Mersana Therapeutics: Unrecognized Promise In UpRi's Cancer Fight

Summary

- Concerns related to safety risks around ILD/pneumonitis are overblown in a disease of high unmet needs.

- I believe clinical benefits outweigh potential safety overhang, and key studies have put in the necessary steps to mitigate ILD risks.

- '1660 could become a key asset in Mersana's portfolio and a much-needed treatment option for patients with a range of solid tumors.

- MRSN has numerous early-stage programs and secured multiple pharma partnerships that could further strengthen upside potential near-term.

- With a 13% WACC and 0% growth rate, my DCF implies a $4.9 price target for Dec-2023.

gorodenkoff/iStock via Getty Images

Mersana Therapeutics (NASDAQ:MRSN) is a "Strong Buy" in my view, for three main reasons:

Firstly, Mitigated Pneumonitis Risks: Despite concerns regarding UpRi's safety, specifically lung toxicities (ILD), I believe the UPLIFT study's design has effectively minimized high-grade pneumonitis risks. The lower dose used in UPLIFT has not reported any Grade 5 events to date, and even in the unlikely event of low-incidence high-grade ILD, UpRi's benefit/risk profile remains favorable for its potential as a key treatment option in platinum-resistant ovarian cancer (PROC).

Secondly, Unmet Needs and Expansion Opportunities: UpRi's unique profile addresses the critical gap in unmet needs left by current treatments following platinum-based regimens and chemotherapy. Furthermore, the potential to expand beyond the initial UPLIFT indication, coupled with a robust set of pharma partnerships, offers exciting call options.

Thirdly, Favorable Risk/Reward Ratio: Although MRSN's stock price has pulled back from its September high, dropping over 50% compared to just 9% for the SPDR S&P Biotech ETF (XBI), I believe the risk/reward ratio leans favorably towards the upside leading up to the mid-year readout, which is scheduled to follow the ASCO conference in June. My DCF analysis supports this view, resulting in a 2023 price target of $4.9.

Mersena Therapeutics (MRSN) - Breakdown

Mersana is a clinical-stage biopharmaceutical company focused on developing innovative antibody-drug conjugates (ADCs) for the treatment of various types of cancer. The company's lead candidate, UpRi (XMT-1536), is a first-in-class ADC targeting NaPi-2b that is currently being evaluated in pivotal studies for platinum-resistant ovarian cancer (PROC).

Mersana was founded in 2001 and has since established itself as a leader in the ADC space with a proprietary platform that enables the creation of highly targeted therapies for cancer patients. The company has also formed multiple partnerships with pharmaceutical companies to develop and commercialize ADCs for a range of indications.

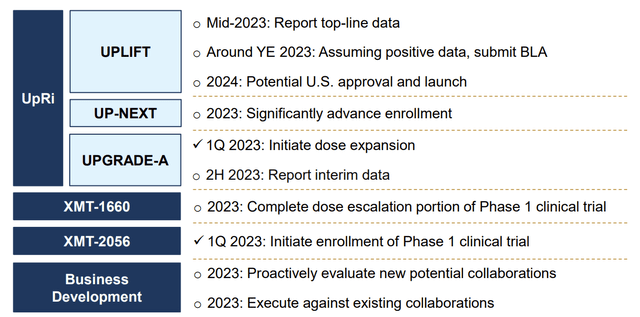

Company Presentation (March 2023)

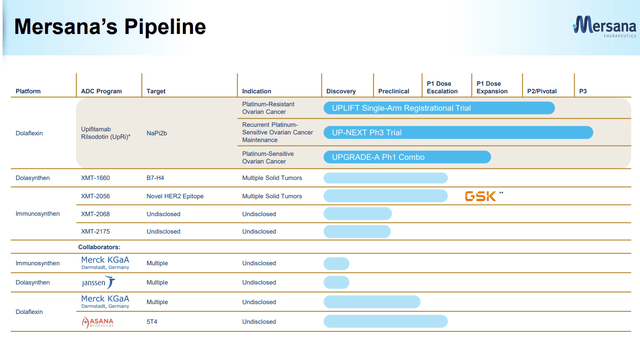

Looking at Mersena's Pipeline (March Presentation), this is what the company has done, what the company is doing, and what it will continue to be working on. In my last biotechnology article on Editas Medicine (EDIT), one of my biggest concerns was EDIT's lack of diversification in its pipeline.

