EPI: An Expensive Play On Robust Growth In India

Summary

- India stocks have underperformed the S&P 500 this year as the growth trade powers higher.

- With a high expense ratio, I'd rather go for lower-cost EM funds.

- Still, bullish seasonal trends often benefit EPI now through Q3.

da-kuk

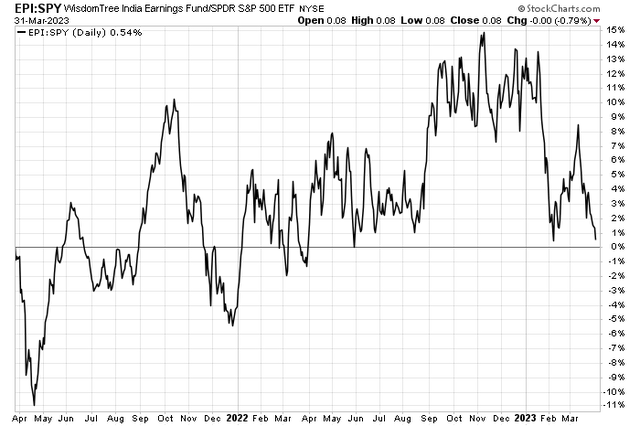

India equities were trending higher versus the S&P 500 ETF (SPY) coming out of the pandemic. With a growing economy and a population that may soon rival China for the world’s largest, there were some macro tailwinds. Lately, though, a return of the U.S. mega-cap tech trade has left the WisdomTree India Earnings ETF (NYSEARCA:EPI) in the dust.

As of the end of Q1, EPI was near a fresh multi-month low in terms of relative performance.

EPI With Negative Alpha vs the S&P 500 in 2023

According to the issuer, EPI seeks to track the price and yield performance, before fees and expenses, of the WisdomTree India Earnings Index. Investors use EPI to gain exposure to broad Indian equities across the market cap spectrum with a valuation-centric approach.

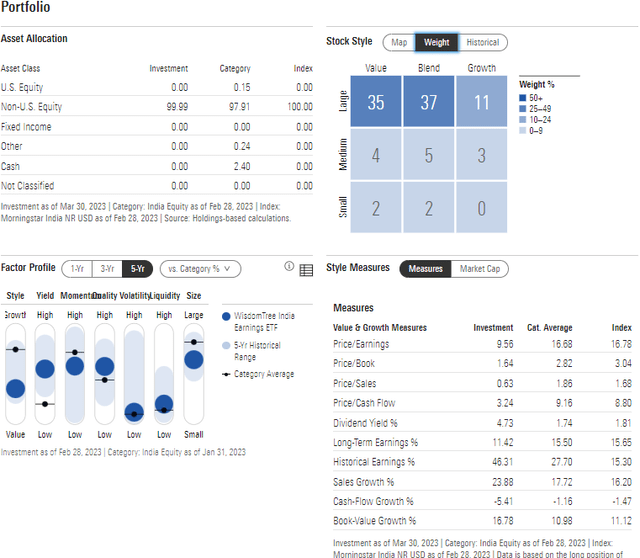

EPI carries a high expense ratio of 0.84% but tradeability is decent with 30-day average volume near 400,000 shares and a median 30-day bid/ask spread of just three basis points. Morningstar data show that the fund’s dividend yield is high at 4.7% - a sizable $1.845 distribution was paid in June last year.

EPI is a large-cap fund with a slight tilt to the value style. On valuation, WisdomTree notes that the forward price-to-earnings ratio is low at just 11.6 as of March 30, 2023, while its average price-to-book ratio is near the S&P 500’s at 1.82. EPI is attractively priced on a price-to-cash flow look at just 7.1.

With high long-term EPS growth and a modest current earnings multiple, I see the fund’s valuation as compelling, but I’d go for other lower-cost emerging market funds. Still, investors seeking a focus on valuation might prefer owning EPI versus a broad fund.

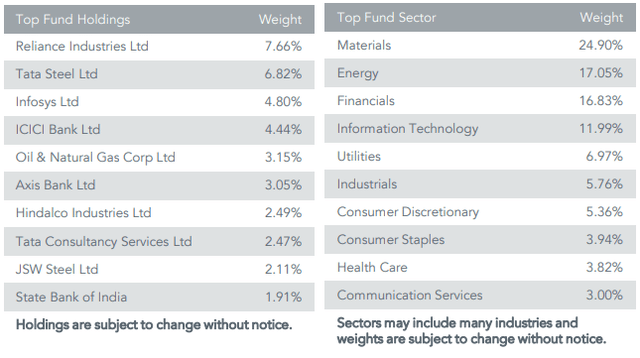

EPI: Portfolio & Factor Profiles

Holding 413 individual stocks, EPI is positioned highly in cyclical sectors. Materials, Energy, and Financials comprise more than 50% of the portfolio while growth sectors like Information Technology, Consumer Discretionary, and Communication Services are only about 20% of the fund, much lower compared to the SPX.

Also, 37% of total assets are in the biggest 10 holdings, though no single stock is more than 7% in the portfolio. So, diversification is not that high in my view given the high weight in value and cyclicals.

EPI: Heavy in Value & Cyclicals, Light on Growth

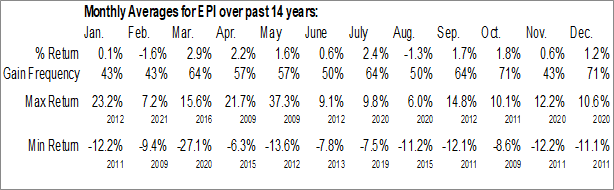

Seasonally, EPI tends to rally in April, like most equity niches. But strength has been seen over the past 14 years from late March until about mid-October. That performance trend contrasts typical price action in the S&P 500, so seasonal trends in EPI might help investors with diversification, according to my interpretation of data from Equity Clock.

EPI: Strong April Returns Historically

Equity Clock

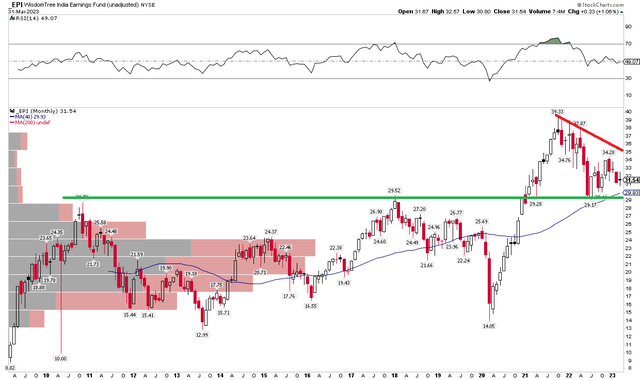

The Technical Take

I went long-term with EPI’s chart. Notice in the graph below that shares have held long-term support near the $29 mark on a recent test back during volatility last summer. Still, relative strength has turned soft given the 20%-plus drawdown from its October 2021 peak near $40. The fund put in a bottom in early July last year but fell to a multi-month low at the March nadir.

I would like to see EPI rise above a downtrend resistance line formed off the all-time high. Still, long here with a stop under $28 looks fine, and further downside cushion should be seen due to high volume by price in the $18 to $24 range. Overall, the technicals appear soft but not overly bearish at the moment on EPI.

EPI: Long-Term Chart Suggests $29 Support

The Bottom Line

I am a hold on EPI. I like the valuation, but the chart is simply consolidating here. Also, its high expense ratio compared to lower-cost index funds is not a strong feature to me.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.