Ducommun: A Good Bet In The Aerospace And Defense Industry

Summary

- Ducommun should continue to benefit from the recovery in the aerospace industry.

- The company should also benefit from the defense budget, its offloading program for defense OEMs, and acquisitions.

- DCO is restructuring its business to improve profitability.

guvendemir

Investment Thesis

Ducommun Incorporated (NYSE:DCO) appears to be well-positioned to benefit from the ongoing recovery in the aerospace industry, with increased utilization rates and build rates of aircraft carriers leading to increased demand for the company's products and services. Additionally, the company is likely to benefit from a growing defense budget, offloading programs for OEM customers, and its positioning on next-generation platforms in the defense market. Furthermore, DCO is seeing healthy order backlog levels in both the aerospace and defense markets, which should provide a stable revenue stream for the company in the near to medium term. In addition to organic growth, the company is also gaining market share through strategic acquisitions, such as its recent purchase of BLR Aerospace.

While the company is facing some challenges related to product mix, program flow-through, and profitability, it is taking steps to reposition its facilities in Monrovia and Berryville to a low-cost production facility in Guaymas, Mexico. This move should help to improve the company's margins over time.

Overall, I am optimistic about DCO's growth prospects and believe that the company's strong position in the aerospace and defense markets, coupled with its strategic acquisitions and focus on improving margins, makes it a good investment opportunity. As such, I recommend a buy rating on the stock.

About the Company

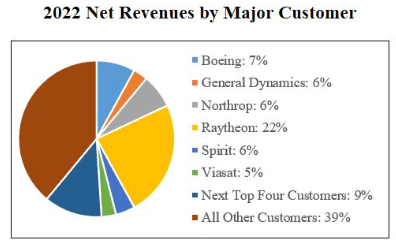

Ducommun Incorporated is a global provider of engineering and manufacturing services for aerospace and defense, industrial, medical, and other industries. However, the company generates the majority of its revenue from the aerospace and defense (A&D) industries. Raytheon Technologies (RTX) and Boeing (BA) are the company's two largest customers, accounting for 22% and 7% of the total revenue, respectively. Impressively, Ducommun's top ten clients contributed 61% of its total revenue in 2022. DCO has two operating segments; Electronic Systems and Structural Systems. Electronic Systems designs and manufactures electronic products used in markets including A&D and industrial end-use markets. Meanwhile, Structural Systems designs and manufactures various sizes of complex aerostructure components and assemblies.

DCO's customer distribution (Company's 10-K)