Mersena having partnerships and a diversified product portfolio reduces my concerns because of the access to additional resources, expertise, and funding, which is spreading the costs of drug development across multiple partners, reducing the impact of any single product failure, and mitigating the risks associated with regulatory approval by having multiple products in development across a range of indications. Note: MRSN has over 10 programs with 5 well-known collaborators.

Mersena's Dolaflexin Platform

Mersana Therapeutics' Dolaflexin Platform is their leading platform that encompasses the ADC Program, UpRi. UpRi utilizes the sodium-dependent phosphate transporter NaPi2b to target platinum-resistant ovarian cancer (PROC).

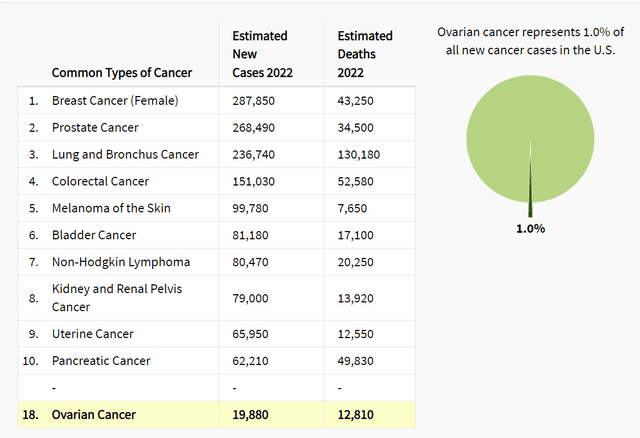

According to data from the Surveillance, Epidemiology, and End Results (SEER) program, approximately 250,000 women are living with ovarian cancer in the United States. The estimated 5-year survival rate is approximately 50%. Mersana's UpRi programs aim to serve this population upon reaching the commercialization stage following successful clinical trials and FDA approval. Mersana currently has three programs for ovarian cancer, with one in Phase 3, one in Phase 2, and the other in Phase 1, as reflected in the company's pipeline.

UpRi is currently the primary focus of investors in Mersana Therapeutics, which is why I gave it a detailed explanation. However, Mersana's pipeline contains several other programs targeting different types of cancer, each with its own potential for success. While a brief explanation of these programs is provided below, a more in-depth analysis of the most important programs will be included in the investment thesis.

Other ADC Programs

XMT-1592: This is a potential treatment for tumors that overexpress the protein NaPi2b, including ovarian, lung, and other types of cancer. XMT-1592 is an antibody-drug conjugate (ADC) that targets NaPi2b and delivers a potent cytotoxic payload to cancer cells. It is currently in Phase 1 clinical trials.

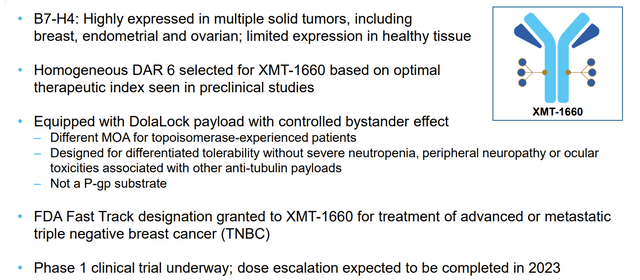

XMT-1660: This is a potential treatment for tumors that overexpress the protein B7-H4, which is found in a variety of cancer types including ovarian, breast, and lung cancer. XMT-1660 is an ADC that targets B7-H4 and delivers a potent cytotoxic payload to cancer cells. It is currently in preclinical development.

XMT-2056: This is a potential treatment for tumors that overexpress the protein NaPi2b, including ovarian, lung, and other types of cancer. XMT-2056 is an ADC that targets NaPi2b and delivers a potent cytotoxic payload to cancer cells. It is currently in preclinical development.

