HSBC Vs. Barclays: Which Is The Better Bank To Own In 2023?

Summary

- HSBC and BCS are large systematically important UK-domiciled banks.

- HSBC's valuation on a price per tangible book basis is slightly below fair value. It is a stable bank but subject to China-related geopolitical risks.

- BCS is trading at a distressed valuation and over 20% earnings yield.

- Share buybacks are the key to unlocking value in Barclays.

- How should you invest in these banks?

Dan Kitwood

Barclays (NYSE:BCS) and HSBC (NYSE:HSBC) are two large banks that are currently in my banking portfolio. Whilst both are domiciled in the UK with a large presence in the UK, these are very different banks with distinct rationale for holding.

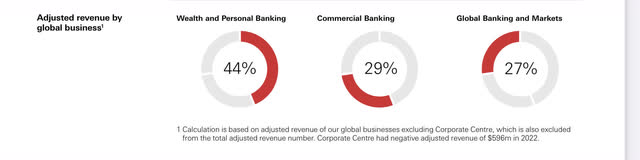

My strategy with HSBC, as detailed in my prior article, is to hedge China related risks. I am very cognizant that rising geopolitical tensions between China and the West, could lead to permanent loss of capital, especially so, where almost 50% of HSBC capital is allocated to Asia (predominantly Hong Kong and China). Having said that, my strategy of selling covered calls and buying out of the money puts as together with the HSBC shareholders' friendly dividend policy, is designed to generate strong double digit annual returns under most market conditions.

My Barclays' investment strategy is completely different. Barclays is trading at ~0.45x tangible book value even though it generates a return greater than 10% on its tangible book value. So in my view, this is an undeservedly cheap bank. There are several reasons for this which I detailed in my prior article and these include the following:

1) Earnings are not (yet) fully translating to increased returns to shareholders in the form of share buybacks and dividends

2) The business model is seen as too heavily reliant on the more volatile investment bank; and

3) Current perception and recency bias even though most of these are in the rear view mirror now. In the past, Barclays haphazardly managed to destroy capital for the best part of a decade with various fines, capital shortfalls and lackluster performance in the investment bank.

The Business Models Contrasted

When it comes to banks, the key aspect to understand is their ability to generate consistently strong risk-adjusted returns on their capital base. Some business models are more attractive versus others and this usually reflects in their valuation metrics. For example, Morgan Stanley (MS) is valued at significant premium to tangible book value as Mr. Market really likes the consistent growth, stability and capital light nature of its wealth management model.

HSBC Business Model

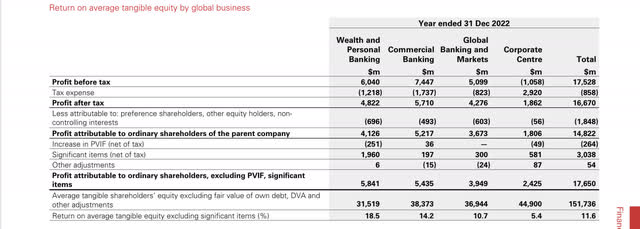

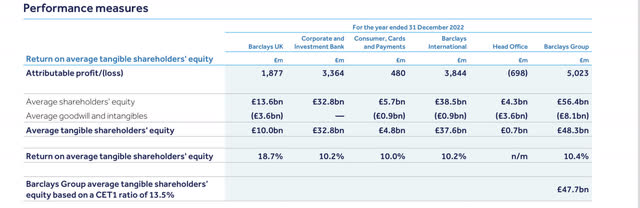

HSBC business model is a highly diversified one and the capital allocated to its various divisions is roughly split equally between three core divisions as shown below:

HSBC'S most profitable business line is the Wealth and Personal Banking ("WPB") division that in 2022 generated a strong high double-digits return on equity allocated of $31 billion. The main profit drivers for WPB are the retail businesses in Hong Kong followed by the UK. It is also the biggest business by far as measured by adjusted revenue:

The commercial banking business is also a relatively high-returning, low risk and stable business focused on deposits and payments with medium size clients.

The Global Banking and Markets business ("GBM") is not as FICC dominated as some of the other European and U.S. peers and importantly also not an outsized part of the bank and consumes around 1/3 of its capital (excluding the corporate centre).

HSBC is also looking to continue to pivot to its Asian businesses with a target of ~50% of capital allocated to Asia. This is also supported by disposals of non-core assets such as the Canadian and French businesses.

Overall, HSBC delivered 11.8% returns on tangible equity (adjusted profit basis) and is targeting to deliver greater than 12% RoTCE on an on-going basis with a dividend payout ratio of ~50%.

HSBC share price currently trades circa 1x tangible book value which is not an expensive valuation by any means given its greater than 12% RoTCE target, however, it is also not a distressed valuation like some of the other European banks such as Deutsche Bank (DB) that is trading at about a third of its book value.

Barclays Business Model

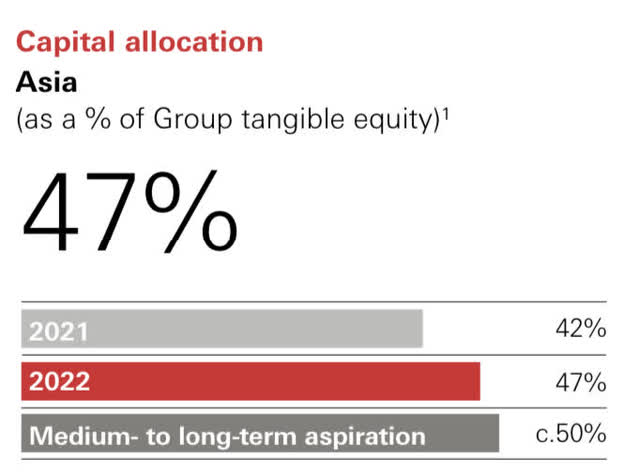

Barclays' valuation is currently a distressed one at ~0.45x of tangible book value. There are several reasons for the relative discount compared to HSBC and a big part of the discount is attributable to what Mr. Market perceives as a lower quality business. This is best understood by looking at its capital allocation as noted in the 2022 annual report:

As you can see above, BCS delivered RoTCE of 10.4%. However, 32.8 billion out of its 47.7 billion of capital is tied in the Corporate and Investment Bank ("CIB"). The market assigns lower multiples for the CIB business especially so as FICC trading (which is seen as more volatile) is a big part of its business.

