ICL Group: An Uncommon Russia-Ukraine Play

Summary

- Through its sustainable low-cost asset base, ICL Group Ltd is a market leader in fertilizer and potash markets.

- ICL Group is a potential beneficiary of further fertilizer trade disruptions from, for example, the Russia-Ukraine war.

- ICL Group is a beneficiary of trends such as the need for increased agricultural efficiency and a growing world population.

- ICL Group is slightly undervalued at current price levels.

NickolayV/iStock via Getty Images

In 2022, food security claimed its spot among political issues globally in conjunction with the outbreak of the war in Ukraine as fears of fertilizer trade disruptions materialized in fertilizer prices. Since then, fertilizer prices have come down but remain elevated. At current prices, the stock appears slightly undervalued, making it a slight buy for conservative, long-term value investors but not without a speculative element in the form of further developments in the Russia-Ukraine war.

Overview of ICL Group

ICL Group (NYSE:ICL), also called Israel Chemicals Limited, is a global agricultural and chemical company being one of five major companies constituting Israel Corporation, Israel’s largest holding company. Through its ownership of some of best potash mines in the world, including the Dead Sea Works, the company retains a key position in the fertilizer market as well as some specialty chemical markets, including the bromine market. Adding fertilizer to crops is a commonly used practice globally in order to maximize output, increase growth speed, and minimize weeds, insects and so on. Fertilizer is synthesized from hydrogen in natural gas and potash.

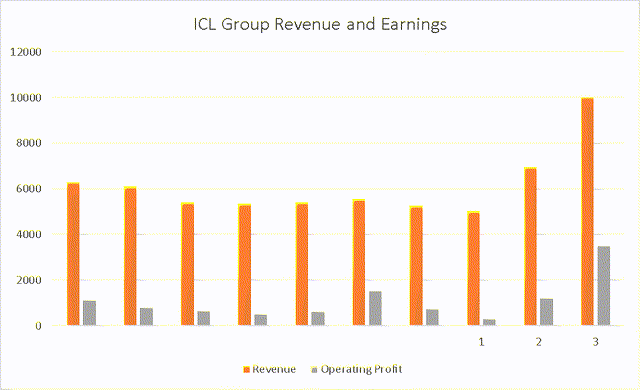

Revenue Breakdown and Latest Results

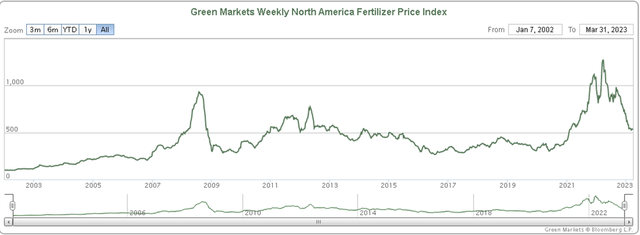

In many ways, 2022 was a record year for ICL Group, with annual sales of $10.02 B. and earnings of $2.16 B, resulting in per-share earnings of $1.69, their highest ever. This is partly a result of the Ukraine war, of which the involved parties, Russia and Belarus, also happen to be among the largest fertilizer-exporting countries, especially to Europe. The initial war outbreak lead to an explosive movement in fertilizer prices, as can be seen below in the Green Markets North America Fertilizer Price Index:

Fertiliser price index (Green Markets)

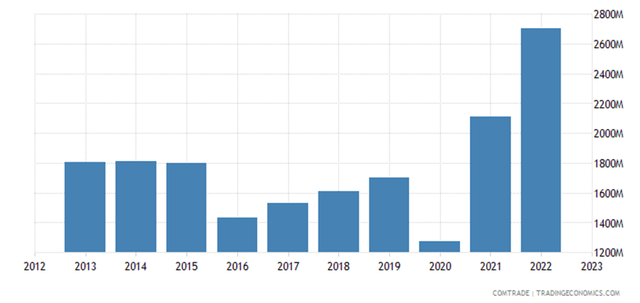

The price spike can be explained by fears of an EU-wide ban of Russian and Belarusian fertilizers, which increased prices dramatically, resulting in ICL Group’s record sales in 2022. But the fears of a fertilizer import ban have until now proven to be overblown as the EU imports of fertilizers from Russia have only increased, with 2022 being a record year regarding the total value of imported fertilizers, amounting to $2.7 B in 2022:

