Elephant Oil Readies $7 Million U.S. IPO

Summary

- Elephant Oil has filed proposed terms for a $7 million U.S. IPO.

- The firm is seeking to develop oil and gas interests in Benin and Namibia.

- ELEP is a highly speculative company with a tiny capitalization.

- I'll pass on the IPO.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

mysticenergy

A Quick Take On Elephant Oil Corp.

Elephant Oil Corp. (ELEP) has filed to raise $6.875 million in an IPO of its common stock, according to an S-1/A registration statement.

The firm operates as an independent oil and gas exploration and production company.

Given the stage of company development and ultra-high risk profile, I'll pass on the IPO.

Elephant Oil Overview

Houston, Texas-based Elephant Oil Corp. was founded to acquire exploration licenses in Benin and Namibia to extract hydrocarbon-based energy sources.

Management is headed by Founder and CEO, Matthew Lofgran, who has been with the firm since its inception in 2013 and was previously CEO of Nostra Terra Oil & Gas Company plc.

The company has a 100% licensed interest in Benin for more than 1.1 million acres in a low-density tropical forest. The exploration period has terminated, and management is in negotiations for an extension of the expired license.

The firm also has an agreement with Namibia for a 70% interest in a block of more than 2.8 million acres in a brushland environment. The exploration period will terminate in August 2029.

As of December 31, 2022, Elephant Oil has booked a fair market value investment of $8.6 million in equity and debt from investors.

Elephant Oil's Market

According to a 2019 market research report by JD Supra, the oil and gas industry in Benin has historically been limited.

The most recent discovery of note was in 2013 when South Atlantic Petroleum discovered an 87 million barrel field.

Since then, the government of Benin has enacted a new petroleum code and model production sharing agreement.

Also, the new code pertains to upstream operations and not to storage or transportation operations.

