Teekay Tankers: Attractive Valuation Overshadowed By OPEC's De-Dollarization Efforts

Summary

- Teekay Tankers has grown immensely in recent years as the breakdown in geopolitical trade relationships causes overseas oil demand to soar.

- The recent surprise reduction in OPEC output and fall in US drilling levels indicate global oil exports may be peaking, mainly if a worldwide economic recession occurs.

- Low production of new oil tanker vessels indicates the market may remain in a shortage over the coming years.

- The recent China-Saudi Arabia oil and currency deal indicates that the "Petrodollar" system may end in 2023, potentially upsetting the global petroleum shipping market.

- TNK appears undervalued long-term, but investors may want to wait for the market to realize the broader impact of the recent changes in oil's geopolitical backdrop.

Dikuch

Crude oil and energy markets have faced tremendous volatility over the past three years. "Lockdown" production cuts, growing labor and capital constraints, regulatory changes, and various geopolitical pressures have upset the global balance of energy availability. Due to the release of SPR reserves, a decline in demand, and increased global output, crude oil prices are not nearly as elevated as they were a year ago. However, the recent decline in US drilling activity and the significant "surprise" production cuts from OPEC signal oil may have reached a cyclical bottom.

Not all energy-related companies benefit from this bullish news for oil. Petroleum shipping tankers crashed on Monday following OPEC's production cut announcement. The popular tanker stock, Teekay Tankers (NYSE:TNK), was hit by around 12% on the news. Since OPEC countries are the primary source of internationally traded oil, reductions to their output threaten to upend the recent bull market in oil tanker shipping rates. I have been bullish on Teekay since 2020 due to its position to take advantage of global supply perturbations and the long-term shortage of available oil tankers.

Teekay's forward "P/E" valuation remains very low at around 3.9X despite its significant share price rise. The current confluence of trends begs the question, is Teekay likely to continue its secular growth at a low valuation, or is the recent OPEC cut and signs of a global recession warnings that it could be reaching a cyclical peak? I believe decent arguments can be made for a bullish and bearish case for Teekay and its peers. However, we can be relatively confident that the stock will experience significant volatility over the coming months, allowing for potential swing trading opportunities.

Can The Tanker Shortage Continue To Grow?

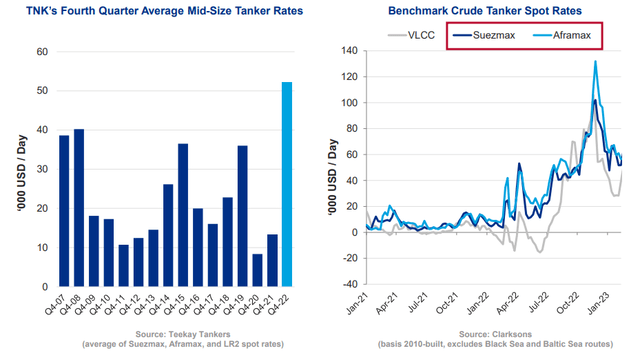

Teekay's stock value has more than doubled since I became bullish in 2020, mainly due to the bullish impact of Russian exports to Europe. The breakdown in that trading relationship has caused Europe to import more oil from OPEC countries via overseas transportation. Further, Russia has exported much more oil to China, exacerbating the global oil tanker shortage. Following the recent end to China's COVID lockdowns (and the global "re-normalization" trend), the deficit has become far more considerable, causing VLCC tanker rates to rise to over $100,000 per day and Suzemax over $75K/day last month. As you can see below, this rate is much higher than the typical levels seen by Teekay over much of the past two years:

Teekay Tankers Shipping Rate Indices (Teekay Tankers Q4 Investor Presentation)

Put simply, tanker shipping rates are stupendously higher than they were over most of the past decade. The extreme shift in the profitability and shortage of oil tankers since 2020 cannot be understated due to its significant impacts on Teekay and the global economy. Teekay's free cash flow is positive if rates are over $15,000 daily. Rates were often below that figure during most of the 2010s, causing Teekay to lose significant value through equity dilution. However, based on the company's estimates, it is expected to earn around $20 in FCF per share with rates around $55K/day (the 2022 average) and approximately $30 with rates around $75K/day as they were last month. This gives TNK an extremely high FCF yield of nearly 80% based on rates today.

Most likely, tanker rates will not sustain current levels. On Monday, the sharp decline in TNK and other oil tankers' value indicates tanker rates likely plummeted following OPEC's production cut decision. On the one hand, TNK's valuation is extremely low, given its profit capacity at elevated tanker rates. Conversely, recession concerns signal risks that could cause tanker rates to plummet back to pre-COVID levels.

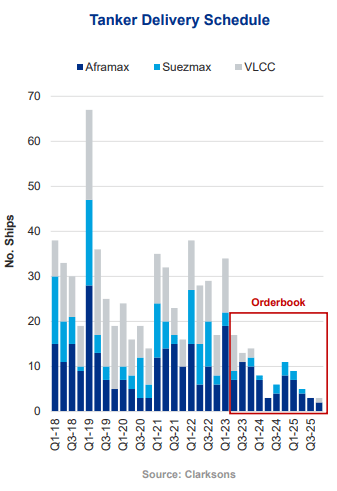

Ultimately, the decline in Russian oil exports to Europe has had minimal impacts on Europe's total oil imports and consumption and Russia's total oil exports. The fall of Russian pipeline exports to Europe has dramatically increased the need for oil tankers worldwide as far less efficient means of transportation are used. While the reduction in OPEC output levels limits exportable oil, it does not fix the core issue in the energy market that has caused tanker demand to soar. One is the Russian-Europe trade breakdown, which I expect will persist until that situation becomes dire (through significant energy shortages in Europe or some peaceful end to conflict). The secondary key issue is the decline in oil tanker production, which will persist based on current order levels. See below:

Oil Tanker Orderbook (Teekay Tankers Q4 Investor Presentation)

The tanker delivery schedule has been depressed over the past three years despite the general increase in tanker rates. It is expected to decline further over the coming two years as tanker companies generally keep low CapEx levels despite significant profits. This is a considerable trend seen across the energy industry, with most large and small fossil fuel companies dramatically reducing long-term capital investments due to rising costs and a perceived decline in long-term demand (due to renewable energy growth efforts). In other words, even with high profits today, companies like Teekay do not want excessive fleet growth because global oil demand is expected, by many, to decline over the next two decades. Of course, over the next ten years, energy prices (and transportation costs) may rise dramatically as companies allow infrastructure to naturally dilapidate without replacement, creating prolonged shortages.

The oil tanker market is susceptible to small changes in the supply and demand of energy products. The cost of shipping fuel has a minor impact on import fuel prices. Since fuel demand is relatively insensitive to changes in oil prices, importers are often willing to pay shipping costs, whatever they may be. In other words, the shipping shortage will not necessarily lead to a material decline in fuel demand, meaning rates can rise astronomically before negatively impacting fuel demand. Thus, Aframax and Suezmax may continue to increase this year past $100K/day if the tanker shortage continues to grow.

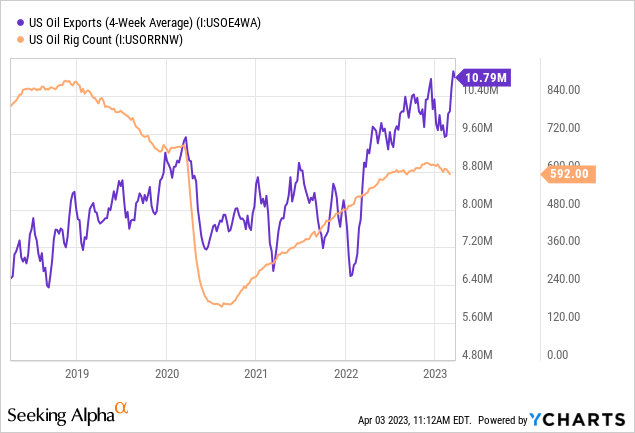

Of course, declines in production and export levels from OPEC are threatening to offset the tanker shortage. While US oil production continues to rebound (albeit very slowly), the US oil rig count has begun to fall sharply as drillers reduce activity due to the sharp decline in oil prices. Most likely, this will lead to a decrease in US oil exports. See below:

The US has also been a critical fuel source for Europe as it reduces Russian imports. Since last year, the (previously) US has had an ample supply of "drilled but uncompleted" wells, and significant SPR reserves allowed for sufficient excess capacity to drive export growth. However, the end of the SPR withdrawal and the decline in drilling activity indicates US exports will also decline as the minor "glut" returns to the prolonged shortage. Combined with the OPEC cut, this trend suggests that tanker rates may have peaked but could rise again if demand in Europe and China remains high despite a potential rise in oil prices (due to reduced import capacity).

Most of the world, mainly Europe and China, appear at high risk of entering a recession this year. The impact this may have on fuel prices remains unclear as OPEC (and North American drillers) seem keen on reducing production to keep up with lower demand outlooks. In my view, it appears likely that Europe, in particular, must dramatically reduce oil consumption due to its growing import dependency and declining currency value, creating a negative signal for shipping rates.

Beware The Growing "Petrodollar Collapse"

OPEC is a vast "wildcard" factor, particularly considering the surprise cut the week after Saudi Arabia's energy and currency deal with China. As the Middle East's economic and diplomatic ties with China and Russia grow, it becomes more likely Saudi Arabia (and peers) will reduce exposure to the US dollar, allowing them to make more substantial efforts to increase oil prices. As long as Saudi Arabia (and its peers) use a dollar-backed currency, they cannot cut production too quickly or risk causing US inflation (which causes their currencies to lose value).

This "petrodollar" system has allowed the US generally low energy import prices and "exorbitant privilege" that allows the US to sustain immense trade deficits. The recent Saudi-China, China-Russia, and South American energy and currency deals indicate the dollar's dominance in energy may be ending this year. In general, I expect this change to have a negative net impact on Teekay as the US and European currency volatility may greatly upset oil exports and imports. With this in mind, investors may want to avoid buying TNK until the full effects of these changes are realized.

The Bottom Line

Overall, there are numerous bullish and bearish factors facing Teekay Tankers today. On the one hand, the stock is trading at an incredibly low valuation, even if tanker rates do not sustain $60K+ levels. Based on Teekay's FCF estimates, its valuation seems very low as long as rates remain above $25K+, giving it a 15-20% FCF yield. Given the long-term decline in the production of oil tankers, it seems likely that a shortage will persist long enough that rates remain at such levels. Indeed, current analyst consensus estimates place TNK's EPS outlook at around $10 per share through 2025, indicating its high EPS is expected to be sustained. Further, the company has deleveraged significantly, reducing its interest rate exposure, and benefits tremendously from inflation - making it a great hedge in today's environment. Thus, from a longer-term perspective (3-5 years), Teekay remains undervalued today.

That said, in the more immediate horizon, TNK may decline in value due to the sharp decline in OPEC (and likely US) export levels. In the current environment, Teekay may have an inverted relationship to crude oil prices as positive signals for oil to reduce oil import demand. The international petrodollar system's potential "planned demolition" may also wrench Teekay's stability throughout the year. From this perspective, I have a neutral outlook on TNK and would not personally buy the stock until the impact of a recession on energy demand becomes more apparent.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of USO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.