Eu Imports of Russian fertilizers (Trading Economics)

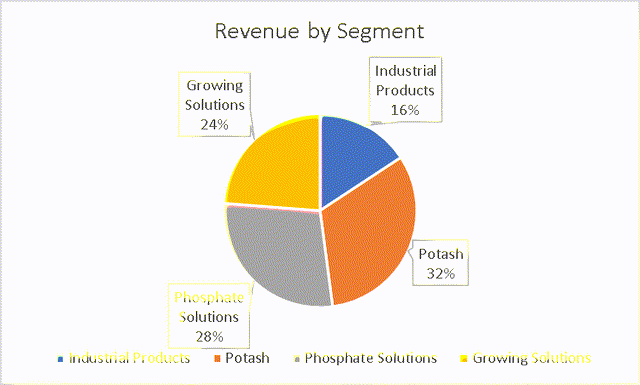

Although fertilizer prices have fallen more than 50% since their 2022-peak, prices are still above their 5-year average, benefiting ICL Group directly, as about 84% of their 2022 sales came from the three segments Growing Solutions, Phosphate Solutions, and Potash, all serving agricultural end customers:

With data from ICL Group's presentation full year and Q4 2022.

Rising Fertilizer Demand Globally

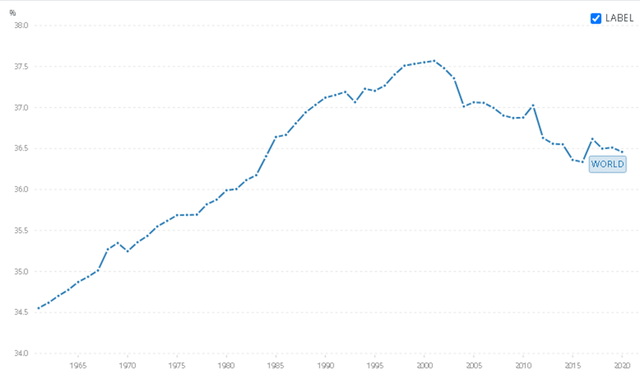

Forecasts by UN project an increasing world population until at least year 2100, meaning ever more food is needed; this translates into a need for more efficient use of the existing agrarian land which has been on a decline since its 2004 peak:

This translates into increasing fertilizer use over the coming years since fertilizer nourishes plants grown. They thereby grow faster, have increased water uptake and photo synthesis. All of this makes it but certain that global fertiliser use will continue to rise for many years to come.

Moat and Competitors

As with any commodity, potash and fertilizer products have nearly identical qualities and customers will usually choose the lowest-cost supplier. This results in a very price-competitive market where low-cost production is critical in order to be profitable. With this in mind, ICL Group is in a great position with its Dead Sea assets being among the most cost competitive mineral sources in the world, as the minerals are harvested from evaporation pools and not mined as in, for example, the large potash mining area of Saskatchewan, Canada. This, as well as well-built infrastructure and access to Israeli ports means that ICL Group has a wide moat around its core business which is almost impossible to replicate anywhere else. Other than that, ICL Group also reaps benefits from employing the highly entrepreneurial- and well-educated people of Israel as well as being an established player in the fertilizer and potash industry since 1929.

