Centamin: A Better Year Ahead For This Small-Cap Producer

Summary

- Centamin was one of the best-performing gold miners last year, outperforming its benchmark by ~2500 basis points, with it being one of a few miners to deliver on guidance.

- This was an impressive feat given the inflationary pressures felt sector-wide, but higher improved productivity and cost savings partially offset the increased diesel/consumables costs.

- Unfortunately, this didn't show up in unit costs, which increased 13% year-over-year and came in above the industry average of ~$1,290/oz.

- That said, investors should see the fruits of Centamin's hard work show up in H2 2023 and 2024, and with the potential to become a dual-asset gold producer by 2026, I see CELTF as a Buy on any pullbacks below US$1.02.

Elena Bionysheva-Abramova/iStock via Getty Images

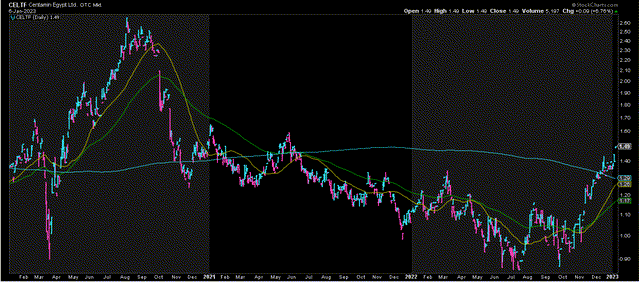

Just over three months ago, I wrote on Centamin plc (OTCPK:CELTF), noting that while the company had a solid year as it met guidance and made continued progress on its cost savings initiatives, the stock was getting a little ahead of itself short-term. This is because the stock was gapping higher into a potential resistance area near US$1.60 - US$1.70. Since then, the stock has significantly underperformed its peer group, down 15% from early January vs. a 3% gain for the Gold Miners Index (GDX). However, this is not related to any deterioration in the fundamentals like other miners such as First Majestic (AG), it's simply because of the stock likely needing a breather after massively outperforming its peer group in 2022 (14% gain vs. 11% decline in the GDX). Let's look at its 2022 financial results and recent developments below:

CELTF Daily Chart - January 2023 (StockCharts.com)

2022 Results

Centamin plc ("Centamin") released its FY2022 financial results last month, reporting annual production of ~441,000 ounces (+6% year-over-year) and sold ~438,600 ounces (+8% year-over-year). This annual production figure came in just shy of the company's FY2022 guidance mid-point of 445,000 ounces, with the increase in production helped by higher open-pit grades and increased tonnes mined at Sukari Underground following the transition to owner-operator mining completed last year. Unfortunately, while production was just below the guidance mid-point and Centamin delivered into FY2022 cost guidance, costs also missed the mid-point ($1,350/oz) and soared 12% year-over-year to $1,399/oz.

Sukari Mine Operations (Company Website)

On the surface, the 13% increase in unit costs year-over-year, which already followed an increase in costs in FY2021 ($1,234/oz - [+] 19%) might appear disappointing and it's certainly not ideal. However, it's important to note that there were several things working against Sukari's cost performance in FY2022 and while it may have missed its guidance mid-point, it at least delivered into its guidance range while most producers were forced to move the goalposts entirely (top and bottom end of guidance range) because of stickier than expected inflationary pressures. A few of the things impacting the unit cost increases on a year-over-year basis for Centamin were:

- increased sustaining capital of ~$164.9 million vs. ~$106.1 million in FY2021

- inflationary pressures that included higher diesel and consumables costs

- slightly lower ounces sold than produced and a slight miss on the production guidance midpoint

Given the lower realized gold price year-over-year ($1,794/oz vs. $1,797/oz), revenue came in just below my estimate of $800 million at $788.4 million, but was still up nearly 8% year-over-year due to increased ounces sold. However, all-in sustaining cost [AISC] margins took a beating in the period, with AISC margins declining from $563/oz in FY2021 to $395/oz in FY2022, translating to a 30% decline. Finally, the combination of much higher capital spending on several projects resulted in negative free cash flow of $18.1 million for the year, the second consecutive year of negative free cash flow after Centamin reported a cash outflow of $6.8 million in FY2021. That said, it still finished the quarter with one of the strongest balance sheets among its peers, with ~$160 million in net cash and a new $150 million sustainability-linked RCF.

Centamin - Quarterly Free Cash Flow & Average Realized Gold Price (Company Filings, Author's Chart)

If one looked at the FY2022 results solely on the surface, it's understandable that some investors might skip past Centamin entirely for potential future investment, given that it's a single-asset gold producer with AISC above the industry average in a non-Tier-1 jurisdiction. However, there's a lot going on behind the scenes that didn't show up in the headline results and several nuances that suggest that Centamin will be a much higher-margin in 2024/2025, even if the recent help from the gold price doesn't stick. And assuming the recent gold price strength is sustainable, we could see Centamin's AISC margins double and come in closer to $790/oz.

