2 Fat Dividends For April: +6% Yields

Summary

- To beat inflation, high-yield dividend growth stocks can work wonders.

- Both companies listed have +6% dividend yields.

- Owning companies in high-barrier-to-entry industries can provide great returns.

ismagilov

The beginning of April is an enjoyable time as a dividend growth investor. It means it's time to tally up all of the Q1 dividends and evaluate how the first quarter of the year has shaken out.

It offers an opportunity to see whether yearly predictions made in December have begun to manifest. And, if not, to determine whether any course adjustments might be necessary.

As we roll into April, I'm keeping my eye on dividend growth companies with huge dividend yields.

The beauty of big yields combined with even modest growth is that you can secure your portfolio's health even amid heavy inflation.

All facts and figures listed below are in Canadian dollars, matching the reporting currency for both companies.

Stock #1: Bank of Nova Scotia (BNS) (BNS:CA) - Yield 6.05%

As one of the Big Five Canadian Banks, BNS has a long record of delivering for shareholders. It operates in four business lines:

- Canadian Banking

- Global Wealth Management

- International Banking

- Global Banking and Markets

The company has paid a continuous dividend to shareholders going all the way back to 1833. It has also managed to increase the dividend in 43 of the past 45 years.

With a track record this solid, it's impossible to ignore when the yield itself notches as high as it currently is. On the $4.12 annual dividend per share, the company is posting a yield of just over 6%.

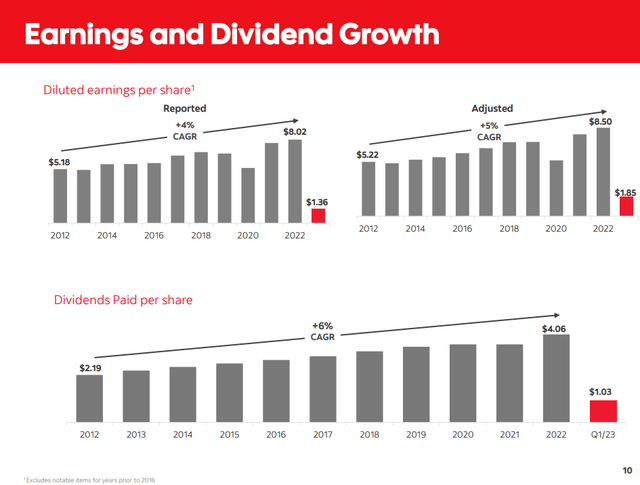

What makes this even sweeter is that BNS has managed a +6% dividend CAGR going back to 2012:

Scotiabank Investor Marketing Presentation, Q1 2023

Looking at the period ahead, there are two areas I'll be focusing on:

- Expansion outside of Canada and United States.

- Execution and direction from the new CEO.

Pacific Alliance Strategy

The key differentiating factor for the bank is its exposure outside of Canada and the US. It is intensely focused on strengthening and expanding its presence in the Pacific Alliance ("PAC") countries of Mexico, Peru, Chile, and Colombia.

The PAC region boasts many attractive qualities. For example, the median age of the population is 30 years of age and the aggregate population is six times that of Canada. Setting a foothold here means BNS is able to take the disciplined banking practices of its home market to be successful in the expanding growth market abroad.

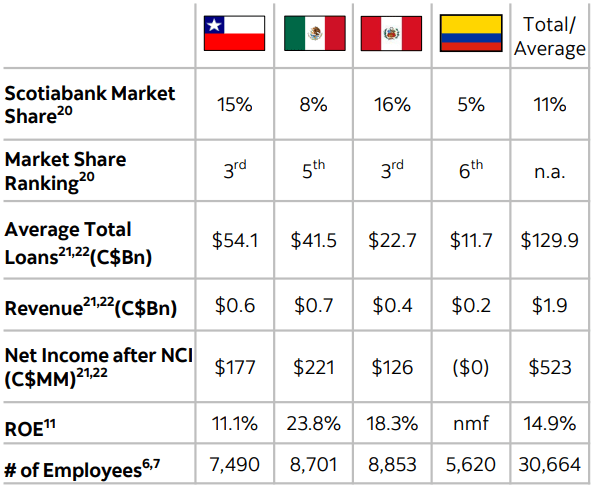

As difficult as it can be to break into international markets, BNS already has a Top 6 position in each of the PAC nations:

BNS Investor Fact Sheet, Q1 2023

This provides an excellent foundation on which to continue building.

Evaluating the New CEO

Scott Thomson joined BNS as an outside hire on February 1 of this year. He has a wealth of executive experience across diverse industries. Most recently, he was CEO of Finning International, the world's largest dealer of Caterpillar (CAT) equipment. His history also includes time at Bell Canada Enterprises (BCE) and Goldman Sachs (GS).

On BNS' recent Q1 2023 quarterly earnings call, Thomson outlined three top priorities:

- Purposely allocating capital.

- Focusing on long-term deposit growth.

- Improve business mix and profitability.

In terms of improving the business mix, Thomson stated the following:

I see areas of strength, and I also see segments where we were underpenetrated like commercial, affluent retail and other high-value segments that have a good profitability and risk profile. We are in the process of assessing our international business mix so that going forward, we allocate our capital to customer segments where we can get appropriate returns for our shareholders.