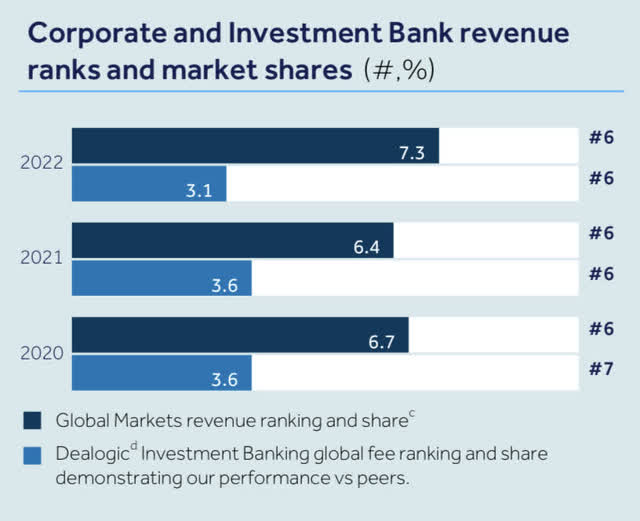

Nonetheless, BCS has made great strides in driving performance and market share in this business as shown in the below chart:

Barclays has been picking up market share in the Global Markets division (i.e. FICC and Equities trading) from U.S. peers as well as benefiting from the withdrawal of European peers such as Credit Susie (CS).

In 2022, given the bear market in the capital markets, BCS dropped market somewhat share in investment banking fees, but that's likely to be temporary in nature given BCS' heavy focus on debt capital markets.

Excluding the one-off administrative error that cost BCS GBP552 million in 2022, the actual performance of the CIB was much better (12% RoTCE) than on a reported basis:

Whilst I do expect FICC trading to normalise from the record levels of 2022, the revenue decline should be offset by recovery in investment banking fees as well as significant revenue uplift in transaction banking that is powered by higher interest rates.

So all in all, Barclays should deliver greater than 10% RoTCE in 2022 which means that it currently trades at >20% earnings yield. This is certainly cheap but Mr. Market has one more key concern and it is the ability of BCS to convert these earnings to dividends and especially share buybacks given where the stock trades at. As demonstrated in my prior article on Barclays, in 2023, the percentage of earnings converted to return of capital to shareholders should be substantially higher. This is exceptionally important especially when the stock trades at only 45 pence in the pound.

Discussion: So Which Bank Should You Own In 2023?

HSBC business model is much more diverse both geographically as well as balanced from a segment perspective. Unlike BCS, it is not as reliant on FICC trading. The focus on Asia where it intends to allocate ~50% of its capital to is both a blessing and a curse. As I pointed out in my prior article, the geopolitical risk with China is a potential grey swan event and if tensions do escalate, HSBC is clearly going to be collateral damage. I do very much like it as an income play which is premised on a progressive dividend policy at ~50% payout ratio complemented by special dividends and share buybacks, but I do remain cognisant of the China related geopolitical risks. Whilst at ~1x tangible book value the valuation is far from demanding, I cannot really see it double from here. HSBC is a very bureaucratic bank and somewhat of an "oil tanker" of a bank, things don't generally change very fast and it is normally all about steady execution on costs and clipping the dividends from a higher rates environment. As such, given the China risks, my preferred trading strategy is to sell covered calls, buy deep out-of-the-money put options (i.e. protection from a China binary outcome resulting in a permanent loss of capital) and clip the dividends. This has been quite an effective income generating strategy for me.

Barclays on the other hands, I believe is trading at very distressed levels. I do understand why the market is concerned with its high capital allocation to the CIB division but I do believe that the franchise is much more stable and balanced than the market assumes. It should perform well and at least earn its cost of capital throughout the economic cycle. It is also an important diversifier in recessionary environment as was seen during the pandemic. However, the real game changer is going to be share buybacks and I see these increase substantially in 2023 and beyond. At such a great discount to book, this is amazing value for shareholders. I have been taking advantage of recent dislocation in the share price due to the banking crisis and have accumulated long term call options as well. I think BCS fair value is around 0.8x to 0.9x of tangible book value.

Final Thoughts

HSBC and BCS are two very different banks with different geographic reach, business mix as well as risks. With HSBC, to me it is very sensible to hedge China geopolitical risks but it is a great income play that should deliver an annual double digit total return.

The culprit for BCS distressed valuation is its perceived over-reliance on the devilishly volatile FICC and Equity trading revenues. However, what the market has failed to realise is that BCS is gaining share from its U.S. peers, such as Citigroup (C) and JPMorgan (JPM), as the latter are increasingly capital constrained. I also expect BCS to continue and direct capital to the more accrual businesses in the UK ring fence bank as well as the international Cards and capital-light Payments business. The game changer is of course buying back shares at a huge discount to book. I expect the share buybacks to increase materially in 2023 as BCS laps some of the regulatory capital headwinds.

So in summary, there is a place for both banks in a portfolio. HSBC is lower risk operationally but subject to heightened geopolitical risks. BCS could easily double if it is able to materially increase the percentage of share buybacks, as I expect, in 2023 and beyond.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BCS, HSBC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.