Alibaba: Road To $160

Summary

- Alibaba Group is undergoing organizational reform, establishing six major divisions under the company.

- The restructuring plan, coupled with the reappearance of Jack Ma, suggests that the Chinese government is ready to ease pressure on tech firms.

- The Chinese e-commerce market is projected to grow at a CAGR of 12% between 2023 and 2027 with a return to post-COVID normalcy, increased adoption of digital technologies, and spending.

- Based on the Sum Of The Parts Valuation Model, Alibaba Group remains undervalued by ~$159 billion, suggesting a target price of ~$160.

- This idea was discussed in more depth with members of my private investing community, Yiazou Capital Research. Learn More »

Wang He/Getty Images News

Investment Thesis & Updates

The plan to divide Alibaba Group Holding Limited (NYSE:BABA) into six divisions sent the company's stock surging and offered a possible model for other large global tech companies facing increasing pressure to split up. Despite the positive news and the 15% climb in stock price, BABA still trades at a steep discount to its intrinsic value. However, as the spin-off path unfolds and clears up, the gap will eventually close, dragging BABA's market cap closer to the estimated $423-$530 billion range, suggesting a massive upside potential.

In today's analysis, we explore Jack Ma's return, Alibaba's reorganization, and how this will generate shareholder value. Indeed, the market currently assigns zero value to all the other five companies, Alibaba's 33% ownership in Ant Group, and all the strategic investments.

According to a March 6 article by a Zhejiang government media outlet on which Li Qiang and Xi Jinping had collaborated, the private sector is the true engine of growth because it accounts for 60% of China's GDP, more than half of the government's tax revenue, and 80% of jobs in urban areas. China's direction and growth refute Western media's speculation that the CCP is anti-capitalist and a destroyer of value; Quoting my words from an article five months ago on "Why The West Misread Xi":

No nation in the history of humankind has ever prospered and advanced in the absence of a dominant and growing private sector. Xi cannot rely on corrupted China's state-owned industry to lead and transition China to the digital economy. In contrast, China needs more visionary entrepreneurs to innovate and lead the way.

Western media seems to misread China's actions, and Li Qiang's (next premier) appointment tells us something about Xi's policy direction.

Therefore, my initial, strong bullish thesis is reaffirmed, with the spin-off plan for each segment being a growth catalyst for bridging the fair value gap. Once the market has more visibility and assurance of the spin-off plan, we should expect BABA to trade closer to the estimated market value and even at a reasonable premium once the political noise clears up.

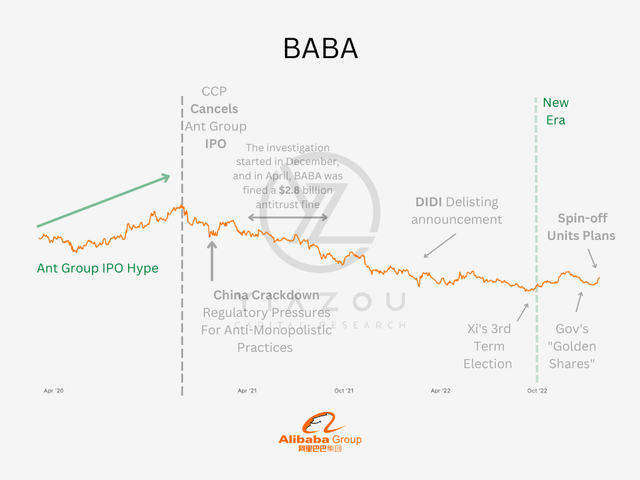

Yiazou Capital Research

Jack Ma Returns, What A Coincidence!

The rising popularity of Jack Ma has made him wildly popular not only in China, but also on a global scale. There was a time that Ma was more googled than Xi Jinping. Then, Ma amassed far too much power and started getting the attention of the CCP. Following CCP's order to halt Ant Group's $37 billion IPO in 2020, which sparked a major regulatory crackdown on Chinese tech organizations, including billions in fines and regulatory overhauls for Alibaba, the tech mogul has kept a quiet profile.

