ICLN: Managing Expectations For Clean Energy

Summary

- The iShares S&P Global Clean Energy Index ETF has beaten the S&P over the last three years, but I question whether it can continue its streak.

- Clean energy has progressed significantly in the last few years, but decarbonization and net-zero emission goals are unrealistic, expensive, and time-consuming.

- The pillars of society, like steel, plastics, fertilizer, glass, rubber, etc., are still heavily dependent on fossil fuels.

- I'm bearish on the broad-based clean energy theme; however, I acknowledge pockets of opportunity in stocks with exposure to the solar segment within clean energy.

GetYourPic

Introduction

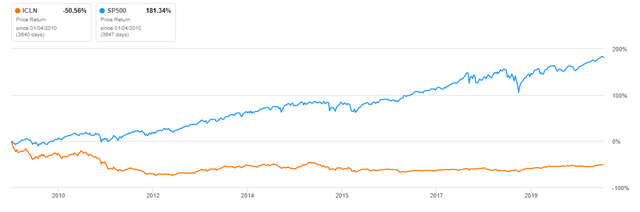

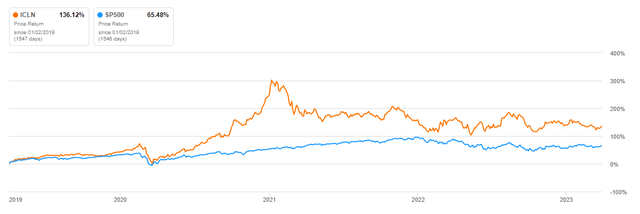

The iShares S&P Global Clean Energy Index ETF (NASDAQ:ICLN) has a three-year absolute return of 136%, compared to the S&P 500 Index (SP500), which returned 65% over the same period. However, when comparing the returns from 2010 to 2019, the iShares Clean ETF returned -50%, while the S&P 500 gained 181%.

Investors may ask themselves, what happened over the last few years that led to the shift in alpha?

Looking at the period when ICLN outperformed the S&P 500 from 2019 to 2022, interest rates were low, and money was cheap. Furthermore, many academic papers prove that clean energy is better for the world than fossil fuels; thus, investors have diverted investments into clean energy, driving the price up.

According to the National Center for Biotechnology Information, the number of articles published about clean energy has grown exponentially over the past few years. They found an average of 292 articles published from 2016-2019, compared to 97 articles published from 2011-2015 and 17 from 2000-2010.

The explosive growth in research from credible scholars undoubtedly signals that clean energy is an important topic, and we must take action to solve the climate crisis. It also signaled to investors that clean energy wasn't just a "fad" but a multi-decade investment opportunity.

A follow-up question I ask investors is can ICLN continue to outperform the S&P over the next three years, or has its momentum peaked? I believe investors have too high of expectations for the future of clean energy due to unrealistic decarbonization goals, as clean energy has many obstacles to overcome.

The Good, the Bad, and the Ugly

I highly recommend reading the 2023 Annual Energy Paper by J.P. Morgan's Chairman of Market and Investment Strategy, Michael Cembalest. His detailed 50-page paper provides enormous insights into the current state of the energy market, and I've summarized my key takeaways in three parts, "The Good, the Bad, and the Ugly."

The Good

J.P. Morgan 2023 Annual Energy Paper

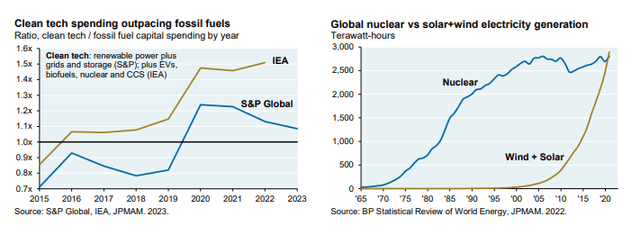

- Investments in clean technology are outpacing fossil fuels, promoting the growth of renewables like solar and wind power. For the first time, wind and solar surpassed nuclear power generation globally.

- The International Energy Agency (IEA) anticipates that peak fossil fuel demand may be reached by the decade's end, even considering slower transition scenarios.

- The next five years could see renewable capacity additions equal to the prior 20 years.

- The U.S. is witnessing rapid battery plant construction growth, supporting energy storage technology advancements. Utility-Scale solar and solar storage solutions are becoming competitive with gas-peaker plants as energy storage costs decrease.

The Bad

J.P. Morgan 2023 Annual Energy Paper

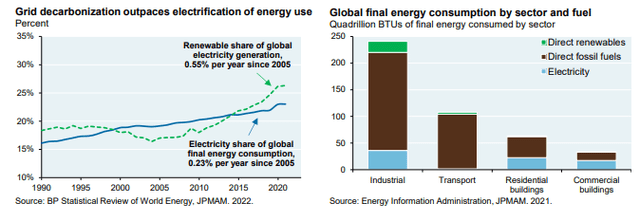

- Two distinct transitions are unfolding: grid greenification (adding renewables) and electrification of general energy use (decarbonizing various sectors). Looking at the chart on the left, the former is progressing at twice the rate of the latter, leading to significant imbalances and potential pitfalls.

