3 Ways You're Probably Mismanaging Your Portfolio In April 2023

Summary

- You probably aren't buying any (gasp!) financials.

- You probably don't have near enough tech stock.

- You're probably ignoring safe fixed income assets.

Delmaine Donson

There's a lot of things people are doing right now that are not the best of decisions. That's been happening for a while frankly. But we have some real clarity on the situation in the markets and the economy at the moment, so let's discuss some clear "no-brainer" choices you can make to increase returns in your brokerage account through 2023 and 2024.

You probably haven't bought banks.

Have you bought any banks yet? Or are you fearful that we're going to have some sort of "banking collapse?" Have you been watching from the sidelines as great banks like JPM, SCHW, WFC, and BAC have fallen perilously off a cliff-face as investors find completely unfounded panic? Well, you aren't alone (obviously... just look at those deliciously low stock prices).

Let's first talk about SVB a tad (I'm really, really going to simplify this for sake of article length). Now you're surely well informed on this situation by now, but it's worth mentioning just a little since it's the reason that our aforementioned banks are indeed so low. The situation at SVB was very, very unique. You need to keep that in mind as you read my article, and try to keep from passing out over the mere suggestion of buying banks.

SVB very uniquely marketed itself towards risky tech startups. Tech startups, as we all know, need cash to grow. That's why easy money policies help tech in general (as well as any growth stock). So when rates start to climb who's getting hit? Yeah, tech. As these companies fell apart, well they needed their money from SVB.

Now here's where SVB really messed up. And check the end of this section for the balance sheet of a bank that really did this right. SVB, as well as every other bank, made some of their money by investing in treasuries and other bonds. Some of these securities are designated as "securities held to maturity."

SVB had invested most of its capital in these at a very, very bad time. See there are two prices when you talk about bonds. Par value is what a bond originally issues at and what it redeems at. It's usually expressed as $100 at time of issue. The second price is market value. That's the price you can sell the bond for between issue and redemption.

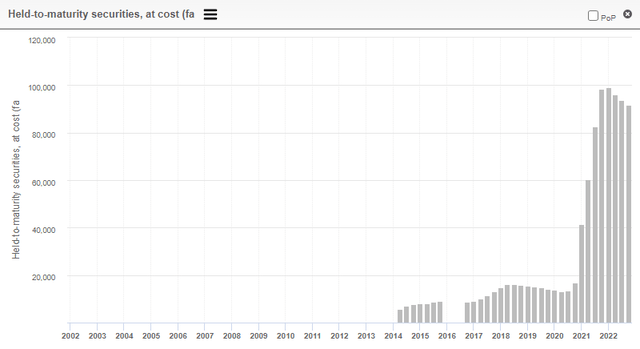

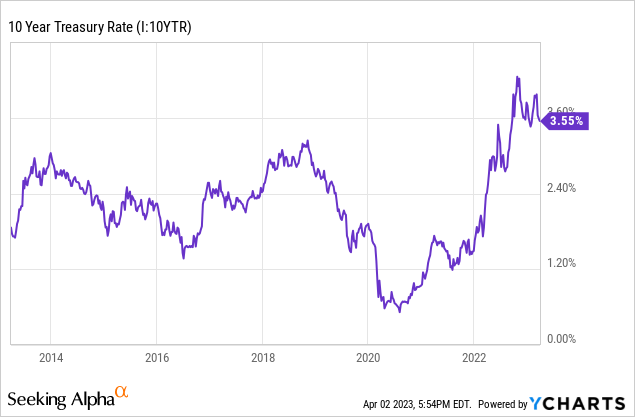

Market value can change based on what interest rates new bonds are paying. Why buy an old bond that pays 1.5% if I can buy a new issue paying 5%? So the market value of the old bonds are driven down if the new bonds are paying more - in this case they paid much more than when SVB invested. Check out this chart of when SVB leaned into these bonds:

SVB securities held to maturity (millions). (Sentieo)