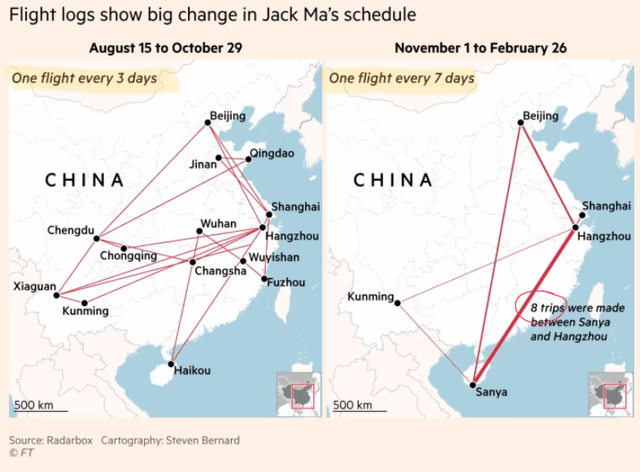

Ma's appearances are positively correlated with China's corporate developments, and exploring the patterns brings some clarity and provides a reasonable basis for future expectations. Not surprisingly, since 2021, amidst the tech crackdown, the flight logs below demonstrate a sharp decline in Ma's busy schedule.

However, Ma slowly resumed his travel in late 2022, as he was seen in Tokyo at the end of November before traveling to Thailand. According to the FT, Ma had previously traveled to Israel and the US. Moreover, there have been infrequent appearances, and he was seen in Thailand, but he had earlier been said to have spent much of 2022 in Tokyo.

FT.com

Here is a short list of the major timeline of Jack Ma's appearances and events:

- October 2020: The outspoken Ma took the stage at the Bund Summit in Shanghai on October 24, 2020, and immediately began firing, openly criticizing China's lack of regulators who are "experts in policy" as opposed to "experts in papers" and asserting that the nation's modern banks are merely an extension of the outdated "pawnshop mindset." His appearance led to Ant Group's IPO cancellation.

- April 2021: Ma stepped down as president of Hupan University, the prestigious business school he created and funded in 2015, in April as well. The Hangzhou-based school already removed the word "university" from its name due to a government crackdown on organizations purporting to be universities but did not have the proper authorization. Activities at the prestigious executive training program have also slowed after some high-ranking officials regarded it as a way for Ma to broaden his network.

- December 2022: Ma resigned from his position as president of the General Association of Zhejiang Entrepreneurs, a powerful business organization in his home province. This group is a well-known founders' networking association that facilitates connections amongst Zhejiang's hordes of businesspeople across the nation and beyond. The province in the east is regarded as China's capitalist epicenter.

- January 2023: According to Guo Shuqing, Communist Party chairman at the People's Bank of China (PBoC), the regulatory crackdown ended on January 7. According to Guo Shuqing, the government announced its support for tech companies in promoting economic growth to create more jobs. The two-year crackdown on the tech sector will "normalize." It is no coincidence that the Ant Group revealed the new shareholder structure, and Jack Ma renounced power on the same day.

- March 2023: According to Bloomberg, Chinese authorities tried to convince Ma, traveling away from the mainland, to return home and aid in showcasing government support for the business community. According to a school's official WeChat account, Jack Ma visited a school in Hangzhou on Monday to talk about issues like ChatGPT and expressed his desire to one day return to teaching, but it remains unknown how long Ma intends to stay in China. When news reports announced that Jack Ma, the founder of the e-commerce giant who had spent more than a year living in Japan, had returned to mainland China, the reorganization plan was made public a few days later.