XMT-2206: This is a potential treatment for tumors that overexpress the protein PRMT5, which is involved in the regulation of gene expression and is found in a variety of cancer types, including lymphoma, leukemia, and solid tumors. XMT-2206 is an ADC that targets PRMT5 and delivers a potent cytotoxic payload to cancer cells. It is currently in preclinical development.

Immunosynthon: This is a platform for the development of antibody-drug conjugates (ADCs) that incorporate immune-modulating agents, which can enhance the immune system's ability to recognize and attack cancer cells. Mersana is exploring several potential targets for this platform, including the checkpoint inhibitor PD-L1 and the cytokine IL-12. Immunosynthon is currently in preclinical development.

Mersena's Upcoming Catalysts

Company Presentation (March 2023)

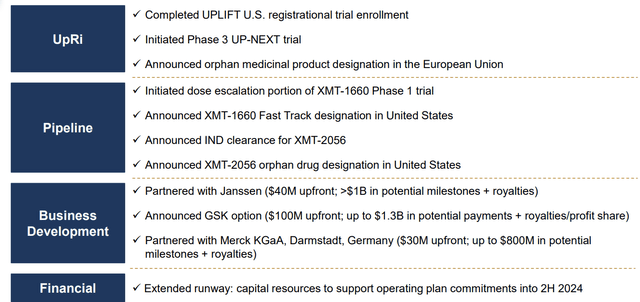

These catalysts are already priced into the stock price. For investors, this means that MRSN needs to have these clinical updates by the date mentioned above. If they have slower-than-expected (or failed clinical trials) clinical updates, the share price will depreciate; if they have faster-than-expected (or better-than-expected) clinical updates, the share price will appreciate. I am confident that Mersena's team will not have worse results than expected, given their successful history of updating investors. Such as, in 2022, Mersena announced numerous milestones successfully:

MRSN 2022 Milestones (Company Presentation )

Mersena's Cash Runway

Mersana Therapeutics has invested significantly in research and development (R&D) over the past five years. R&D expenses were $59.9 million in 2018, $55.0 million in 2019, $67.0 million in 2020, $132.0 million in 2021, and $173.4 million in 2022, totaling $487.3 million. This averages out to approximately $97.5 million per year.

With $280.7 million in cash and short-term investments on its balance sheet, Mersana has a cash runway of approximately 2.9 years. This means that the company is fully funded for R&D expenses from 2023 to sometime in 2025. While this is a positive indicator of the company's financial stability, it is not particularly noteworthy, as most early-stage biotech companies have a similar cash runway.

Investing in R&D is essential for biotech companies to develop and bring innovative therapies to market, and Mersana's commitment to R&D highlights its dedication to advancing its pipeline and improving the lives of patients.

Investment Thesis

UpRi, Mersana's Pivotal Catalyst in Ovarian Cancer Treatment

UpRi (also known as XMT-1536) is an innovative first-in-class ADC poised to revolutionize ovarian cancer (OC) treatment by targeting NaPi-2b in various settings. As a key driver in Mersana's valuation, I am closely monitoring three groundbreaking studies: Phase 2/pivotal UPLIFT in platinum-resistant OC, Phase 3 UP-NEXT in platinum-sensitive OC as maintenance therapy, and Phase 1 UPGRADE-A in platinum-sensitive OC as a combination regimen.

In my view, the UPLIFT trial's success will significantly boost confidence in UpRi's potential for treating OC. I believe UPLIFT has the potential to showcase a favorable efficacy/safety profile that will be well-received in platinum-resistant ovarian cancer (PROC). The trial has been meticulously designed to minimize pneumonitis risks and demonstrate statistical significance in the objective response rate (ORR) endpoint.

Company Presentation (March 2023)

Following in the footsteps of Avastin's proven expansion strategy, UpRi aims to broaden its scope beyond the UPLIFT indication. Given the increasing focus on overall survival (OS) benefits in the maintenance setting following updates from various PARP agents, it's essential to keep an eye on how progression-free survival (PFS) is received as a primary efficacy endpoint. Ultimately, data on OS might be necessary for novel agents like UpRi to gain traction in the maintenance setting.