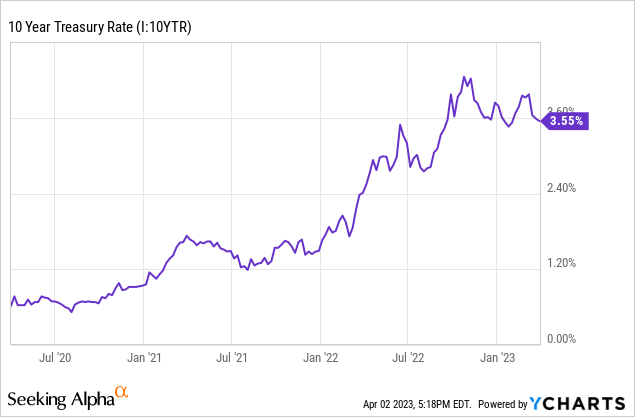

See how they finished that purchasing in Q3 2021? Now check out the chart of 10-year treasury yields:

Yeah. Yields began to spike up hard in the beginning of 2022 as rates began to rise. And what's really crazy about this whole thing is this wasn't a surprise. The Fed literally told us in 2021 what they were going to do!

So remember how I said old bond market values drop when new ones pay better? That's what happened to all of SVB's securities marked as "held-to-maturity." Now normally those price drops aren't a problem, since the securities will be held to maturity and you'll receive the issuing value back (thus making treasuries mostly riskless).

But problems happen in the meantime if, for some reason, you need that money. Like for instance loosing tons of deposits because your main clientele can't stay in business. And boom. SVB essentially runs out of liquid cash and is forced to sell those "held-to-maturity" securities which have, in the meantime, dropped precipitously in value. SVB failed because of its own complete and utter inability to look at the future and instead live in the moment. Ouch.

Now, how does this relate to the rest of the banking sector and why should you go buy some? Easy, SVB's failure was attributable directly to their incompetence, and was a unique situation, a situation that a great many other banks do not find themselves in.

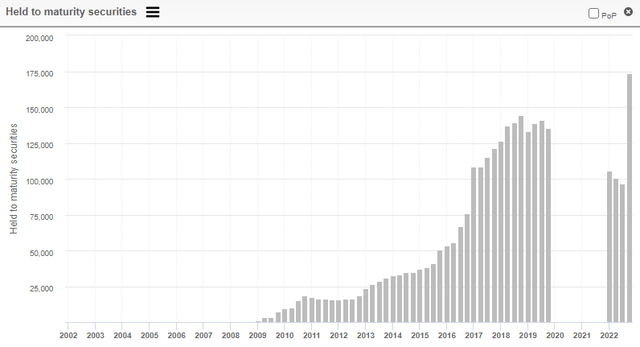

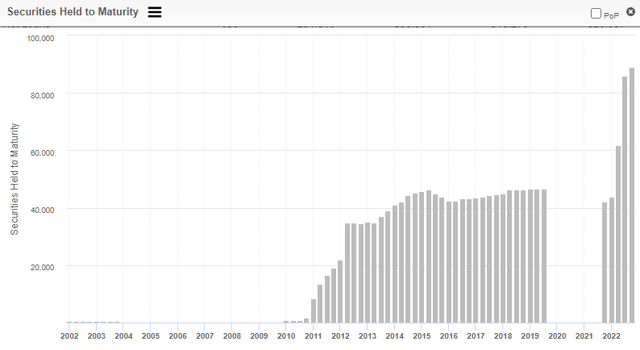

Go look at many of the other banks mentioned above. Most have huge amounts of cash on hand to deal with any depositor withdrawals, they do not market themselves solely to risky clients, and in some cases were extremely tactical with their investments held to maturity. Check out these balance sheets from SCHW and USB for their investments held to maturity:

Chart for SCHW's investments held to maturity (millions). (Sentieo) Chart for USB's investments held to maturity (millions). (Sentieo)

Wow. It's almost like they, you know, saw what was happening.

Long story short, don't be afraid of banks. Buy them. JPM, WFC, BAC, SCHW, USB. They're cheap right now. They're easy returns.

You probably haven't bought enough tech.

The tech boom after COVID, brought on by easy money policies, and it's subsequent bubble bursting has probably soured many people on buying tech right now. Hey, I get it! If I was heavily in tech when the S&P hit 4800 and didn't sell it prior to that (say if I didn't bother to listen to the FOMC that they were going to raise rates) then I'd be angry at tech as well! But we can't let that stop us from a great investment opportunity.

