Markets Unlocked 4/3/23: Upside Potential

Summary

- As we head into the second quarter of the year, markets are showing some resilience.

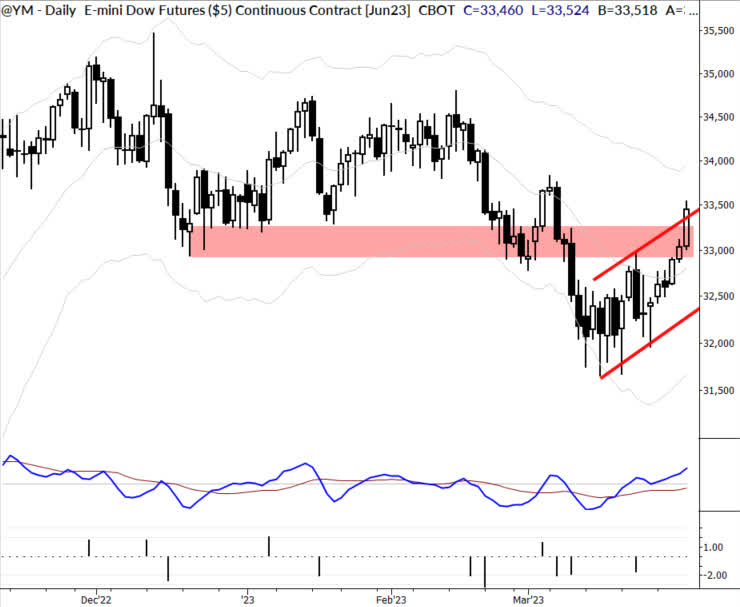

- For much of March, we were looking at apparently bearish patterns in major indexes, with the DJIA and the Russell 2000 on the edge of a breakdown.

- Even if our longer-term concerns are valid, new all-time highs are possible before any weakness sets in.

everythingpossible/iStock via Getty Images

As we head into the second quarter of the year, markets are showing some resilience.

Current market conditions

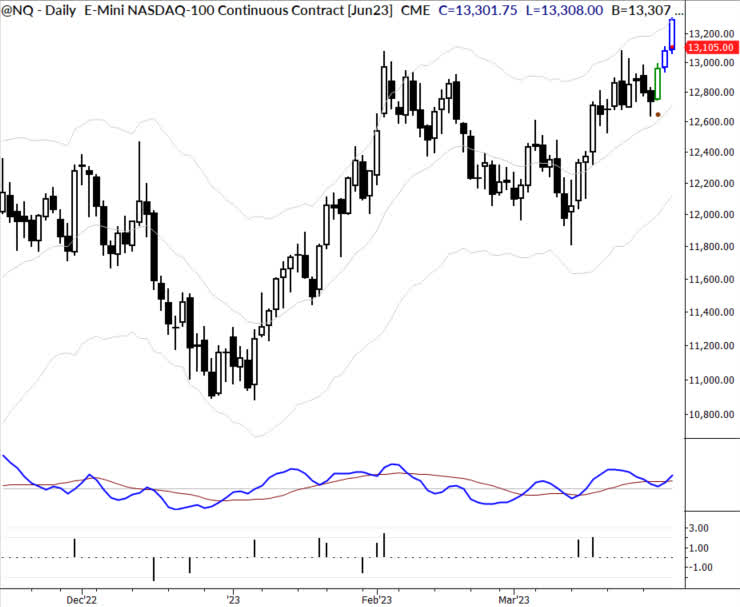

Economic and macro data is mixed; there's nothing new here - this is almost always the case. For much of March, we were looking at apparently bearish patterns in major indexes, with the DJIA and the Russell 2000 on the edge of a breakdown. However, strength started to emerge in the last two weeks, culminating in a solid rally into the end of the month. (See chart of the Nasdaq below.)

This is a conflicted period for markets. While we hold grave longer-term concerns (and could even see a bear market emerging within the next 6-24 months), we will watch near-term price action and lean to the upside as long as the bulls are in control. One of the easiest patterns to monitor is at the top of this blog post - the DJIA is now pressing back into previous support, perhaps setting up a significant rally. Even if our longer-term concerns are valid, new all-time highs are possible before any weakness sets in. Cultivate flexibility and focus on risk management.

The week ahead (potentially market-moving data points)

- Monday: 10:00 ISM Manufacturing

- Tuesday: 10:00 Factory orders, JOLTS

- Wednesday: 8:15 ADP Employment, 8:30 Trade Balance, 10:00 ISM Services

- Thursday: 8:30 Jobless claims

- Thursday: 8:30 Employment

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by