Polestar: Continues To Deliver

Summary

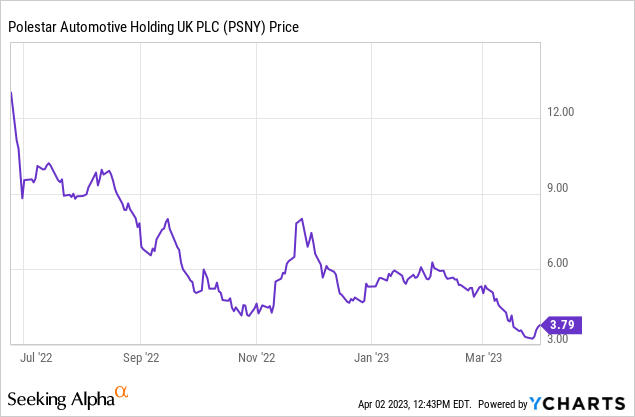

- Polestar is now down nearly 30% year to date.

- It is one of the most exciting emerging car manufacturers in the EV industry, and its opportunities are huge.

- The latest earnings showed substantial progress with strong revenue growth and an improved bottom line.

- The balance sheet is what makes me cautious, as cash in hand can only support less than a year of operation.

- I rate the company as a hold.

Trygve Finkelsen/iStock Editorial via Getty Images

Investment Thesis

Polestar (NASDAQ:PSNY) was one of the most high-profile SPACs that went public last year. However, the company has been performing poorly with shares down over 70% from its all-time high. I see decent potential in the company but now is not the best time to buy.

Polestar is one of the few emerging EV brands that actually delivers and executes. The upcoming launches and expansion into new markets should continue to be strong growth drivers. The latest earnings continued to show solid progress with strong delivery volumes, revenue growth, and improved operating leverage. However, the balance sheet and cash burn are notable concerns that may weigh heavily in the near term, therefore I rate the company as a hold.

Why Polestar?

EV is a fast-growing industry with massive growth opportunities. According to Statista, its market size of is forecasted to grow from $453.7 billion in 2023 to $857.5 billion in 2030, representing a strong CAGR (compounded annual growth rate) of 17%. S&P Global (SPGI) also expects 50% of new vehicles to be electric by 2030. This resulted in the EV industry becoming increasingly crowded, with different emerging brands such as Lucid (LCID) and Rivian (RIVN) each launching their respective designs. However, most companies failed to deliver what they promised and turned out to be a let-down.

I believe Polestar is a rare exception that could become a prominent player in the industry, as it continues to progress quickly and show extraordinary execution. For those unfamiliar with the company, Polestar is an emerging EV manufacturer founded in 2017, with support from Volvo (OTCPK:VOLAF) and Geely (OTCPK:GELYF). The backing from the two established brands gives Polestar a huge advantage, as it allows the company to leverage their factories, engineers, and designers, which vastly increases efficiency and reduces costs. Unlike other companies, Polestar managed to deliver meaningful volume and demonstrate solid operating leverage. For context, Lucid and Rivian each delivered 4,369 and 20,322 vehicles in FY22, while posting a negative gross profit. On the other hand, Polestar delivered 51,491 vehicles and also recorded a record gross profit, which is extremely impressive.

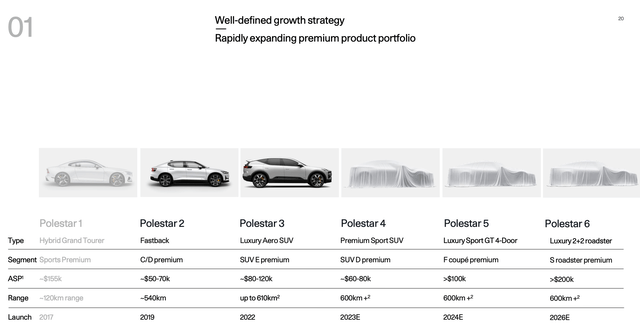

Despite such progress, this is only the beginning. The company is starting to ramp up production for Polestar 3 this year and expects to launch Polestar 4 and Polestar 5 in the coming two years. It is also continuing to expand into new countries, as its brand awareness is still low in most countries outside of Europe. I believe these catalysts alongside the strong execution and industry tailwinds will continue to drive growth.

Strong Progress In Q4

Polestar announced its fourth-quarter earnings earlier this month and the results are impressive across the board.

The company reported revenue of $985.2 million, up 67% YoY (year over year) compared to $589.5 million. The growth is attributed to strong delivery numbers, led by Polestar 2 and market expansion. The company delivered 51,491 vehicles in 2022, up 80% YoY from 28,677.

The bottom line showed significant improvement thanks to excellent costs and expense control. Operating leverage also improved as it benefited from better economies of scale. Despite revenue being up 67%, costs of sales were only up 57% YoY from $590 million to $923 million. This resulted in the gross profit flipping from negative $(200,000) to $62 million. The gross profit margin was 6.3%. Operating spending was also muted. SG&A (selling, general, and administrative) grew by 1% from $237 million to $239 million, largely due to increased marketing efforts. While R&D (research and development) expenses dropped 37% from $76 million to $48 million. The lowered spending resulted in the operating loss improving 39% YoY from $(337) million to $(205) million. Net loss was $(262) million compared to $(337) million.

The FY23 guidance for delivery volumes is also strong. The company expects global volume to increase by 60% YoY to 80,000, as the momentum of Polestar 2 remains superb.

Balance Sheet and Cash Burn

The latest quarterly earnings were strong, but Polestar's balance sheet and cash burn remain concerning. While net loss has improved in the past year, cash burn continued to deteriorate. In FY22, net loss contracted 53.5% YoY from $(1) billion to $(465) million, yet operating cash flow worsened 253% YoY from negative $(312) million to $(1.1) billion.

At the end of the fourth quarter, the company only has $974 million in cash, with $1.45 billion in debt. Considering the current amount of cash in hand, the company only has roughly a year of runway left, assuming the rate of cash burn remains constant. It will likely need to raise more capital and it will be costly in the current environment. Borrowings are extremely expensive due to increased rates, while offerings will dilute shareholders substantially as the share price has plummeted. I believe this alongside the notable debt load will likely weigh heavily on the company in the near term.

Investors Takeaway

I believe Polestar is a company with huge growth potential. It is one of the few pure EV companies that can actually execute and deliver meaningful volume, and the upcoming launches and market expansion should continue to drive growth. The rapid expansion of the EV industry should also provide further tailwinds moving forward. The company continued to show significant growth with a lowered operating loss, as operating leverage improved. However, its balance sheet and cash burn present meaningful uncertainties in the near term that may impact financials. Therefore, I rate the company as a hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.