Will The Concentrated Rally Fizzle Out?

Summary

- The rally in 2023 has been largely concentrated in the top stocks in the S&P 500.

- Concentrated rallies like this have often preceded drawdowns and volatility in the past.

- There are fundamental reasons to be cautious in this market, while many technical signals continue to be optimistic.

Jonathan Knowles

The first quarter of 2023 has been a great beginning for stocks. A recent Bloomberg headline summarizes the bullishness in the face of a banking crisis: Nasdaq 100 Enters Bull Market as Bank Jitters Ease, Tech Rallies.

While the rally can continue, there are some signs for caution. One concern is that the 2023 rally has largely been concentrated in just a few stocks.

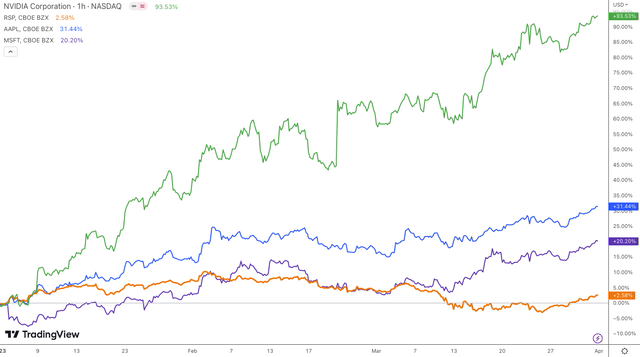

Specifically, if you owned all the stocks in the S&P 500 with an equal weighting, represented below as Invesco S&P 500 Equal Weight ETF (NYSEARCA:RSP), your first quarter return would only be 2.6%. During this same period, Nvdia (NVDA) is up by over 93%, Apple (AAPL) is up by over 31%, and Microsoft (MSFT) is up by over 20%.

This year's rally has not yet been broad-based. In the past, rallies that are concentrated in just a few names have often fizzled out.

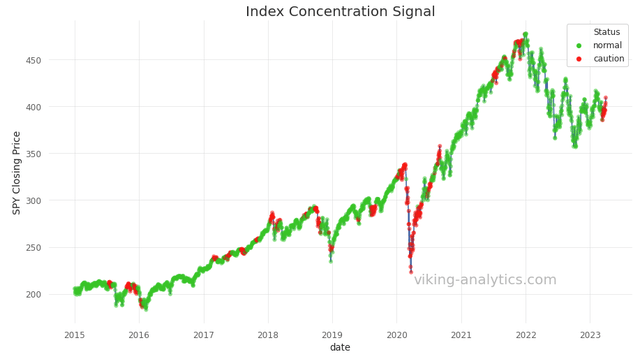

Index Concentration Signal

We looked at a 20-year history in the SPDR S&P 500 ETF (SPY) in comparison to Invesco S&P 500 Equal Weight ETF to uncover when concentrated bullish thrusts can lead to trouble. Simply put, this signal is 100% allocation to SPY when the signal is green, and 0% allocation when the signal is in red below. The use of this signal increases the Sharpe ratio of the S&P over the 20-year horizon from 0.52 to 0.84.

Due to a widening divergence between the top names in the S&P and all names, this signal has been flat for the last two weeks. If we were to add a narrative to the current environment to explain the bullish thrust, one might opine that the last two weeks benefitted from passive flow, trend following and end of quarter buying that lifted stocks to new monthly highs in March.

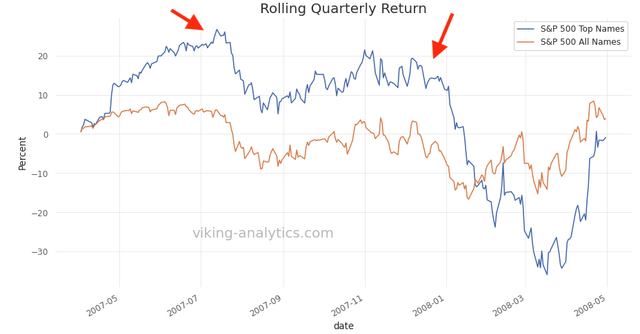

Diving Into Some History

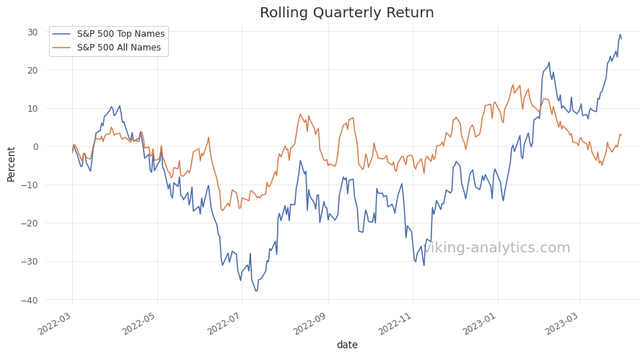

The chart below shows the difference in rolling returns in the top stocks in the S&P 500 versus the return in all stocks in the S&P. The increasing divergence in mid 2007 and late 2007 corresponded with large eventual drawdowns.

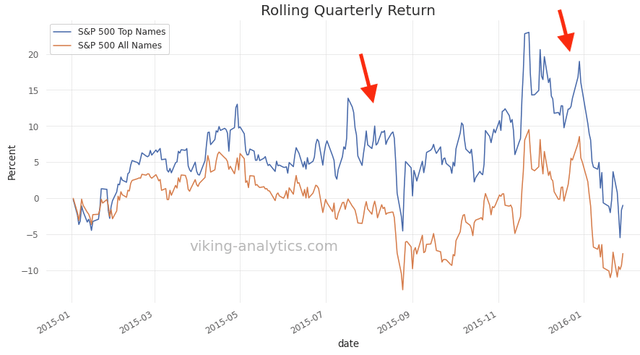

The divergence between the top names in the S&P and the total index also pre-dated volatility and drawdowns in mid 2015 and in late 2015.

What's The Current Status?

The top 10 names in the S&P have a combined return near 30% year-to-date, while the RSP has a return of under 3%. This year's rally has not benefitted all stocks equally.

Final Thoughts

There is no silver bullet in determining the next move in the markets. The famous quote by Keynes comes to mind - "Markets can remain irrational longer than you can stay solvent." We use market-based signals not to predict the future, but to help determine our allocations and risk exposure.

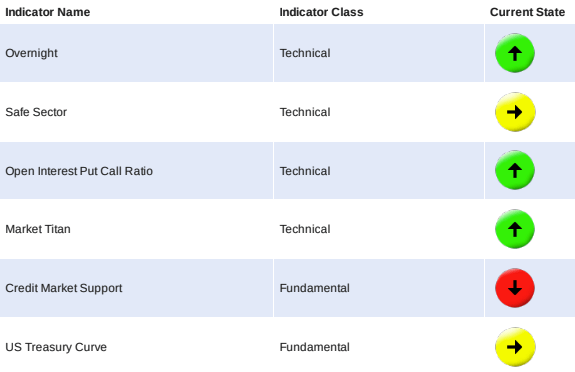

At the moment, we are fundamentally cautious due to the inverted yield curve and tight credit conditions. Technically, on the other hand, there are reasons for optimism and even bullishness. The most recent bullish tends to fit this combined narrative.

Overall, some allocation to stocks is justified, and the Index Concentration signal is merely one reason to reduce risk.

Market Navigator Signals (Viking Analytics)

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This is for informational purposes only and is not trading advice. I am long equities, including SPY, at reduced exposures.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.