I've been buying tech all throughout this downturn, but if you haven't it isn't too late. For reference I have my managed accounts all around 20% tech at the moment. My personal accounts are near that as well. They were maybe 5% at the start of 2022 (again, because the FOMC was super clear about what they were doing).

See, as I mentioned, easy money policies can spur tech growth. We know that. So you might be saying to yourself, "well current policies are restricting credit! They can't grow like that!" You're right. But, why would we want to invest for the current conditions? Buy low, sell high. We want to invest for the future.

The FOMC themselves say they see rates dropping heavily in 2024. The CME Fed funds futures currently show drops in December of this year (something I think might be accurate). We want to invest for the future: we need to look ahead and buy for what is going to happen, not for what is happening now.

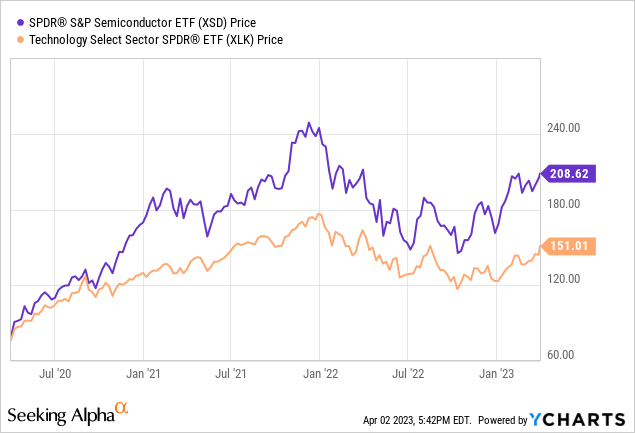

In the chart above I show XLK has recovered some, but what's important is it's trend. Where do you think tech is going in the future? The other price on the chart is XSD- the semiconductor SPDR.

Friends, the future is paved in 1s and 0s. If you don't believe that then I'm not sure why you're reading this article. Semiconductors need to be manufactured in ever growing quantities. They'll be just like oil has been for decades: it's demand rises almost every single year. Everything has a computer in it nowadays, even a tractor.

I really, really like semiconductors here. Some of my favorites are TSM and INTC. TSM because it's the largest manufacturer in the world (TSMC out of Taiwan), and INTC because of the new foundries it's building and getting online here in the United States. And it's dirt cheap right now. Yeah, INTC has some issues but they're still one of the very few owners of foundries and if you've used their 12th and 13th gen CPUs (this is being written on an i9-12900K) then you know how awesome the tech is.

Long story short, buy tech and specifically semiconductors. The future is glittering with ever smaller nanometer processes and billions of transistors.

You're probably ignoring amazing rates in fixed income assets.

Now typically I'm very much against a growth portfolio having any fixed income assets (outside of certain circumstances like buffering for a downturn), but right now is a little different.

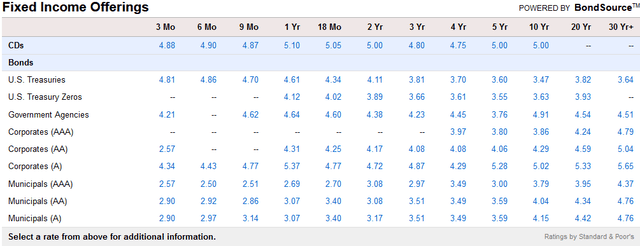

Treasury rates are near the highest they've been in over a decade. I just now logged into Schwab and the rates are awesome.

Current bond yields (Charles Schwab)

Yes, you can get a 1 year Certificate of Deposit for 5.1%. That's beyond amazing. That's actually dropped a little because I have 5.25% CDs in managed accounts. But it's still a great return. And as long as it's under $250,000 at any one bank then it's FDIC insured.

So think about that. 5%, fully insured, riskless. What's not to like? If you're sitting on cash, and are risk adverse, then CDs and bonds are paying great rates right now. Don't be afraid to wade into those waters and invest some money. Even if you're young and focusing on growth, it's really not a bad place to be if you're concerned about the economy.

Although I'm not concerned at all about the economy. I'll write another article on that.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM, WFC, BAC, SCHW, INTC, TSM, XSD, XLK, XLF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.