About two months ago, we analyzed why the new premier appointed, Li Qiang, revealed something about Xi's policy priorities and how the West has misread Xi's actions, marking the beginning of a new era. Premier Li Qiang is said to have convinced Ma to return to the mainland to increase foreign investor confidence in China. In addition, Li has supported the nation's opening-up policy and encouraged foreign investment.

The atmosphere in China since the suspension of the Ant IPO has become more oppressive as the government has adopted a more autocratic approach. Last week's developments have been well-received by many, and coincidentally, Ma reappeared at a public school in Hangzhou this week after over a year of traveling abroad. Hence on the surface, the announcement, along with Ma's return to China, was carefully coordinated, and the development suggests that the government is ready to resume IPOs for the tech sector.

cnn.com

Alibaba's Reorganization "1+6+N"

Zhang Yong, chairman and CEO of Alibaba Group, issued a letter to all employees on March 28, announcing the launch of the organizational reform and the establishment of six major organizations under the Alibaba Group. Organizational changes and potential innovation incentives may strengthen business-level competitiveness. Additionally, market-based benchmarking may promote business revaluation, thereby promoting the revaluation of Alibaba Group's overall valuation.

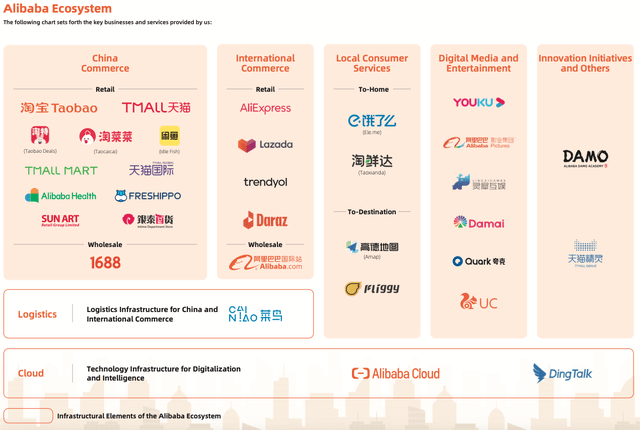

The smaller companies of the Alibaba Group, such as AliHealth, Sun Art Retail Group, Intime Retail (Group) Co, Hema Xiansheng, and Quark, are denoted in the reorganization plan as "N," whereas Alibaba Group is referred to as "1" throughout.

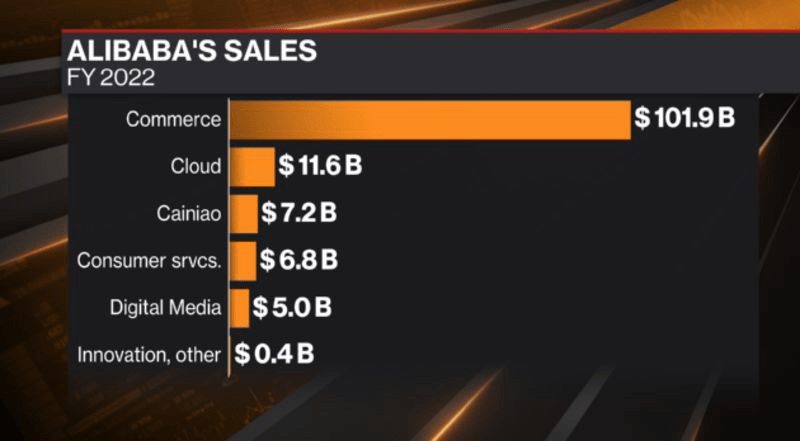

The change brought about by this organizational reform is a change in the business governance mechanism. In addition, the market-oriented initiative is expected to enhance the market competitiveness of the services provided by each business. Following the split, the company will consist of several units, such as a cloud intelligence department, a digital enterprise segment, a Taobao Tmall e-commerce platform, local offerings like food delivery, Cainiao logistics, and digital media and entertainment. The only exception to the autonomy granted to each division for potential spin-offs and independent IPOs is Taobao Tmall, which is the group's most valuable asset.

bloomberg.com

All business segments and companies, except Taobao Tmall Group, are expected to form independent financing and spin-off, and qualified business groups or companies are expected to be listed independently when ready. After these companies are listed, Alibaba Group will decide whether to maintain or give up control after further evaluating its strategic importance. Therefore, the potential business groups and companies will be separated and listed separately to drive value and promote the overall valuation of Alibaba.

