SOXQ's AI Prospects And Opportunity With SOXS, But Timing Is Key

Summary

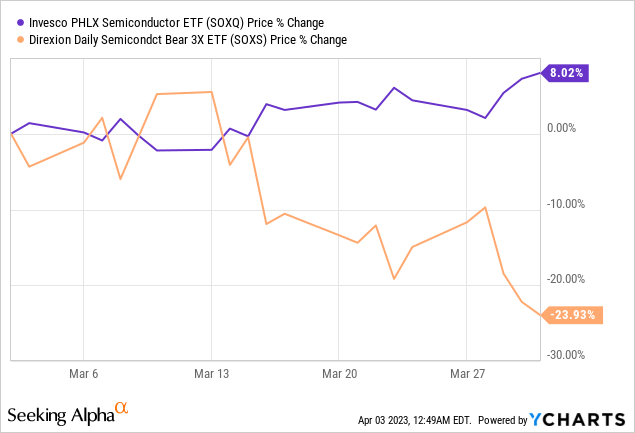

- This thesis is about two ETFs, Invesco's SOXQ and Direxion's SOXS which are inversely related as when one rises, the other one falls.

- After an 8% rise in the last month alone, it is better to be cautious about SOXQ despite the tremendous opportunities provided by Generative AI.

- Talking risk, there is also the investigation by China on Micron, which is a first in the case of a major U.S. semiconductor manufacturer.

- Normally, uncertainty impacting the Invesco ETF bodes well for SOXS, but, here, with a 3 times leveraged ETF, it is important to get the timing right, which is not the case right now.

- In these conditions, I have hold positions on both.

SweetBunFactory

There is a lot of excitement about AI or artificial intelligence right now and especially about how it will favor semiconductor stocks. In this respect, the Invesco PHLX Semiconductor ETF (NASDAQ:SOXQ) in the blue chart below has delivered gains of 8% within the last month alone compared to a loss of nearly 24% for the Direxion Daily Semiconductor 3x Bear Shares ETF (NYSEARCA:SOXS) which suffers when chip stocks are up.

There are several reasons for the above price action including the possibility of the Fed Reserve becoming more dovish concerning monetary policy, the excitement around OpenAI’s ChatGPT, and Micron’s (NASDAQ: MU) financial results, but, for more data-driven investors this thesis aims to identify the specific reasons which would justify an investment in SOXQ.

Now, as a highly leveraged ETF, SOXS is rather geared towards trading as I will detail further and, with the three catalysts I identify later, there may be a window of opportunity, but, it is also important to get the timing right.

How Generative AI Can Bring More Chips Sales

Investors will note that AI itself has been around for decades be it analytics AI where researchers would dice through tons of data to extract meaningful information for decision-making purposes, like identifying a new drug. Then came Recommendation AI used by marketing companies to know the particular tastes of someone who has been accessing various websites together with the time spent on each, to have an idea of his or her behavior to ultimately recommend the product most likely to be purchased.

Then, a few months back Generative AI emerged with ChatGPT, a user-driven interface whereby a prompt is offered for typing in a query and the system can find an answer. This simplicity, fun, experimenting, and chatting approach made ChatGPT “go viral”, initially with the text, but later also with image and video formats. In this respect, Microsoft (NASDAQ:MSFT), a major investor in OpenAI, the company behind ChatGPT, has integrated this technology into its Bing search engine and office productivity tools such as Microsoft Office 365, signifying almost instantaneous exposure to billions of users.

Now, semiconductors are tiny electronic components essential in everything from telephones and electric cars to sophisticated weapons, robotics, and other high-tech machinery. Extrapolating further, servers equipped with processors like Nvidia’s (NASDAQ:NVDA) Tensor A100 built using semiconductors are needed to support AI applications.

Thus, as the largest company in the industry with a valuation of $685 billion, Nvidia dominates the market for specialized chips with one of them being the A100 GPU or Graphic Processing Unit. Thousands of these have proven ideal for training AI programs like the hugely popular ChatGPT. However, in addition to the training part where algorithms learn from large sets of data, Generative AI also includes inference tasks that encompass the usage aspect, for which Nvidia faces competition, namely from Intel (NASDAQ:INTC) with its Hanana Gaudi 2 processors. These can process inference applications faster than Nvidia’s GPUs by about 20%, not to forget Advanced Micro Devices (NASDAQ:AMD) which has also just released its new RYZEN 7000 chips in January this year which includes a built-in engine to run AI tasks faster.

