Triton International: Thinking Through Decisions For Allocating Its Cash

Summary

- Triton International invested heavily in its container fleet in 2021, and is now reaping the cash flow benefits of its long-term leases on those containers.

- With lower capex going forward, free cash flow is strong, but Triton faces decisions on how to deal with 2023 & 2024 debt and starting to call its preferred shares.

- Although it has moved into the investment grade rating on its debt, its cost of debt refinancing could still head higher from ongoing tightening conditions.

Fahroni

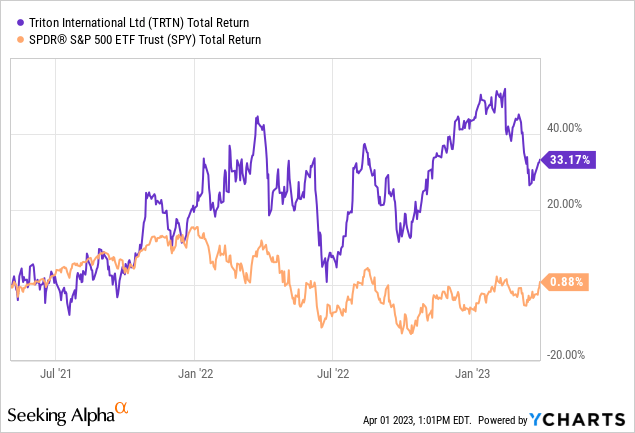

It has been nearly two years since I addressed the investment thesis for Triton International (NYSE:TRTN), a leading lessor of shipping containers, so it is well past due the point that I should update my view (though I happily concede that other Seeking Alpha contributors have covered Triton very well in the intervening time). Back in May of 2021, there were clear signs that global shipping would be recovering as consumer demand rose in a post-Covid environment, and at the time Triton was in the midst of placing its inventory of shipping containers into long-duration leases at very attractive prices as shippers scrambled to meet demand. The result for common shareholders has been a market-beating total return since then, but as the macroeconomic environment of inflation, rising interest rates and potential for recession really settle in for at least the near to medium term, it is worth asking if those same market-beating returns are likely to continue.

2022 In Review and Peeking Ahead

Management released the 2022 full year results and some 2023 guidance in mid-February, with the guidance being weaker than hoped, sending shares down, although 2022 in and of itself was quite solid.

The lion's share of revenue comes from lease contracts on its inventory of shipping containers, with major shipping lines like CMA CGM and Ocean Network Express; their top three customers account for nearly 50% of their lease billings. Total combined operating leases and finance leases for last year were $1.68 billion, up some 9.5% over 2021. The year finished with a utilization rate of its container inventory at 98.4%, though the company reported that as of February 8, 2023 that rate had already dropped to 97.6%. That utilization rate will ebb and flow based on agreements in place, renewals and new leases made, as well as disposals of containers from the fleet as some of their useful lives age out. In Triton's case, the company did allocate large sums in 2021 to acquire new containers to have available and managed to put them to work quickly, but has since moderated its acquisition of new containers as market conditions have changed. Total cash flows used for buying leasing assets and financing leases went from $3.4 billion in 2021 to $0.9 billion in 2022. The primary point here is that while overall utilization rate will continue to moderate in a slowing economy, the general base size of the fleet of containers Triton is leasing is larger from 2022 onward.

On the expense side, the biggest accounting expense for Triton is depreciation, and 2022 was no different at $634.8 million, followed by interest expense of $226.1 million. With Triton's single biggest expense being non-cash, the net income on the P & L comes in at $0.75 billion for 2022 but actual cash flow from operations was a more than a billion dollars higher, $1.88 billion, and free cash flow was nearly half a billion higher, at $1.24 billion.

For 2023, there is reasonably an expectation of some softness. Shippers are no longer scrambling to find any available container due to elevated demand and constraints of port congestion. Those shippers have most likely already locked in the majority of their new leasing needs, so going forward for Triton in the near term, results will be more about managing the balance between renewing existing contracts and disposing of unnecessary used containers.

Capital Allocation and Valuation

I've written previously that Triton's secret sauce was its capital allocation, which has broadly worked out to its shareholder's advantage thus far: using preferred shares from 2019 to 2021 mostly to fund common share buybacks, getting its debt profile to the point of being able to qualify for investment-grade ratings, and directing enough cash to invest in new containers when the market needed to expand the fleet, and still pay out a generous dividend.