Commercial Aerospace Business

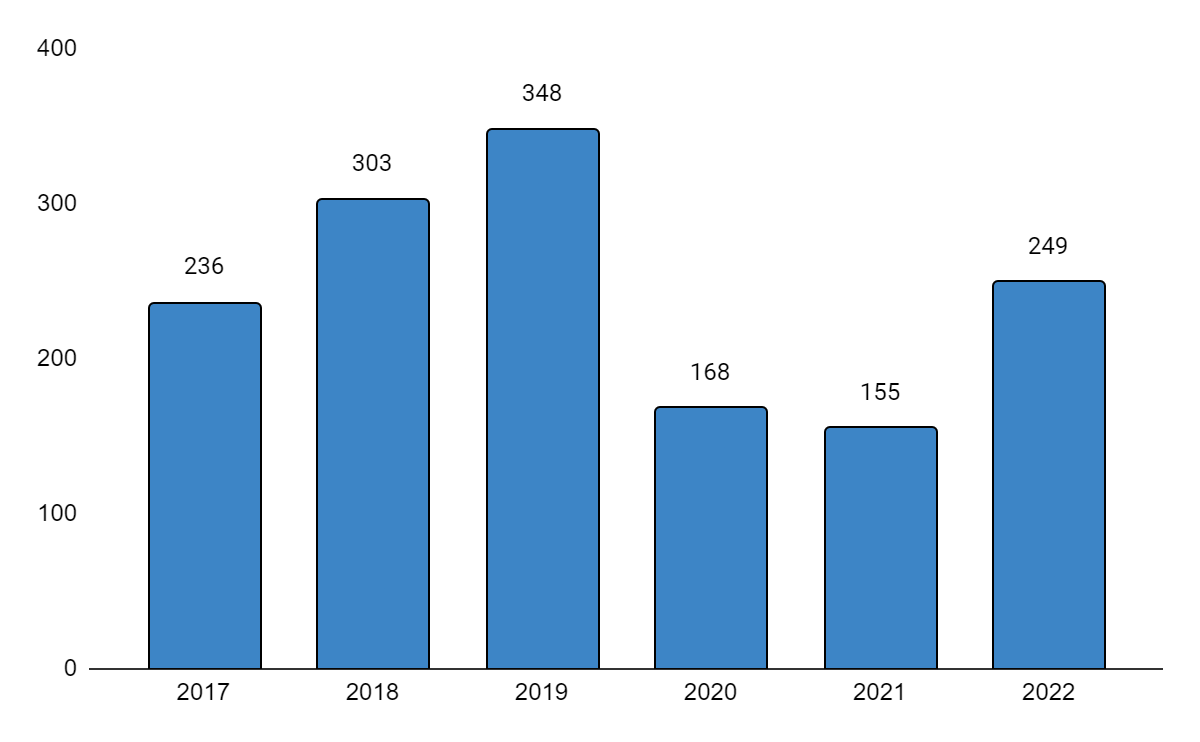

Commercial Aerospace business revenue chart (Created by DzD Analysis by taking data from DCO)

DCO generates 35% of its revenue from the commercial aerospace business. Prior to the COVID-19 pandemic, the company had steady revenues. However, due to reduced air travel, revenues suffered during the pandemic and have not fully recovered. Nonetheless, in 2022, the commercial aerospace business saw impressive 61% year-over-year growth, generating $249 million from clients such as Boeing, Airbus, and Gulfstream. This growth was due to an increase in build rates and air travel demand. Third-party sources suggest that Boeing produced approximately 25 737s per month in 2022, while Airbus manufactured 45 A320s and 6 A220s per month. However, both companies fell short of their production targets due to supply chain challenges, primarily in procuring engines. The rise in build rates was mainly due to robust demand and a slight improvement in supply chain constraints. Encouragingly, the latest data from the International Air Transport Association (IATA) indicates a positive trend in January 2023, with global air traffic reaching 84.2% of January 2019 levels, while Revenue Passenger Kilometers (RPK) grew by 67% compared to January 2022, signaling a resurgence in air travel demand.

Looking ahead, the outlook for commercial aerospace remains healthy as it is still in the recovery phase. The improvement in RPKs should continue to drive increased fleet utilization and the demand for new aircraft. Additionally, the company had a healthy order backlog of $325 mn at the end of 2022, which is 17% higher compared to 2021. This was driven by Boeing's 737 MAX, Airbus' A320 and A220, and Gulfstream aircraft orders, which were impacted in 2020 and 2021. For 2023, Boeing has forecasted building 31 aircraft per month, which is above the prior year's rate but still lower than historical levels. Ducommun supplies Boeing with titanium, CDP thermoplastics, and lightning protection products, which could lead to higher revenues. Meanwhile, Airbus aims to produce 65 A320s per month by 2024, and Ducommun is one of the major suppliers of titanium to Airbus. Overall, I believe the commercial aerospace business revenue in the near to medium term should be driven by a healthy order backlog, a recovery in the industry, and increasing build rates.

Defense and Space Business

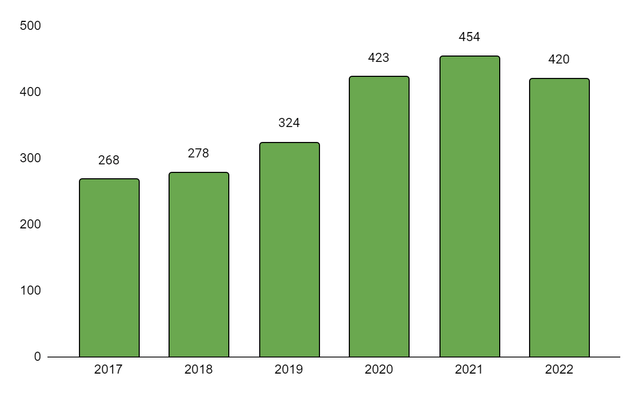

Defense and space business revenue chart (Created by DzD Analysis by taking data from DCO)

Ducommun's revenue is primarily derived from the defense and space businesses, which account for approximately 59% of its revenue. However, after experiencing unprecedented growth in 2020 and 2021, the revenue from these businesses declined by around 7.5% in 2022. The decline in revenue was due to the moderation in demand and the tough year-over-year comparisons. In 2020 and 2021, the defense business revenue benefited from the healthy demand from various programs, such as UAV, F-15, F-16, F-18, and other missile programs. Unfortunately, due to the moderation in demand, revenue and backlog growth were negative in 2022. Furthermore, the order backlog declined by 12% year-over-year to $457 million in 2022.

