KMLM: Follow The Big Money Investors

Summary

- The recent decline of KMLM can be attributed to the cooling off of the commodities bull rally and some other factors.

- In my view, using trend-following techniques can generate long-term alpha, making KMLM's strategy a great fit for a rational investor.

- The behavior of institutional investors, who are continuing to invest in KMLM despite its temporary difficulties, suggests the selloff may be temporary.

- Even if the fund halves its distribution amount for FY2023, the distribution yield would fall to only ~6.85%, which is still a lot.

- Consider buying this ETF during its weakness, following big-money investors.

- Looking for more investing ideas like this one? Get them exclusively at Beyond the Wall Investing. Learn More »

bankrx/iStock via Getty Images

Intro & Thesis

During periods of active decline in the S&P 500 index (SPX) and other indices, systematic CTA-driven ETFs experienced growth due to their strategic positioning, including net short equity positions and long positions in various commodities, gold, and currencies. These asset classes are known to have a negative correlation with the traditional stock market during rough times.

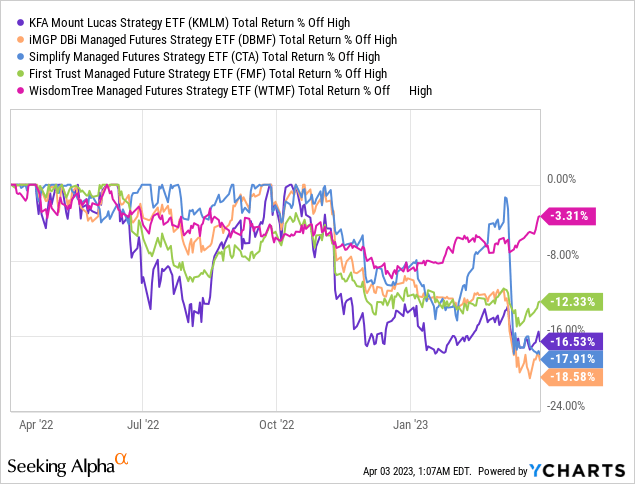

Recently, there has been a sharp decline in these ETFs attributed to the cooling off of the oil rally and a surge in equities, exceptionally high beta stocks, that have been alleviated by a decrease in market inflation expectations and the upcoming down cycle of the Fed rates. However, the high dividend yield did not let their total returns fall so much:

I have already written about 2 other funds - iM DBi Managed Futures Strategy ETF (DBMF) and Unlimited HFND Multi-Strategy Return Tracker ETF (HFND) - which I still consider excellent diversifiers for the medium-term portfolio of an ordinary retail investor. Today I would like to draw your attention to another fund - KFA Mount Lucas Managed Futures Index Strategy ETF (NYSEARCA:KMLM), which looks quite interesting after a period of active selling.

What Is KMLM?

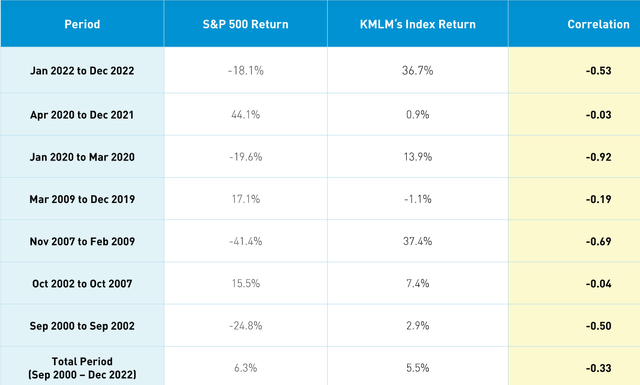

According to Seeking Alpha data, KMLM is a US-based exchange-traded fund managed by Krane Funds Advisors, LLC, which invests in fixed-income, commodity, and currency markets worldwide through derivatives such as futures and other funds. The fund's portfolio consists of debt instruments, government securities, corporate bonds, and other non-government fixed-income securities with maturities of up to 12 months, as well as futures contracts on commodities such as corn, crude oil, and gold. The ETF seeks to track the performance of the KFA MLM Index and was established on December 1, 2020.