Financial Health and Credit Rating

On the surface, ICL Group’s balance seems rocky with a quick ratio of 0.92 and a current ratio of 1.75, which normally would indicate problems in meeting short-term obligations with its current liquid assets and that the company is dependent on being able to sell its inventory and converting receivables short term. Having in mind that the company is selling fertilizers, a product with stable demand and turnover, a low quick ratio appears to be nothing to worry about. Nonetheless, the company’s bonds were in 2022 given a BBB- rating by Fitch, meaning an almost non-investment-grade rating. This is despite a more-than-double operating cash flow in 2019 of almost $1 B to $2,025 B in 2022 while keeping net debt nearly constant for nearly 4 years.

The credit rating mostly reflects a scenario where fertilizer prices are suppressed by a recession as in the years following the GFC, making ICL Group less profitable. This is a scenario to keep in mind and one in which the company’s results will be most comparable to the 2019 levels with sales of $5.27 B and earnings of $475 M. This is what the unfavourable scenario below is modelling after.

This would actually be consistent with reverting to about the mean of ICL Group’s long term annual sales, as can be seen in the below picture.

Valuation

A reasonable valuation of ICL Group stock is at best achieved by summing the per-share discounted cash flows. Therefore, estimates of their future annual free cash flow figures are needed. Statista forecasts that the global fertilizer market will increase to $241.87 B in 2030 from $193.28 B in 2020, implying an annual growth rate of about 2.5%. This will be used as growth rate of ICL Group’s free cash flow in the unfavourable scenario below and not in the base and favourable scenarios as the forecast was made before the war in Ukraine and do not reflect the impact of fertilizer trade disruptions which result in higher prices.

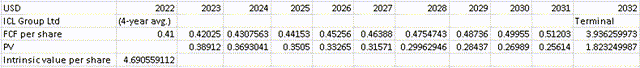

The Unfavourable Scenario

The future cash flows in this scenario are projected from its lower 4-year average instead of its 2022 numbers in order to arrive at more conservative estimates. A standard discount rate of 8% is used and a terminal multiple of 7.5 as well as a growth rate of 2.5 % is used. This results in a per-share value of about $4.7:

Made in Excel with data from Yahoo Finance

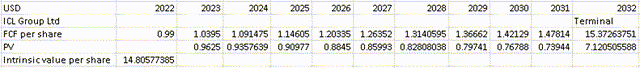

The favourable scenario includes an annual growth rate of 5% the next 5 years and 4 % the following 5 years. A slightly higher terminal multiple of 10 is used. This results in a share price of $14.8. This valuation reflects higher fertilizer prices because of further disruptions in Fertilizer trade in the future. Furthermore, the cash flows are projected from record 2022 numbers:

Made in Excel with Yahoo Finance numbers

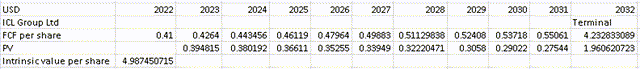

The base scenario below is based on the 4-year average free cash flow with a growth rate in the next 5 years of 4% and 2.5 % in the following 5 years. A reasonable terminal multiple of 7.5 is used as is a discount rate of 8%. This results in a stock price of about $5:

Made in Excel with Yahoo Finance numbers

By assigning each scenario with probabilities, one can arrive at a probability-weighted price estimate. Giving the unfavourable scenario with a probability of 25%, the base scenario with 45%, and the favourable scenario with 30%, one can find a probability-weighted estimate of the future stock price by summing the products of each probability and price. By this computation, the per-share value is $7.856, indicating 15% upside from Friday 31st’s NYSE close price of $6.8.

Conclusion

ICL Group is a large established chemicals and agricultural input company which offers a way to profit off potential food security worries, for example, from further developments in the Russia-Ukraine war, while still following value investing principles by buying under intrinsic value at current levels. Although a recession might lower fertilizer prices, it still seems a reasonable bet for a long-term investor because of how the company is a beneficiary of certain long-term trends such as increased agricultural efficiency, growing world populations, and is able to leverage its low-cost production assets. On a personal level, this is a stock I would be eager to buy at an even lower price as potential global recession fears play out.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.