Elephant Oil's Financial Performance

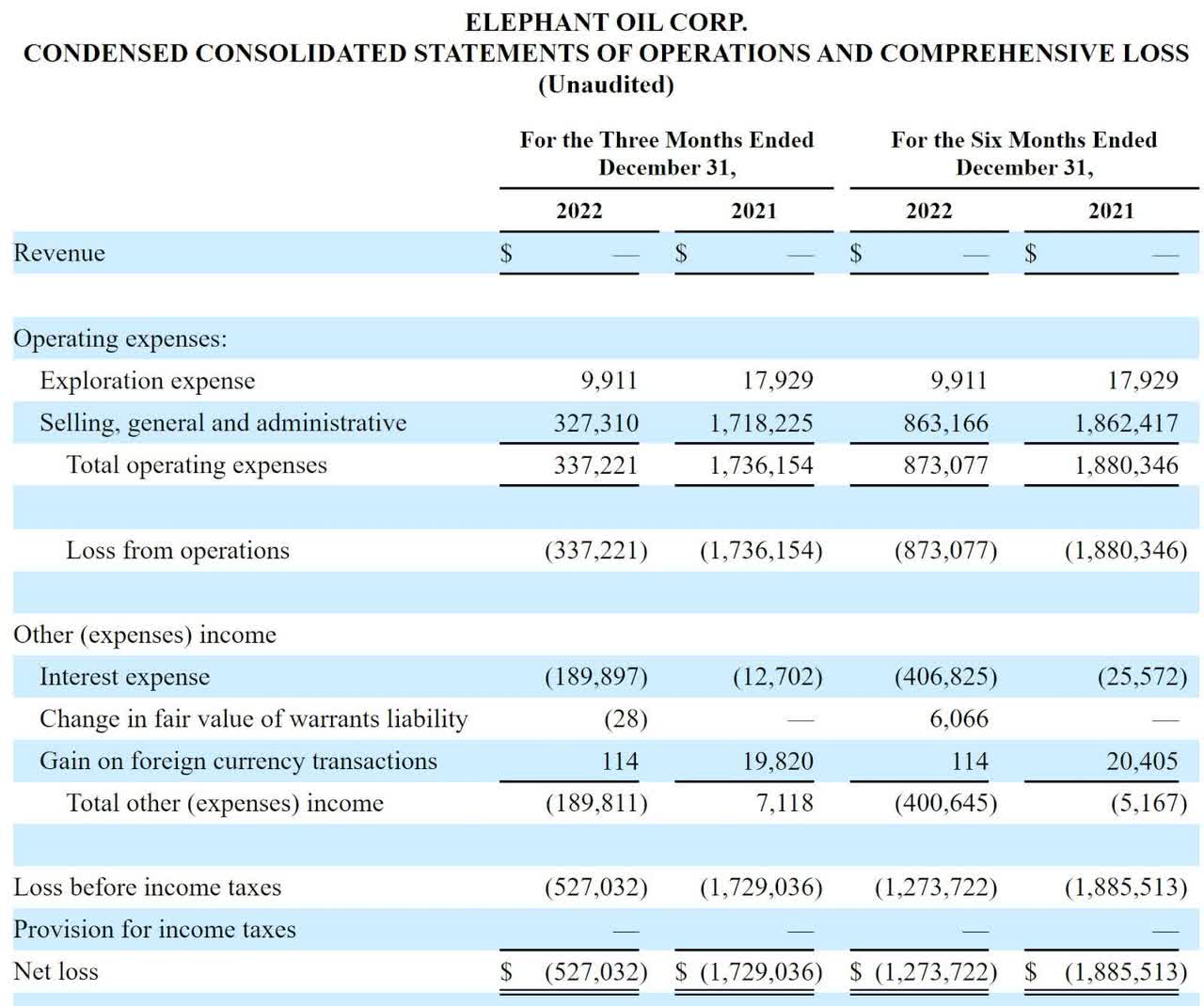

The company's recent financial results indicate no revenue and material SG&A expense associated with its development efforts.

Below are relevant financial results derived from the firm's registration statement:

Statement Of Operations (SEC)

(Source - SEC)

As of December 31, 2022, Elephant Oil had $25,436 in cash and $4.4 million in total liabilities.

Elephant Oil's IPO Details

Elephant Oil intends to raise $6.875 million in gross proceeds from an IPO of its common stock, offering approximately 1.5 million shares at a proposed midpoint price of $4.50 per share.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

The company is also registering for sale 784,106 shares from potential selling shareholders.

Assuming a successful IPO, the company's enterprise value at IPO would approximate $66.2 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 10.51%. A figure under 10% is generally considered a 'low float' stock, which can be subject to significant price volatility.

Management says it will use the net proceeds from the IPO as follows:

approximately $3.7 million to mobilize a drilling rig to Benin, to commence exploration and drilling activities as well as additional surveys on Block B, and to pay license fees in Benin;

approximately $0.3 million for initial surveys and license fees in Namibia

approximately $0.2 million for further expansion of portfolio or further exploration activity of existing assets; and

approximately $0.1 million for working capital and selling, general and administrative purposes.

(Source - SEC)

Management's presentation of the company roadshow is available here until the IPO is completed.

Regarding outstanding legal proceedings, management says the company is not subject to any material legal proceedings.

The sole listed bookrunner of the IPO is Spartan Capital Securities.

Commentary About Elephant Oil's IPO

ELEP is seeking U.S. public capital market investment to fund the start of drilling activities in Benin.

The firm's financials show no revenue to date and some SG&A costs.

The firm currently plans to pay no dividends and to retain any future earnings for reinvestment back into the firm's growth and operational requirements.

The market opportunity for oil and gas products in the country of Benin is considered low based on its historical activity.

Spartan Capital Securities is the sole underwriter, and the only IPO led by the firm over the last 12-month period has generated a return of negative (86.8%) since its IPO. This is a bottom-tier performance for all major underwriters during the period.

Risks to the company's outlook as a public company include its tiny capitalization, lack of revenue history, and speculative nature.

As for valuation expectations, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately $66 million, despite no revenue history.

Given the stage of company development and ultra-high risk profile, I'll pass on the IPO.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This report is for educational purposes and is not financial, legal, or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or be removed at any time without notice. The author is not an investment advisor. You should perform your own research on your particular financial situation before making any decisions. IPO investing can involve significant volatility and risk of loss.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.