Apart from revitalizing the valuation of BABA, the new plan will also serve some other key objectives, such as satisfying Chinese regulators who have intensified their scrutiny of large tech companies. Recently, regulators have promised to increase support for private companies after years of inspection that has left investors wary and negatively affected market sentiment towards China and its corporate governance.

The Buffett & Singleton: Decentralization

The Buffett & Singleton advantage is a business strategy that emphasizes decentralization and autonomy within a company's various business units. This approach can help unlock shareholder value by allowing each unit to operate independently and focus on its strengths and opportunities.

For Alibaba Group, adopting the Buffett & Singleton advantage could help the company navigate its complex business structure, which includes numerous subsidiaries and affiliates in various industries. By giving each of these units more autonomy, Alibaba can create more agile and responsive business operations that can better adapt to changing market conditions and customer needs.

Moreover, a more decentralized structure can help Alibaba leverage its extensive data and technology resources. By empowering individual business units to experiment and innovate, the company can more quickly identify and capitalize on new growth opportunities.

Finally, the Buffett & Singleton advantage can help improve Alibaba's corporate governance, as it encourages greater accountability and transparency at the business unit level. This can help mitigate risks and ensure that each unit operates in the shareholders' best interests.

Regulatory Support & Delisting Risk

The recent approval of Ant Group's capital raising suggests that the regulatory environment in China has become more supportive of internet companies. On December 30, 2022, Ant Group's consumer finance unit received approval from the China Banking and Insurance Regulatory Commission Chongqing office to increase its registered capital from RMB 8 billion to RMB 18.5 billion.

Moreover, on December 15, 2022, the Public Company Accounting Oversight Board (PCAOB) announced that it could inspect and investigate completely issuer audit engagements of PCAOB-registered accounting firms based in Mainland China and Hong Kong SAR. This development resets the three-year clock for American Depository Receipt (ADR) delisting risk, according to the SEC's Statement on PCAOB's Determinations Regarding Public Accounting Firms in China. As a result, this positive development removes the risk of delisting for at least the medium term.