- Transitioning to cleaner energy sources is challenging, meaning decarbonization will be gradual. Trillions have been invested in renewables and electricity networks since 2005, but the world still relies on fossil fuels for about 80% of its energy today, only down 5%, from 85% in 2005.

- Essential commodities like steel, plastics, fertilizer, glass, rubber, etc., are still heavily dependent on fossil fuels. This is especially true in emerging markets that have become the primary producers of these materials.

- The chart on the right shows that it is difficult to electrify diverse industrial, commercial, residential, and transport energy uses. Renewable energy replaces fossil fuels for heating and cooling systems in buildings and homes rather than crucial industries.

The Ugly

J.P. Morgan 2023 Annual Energy Paper

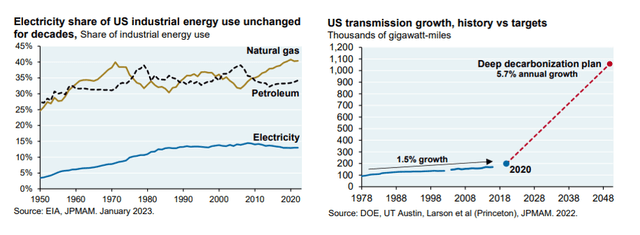

- Electrification of the industrial sector is proving to be an immense challenge, with the U.S. electricity share of industrial energy consumption hardly growing for 40 years. This stagnation highlights the grim reality of reducing emissions in this sector which uses the most energy.

- The sluggish pace of grid expansion needs to catch up to what is needed for ambitious decarbonization plans, seriously jeopardizing climate goals.

- Critical minerals, vital for energy transitions, are not scarce but are plagued by daunting challenges tied to availability, geopolitical control, and costs.

- The future of the energy landscape is uncertain, with many 2050 projections appearing to be wishful thinking rather than practical. While decarbonization is making some headway in electricity, cars, and building heating, the complete transition necessary to mitigate climate change remains frustratingly vague.

ICLN ETF Composition

iShares ICLN 2022 Annual Report

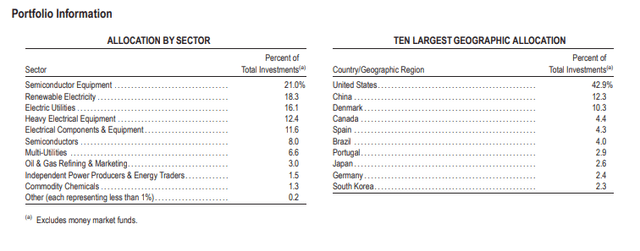

The top sectors in ICLN are Semiconductor Equipment, Renewable Electricity, and Electric Utilities, constituting more than 55% of the total ETF. Overall, the ETF is well diversified with exposure to growth-oriented technology stocks and more stable utilities, which can mitigate risk and volatility.

From a geographic standpoint, the U.S. has the highest allocation weight of 42.9%, while the combined allocation for European and Asia is 17.9% and 17.2%, respectively. The ETF focuses more on developed markets, which have led the way in clean energy investments, rather than emerging markets prone to using more fossil fuels. However, I would like to see more allocation in Europe since they are more ambitious with respect to the clean energy transition. The ETF has no exposure to European countries like Norway and Sweden, which are further ahead in advancing electrification.

Final Thoughts

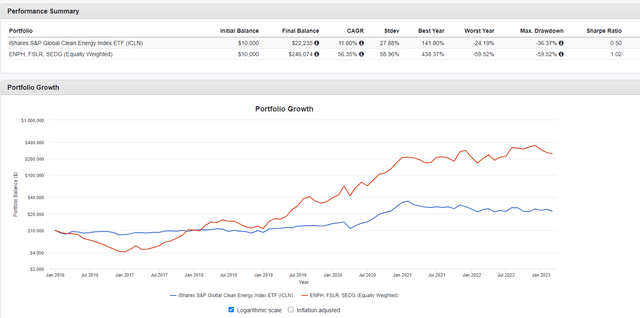

I believe there are a small number of winners within the clean energy sector, and investors are better off choosing individual stocks rather than indexing. The themed ETFs have limited upside as returns will get dragged down by the bottom performers and have high expense fees.

I'm picking on iShares S&P Global Clean Energy Index ETF, but I'm also bearish on all the broad themed clean energy ETFs exposed to wind, hydropower, geothermal, hydrogen, and biomass. However, I'm more optimistic about solar energy since it has better economies of scale and doesn't have the same critical minerals constraints as wind.

ICLN does have the most exposure to solar through its top holdings of ENPH, FSLR, and SEDG. But, If you had only invested in these top three holdings, you would have achieved a CAGR of 56% vs. the total ETF of 28% from 2016 to 2023.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.