Looking ahead, I believe the revenue growth in the defense business should be flat to slightly negative in 2023 due to the completion of certain projects in 2022. However, the company has a healthy order backlog, which should partially offset these headwinds. Additionally, the recent passage of the FY23 National Defense Authorization Act (NDAA) in December 2022, which allocates $816.7 billion to the Defense Department, is expected to benefit Ducommun's order rate in FY23. With its missile defense and radar systems such as the LTAM system for missiles, the NASAM system for radar and missiles, and the THAAD system with TPY-2 radar, the company is well-positioned to take advantage of this defense budget

In the long run, the defense business should benefit from a prime loading program, high-value level assemblies, and positioning on next-generation platforms. Firstly, DCO offers an offloading program to OEMs (primes). Under this program, the company manufactures products at a lower cost with higher quality for OEMs that face the problems of a lack of expertise and high-cost locations. The company achieved its target of $45 mn in 2022 through this program, up from $31 mn in 2021. For 2023, the company is targeting $90 mn with the majority coming from the circuit card business for Raytheon Technologies at Appleton, Wisconsin, and Tulsa, Oklahoma. By 2025, the company anticipates the revenue from this program should be ~$125 million as OEMs continue to drive cost reductions and challenge the reasoning of keeping certain types of production in-house.

Secondly, DCO is also moving towards higher-value assemblies by providing interconnects, circuit card assemblies, and integrated systems. The company is providing server and modem boxes for in-flight WiFi to ViaSat and is providing several complex circuit card assemblies for the SM-3 and SM-6 missiles for Raytheon. Lastly, the company's positioning on next-generation platforms should help drive growth in the defense business. DCO is well-positioned with products such as radars and missiles for hypersonics, fixed-wing military aircraft, and nuclear submarines.

Overall, I am optimistic about the defense business medium- to long-term outlook given the healthy backlog levels, the NDAA budget, the offloading program for OEMs, the move towards high-value assemblies, and DCO's positioning in the next-generation platform.

Acquisitions

Ducommun is proactively expanding its Engineered Products businesses, which specialize in aerospace and defense, through both acquisitions and organic growth in the aftermarket. This segment currently generates 15% of the company's total revenue, and DCO aims to increase this figure to 25% by 2027. The company's acquisition strategy is focused on three key value-creating opportunities: gaining market share, accelerating new product development, and implementing value-based pricing.

DCO is gaining market share by investing in the acquired company's engineering capabilities, sales resources, distribution centers, and other unmet needs in the market. In addition to market share gains, DCO also focuses on accelerating new product development in its Engineered Products segment. One good example of new product development is the addition of handling systems to Nobles. DCO acquired Nobles in 2017, which was the leader in ammunition shoots. Post-acquisition, DCO helped the company move into broader ammunition handling systems by investing in engineering resources. Nobles was able to establish a new product line for ammunition handling and expand its business. Finally, DCO is also implementing value-based pricing to ensure that it receives appropriate compensation for the value that its products provide. By pricing products based on the value they deliver to customers, the company can maintain pricing power while providing high-quality products and services.

Recently, the company entered into a transaction to acquire BLR Aerospace. This transaction is expected to be completed during the second quarter of 2023. BLR is a leading provider of aerodynamic systems that enhance the productivity, performance, and safety of rotary- and fixed-wing aircraft on commercial and military platforms. The acquisition should accelerate the company's growth in the commercial aerospace market, which has significant potential in the coming years. In conclusion, I believe DCO's acquisition strategy, combined with its organic growth initiatives, is expected to drive revenue growth, expand the product portfolio, and enhance profitability in the long run.

