EMO: MLP Equity CEF, From The Saba Playbook

Summary

- ClearBridge Energy Midstream Opportunity Fund Inc. is an MLP equity closed end fund.

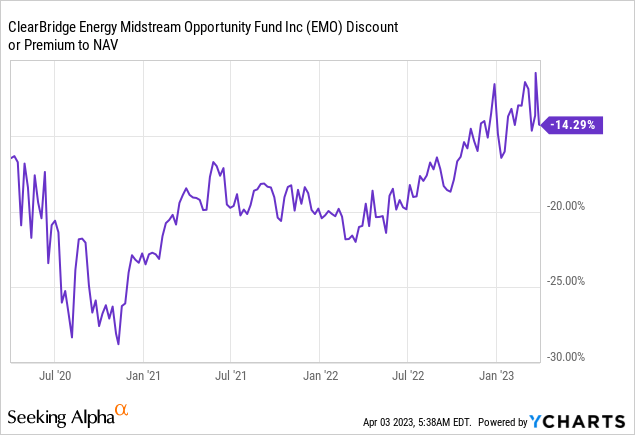

- The CEF is currently trading with a -14% discount to NAV.

- Saba Capital, an activist fund, has a large stake in EMO.

- We have seen Saba successfully close the discount arbitrage in Center Coast Brookfield MLP & Energy Infrastructure Fund.

- With OPEC now cutting production for the year and EMO still at a large discount to NAV, we feel this is a nice yield trade with a large one-time upside potential.

VladKol

Thesis

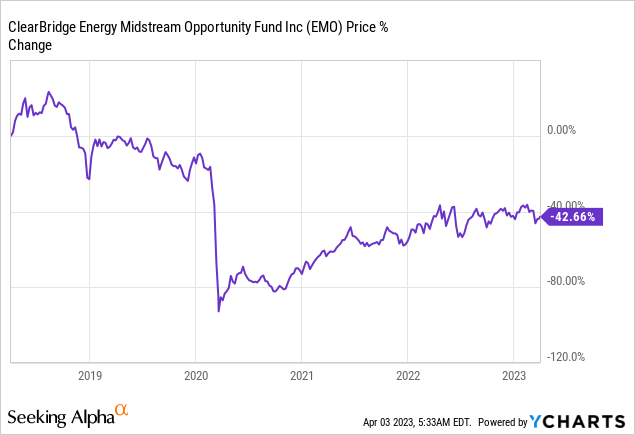

ClearBridge Energy MLP Opportunity Fund Inc. (NYSE:EMO) is an equity closed end fund. The vehicle focuses on MLP equities, and seeks a high total return, with an emphasis on cash distributions. Just like other CEFs in the MLP space, the fund suffered an enormous draw-down during the Covid crisis, and never quite recovered:

The MLP asset class was suffering from high leverage ratios and an unfriendly regulatory framework, and really collapsed during Covid. Add leverage on top of that as EMO did, and you get a disaster. As a reminder, for CEFs, when the assets drop in price significantly and the leverage trigger is hit, the fund has to unwind some of that leverage. And when you liquidate assets at the bottom you destroy NAV permanently:

Because of their closed-end structure, CEFs are allowed by law to use leverage. Specifically, according to the Investment Company Act of 1940—which provides the framework for CEFs, mutual funds, and ETFs—CEFs are allowed to issue:

- Debt in an amount up to 50% of net assets

- Preferred shares in an amount up to 100% of net assets

Source: Fidelity

Investors rarely forget a -80% drawdown, and EMO has dragged its feet ever since, with a significant discount to net asset value:

Investors voted with their feet, choosing to abandon a losing asset class and CEF structure, thus creating a massive discount to the fund's asset value.

Has anything changed for the MLP asset class?

We believe a lot has changed for the asset class - we have seen significant deleveraging and a firming up of future cash-flows as this energy super-cycle is taking hold. 'Green energy' might be the politicians' favorite topic, but it is not a commercially viable alternative as of now. It will take many years for green energy to be a compelling, low price alternative to fossil fuels. We will let ClearBridge's market update take center stage:

Valuation for U.S. midstream companies remains well below the levels seen before the pandemic. Entering 2020, enterprise value to EBITDA (EV/EBITDA) multiples stood at roughly 10.5x. Despite the rebound the sector has experienced since the March 2020 lows, the sector today trades at 8.6x — despite what we view as a vastly better business model today than entering 2020. Dividend/distribution coverage has moved from 1.1x to more than 2.0x. The sector has moved from being free cash negative to free cash flow positive (increasingly so in 2023) and balance sheet leverage (debt/EBITDA) has moved from in excess of 5.0x to below 3.5x. With no need for midstream companies to access capital markets for the foreseeable future, we increasingly expect excess cash flow (above and beyond capital spending and dividends/distributions) to be used for increasing share buybacks and further increasing dividends/distributions.

Source: Asset Manager 'State of the Market' Commentary

While managers always try to talk their book, we do think MLPs have hit a nice 'sweet spot'. We think we are going to see less volatility here going forward, and the infrastructure around fossil fuels will be in demand for many years. Unless companies lever up again, the sector is set for a nice smooth sailing.

Can the EMO discount to NAV narrow?

While EMO has a nice 7.5% dividend yield, the fund has a very large discount to NAV, which make potential capital gains very appealing. Saba Capital, an activist fund, has a large stake in EMO. Similarly with what we saw for Center Coast Brookfield MLP & Energy Infrastructure Fund (CEN) which we covered here, Saba is going to push for this discount to narrow. At the end of the day this is a risk free arbitrage - you have a pool of assets worth 100, yet the market is trading them at 86c/$ because of the CEF structure.

Saba has proven itself to be a very savvy activist investor, and we think they will continue to push their agenda for EMO until the discount becomes more palatable (i.e. sub -5%).

We do not think there will be enormous capital gains from the MLP asset class going forward. Just steady dividend yields. So from that angle, the only way to play nice capital gains is from the narrowing of the discount to NAV for certain CEFs. A retail investor can just piggy-back on the research and efforts compiled by activist managers such as Saba, and wait for transformative corporate actions that can generate significant capital gains.

Conclusion

EMO is a closed end fund focused on MLP equity. The asset class has suffered a historic transformation after its massive Covid drawdown with lower company level leverage and improved cash-flows. We do not see significant capital gains here going forward, but a nice steady stream of cash-flows. EMO was decimated during Covid due to its leverage, and has traded at a discount to NAV ever since. The current discount is around -14%. Saba Capital, an activist fund, has a large stake in EMO. Similarly with what we saw for Center Coast Brookfield MLP & Energy Infrastructure Fund which we covered here, Saba is going to push for this discount to narrow. As a retail investor we think it is smart to partner-up with an activist investor with a proven track record. A savvy investor should always look at the next trade, and with OPEC cutting production yesterday and Saba having proven its worth in the CEN melt-up of 10% on March 31, we like what we see in EMO.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.