I believe this is the right emphasis for BNS at this stage. Deepening relationships with existing customers and likewise targeting higher-value targets for growth is a fine strategy.

While it is still early to tell whether the company will be able to execute on Thomson's vision, I am encouraged by the direction being undertaken. He brings a fresh perspective that I believe will serve the company well.

Stock #2: BCE Inc. (BCE) (BCE:CA) - Yield, 6.39%

BCE is the largest communications company in Canada. It serves retail and business consumers across the spectrum for their digital media needs.

The dividend yield is currently a healthy 6.39%. The great news is that this is based on the annual dividend payment of $3.87 which is the result of a recent 5.16% raise which takes effect with the April payment.

If you believe the safest dividend is the one that just got raised, this is a positive sign. Beyond the current increase, BCE has managed to reward shareholders with ~5% increases going back fifteen consecutive years.

Now let's take a look at the company's recent results and business prospects ahead.

Recent Results

The company operates in three segments:

- Bell Wireline (49%)

- Bell Wireless (39%)

- Bell Media (12%)

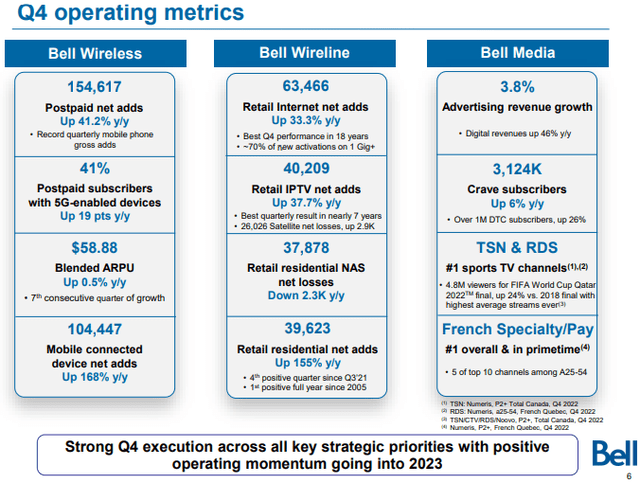

As part of BCE's recent Q4 earnings release, I was impressed by the rate of growth posted both on the Wireless and Wireline sides of the equation:

BCE Q4 Earnings Call Slide Deck

Consider the following:

- Wireless posted a 41% YOY growth rate with high-value mobile phone subscribers. This is absolutely gargantuan when you consider BCE is already a leading provider of these services in Canada. It speaks to both the company's execution and the expanding nature of this line of business.

- With wireline, BCE popped 33% in retail internet net adds, its best Q4 number in 18 years.

These pack a wonderful one-two punch when you consider the benefits consumers realize by bundling services; each line of business builds on the success of the other.

On the company's Q4 2022 earnings call, CEO Mirko Bibic highlighted how the recent success can be attributed to their multi-year CapEx plan:

Since 2020, we have accelerated CapEx, investing more than $14 billion, the highest ever over a 3-year period by Canadian Communications company and we are doing it to forge ahead aggressively on constructing the broadest fiber footprint in North America, opening up Wireless Home Internet to 1 million rural homes in rural communities and building our mobile 5G networks faster.

In other words, BCE isn't resting on its laurels. The company is using its deep pockets to build on its lead and meet customers where they are to serve them.

On this note, BCE's mobile 5G coverage now already covers 82% of Canadians.

Beyond their core business lines, BCE also recently created Bell Ventures which is focused on growing, early-stage companies. These investments are designed to develop tech solutions which enhance Bell's own 5G and fiber networks, along with developing solutions for network security, IoT, robotics, and other emerging areas.

The beauty of BCE's business model is the huge barriers to entry for competition. Developing assets of this scale requires human resources and huge infrastructural investment.

Conclusion

These are two solid Canadian companies operating within oligopolies in their respective industries. Getting a huge +6% dividend yield is tremendous, particularly when you factor in their dependable track records of growth.

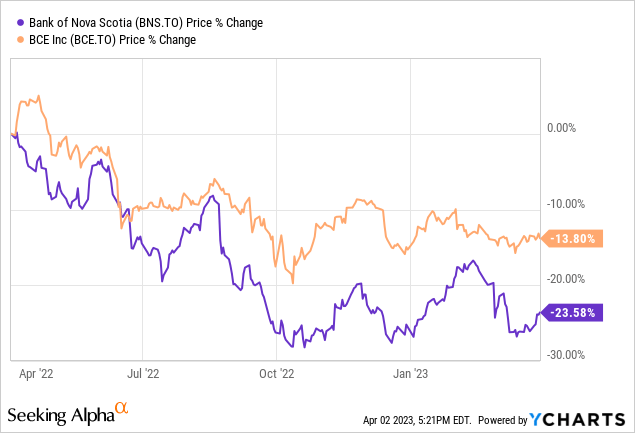

Their recent share pullbacks have juiced up their dividend yields, increasing the value proposition for new investment capital:

The underlying businesses, despite the stock pullbacks, remain strong. This gives me confidence both as an existing shareholder and with an eye to increasing my stake.

Full Disclosure: Long BNS, BCE

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BNS:CA, BCE:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.