Benefits to SOXQ's holdings including Micron

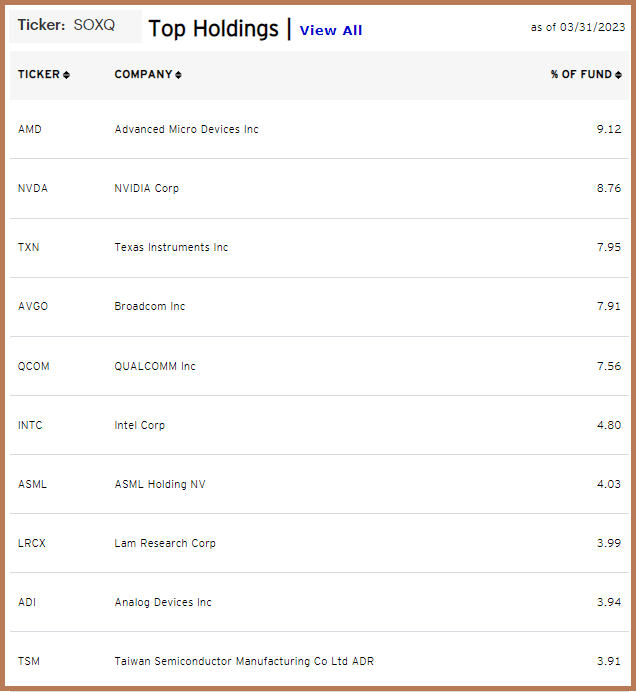

Today most of the training and inference tasks are performed on Nvidia’s GPUs which can cost up to $10K just for one unit compared to ten times less for either one of Intel’s or AMD’s CPUs (Central Processing Units). Therefore, while Nvidia is likely to see more sales for its GPUs for training AI algorithms as companies like Bloomberg release their own GPT flavors with BloombergGPT, other SOXQ’s holdings, as pictured below, are also likely to benefit. For investors, the ETF tracks the PHLX Semiconductor Sector Index.

SOXQ's Top Holdings (www.invesco.com)

Pursuing further, while not forming part of the ETF’s top holdings, Micron which constitutes 3.82% of its overall assets has been pretty much in the limelight recently. First, despite dismal second-quarter results for fiscal 2023, with some good guidance hinting towards the end of the oversupply in the memory industry, its stock gained, also helping to carry with it the whole sector on March 29.

Second, there was adverse news that Chinese authorities will be opening an investigation into the company’s products on security grounds. With China accounting for around 11% of its revenues in FY22 (ending in Aug), the stock suffered upon the release of the news. Now, with semiconductors being critical components for everything electronics, investors should expect continued geopolitics-induced volatility as U.S-China relationships continue to go sour. This time, China's action could have been a reaction to Taiwan’s President visiting the U.S., sanctions limiting the export of advanced chips to China enacted in October last year, and ongoing with America's allies.

Now, this is precisely the advantage of choosing the ETF route to invest in semis as it offers more diversified exposure to the whole chip ecosystem. Also, with AI infrastructure requiring up to eight times more DRAM memory content than for normal computing tasks, Micron has the capability to sell more chips in its other markets to partially offset the shortfall in China in the longer term.

However, in the meantime, it is better to be in the backseat for reasons I enumerate below.

Opportunity with SOXS but Timing is Key

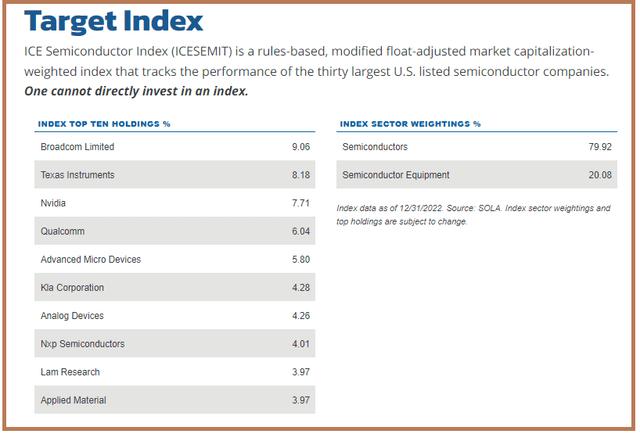

First, China’s action which is unprecedented in terms of investigating a major U.S. company, could put a hold on investors' appetite for chip stocks and instead prompt them to adopt a wait-and-see attitude. Second, rising oil prices after the surprise OPEC+ cut of 1 million bpd of production could make the task of fighting inflation more difficult. This could lead the Fed to become more aggressive in monetary policy tightening with high-interest rates being bad for tech in particular due to their higher valuations. Third, the ICE Semiconductor Index (ICESEMIT) which is inversely tracked by SOXS by three times (-3x) is up by 3.65% during the last month, implying that there could be some consolidation with stocks moving down.

