Freeport-McMoRan: Electrifying The Future (And Don't Forget About Gold)

Summary

- The acceleration of clean-tech and EV production is and will be a bullish tailwind for global copper demand for years to come.

- Indeed, some analysts are predicting a very tight copper market could push the price up to $12,000/ton later this year.

- Freeport-McMoRan is a top producer of copper but also a large producer of gold - which has been rallying this year.

- FCX currently trades with an arguably rich forward P/E=20.8x and yields only 1.4%. However, the shares are still attractive, and here's why.

FactoryTh

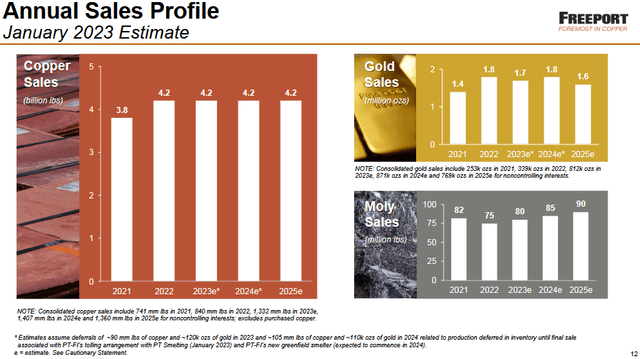

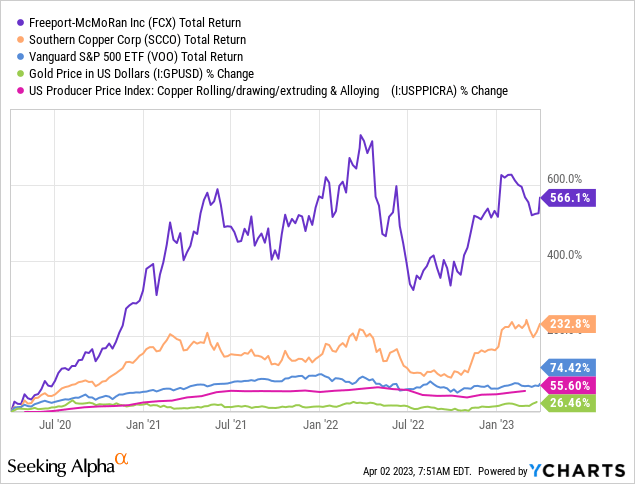

As can be seen in the graphic below, Freeport-McMoRan (NYSE:FCX), a miner highly levered to both the price of copper and - to a lesser extent, gold - has ridden the price increases of both to not only significantly outperform its peer Southern Copper (SCCO) over the past 3-years, but also the S&P500 as measured by the Vanguard S&P 500 ETF (VOO). While the price of rolled copper rose 55% over that time frame, there could be further gains ahead as the EV transition picks up speed. That's because EVs use from 2-3x the amount of copper as compared to traditional ICE-based vehicles and, as a result, copper demand is expected to double by 2035. That's a fundamentally bullish catalyst for a company like FCX that produces ~4.2 billion lbs of copper per year. Meantime, don't forget gold: FCX produced 1.3 million ounces of gold last year, and gold has been rallying of late. We reiterate FCX stock as a BUY.

Investment Thesis

The simple fact is this: acceleration of the clean-energy and EV transition means the global energy & transportation systems are going to be much more dependent on copper. That's because EVs use 2-3x more copper than ICE-based vehicles and is also used to build-out both solar & wind capacity. Copper is also a critical component to build out transmission infrastructure as well as components for battery-charging stations.

As Daniel Yergin - S&P Global Vice Chairman - said recently in a CNBC interview:

The energy transition is going to be dependent much more on copper than our current energy system. There’s just been the assumption that copper and other minerals will be there. ... Copper is the metal of electrification, and electrification is much of what the energy transition is all about.

S&P forecasts copper demand will nearly double to 50 million metric tons by 2035 and will reach more than 53 million metric tons by 2050. To put that into perspective, S&P Global noted that that is “more than all the copper consumed in the world between 1900 and 2021.”

