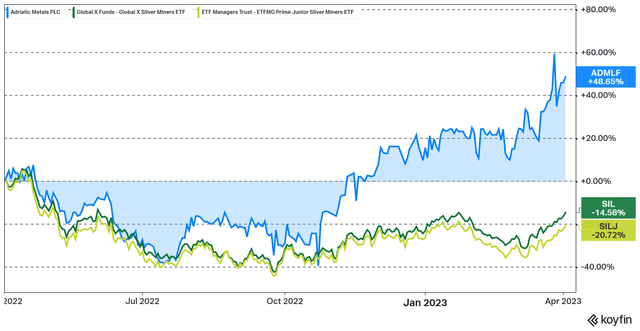

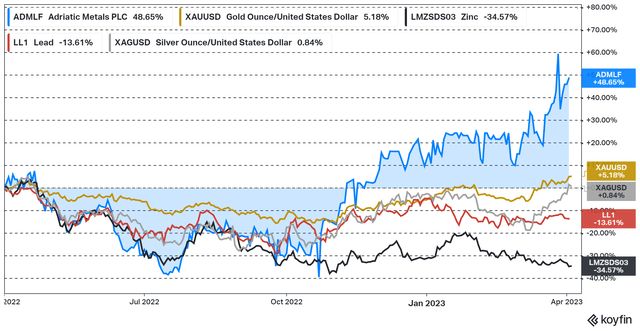

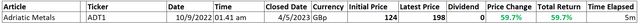

I have covered the company in the past and the stock has returned 60% since my strong buy article in October of last year. Adriatic Metals is one of the few precious metals development companies that has had a good performance over the last year. It has outperformed most silver miners by quite a lot. Note that some development companies have underperformed the producers over that period, so the relative outperformance against some other developers is even larger than what the chart above indicates.

Figure 2 - Source: My long Adriatic Metals article return

Also, the prices of the main base metal components of the project: zinc and lead, have declined over the last year, so the NPV of the project has not been getting a boost from there lately.

I have recently liquidated my holdings in Adriatic Metals to invest in peers with even more depressed valuations. That said, Adriatic Metals is far from expensive at this level, provided the commissioning and ramp of Vares goes according to plan in 2023. The share price is just not as depressed as we saw during part of 2022.

Vares Update

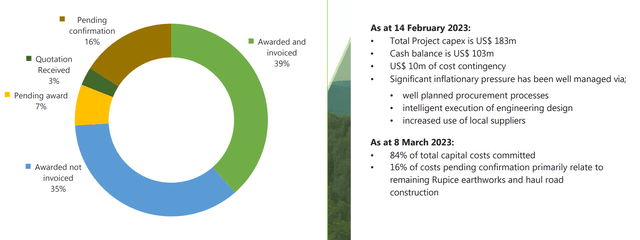

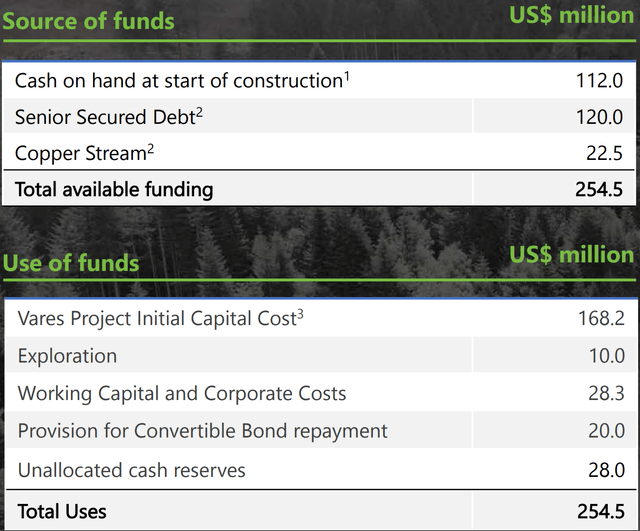

Vares was about 60% complete in January, where only 16% of total cost is now pending confirmation. That means there is very little chance for any substantial cost overruns at this stage.

Figure 4 - Source: Adriatic Metals Presentation

Total project capex is now estimated to be $183M, which is about 9% above the initial estimate in the feasibility study. The company has in my view done an excellent job keeping costs under control in the current inflationary environment.