That being said, I see UpRi's expansion into maintenance and earlier-line treatment in combination with carboplatin as a promising move. I believe this strategy offers an attractive upside as Mersana prepares to unlock the potential of UPLIFT later this year. Eagerly awaiting further insights into the combination's efficacy in the second half of the year, I will be closely following the interim read from the UPGRADE-A trial.

'1660: A Promising ADC Targeting B7-H4 with Strong Potential

Company Presentation (March 2023)

Mersana's latest wholly-owned asset, XMT-1660, is an innovative antibody-drug conjugate (ADC) that targets B7-H4, a protein that is highly expressed in a variety of solid tumors, including breast, ovarian, and endometrial cancers. In fact, more than 50% of triple-negative breast cancer (TNBC) samples have been found to exhibit 2-3+ IHC of B7-H4 staining. Functionally, B7-H4 negatively regulates the proliferation and effector function of CD4+ and CD8+ T cells, but its role in oncogenesis is not yet fully understood.

Competitor mapping reveals that several early-stage assets are currently evaluating B7-H4's viability as a cancer target, and updates from competitors such as SGEN and GMAB later this year could provide further insight into '1660's potential in target indications and B7-H4's potential as a cancer target.

Preclinical studies with '1660 have shown significant promise, particularly in mouse models of breast, ovarian, and endometrial cancers. In vivo activities have been demonstrated in a variety of patient-derived xenograft models, with a trend for response in models that express higher levels of B7-H4.

The Ph 1b study for '1660 (NCT05377996) is currently underway, with dose escalation expected to be completed later this year. This all-comer trial aims to enroll approximately 42 patients with various cancers, including TNBC, HR+/HER2- BC, ovarian cancer, and endometrial cancer. Safety and tolerability will be the primary endpoints during dose escalation, while the dose expansion portion will focus on ORR, DoR, and safety with 35 EC/OC, 30 TNBC, and 35 HR+/HER2- BC patients.

In brief, I am confident that '1660 has strong potential to offer a significant upside. With its unique targeting of B7-H4 and promising preclinical data, '1660 could become a key asset in Mersana's portfolio and a much-needed treatment option for patients with a range of solid tumors.

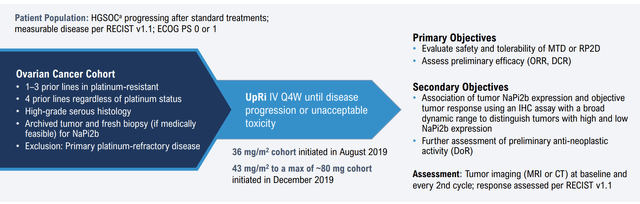

UpRi's First Look in Ovarian Cancer: Dose Escalation

The dose escalation portion of UpRi's clinical program began in December 2017, enrolling un-selected patients with ovarian cancer, non-small cell lung cancer, and other NaPi2b-expressing tumors such as endometrial, papillary renal, salivary duct, and papillary thyroid cancers. The study evaluated escalating Q3W and Q4W doses, with updates on the platinum-resistant ovarian cancer subset first reported in early 2019, then at the American Society of Clinical Oncology (OTC:ASCO) in mid-2019, and at the March 2020 company event.

The initial data cut in January 2019 was encouraging, with two partial responses out of eight patients. Later, at ASCO 2019, data on 19 evaluable ovarian cancer patients dosed at >30mg/m2 showed a 28% partial response rate. In March 2020, Mersana provided another update on a larger dataset of 39 evaluable ovarian cancer and non-small cell lung cancer patients with a detailed breakdown on NaPi2b expression. Despite all patients having a median of five prior lines of therapy, the data showed early signs of clinical activities, particularly at higher doses (north of 30mg/m2) and in patients with higher NaPi2b expression.

In brief, the early dataset supports UpRi as an active drug with a clinically meaningful profile, given the historically low-single-digit to low-teens response observed in this late-line setting.

Regarding safety, data on 59 patients were presented in March 2020. There were two cases of transient G3 AST and one case of G2 AST/G1 ALT reported in the 30-40mg/m2 Q3W/Q4W groups, but not in the 43mg/m2 Q4W group. There were four TR SAEs, including G1 pyrexia, G2 pyrexia, G3 congestive cardiac failure, and G3 vomiting. The most frequent G3 events were transient elevated AST increase, and 43mg/m2 was determined to be the MTD. The main take, there were no major red flags at this March 2020 read, and UpRi appears to have a favorable safety profile.