Triton has now gone a year without issuing any new preferred series, and the A series (TRTN.PA) are callable in less than a year, March 15 of 2024, with multiple more series coming up for possible redemption over the quarters following. A big question for an investor looking at the investment thesis for Triton starting now, at least for the common shares, is how Triton plans on dealing with the preferred share redemptions. There are five series of preferred shares, all with similar features - primarily as cumulative and non-convertible to common shares, callable for par of $25:

- Series A 8.50% cumulative perpetual preferred, 3 million shares callable at 3/15/24; cost to redeem (not counting dividends) of $75 million; annual dividend cost if not redeemed of $6 million.

- Series B 8.00% (TRTN.PB), 5 million shares callable 9/15/24; cost to redeem of $125 million; annual dividend if not redeemed of $10 million.

- Series C 7.375% (TRTN.PC), 7 million shares callable 12/15/24; cost to redeem of $175 million; annual dividend if not redeemed of $12 million

- Series D 6.875% (TRTN.PD), 6 million shares callable 3/15/2025; cost to redeem of $150 million; annual dividend of $10 million

- Lastly, Series E 5.750% (TRTN.PE), 7 million shares callable 9/15/26; cost to redeem of $175 million, annual dividend of $10 million.

I rounded some of my figures above and did not factor in any potential for over-allotments on any of the series; the full amount in preferred dividends for 2022 was $52.1 million. There is no mandatory redemption, of course, but originally the cost of capital was high on these series relative to the low-interest rates of the era, although at the time Triton was considered investment grade on its debt.

Since these issues, both of those variables have changed - the company was moved up to investment grade rating BBB- by Fitch in the fall of 2021, but baseline interest rates for any new debt issuance are hundreds of basis points higher. And it isn't as though Triton was locked in on extremely high rates on its existing debt; with its interest rate swap agreements factored in, Triton's existing average interest is just 2.80%. However, before getting to the possible preferred share redemptions starting next year, Triton will need to determine what to do about the $1 billion of 2023 debt maturities.

Taking 2022 as a starting point for thinking about cash flow and capital allocation, CEO Brian Sondey spoke on the Q4 earnings call to the flexibility they have to work with (edited/shortened for clarity):

In 2022, we generate slightly over $1.6 billion of cash flow. We need to allocate a little more than half of this cash flow for replacement capital spending . . . This leaves us with a little over $700 million of steady state cash flow. We use roughly $160 million per year for our regular dividend. As a result, we have about $545 million of steady state cash flow. . . If we focus on capital investment like we did in 2021, we can self-fund the equity needed for nearly 20% asset growth while keeping our leverage ratio constant. Alternatively, if we focus on share repurchases like we are now, we can repurchase about 13% of our shares at the current trading range. If we wanted instead to focus on dividends, we could pay well over $9 per share on top of our regular dividend, bringing the total annual dividend into the range of $12 per share. . . [or] we’re able to use our strong cash flow to drive per-share fleet growth almost regardless of market conditions, again while holding our leverage ratio steady.

The $545 million goes to $493 million after paying the preferred dividends. Coming into the year, there was $83.2 million in unrestricted cash on the balance sheet, which puts the total at about $576 million to work with, assuming 2023 cash flows are roughly the same as 2022. So for 2023, the expectation would be continued common share repurchases and perhaps some debt payoff, though clearly refinancing the majority of the $1 billion.

To fully redeem all the preferred shares coming due in 2024 will take $375 million, but debt maturities are still fairly substantial, $906.8 million. Triton should be able to handle all of the preferred redemptions based on its ability to generate cash flow, or borrow if that is more capital efficient, but it does not appear to be likely to continue repurchasing common shares in 2024 at anything like the pace of $554 million done in 2022.

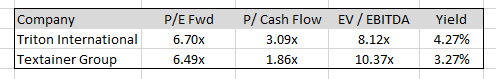

So where does this leave the common shares in terms of fair valuation? On a relative basis, in comparison to Textainer Group (TGH), Triton's valuation is in-line. In fact neither is expensive by traditional measures; I personally tend to go with higher yield as tie-breaker when deciding, so long as I am comfortable with the dividend safety.

