Aehr Test Systems: As Good As It Gets

Summary

- Aehr faces risks and revenue uncertainty due to reliance on CapEx decisions of a limited number of key customers.

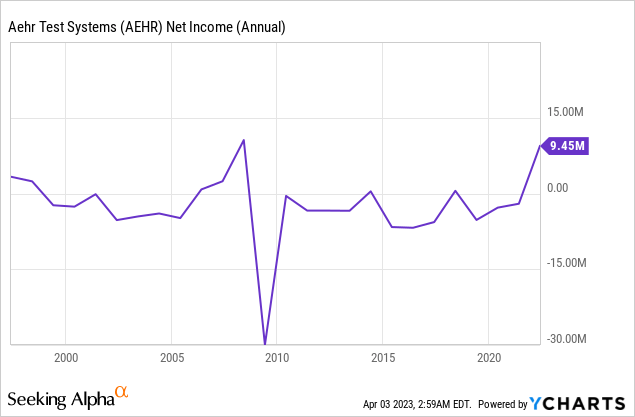

- Despite currently experiencing an upcycle with record-high revenues, Aehr has a history of financial instability and losses during downturns.

- The company's CFO's departure and the stock's high forward P/E ratio is a signal for shareholders to evaluate their investments in the company.

genkur

Investment Thesis

In the highly cyclical semiconductor testing and burn-in equipment industry, Aehr Test Systems (NASDAQ:AEHR) occupies a niche position that, while somewhat insulated from broader macro-industry trends, remains vulnerable to the CapEx decisions of a handful of key customers that generate the majority of its revenue. This dependence on a limited clientele exposes the company to risks and revenue uncertainty that is challenging to predict, exacerbated by its lack of diversification and niche focus.

In my opinion, the most important rule in investing in cyclical stocks is a track record of profitability during downturns. Aehr's historical losses during downturns are concerning as it suggests a struggle to maintain profitability during periods of reduced demand. The company's small size, when compared to larger players like Teradyne (TER) and Advantest (OTCPK:ATEYY), underscores its vulnerability to market fluctuations.

While Aehr is currently experiencing an upcycle with record-high revenues, this could be a sign that the company is approaching its peak, potentially signaling an opportunity for investors to take profits and reduce exposure. Given the cyclical nature of the industry, it's important to remember that the strong demand driven by Aehr customers won't last indefinitely, and a period of sales decline will eventually follow.

Investing in Aehr may be most attractive when the company is near the bottom of its cycle or when its valuation is more appealing and vice versa. At his point, with shares trading near record highs, I believe it is time to sell.

Revenue Cyclicality: Analysing Recent Momentum through the Lens of Historical Cyclicality

Over the past six years, Aehr's financial performance has been a mixed bag, reflecting the inherent volatility of the cyclical semiconductor testing and burn-in equipment industry. Sales have fluctuated significantly, peaking at $50.8 million in FY 2022 (year-ended May 2022) and reaching lows of $16.6 million in 2021 and $19.9 million in 2017. This inconsistent revenue trend highlights the company's dependence on a limited clientele and the CapEx decisions of its key customers.

Similarly, gross profit has varied widely over the years, with a peak of $23.7 million in 2022 and a low of $6.8 million in 2017. The company's operating expenses have also fluctuated though less dramatically, mirroring the high fixed costs associated with capital-intensive manufacturing operations. This had a direct impact on Aehr's operating income (loss), which swung from a profit of $7.8 million in 2022 to losses ranging from $2.8 million to $5 million in previous years.

Aehr's net income (loss) has similarly oscillated between gains and losses, with the most notable gain of $9.4 million in 2022 and losses peaking at $5.7 million in 2017. This financial rollercoaster ride underscores the challenges Aehr faces in maintaining profitability during industry downturns and the risks associated with investing in a smaller, less diversified player in the semiconductor testing market. It also mirrors the limits of recurring revenue from the sale of its Contactors.

The company released its financial results for the three months ended February 2023 last week, showcasing strong momentum and a continuation of an upward revenue trend seen in recent quarters, with sales rising from $10 million in the three months ended August (FQ1 2023) to $17.2 million in the three months ended February (FQ3 2023). Net income has followed the same trajectory, reaching $4.1 million in the most recent quarter.

Despite the recent upcycle in Aehr's performance, investors should approach the company with caution, keeping in mind the cyclical nature of the industry and Aehr's history of financial instability. While the company's most recent performance might look promising, the longer-term picture tells a more complex story.

CFO Departure Raises Concerns Amid High Valuation

Last Friday, Aehr shares fell by 15% after the CFO's departure announcement during the company's earnings call. The move will allow more freedom for the executive to cash out on his stock options awards while shares trade at all-time highs, which is a smart decision that shareholders should follow. Currently, the stock's forward price to earnings "P/E" ratio stands at a rich 54x, raising concerns about the company's valuation.

The market's reaction to the news suggests that investors are concerned about Aeher's ability to maintain its current momentum without the leadership that has steered the company during its recent upswing.

Moreover, the high forward P/E ratio of 54x indicates that the market is pricing in significant future growth and profitability. However, given the cyclical nature of the semiconductor testing industry, it is essential for investors to consider the potential risks associated with the company's concentration in a single market and its dependence on a handful of key customers.

The CFO's departure, along with the company's rich valuation, could serve as a wake-up call for investors to evaluate the risks associated with their investment. While the company has recently posted impressive financial results, it is crucial to remember that the semiconductor industry is prone to cycles, and the current upswing may not last indefinitely.

How I might be wrong

Investors should be aware of the cyclical nature of the semiconductor testing industry and the risks associated with Aehr's concentration in a single market. However, it is essential to consider the benefits of the company's niche focus and close ties with key customers, which may contribute to its success during upcycles and help mitigate some risks during downturns. The company's small size and customer concentration could allow it to develop a deep understating of its client's specific needs and challenges, which, with time, could translate to shareholder value. Overall, the decision to invest in Aehr depends on the investor's risk tolerance.

Summary

Aehr, a niche player in the cyclical semiconductor testing and burn-in equipment industry, is experiencing an upcycle with record-high sales. However, its dependence on a limited number of clients and the CapEx decisions of key customers expose it to risks and revenue uncertainty. Aehr's historical losses during downturns and its small size compared to larger competitors also underscore its vulnerability to market fluctuations.

The high FWD P/E ratio of 54x, coupled with the cyclical nature of the industry and dismal historical performance during downturns, is a signal for shareholders to cash out while the stock trades at all-time highs.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.