In a recent press release, Freeport-McMoRan CEO Richard C. Adkerson said that the company is operator of 9% of the world's copper production. That being the case, the investment thesis in Freeport-McMoRan is relatively simple and straight-forward: if you are bullish on the long-term prospects for copper, you've got to be long-term bullish on FCX stock.

Going Forward

Last year, Freeport-McMoRan boosted sales volumes of both its copper and gold production - by 10.5% and 34%, respectively. As a slide from the Q4 Presentation below shows, this year copper production is expected to stay flat on a yoy basis at 4.2 million lbs, and gold sales are expected to dip slightly to 1.7 million ounces from 1.8 million ounces:

That being the case, the primary catalyst for what drove the stock over the past couple of years (copper & gold production growth and strong pricing) will not be the driver this year: it will have to come from the price of the two commodities alone - and to a lesser extent from production growth of moly - which is expected to rise by 5 million lbs yoy. Note: in Q4 FY22, Freeport sold 1 billion lbs of copper, 458.000 ounces of god, and 19 million lbs of moly.

So far, the company is off to a good start. Copper has rallied sharply from the lows of last year and is up from $3.81 at the beginning of this year to close Friday at $4.08, or +7%:

MarketWatch

That could be just the start. Analyst Kostas Bintas of Trafigura (the world's top copper trader) says that copper could rally to $12,000/ton by the end of the year. Bintas said copper is "the most critical metal globally given the shortage in the market. We only had 3.5 days of copper stock equivalent at the end of last year."

To put the $12,000/ton price into context, copper hit a record high of $10,845/ton in March of last year. Note: at that time, FCX stock traded 25% higher than it closed on Friday.

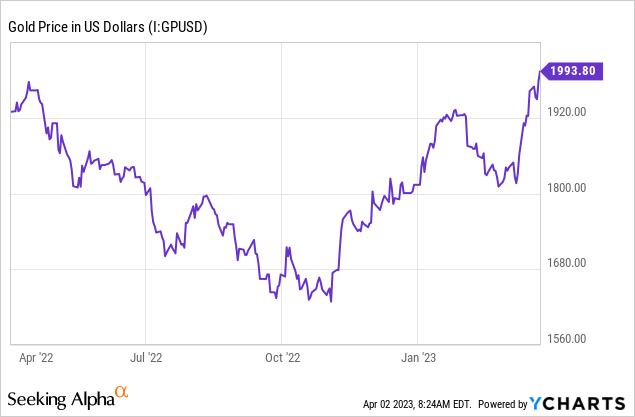

Gold has also rallied since the beginning of the year (~8%):

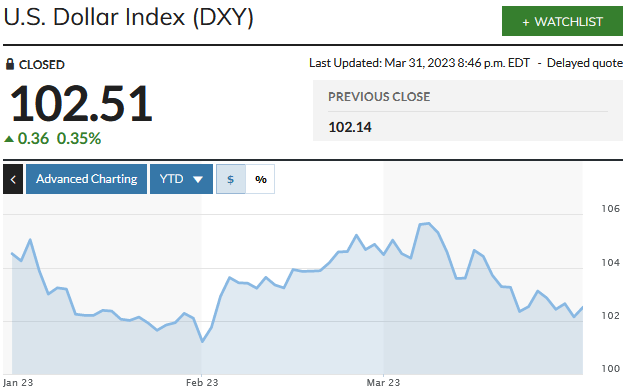

Both copper and gold are typically priced the world over in U.S. dollars. And while some of the rally in copper & gold prices has been due to recent weakness in the U.S. dollar, that doesn't explain all of the rally in the two commodities' price. I say that, because the U.S. Dollar Index has only fallen ~2% YTD:

MarketWatch

My conclusion is that the copper rally has been driven by strong fundamental demand as global EV sales continue to boom. The gold rally likely has more to do with recent banking drama (i.e. Silicon Valley Bank) and fears that Republicans in Congress are likely to resist raising the U.S. debt-ceiling (as they did three times under the previous administration ...) until the U.S. Treasury teeters on a financial crisis.