Alibaba's Improving Outlook

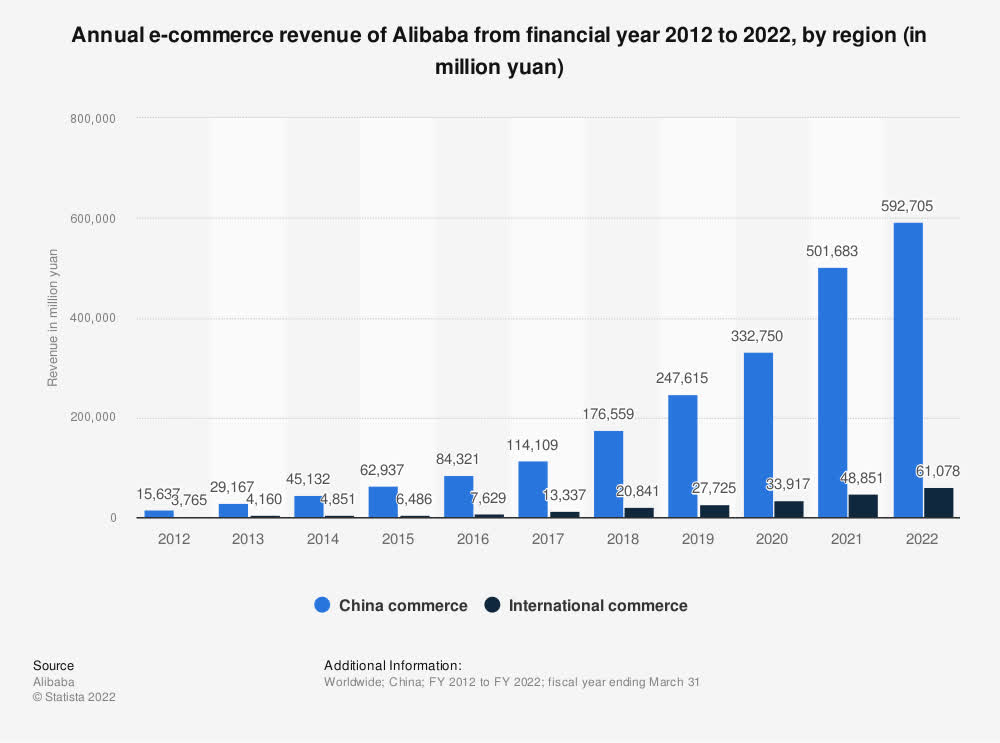

The Chinese e-commerce market is expected to grow at a CAGR of 12% between 2023 and 2027. While some may view this projection as optimistic, given a slowdown in online physical goods sales growth, it is achievable due to several factors. These include the expected return to a more normal post-COVID policy in 2023, the continued spending power of Chinese consumers, and the increased adoption of digital technologies in less developed markets.

I believe that e-commerce penetration in China, despite being the second highest in the world, will continue to rise as the younger generation, who are tech and Internet savvy, will become the main consumption driver in the medium term. Therefore, although Alibaba may lose market share to competitors, its e-commerce gross merchandise value (GMV) and revenue can still increase if it provides consumers more value than offline retailers.

This can offset the impact of lower market share with higher e-commerce penetration. In addition, Alibaba is making efforts in online-2-offline (O2O) integration and expanding into categories with lower online penetration, such as fresh produce and home decoration. As a result, there is still a high potential for positive growth for Alibaba in the e-commerce market, supported by recent Alibaba's e-commerce revenue growth in China by 18% in 2022.

statista.com

Alibaba experienced a mid-single-digit year-on-year decline in the physical goods GMV generated on Taobao and Tmall in the December quarter, primarily due to soft consumer demand and logistics disruptions caused by a surge in COVID-19 cases. Apparel sales and consumer discretionary categories were particularly affected, while healthcare, pet care, and fresh produce performed well. Although sales remained weak in January and early February, the company has seen momentum in consumption recovery as normal work and life resumed, particularly in categories such as apparel and sports & outdoors. Management highlighted that merchants strongly desire to return to the market.

Alibaba addressed concerns about market competition and price subsidies, stating that the company focuses on delivering better content and customer experiences through technological innovations. This strategy would pave the way for long-term, sustainable growth. To strengthen its market position for Taobao and Tmall, the company is introducing a wider variety of consumption-related content in short-form videos, live streaming, and other formats to enhance user stickiness and time spent. Additionally, the company focuses on enhancing the value-for-money proposition and catering to consumers' time-sensitive needs for high-frequency everyday necessities through digital neighborhood retail.

Ant Group Could Fuel Alibaba's Cloud Growth

Continuing Alibaba's cloud leadership in mainland China and further strengthening the firm's partnerships with established independent software vendors such as SAP, IBM, and Salesforce should support Ant Group's ongoing use of related services from the internet giant.

The robust capabilities of Alibaba's cloud infrastructure and platform services, which continued to surpass those of rivals Huawei and Tencent in a 2022 global assessment by IT research and consultancy Gartner, can help Ant Group maximize its technology investments to meet growth targets. According to Gartner's report published in October, Tencent Cloud trailed peers in innovation gains last year after Huawei overtook it to become China's second-largest cloud provider in 2021.