Triton and Textainer Relative Valuations (Author's Spreadsheet; data from Seeking Alpha)

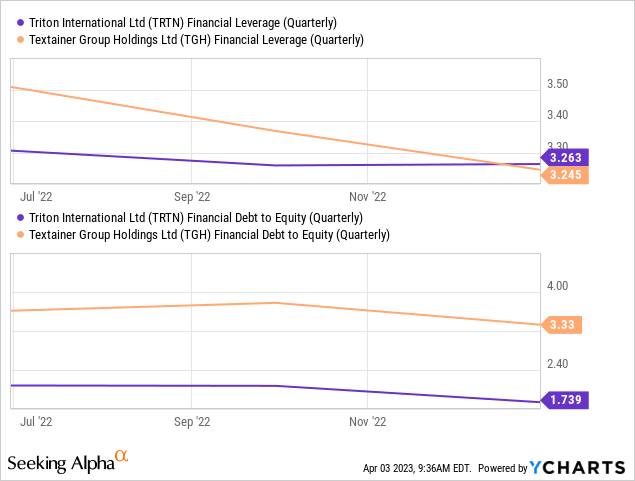

In this case, the valuation on both remains well in value territory, without being over-levered.

From Triton's overall position of financial health, ability to create cash flows with long-term leases in place and having already made its large CapEx investments, the potential for continued strong returns to shareholders are still in place.

The major risk with Triton, in my view, is its fairly high dependence on a limited number of customers. While those counter parties are major shipping line operators, if any one of its top three customers were to experience financial distress and default on its lease payments, the impact to Triton's cash flows would not be good. However, I see no near-term red flags indicating that global shipping is facing a crisis; it is worth noting that spot prices have normalized again relative to the beginning of the pandemic. The linked report states that

The latest Drewry WCI composite index of $1,717 per 40-foot container is now 83% below the peak of $10,377 reached in September 2021. It is 36% lower than the 10-year average of $2,690, indicating a return to more normal prices, but remains 21% higher than average 2019 (pre-pandemic) rates of $1,420.

The biggest challenge to the shipping lines may be more in the form of environmental regulations on carbon emissions and the associated costs of compliance as opposed to any concerns for demand for their services. Nevertheless, no matter one's political perspective or views on the relative good of greener shipping, I don't expect any government to clamp down hard enough on shippers to really put a dent in their ability to deliver the world's goods.

Conclusion

Depending on market conditions for the cost of debt over the coming 12 to 18 months, the common shares may not see much in the way of capital appreciation. The caveat is that the shares may benefit from the impact of 2023 share buybacks, which could be in the $400 million range, but I anticipate to slow down markedly in 2024 as the company deals with its preferred shares and refinancing some fairly big chunks of debt. The good news is that share buybacks done in 2023 and preferred redemptions start in 2024, capital will be freed up that would allow for continuing to raise the dividend on the common shares, but with only modest expectations for capital gains.

I am mostly neutral on the preferred shares at this point; the call window is getting short enough and other safe options are available with decent yield that I am not sure the risk / reward profile is justified, at least for A, B, and C series that can each be called next year, and the market pricing is starting to coalesce fairly closely around their par values, with the A series above par. They are all yielding between 7% and 8% on cost at the moment, with the D and E series offering more substantial to discount to par (market price around ~$21.00 per share for both), so yield to call is a significant part of the total return aspect for the two that are the furthest out on the call schedule. The discount could be reflecting some market uncertainty on Triton's ability to navigate both its debt refinancing between now and the end of 2024 on attractive terms and knocking out the full preferred redemption. Based on the current environment and Triton's cash flow generation, I do not see the concern, but grant that the $1.9 billion in debt Triton has to deal with spread over 2023 and 2024 could end up being financed at less attractive terms, or that they will go back to issuing new preferred shares to raise some cash, if the market will bear it at better terms than rolling over all its debt.

I am already long a mix of commons with the C and E preferreds to the full amount of exposure I want in my portfolio, but still consider the common shares a good value for long-term investors with an interest in income.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TRTN, TRTN.PC, TRTN.PE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.