Improving the Bottom Line

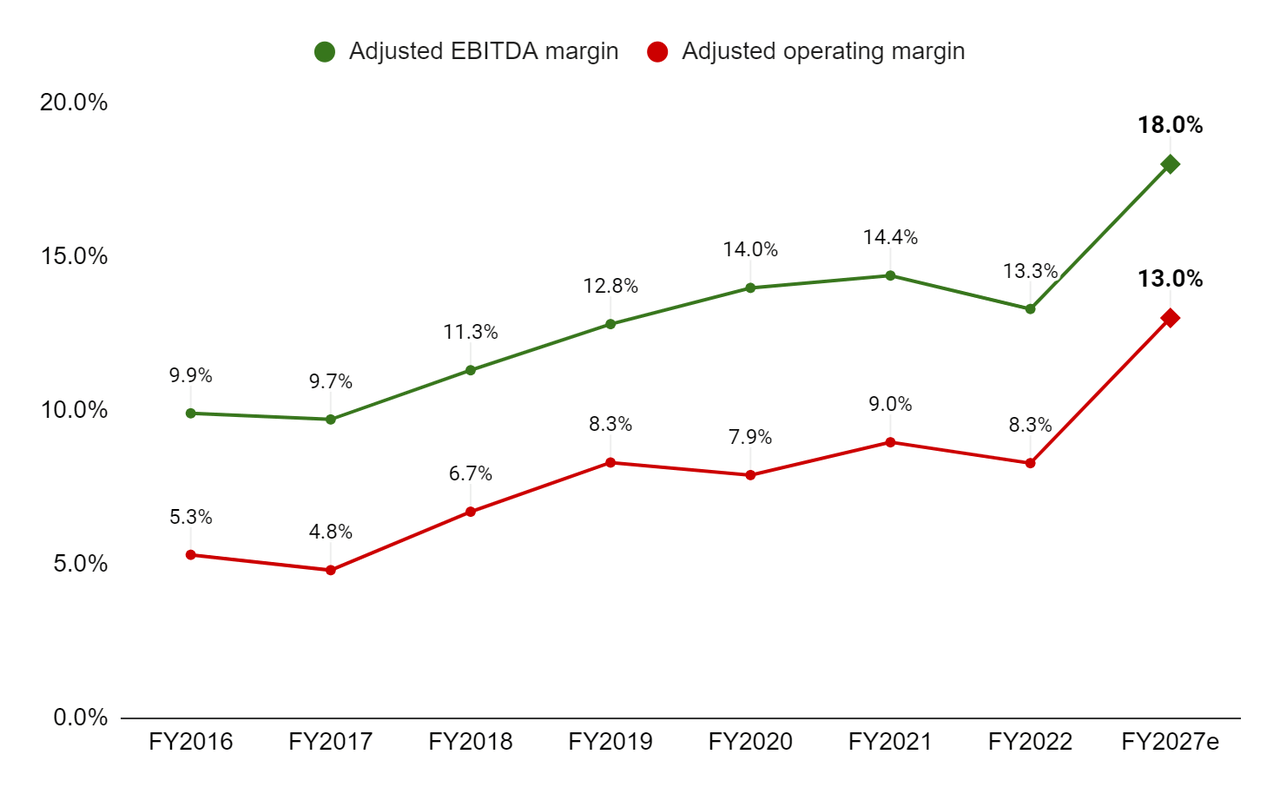

DCO's adjusted operating margin and adjusted EBITDA margin (Created by DzD Analysis by taking data from DCO)

The adjusted EBITDA margin and adjusted operating margin declined by 110 bps and 70 bps Y/Y to 13.3% and 8.3%, respectively. The decline was due to the impact of supply chain constraints and a labor shortage across the company's manufacturing facilities. The company is continuing to manage the supply chain constraints through proactive supply chain efforts, executing strategic buys, and utilizing inventory investments. In addition to this, the company is also aggressively managing its discretionary spending to drive margin expansion.

To further improve its margins, DCO is also repositioning production at its Monrovia, California, and Berryville, Arkansas, facilities in the first half of 2023 due to the challenges related to product mix, various program flow-through, and profitability. The company will redeploy the production from these facilities to its low-cost manufacturing facility in Guaymas, Mexico. The company increased the square footage of this facility from 62,000 to 115,000. The company anticipates incurring an additional $12 mn to $16 mn in restructuring expenses for facility consolidations, severance, and impairment of long-lived assets in 2023. These initiatives will generate annualized savings of $11 million to $13 mn, starting in 2024.

DCO is targeting to achieve an 18% adjusted EBITDA margin and a 13% adjusted operating margin by the end of 2027. This should be done by gaining operating scale at its performance center and driving costs down. Firstly, the company was able to get $100 mn in revenue from its Appleton plant, which is currently running at optimum efficiency. The facility has more than 300 employees working three shifts and a high level of automation and robotics. The company is replicating this model across its other performance centers. Secondly, the company is driving the costs down by shifting toward low-cost production facilities such as Guaymas, Mexico, which we discussed above.