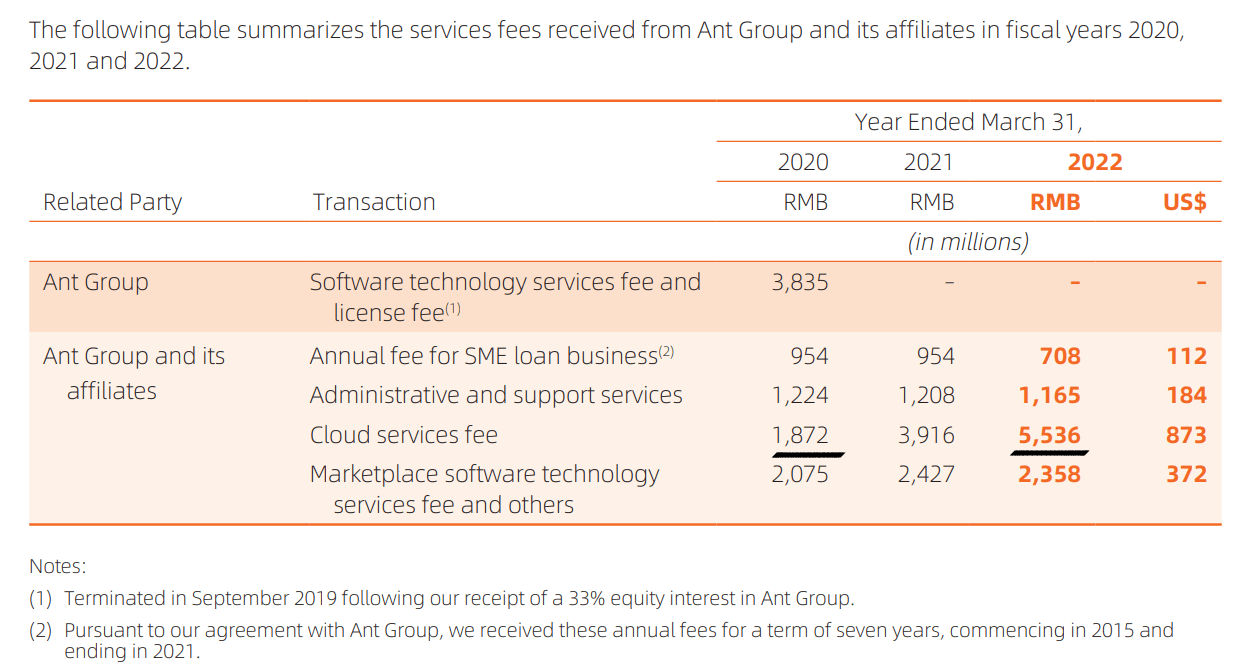

If Ant Group aims to grow its fintech businesses after addressing outstanding regulatory concerns by Beijing, it would likely prompt Ant to adopt more cloud technology from Alibaba in its operations. Hence, Alibaba could gain more cloud revenue from Ant Group, which would lift Alibaba's revenue-growth outlook and narrow its EV/sales valuation discount to peers such as Tencent and Meituan. The related fees for Alibaba's cloud usage by the Ant Group have already grown six-fold to make up 7% of Alibaba's 2022 cloud revenue from 3% three years earlier, even after Ant halted plans for an IPO.

Alibaba Group - Fiscal Year 2022 Annual Report

Increasing Competition From Smaller Players

Alibaba faces headwinds due to the e-commerce market share gains by short-video-based platforms, given its larger GMV base, more overlapping categories with short-video e-commerce platforms, and revenue exposure to branding ads budget. However, the impact on Alibaba is primarily priced in, as I don't think many investors have high expectations for Alibaba's core revenue growth in the coming years.

As long as Alibaba sustains a positive revenue growth rate, its share price will be driven by positive earnings revisions in the next 6-12 months. Nonetheless, I see limited downside risk to the current valuation given a stable 2022-25E e-commerce GMV CAGR outlook.