Recent Developments

While rising diesel prices and general inflationary pressures certainly put a dent in Sukari's AISC margins in FY2022, it's important to note that the company mitigated further margin compression by optimizing its open-pit fleet and tonnes mined per hour has improved from 300 to 354 regarding owner truck productivity from August 2020 to December 2022 (monthly average figures). The installation of high-performance truck trays has helped this, as has haul road maintenance improvements (properly graded roads = better tire life and running speeds) and improved haul cycle planning. So, while 2022 could have been a disaster from a cost standpoint, given the amount of tonnes moved, Centamin's open-pit fleet productivity helped to partially offset the higher diesel price and keep AISC below $1,400/oz.

Second, while it didn't show up much in the FY2022 results because of the Q4 2022 commissioning, the Sukari 36MW Solar Plant (plus 7.5 MW battery-energy storage system), which is the largest global hybrid solar farm powering a gold mine currently. Centamin expects the newly commissioned solar plant to reduce annual diesel consumption by ~22 million litres, resulting in a potential savings of $20 million per year. Not only does this benefit Centamin from a margin standpoint, but it helps to reduce the company's exposure to diesel price volatility, which was one reason many producers missed guidance in FY2022 and came in well above their own internal estimates. Given a full year benefit of the solar plant in FY2022, costs should improve meaningfully.

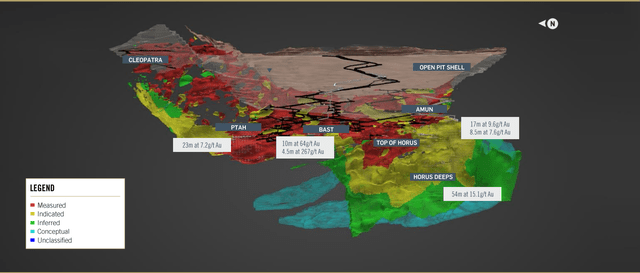

Sukari Underground Exploration Success (Company Website)

Third, Centamin is reviewing the potential to increase the size of its solar plant, it's working towards an underground expansion (1.5 million tonnes per annum vs. 1.0 million tonnes per annum), and it hasn't even begun exploiting the ultra high-grade areas of Sukari Underground (Bast, Horus Deeps) given that it wants its gravity circuit in place to ensure it isn't losing any high-grade nuggety gold. Finally, Centamin's underground mining costs and productivity have improved following the switch away from contract mining (with further improvements once paste fill plant commissioned) and the company is looking at tying into the grid to benefit from a grid and solar mix and lower-cost power vs. a current solar/diesel mix. And, as shown below, several other initiatives are under review or already in progress:

- regrind circuit

- water detoxification plant

- mill automation

- recycling mill liners into grinding media

- power optimization

Centamin - Cost Savings Program Success To Date (Company Website)

During FY2022 alone, Centamin reported savings of ~$43 million from its cost savings program, pushing cumulative cost savings to $116 million, representing 77% delivery under its goal to date. However, as shown above, there are certainly opportunities to deliver additional cost savings and the combination of the winding down of the waste stripping program in 2023, higher production, and increased underground mining rates that should spike the average feed grade should help to pull costs back towards the $1,200/oz range long-term. So, assuming an average realized gold price of $1,980/oz gold price in FY2025 and AISC of $1,200/oz, we could see Centamin's AISC nearly double from FY2022 levels to $780/oz (FY2022: $395/oz).

Centamin - AISC, Industry Average AISC & Forward Estimates (Company Filings, Author's Chart & Estimates)

To summarize, while the sharp decline in margins since FY2020 isn't ideal and on the surface it might be hard to get behind Centamin as a potential investment, there's lots to like under the surface that hasn't showed up yet and will dramatically improve the company's financial performance. Unfortunately, investors will only see a glimpse of this in FY2023, with production expected to increase slightly to ~465,000 ounces (guidance midpoint) at an AISC midpoint of $1,325/oz (down 5% year-over-year). However, as noted above, I expect 2024 and 2025 to be much better years, and on a company-wide basis, Doropo could be a game-changer with an even lower cost profile in West Africa with the possibility of first gold pour in H1 2026.

Future Catalysts

In regards to future catalysts, there are several, in addition to what should be a strong rebound in AISC margins this year as long as the gold price doesn't collapse from current levels (which should improve sentiment for the stock). The first of these catalysts is an Pre-Feasibility Study on the company's Doropo Project which looks capable of producing well over 200,000 ounces per annum in its first five years at all-in sustaining costs below $1,025/oz (adjusting for inflationary pressures). The upfront capital for the project should come in below $325 million, which could easily be funded with project debt and cash on hand while the company looks to ramp up Sukari Underground which is its next major project. Assuming Doropo is green-lighted, Centamin could become a 650,000-ounce producer (2027-2031) at industry-leading costs.