Overall, I am optimistic about the company's profitability prospects. DCO's margins should benefit from the shift toward low-cost manufacturing facilities, improving efficiency at its facilities, reducing discretionary spending, and taking proactive measures to handle supply chain constraints.

Valuation

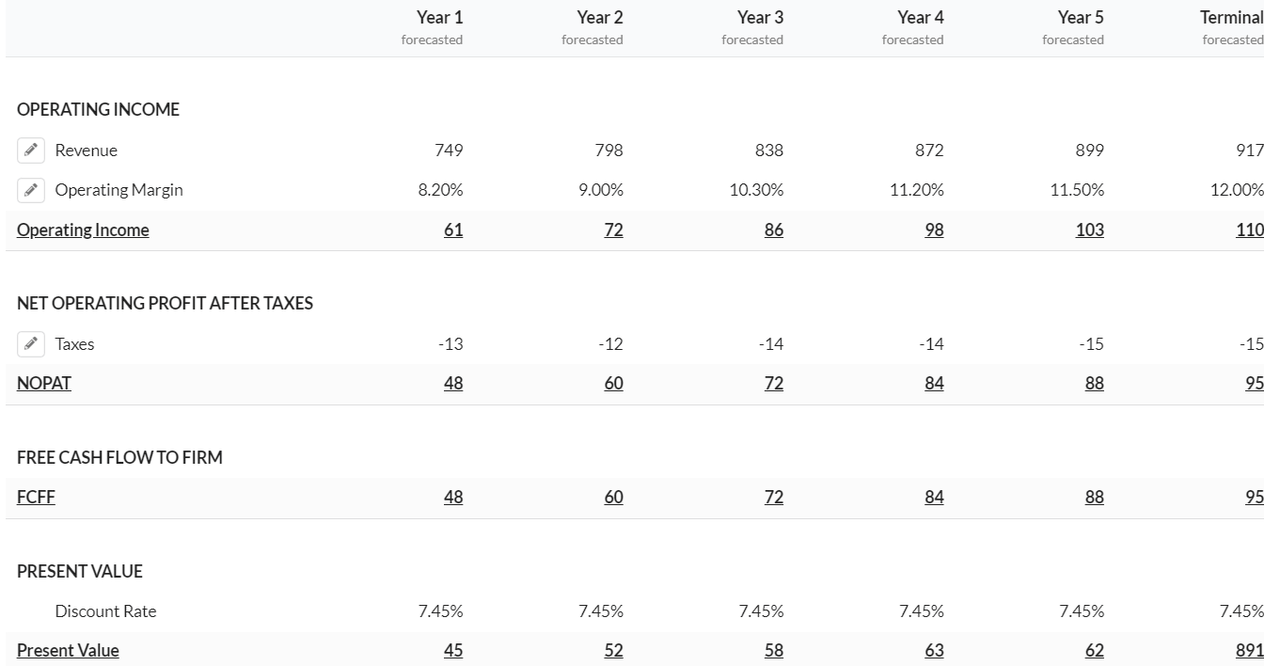

DCF Valuation (Created by DzD Analysis using Alpha Spread)

In my DCF calculations, I am assuming revenue growth to be in the mid-single digits in 2023, given the healthy order backlog levels, increasing build rates, defense budgets, and recovery in the aerospace industry. Beyond 2023, I have assumed growth to be between the low to mid-single digits, with a terminal growth rate in the low single digits as the recovery in the aerospace industry gets completed. I have assumed the operating margins should be impacted in 2023 due to the company's ongoing restructuring program. However, beyond that, the margins should improve as the benefits of the restructuring program come to fruition. I used a discount rate of 8.64% by using the cost of equity of 7.45% and arrived at a fair value of $78.56 for DCO.

Using the relative valuation, the stock is currently trading at 12.95x FY23 consensus EPS estimate of $4.23 and 14.65x FY24 consensus EPS estimate of $3.74, which is below its five-year average forward P/E of 17.80x. Hence, based on my DCF calculations and relative valuation, I believe the stock is undervalued.

My Final View

In conclusion, I believe DCO is a good buy at current levels given the healthy revenue and margin growth prospects. The company's focus on the offloading program for defense customers, new product development, and acquisitions has helped it gain market share and grow its revenue. With its continued investment in low-cost manufacturing facilities, DCO is well-positioned to achieve its profitability targets and benefit from the expected growth in the aerospace and defense industries. Overall, DCO's strategic initiatives and focus on innovation should continue to benefit the company in the long term.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.