Therefore, three catalysts could trigger a downside in chip stocks, and SOXS could deliver gains of theoretically up to 10.95% (3.65 x 3). This means that SOXS can significantly magnify gains over the short term in case there is volatility engulfing the stocks included in ICESEMIT as pictured below.

SOXS's Target Index (www.direxion.com)

At this stage, it is important to stress on caution.

First, I deliberately mentioned “ theoretically” when invoking possible gains as in practice leveraged ETFs suffer from the compounding effect, caused by the SOXS's share price fluctuating widely within a trading period. Now, more is the degree of fluctuation, and more leveraged is the ETF which is certainly the case here, less will be the gains, and this is the reason why Direxion advises to compute gains on a period of one day only.

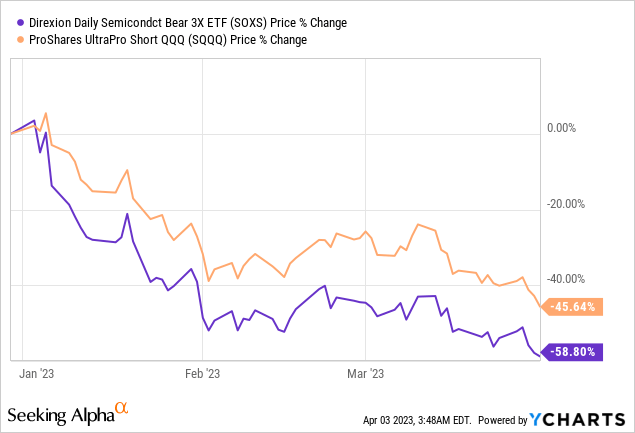

To have an idea of SOXS’s volatility level, I performed a comparison with the ProShares UltraPro Short QQQ (SQQQ) which is another 3x inverse leveraged ETF over a three-month period. The results show that, with a downside of 58.8% as per the blue chart below, semiconductor stocks are more prone to volatility than the wider tech sector.

Therefore, to reduce the probability of losing money and as advised by the Security and Exchange Commission, one has to avoid adopting a buy-and-hold strategy as commonly done with normal stocks or ETFs, due to the erosion in value over the long term. Associated Risks are further explained in Seeking Alpha’s Leveraged ETF Coverage Policy section, namely, the way these are different from the active and passive investment vehicles investors are used to.

This is the reason that timing is very important as well as having more of a trader’s mentality whereby you are either ready to close your position, either with a small gain in case your trade has been successful or exit with a loss when your luck has run out, instead of waiting for an elusive jackpot.

Concluding with Caution

It may seem strange that after enticing investors about the potential of new applications like ChatGPT requiring lots of chips and opportunities for SOXQ's holdings, I have a hold position on the ETF, but, noteworthily, provided three reasons for this. Well, there is a fourth reason and this has to do with the first quarter earnings season from next week, where firm evidence may transpire as to whether a recession is knocking at the door.

As for SOXS, it is precisely the cautionary instance on the Invesco ETF, which could contribute to an upside, but, bear in mind that due to its extreme volatility, it is important to get the timing right. In this respect, the last time I covered the ETF was on January 21 when it was priced at $28.28 and it is now at $16.28, or more than 42% down. During this period, as per my observation, the ETF has produced occasional upsides, but only amounting to around 10% in one week, which represents insufficient gains given the compounding risks incurred.

SOXS Performance to date ( www.seekingalpha.com)

Looking into the rear mirror, there were better one-week gains of 20% and above last year and these occurred primarily as a result of the Federal Reserve hiking interest rates aggressively. Such is no longer the case currently, but, a critical decision will have to be made on rates during the next FOMC meeting in the first week of May. Till then, it is unlikely to witness the degree of volatility which may deliver a meaningful rise in SOXS, unless the U.S. falls into recession.

Finally, semiconductors, which are already essential for the production of electronic goods could see their use significantly improved as the tools and devices which we use in our everyday life become more intelligent. As such semis stock could prove to be more resilient to economic uncertainty as part of the wider tech sector when compared to more cyclical stocks coming from the banking or consumer discretionary sectors, but, as for every investment, timing is key.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.