I eagerly await the upcoming UPLIFT study results. I am confident that UpRi has the potential to provide significant benefits to patients with ovarian cancer, providing a much-needed treatment option for those with limited options in the late-line setting.

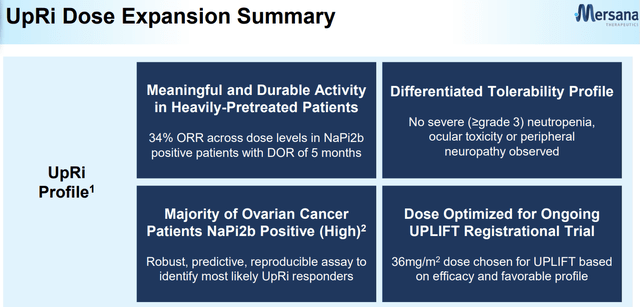

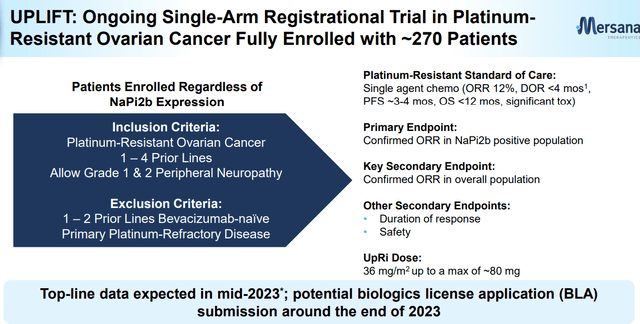

UpRi's First Look in Ovarian Cancer: Dose Expansion

Company Presentation (SGO-2022)

The dose expansion portion of the Ph 1/2 study evaluated UpRi in platinum-resistant ovarian cancer patients who had 1 to 3 prior lines, or 4 or more prior lines regardless of platinum status. The dosing regimens were 36 mg/m2 Q4W or 43 mg/m2 Q4W with a maximum of 80 mg total until disease progression or unacceptable toxicity. As of the June 2021 data cut, 67% of patients had 1 to 3 prior lines of therapy. The efficacy data from the dose expansion portion was consistent with the dose escalation data, with response being more prominent in NaPi2b-high expressors regardless of the diagnostic approach used to evaluate NaPi2b expression. The NaPi2b-high subset reported a 34% ORR with a DoR of approximately 5 months, which is meaningful given the current standard of care ORR of ~12%. However, the higher dose cohort (43 mg/m2) reported a lower ORR of 13%, and it is unclear whether earlier-line patients drove the response.

Company Presentation (SGO-2022)

My main take is the efficacy of UpRi in the NaPi2b-high population is convincing based on the clinical data collected to date. Pneumonitis side effects were a key investor focus, with two grade 5 cases reported in the higher dose arm (43 mg/m2). The trial protocol was subsequently modified to have enhanced guidance on identifying and managing pneumonitis cases, and the ongoing protocol was refined to exclude patients with severe uncontrolled pulmonary disease or CAD, history of or suspected pneumonitis or ILD, oxygen saturation, or room air below 93%. High-grade AST elevation was found mostly in the higher and intermediate dose levels, with ~30-40% G3+ AST increase reported at the last data cut in Sept 2021. The most common reasons for dose reductions, according to management, were AST elevations and fatigue, which may be mitigated with the change to the 36 mg/m2 dose (up to ~80 mg) in UPLIFT.

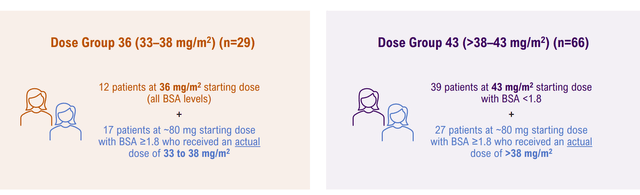

UPLIFT Results Expected Mid-Year

Mersana initiated the UPLIFT study, a single-arm registrational global trial, in April 2021. The study completed the enrollment of 272 patients with platinum-resistant ovarian cancer (PROC) in October 2022 and is on track to report top-line results in mid-2023 following the ASCO conference. Mersana plans to file a biologics license application (BLA) with the FDA by the end of 2023 after the UPLIFT trial's results.