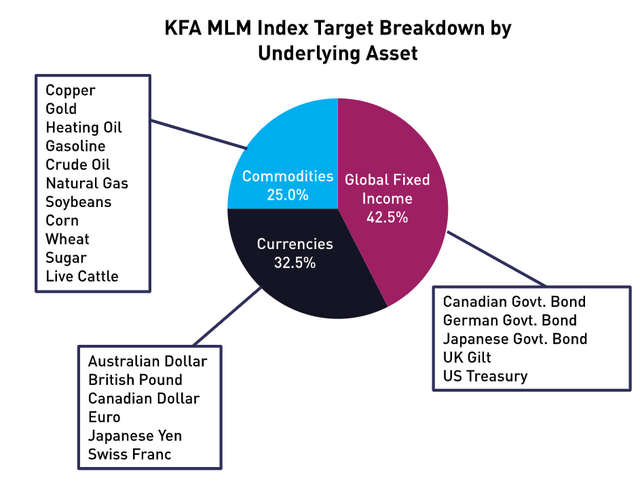

The index is intended to reflect the return that investors in managed futures can achieve through an efficient passive trend-following algorithm, that has the following target breakdown by underlying assets:

The KFA Mount Lucas Index, as stated in the latest factsheet, trades in 11 commodities, 6 currencies, and 5 global bond markets, with weights assigned based on their relative historical volatility. Additionally, the constituent markets within each basket are equally dollar-weighted. The fund generates a daily trend signal by comparing each market's price with its long-term moving average, which results in either long or short signals. Market trading signals are assessed once a day, while rebalancing takes place on the first day of every month, and futures contracts are rolled forward on a market-by-market basis.

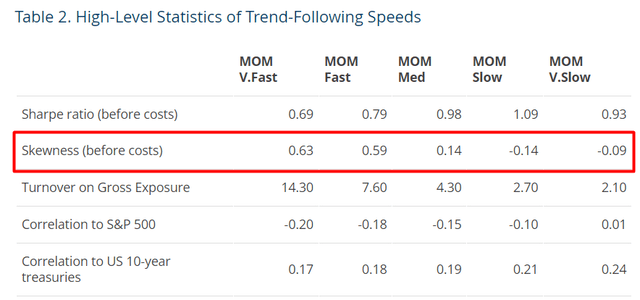

In general, trend following is an interesting area of discussion - some people believe in it, and others consider it absolutely meaningless. I belong to the first category - I think it makes sense to follow the classical and absolutely unambiguous instruments like moving averages. Even if it looks like something too simple to work, in practice it turns out that this is one of the best ways to generate alpha, provided that the chosen trend is stable. Not to be unfounded, I will give an example from a recent study by Man Group (OTCPK:MNGPF) - one of the largest investment managers in the world with a particular focus on quantitative strategies.

The researchers found that "speedy" trend-following strategies [based on a suite of double exponentially weighted moving-average crossover ('MAC') models] had the greatest positive skewness among the other models:

Man Group's research, author's notes

Skewness refers to the asymmetry of the distribution of investment returns, measuring how returns deviate from the average return. If the distribution is symmetrical, skewness is zero, but if it is skewed to the left, there are more negative returns than positive returns, and if it is skewed to the right, there are more positive returns than negative returns.

KMLM ETF's ability to achieve a NAV of +20.63% by the end of 2022 may be attributed to the positive skewness of its returns [recall - rebalancing takes place on the first day of every month], as well as the experienced managers who executed timely trades based on their expertise.

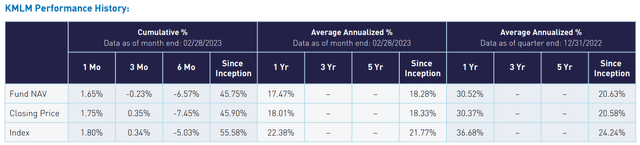

Unlike the relatively young KMLM ETF, its underlying index has a long history, from which we can see how uncorrelated its return is with the broader market in the face of SPX:

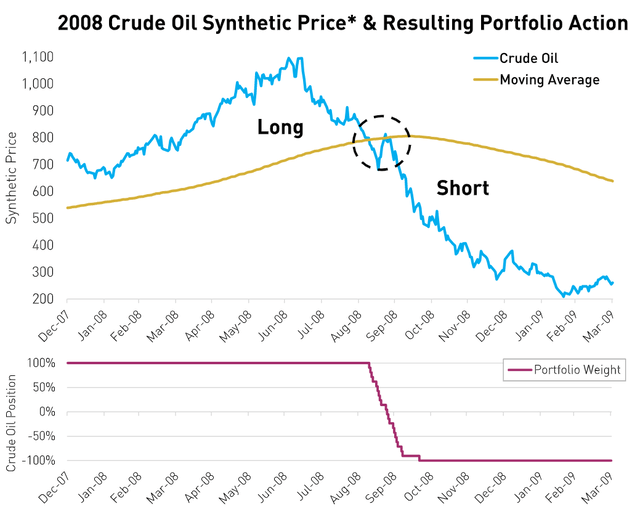

To illustrate how the index algorithm works, let's take the example of the crude oil position in 2008. When the price of crude oil crossed below the long-term moving average, the algorithm generated a sell signal, and the index reversed its long position into a short position:

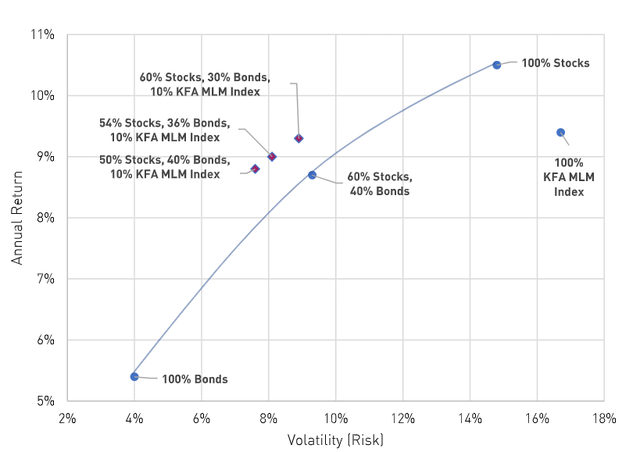

By using a straightforward investment strategy like this, there is a low correlation between the assets within a portfolio, and when this is combined with positive skewness, it can lead to a final return that is above the efficient frontier. This suggests that investors who do not include this type of strategy in their allocation may miss out on potential gains, despite taking on about the same level of risk.

Therefore, not even looking at the fund's holdings as of the latest reporting date [the weights within its portfolio change rapidly], I believe this ETF will outperform the SPX on a risk-adjusted basis over the long term as volatility increases.

Someone's pouring money into KMLM despite its selloff

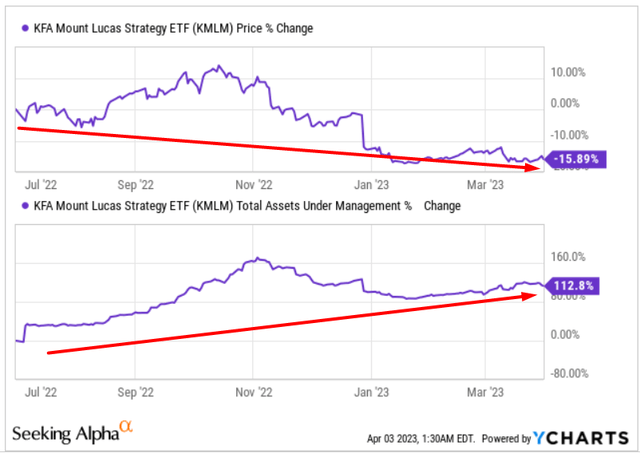

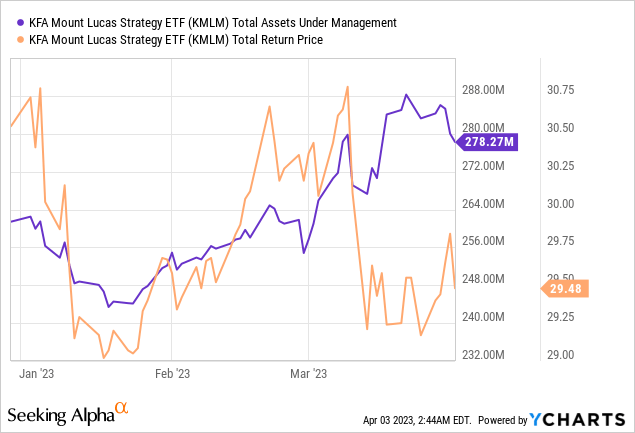

One of the confirmations of the opinion that KMLM is now having only temporary difficulties is likely the behavior of institutional investors, who I believe are continuing to pour money into this ETF despite its downward momentum in recent months:

The discrepancy is especially noticeable when we zoom in a little:

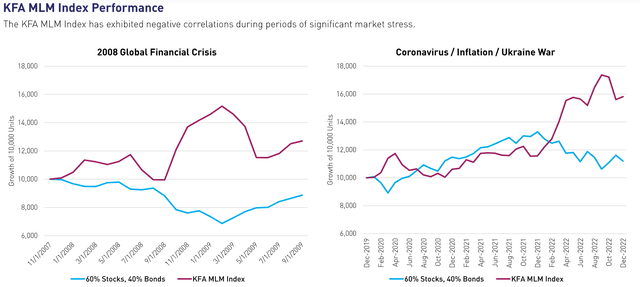

I suspect that the big players are getting in now amid weakness in KMLM because they recognize that the risk of higher volatility is growing in the near term - this is the period when the underlying index of this ETF has performed best on a relative basis:

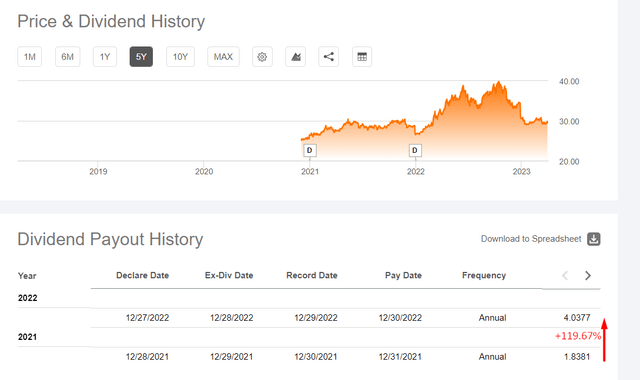

The fund has an annual distribution policy - in FY2022 the single distribution amounted to $4.0377 per share - which was yielding over 14% at the time.

Seeking Alpha, KMLM's Dividends, author's notes

Even if the fund halves its distribution amount for FY2023, the distribution yield would fall to only ~6.85%, which is still a lot in my view. I think this is one of the reasons for the active accumulation.

Concluding Thoughts

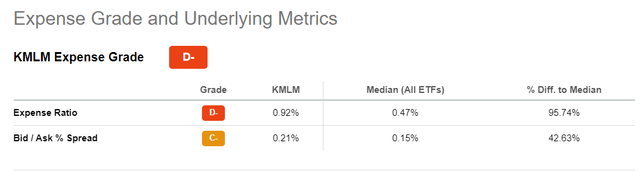

Naturally, all investment theses have risks. The expense ratio and bid/ask spread of KMLM are quite high compared to Seeking Alpha's broad ETF coverage:

On the other hand, investors pay for the opportunity to access a product managed like a CTA-based hedge fund. The expense ratio of less than 1% is significantly better than the traditional 2/20 or 1/10 fee structures charged by the hedge fund industry. So by investing in this product, investors can potentially achieve better returns while also keeping a greater portion of their profits.

Furthermore, it's important to note that KMLM employs a significant amount of leverage.

Seeking Alpha, KMLM's Holdings

This amplifies the potential returns but also increases the risks - if the market fails to follow the managers' way of thinking [or the algorithms utilized by KMLM fail at some point in time], the fund is likely to face challenges.

Nevertheless, I believe that KMLM, like DBMF and HFND, can add alpha in the event of another capital market sell-off - we have seen that in the past with the behavior of its underlying during the 2008 period and the coronavirus crisis.

So my recommendation is to consider purchasing this ETF during its current period of weakness - maybe it's worth following big-money-investors who seem to have been doing so for several weeks already.

Thank you for reading!

Struggle to navigate the stock market environment?

Beyond the Wall Investing is about active portfolio positioning and finding investment ideas that are hidden from a broad market of investors. We don't bury our heads in the sand when the market is down - we try to anticipate this in advance and protect ourselves from unnecessary risks accordingly.

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% - hurry up!

This article was written by

Chief investment analyst at a small Singapore-registered family office. A generalist in nature. Mainly focused on special situations, IPOs, and undercovered/hidden stocks. Ranked in the top 4% of financial bloggers by Tipranks (as of June 17, 2022, compared to the S&P 500 Index over 1 year).

BS in Finance. The thesis description can be found in this article.

DM me in case you're interested in investment consulting services.

**Disclaimer: Associated with Oakoff Investments, another Seeking Alpha Contributor

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in KMLM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.