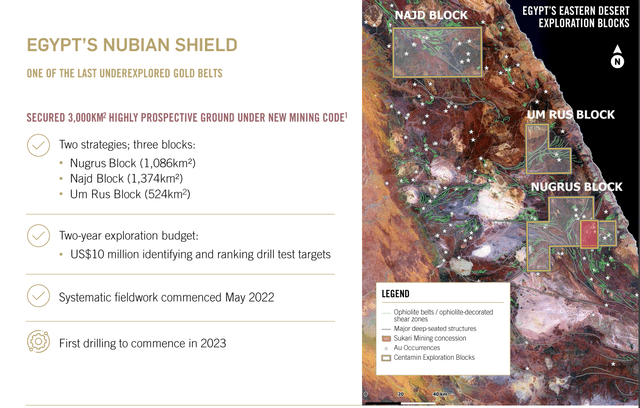

The second catalyst is that the company is getting ready to drill its Eastern Desert Exploration [EDX] blocks, with its Nugrus Block being drill ready with the potential to start drilling this by summer of this year. This means that we could see initial drill results from this prospect by year-end and if the company ends up hitting anything significant, this could provide mid to high-grade feed to supplement Sukari feed later this decade given that the project sits ~35 kilometers from the Sukari Mill. So, between stronger financial results in FY2023 and FY2024, a return to positive free cash flow in the second half of this year and much-awaited economics on Doropo and news from its EDX blocks, I would not be surprised to see Centamin head back above US$1.50 before year-end.

So, is the stock a Buy?

Based on ~1.16 billion shares outstanding and a share price of US$1.27, Centamin trades at a market cap of $1.47 billion and an enterprise value of ~$1.33 billion. Assuming the company did not have a profit-sharing agreement at Sukari, this would be a dirt-cheap valuation for the company, given that even single-asset producers with mines that enjoy at or near Tier-1 scale (500,000 ounces per annum) typically trade at valuations well over $1.0 billion if they are at the low end of the cost curve. However, while Centamin should see a decline in unit costs this year with a further decline in 2024 due to increased production, it shares half of its profits with the Egyptian Mineral Resource Authority. This means that while it's a ~500,000-ounce gold producer from a managed standpoint, it's more like a ~250,000-ounce gold producer from an earnings standpoint.

Centamin - FY2021 & FY2022 Results & Annual Earnings After Profit-Share (Company Website)

Using what I believe to be a fair value estimate of ~$820 million for Centamin's share of Sukari (50/50 share as of July 1st, 2020) and a fair value for Doropo of ~$460 million, I see a fair value for Centamin of $1.28 billion at a 1.0x NPV (5%) multiple. However, this doesn't include any exploration upside at any of its projects (Sukari Regional, Sukari Underground, Doropo) nor does it place any value on its 3,000 square kilometer land package (Nugrus Block, Najd Block, Um Rus block) acquired under the new mining code. Finally, it places no value on its ABC Project. Adding in what I believe to be a reasonable value of $250 million for exploration upside, its new claim blocks and its ABC Project, and its net cash, I see a fair value for Centamin of $1.69 billion [US$1.45].

Egypt's Eastern Desert Exploration Blocks & Work Program (Company Website)

If we compare this figure to Centamin's current enterprise value of ~$1.33 billion, Centamin is trading at a discount to what I believe to be fair value, and if gold prices can find a new floor at $1,800/oz there would be further upside to this fair value estimate. That said, I prefer a minimum 30% discount to fair value when buying small-cap producers, and especially regarding single-asset producers. If we apply this discount to Centamin, this translates to a low-risk buy zone of US$1.01 per share. So, while I see some upside in Centamin and the stock offers an attractive dividend yield relative to most other single-asset producers, I don't see a low-risk buying opportunity just yet.

Summary

2021 was a tough year for Centamin following movement in a localized area of waste material (Stage 4 West wall), and besides investments in waste stripping, the company has invested heavily in cost savings initiatives for the operation. While these improvements didn't show up in the headline results in 2022 because of the relatively low production, elevated sustaining capital and inflationary pressures, key operating metrics are trending in the right direction, and investors should see the fruits of this labor going forward, with these optimization efforts benefiting from the tailwind of higher gold prices. Plus, the company continues to see exploration success at Sukari Underground and a major discovery at the Nugrus Block could be a game-changer.

To summarize, I see Centamin as a solid buy-the-dip candidate, but the ideal buy zone comes in at US$1.01 or lower, where investors would have more of a margin of safety and get any exploration upside for free.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing. Given the volatility in the precious metals sector, position sizing is critical, so when buying small-cap precious metals stocks, position sizes should be limited to 5% or less of one's portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.