Company Presentation (March 2023)

The UPLIFT study's primary endpoint is the confirmed objective response rate (ORR) in the NaPi2b-high population (based on TPS≥75). At baseline, the enrolled subjects received 36mg/m2 of UpRi IV every 4 weeks (up to 80mg) and ranged from 1 to 4 prior lines of therapy (prior bev experience is required for 1 to 2 prior lines). I anticipate the number of NaPi2b-high cases to be significantly higher than the initial ~100 number provided by the company, assuming a ~60% prevalence among PROC patients.

The confirmed ORR in the overall population, including NaPi2b-low expressors, will serve as the secondary endpoint. It is noteworthy that the patients receiving the higher 36mg/m2 Q4W dose will not be part of the primary efficacy analysis but will be included in the overall data package for safety analysis.

This aims to analyze potential scenarios for UpRi's efficacy and safety in the UPLIFT trial, with a focus on objective response rate (ORR), duration of response (DoR), and safety outcomes.

Biotechnology Catalyst

In the past two years, or since March 2021, XBI is down over 40%, and down 20% in the past 12 months. Likewise, MRSN is down 23% in the past 24 months. According to numerous reports: Grand View Research, BioSpace, IBISWorld, Precedence, and BCC Research (and many more), the biotechnology industry will be worth over $3 trillion by 2030 from its current market value of just under $1 trillion.

My favorite biotech report was recently published by Barron's. In summary, Barron's points out that the biotech industry offers opportunities for investors to beat index funds since it is an area where stocks can be mispriced. The potential for most biotech companies is not their current earnings or valuations but whether they will have positive test results for a potential blockbuster drug and FDA approval for its sale. These factors are not easily discernible through quantitative screens or by the average Wall Street analyst trained to read income statements and balance sheets. Therefore, investing in biotech now may be a good decision. The report ends with:

the small-fry biotech funds will triumph again.

So, numerous analysts and reports have been published in 2023, yet the market sentiment surrounding biotechnology does not seem to be fully pricing in the industry's future potential. This is likely due to the complexity of understanding biotechnology companies and the relative newness of the industry. As investor awareness of the industry increases, it will be interesting to observe how the market values Mersena's share price in the years to come.

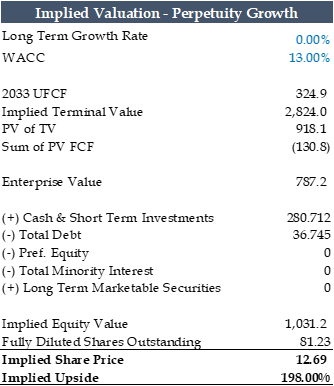

Discounted Cash Flow Analysis

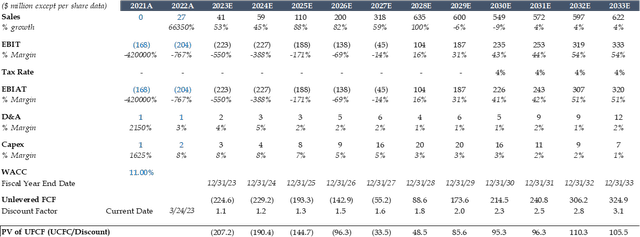

I used the median estimates from Capital IQ to forecast Mersenas Sales, EBIT, taxes, Capex, and D&A.

Looking at the sales forecast, massive sales growth in the coming years is due to the UpRi Programs that are currently in phases 2 and 3 and waiting to get to the commercialization stages.

To calculate the UFCF, I used: EBIT*(1-tax rate)+D&A-Capex. Where Mersena is cashflow positive from 2028 onwards, according to my DCF.