Earnings & Valuation

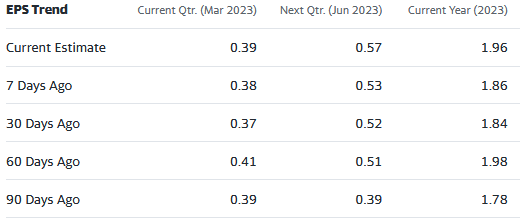

According to Yahoo Finance, FCX's earnings estimates have been rising - not so much for the current quarter, but for Q2 and the full-year:

Yahoo Finance

Indeed, since the start of the year FCX's Q2 EPS estimates have risen by 46% while full-year FY23 EPS expectations have risen 10%. That said, given the stock closed Friday at $40.91, or a forward P/E = 20.9x. That's not exactly cheap for a miner, I'll grant you. But my perspective is that FCX is a core long-term holding because I expect the EV and clean-tech boom to continue for many years to come. Indeed, I expect the transition to accelerate with each passing year for many years to come. That being the case, I agree with Daniel Yergin's assessment of global copper demand growth (mentioned earlier). That being the case, I would argue that the valuation level of a copper producer like Freeport-McMoRan should expand due to strong demand growth combined with the potential for structural supply deficits.

Meantime, gold could be a somewhat unexpected kicker that could really juice returns for FCX stock this year.

Risks

As a commodity price taker, the primary risks is - obviously - that the price of copper (or gold) cold fall precipitously due to a severe global economic recession. Given Putin's horrific and on-going war in Ukraine, that has arguably broken the global energy & food supply chains and causing high-inflation the world over, that is certainly a possibility. However, the longer the war drags on, the more the global economy is (sadly perhaps ...) getting used to it. I would argue that the global energy supply chain has already been completely re-configured.

The much biggest risk in my opinion is that the price of copper generally continues to climb due to occasional structural supply deficits. And that will be very bullish for the price of FCX stock considering that it is highly levered to the price of copper: each $0.10/lb increase adds an estimated $335 million to FCX's annual cash-flow.

Another risk would be if China decides to supply Russia with offensive military supplies for the war-on-Ukraine. That could precipitate big sanctions by the U.S., the EU, and its NATO allies. The result could be a big drop in copper demand (and the price of copper).

A big rally in the U.S. dollar could also put downward pressure on the price of copper and gold.

FCX's net-debt feel to $1.3 billion by year-end 2022, down from $6.1 billion at year-end 2020. Debt-reduction is a positive catalyst moving forward.

Summary & Conclusion

FCX is one of the largest copper producers on the planet and is expected to hold production relatively flat at 4.2 billion lbs over the next three years. The company is highly levered to the price of copper and will be a beneficiary of long-term copper demand growth. Debt reduction and increasing efficiency should lead to better shareholder returns . Strong copper demand going forward will likely mean that FCX will no longer be such a cyclical company - suffering boom & bust cycles - and, therefore, is likely to see an uptick in its valuation.

Bottom line: I am bullish on copper, so I am bullish on FCX - which I rate as a BUY with a $50 price target (+25% from here). Freeport should be considered as a core materials/commodity holding for those who want to build a well-diversified portfolio for the long-term.

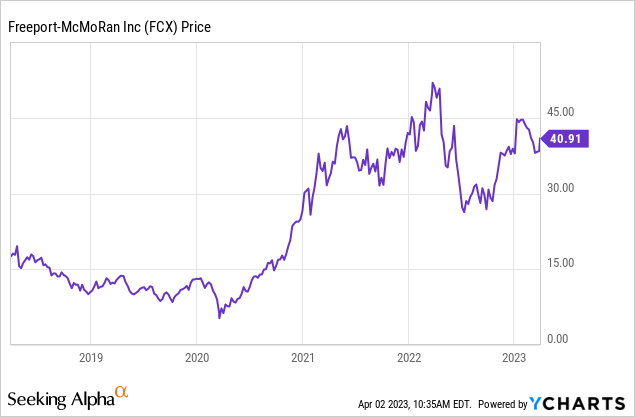

I'll end with a 5-year price chart of FCX and note that my $50 price target would take FCX back to the level it was last March:

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FCX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.