While I am not overly concerned about a larger cost overrun, we have still seen supply chain issues in many parts of the world. So, there is always a chance of delays due to some critical components missing. Adriatic Metals has a decent size cash buffer on top of the contingency, so if delays were to happen, that would be very manageable for the company.

Figure 5 - Source: Adriatic Metals Presentation

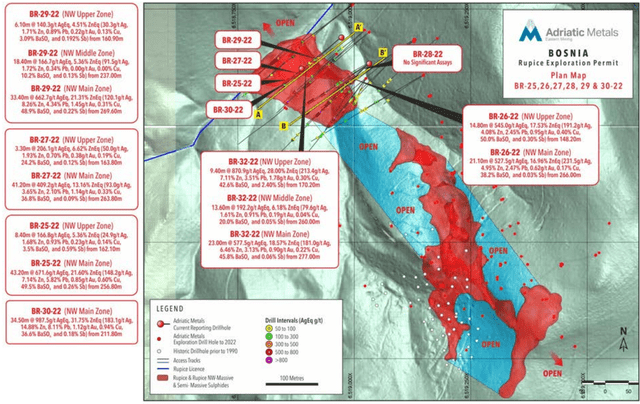

Another positive aspect with Adriatic Metals is the ongoing drilling at Vares, where the results have continued to be very good. There is a resource update due to be released around Q2-Q3 2023. So, the total resource is likely to expand this year as are reserves, with some conversion from resources. Exactly how much resources and reserves will grow, remains to be seen, but there is a good chance the growth will be substantial based on what we have seen from the exploration results.

Figure 6 - Source: Adriatic Metals Presentation

Valuation

Adriatic Metals has a fully diluted share count of 291M, which in turn gives us a market cap of around $720M using the latest share price. The company will also have a manageable debt load of around $120M once Vares is in production.

For the valuation, I have relied on the NPV in the feasibility study, then adjusted for the changes in commodity prices since it was released. The commodity prices I have used today are the following: gold $2,000/oz, silver $25/oz, zinc $2,800/t, and lead $2,100/t, which are close to today's spot prices.

We then get an estimated NPV of $1,026M. So, we are consequently looking at a market cap to NPV of 0.7.

Conclusion

A market cap to NPV of 0.7 is far from expensive for a project that is about to start producing, with very healthy growth prospects going forward as well. However, the attractiveness has decreased compared to nine months ago, when the stock was trading at about half the current stock price.

Commissioning and ramping up production from a mine are far from riskless, where it is common to see both delays and prolonged periods before reaching nameplate capacity.

Another minor concern is the fact that about half of the projected revenues come from base metals, where the near-term future looks more uncertain, even if that is more of a subjective opinion.

If one were to look purely on the absolute risk-reward for Adriatic Metals, it still looks relatively good, but the fact is that there are many other precious metals miners, with less base metal exposure, that are trading at much more depressed levels than Adriatic Metals. So, I have recently sold my holdings in Adriatic and deployed the money elsewhere, where the risk rewards are in my view even more attractive.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you like this article and is interested in more frequent analysis of my holding companies, real-time notifications on portfolio changes, together with macro and industry analysis. I would encourage you to have a look at my marketplace service, Off The Beaten Path.

I primarily invest in turnarounds in natural resource industries, where I have a typical holding period of 1-3 years. Focusing on value offers good downside protection and can still provide great upside participation. My portfolio generated a return of 81% during 2020, 39% in 2021, -8% in 2022, and is up 2% in March of 2023.

This article was written by

I enjoy my anonymity, where I write under the name Bang For The Buck. I hold a BSc and MSc in Financial Economics, but most of my value-based investment knowledge comes from independent learning where I am a perpetual student. I primarily focus on turnaround stories, with attractive valuations, in cyclical industries. I have a significant portion of my portfolio exposed to the precious metals industry due to current monetary and fiscal policies.

I publish regular articles on Seeking Alpha and offer a Marketplace service called Off The Beaten Path where subscribers receives real-time updates on the portfolio, in-depth portfolio reports, and frequent updates on holdings companies. As the name suggest, I primarily invest in industries and companies that are underappreciated, which I have found provides more attractive returns.

I am always happy to respond to comments and questions in my articles during the first few days. More in-depth and ongoing discussions are had inside Off The Beaten Path.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.