I used the growth in perpetuity method to arrive at MRSN's implied share price for 2023:

Author's Data

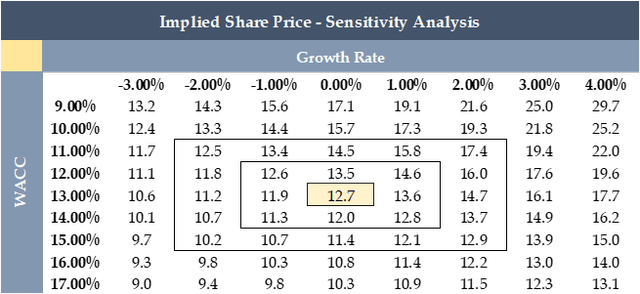

After performing a rigorous analysis of MRSN, I determined a weighted average cost of capital (OTC:WACC) of 13%. MRSN's high 13% WACC is driven by a substantial 92.5% weight of equity and an elevated cost of equity, factoring in the company's high beta and the current risk-free rate. The WACC also includes a 2% size premium, accounting for uncertainty and aligning it with competitor benchmarks.

Based on my optimistic outlook of the company, I used a growth rate of 0% to estimate a price target of $12.7 by 2033, representing a potential appreciation of 198.0%.

To provide additional flexibility, I have included a sensitivity analysis (see table below) where one can input different WACC and growth rates to estimate a different price target. However, I must note that due to the uncertainties in predicting a company's performance over a 10-year period, I believe it is challenging to provide an accurate long-term price target. Therefore, to provide a more reasonable estimate, I have divided the 10-year price target by 10 to arrive at a 2023 price target of $4.9, which represents a 19.8% yearly upside from the current price of approximately $4.2.

Again, it is essential to note that the following analysis is a 10-year discounted cash flow projection, which has inherent uncertainties and risks associated with it. The projections are made based on the assumptions of a successful clinical trial for all pipeline products. However, it is crucial to keep in mind that the probability of all these assumptions materializing is low, with a likelihood of less than 1%.

Nevertheless, my DCF provides valuable insights into the potential upside possibilities for MRSN, assuming a successful clinical trial for all pipeline products. It is important to use this analysis as a tool to assess the company's future prospects and not as a definitive prediction of its performance.

Risks To Rating & Price Target

The failure to show clinical benefits in ongoing studies for UpRi - Although UpRi has shown promise in clinical trials, there is always the risk that it may not demonstrate the efficacy needed to receive regulatory approval or achieve commercial success.

Tolerability and safety issues related to UpRi - The safety profile of UpRi has been a topic of concern, particularly around lung toxicities (ILD). Although the UPLIFT study has been designed to mitigate much of the high-grade pneumonitis risks, there is still the possibility of safety issues arising that could negatively impact UpRi's clinical development.

Regulatory risks related to UpRi's path towards global approval - There is always the risk of regulatory delays or a failure to obtain approval from the FDA or other regulatory bodies, which could impact Mersana's ability to bring UpRi to market and achieve commercial success.

Manufacturing ramp-up to commercial launch - As Mersana advances towards commercialization, there is a risk of manufacturing issues or supply chain disruptions that could negatively impact its ability to meet demand for UpRi.

Slower than expected commercial launch for UpRi - Despite the promising results from clinical trials, there is always the possibility that the commercial launch of UpRi may take longer than anticipated, impacting the company's revenue projections and stock performance.

Failure for UpRi to expand beyond the initial treatment indication - Although UpRi's strategy to expand beyond the UPLIFT indication is a tried-and-true strategy, there is always the possibility that UpRi may not be successful in achieving regulatory approval for other indications or may face significant competition from other therapies in those indications.

In Brief

I'm excited to give Mersana Therapeutics, Inc. (NASDAQ:MRSN) a Strong Buy rating. I believe the concerns surrounding safety risks, particularly ILD/pneumonitis, are completely overblown when considering the high unmet needs in the ovarian cancer space. In my opinion, the clinical benefits of UpRi far outweigh any potential safety concerns, especially since key studies have taken diligent steps to mitigate ILD risks.

I have confidence that UpRi could become a pivotal standard of care option for a substantial portion of ovarian cancer patients. Finally, Mersana has multiple promising early-stage clinical programs and has secured valuable partnerships with well-established pharmaceutical companies. These factors only serve to further boost the company's upside potential in the near term. Thus, I am confident my $4.9 for 2023 is well-founded.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.