SOTP Valuation Suggests A $160 Target Price

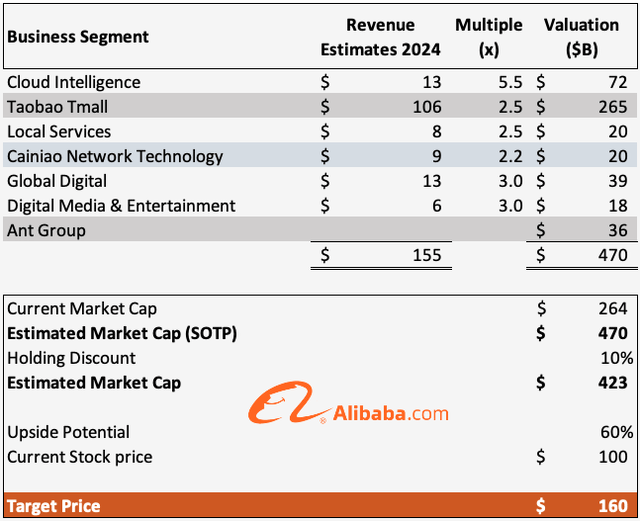

The transition to a holding company form is unusual for large Chinese tech companies, which will serve as a model for Alibaba's peers. One of Beijing's main objectives during its extensive crackdown on the technology sector is addressed by decentralizing the company's business lines and decision-making authority. This provides a reasonable basis for valuing the group based on the Sum-of-the-Parts Valuation (SOTP) method.

Alibaba

However, The Taobao Tmall Commerce Group is an exception and will remain a wholly owned unit of Alibaba Group. Thus, the model remains conservative by assigning a 2.5x multiple on Taobao Tmall Business. Even though Ant Group's valuation and IPO timing remain unknown, if it is classified as a bank at the point of IPO, we should expect a valuation of around $110 billion, or $36 billion, for Alibaba's stake.

First in the IPO queue is Cainiao Network Technology, Alibaba's logistic unit valued at more than $20 billion, suggesting at least a 2.2x multiple on FY2022 revenues. Similarly, apart from the Cloud and Local Services segments which attract a 5.5x and 2.5x multiple, I have applied a 3.0x multiple on the rest of the business units.

Analysts' average estimate hovers around $140 billion in revenue in FY 2024. However, I expect Alibaba to grow faster, leaning toward the upper end of estimates with projected revenue of $155 billion for FY 2024. To that effect, Alibaba Group's market cap is estimated at around ~$423 billion or ~$160 per share (after applying a 10% holding discount). Thus, the undervaluation gap will incrementally narrow as investors gain more visibility for the individual IPO plans and timing.

Lastly, according to credit traders, the spreads on Alibaba's dollar bonds shrank by 1 to 5 basis points, a minor improvement given the firm's already excellent credit rating. Moreover, according to Morgan Stanley, the value of the Alibaba group might reach $530 billion, suggesting a double upside potential from current levels.

Author's Estimates

Takeaway

Alibaba's stock still trades significantly below its fair value, but the spin-off plan will act as a catalyst for bridging the undervaluation gap in the market. Following this, once the market understands that China supports capitalism supported by the consistent growth in the private sector, investors shall expect a re-rating in P/E multiples closer to 20-25x.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.

This article was written by

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate the due diligence process through in-depth analysis of businesses.

I previously worked for Deloitte and KPMG in external & internal auditing and consulting.

I am a Chartered Certified Accountant and a Fellow Member of ACCA Global, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.

My primary strategy focuses on high-quality, free cash flow generative stocks with an above-average growth rate and a strong business moat.

I manage my own highly concentrated portfolio, and I occasionally engage in short-term trades to profit from asset mispricings when Mr. Market does not feel very well.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA, 9988 either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have a beneficial long position in the shares of Alibaba Group, through both NYSE: BABA and HKG: 9988. More than 97% of my position is held in 9988 through Hong Kong Exchange.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.