Lithium Americas: Let Production Begin

Summary

- Lithium Americas Corp. is set to start production at a mine in Argentina.

- The lithium miner is now moving full speed ahead at the Thacker Pass mine in Nevada.

- Lithium Americas stock is cheap based on the estimated profits from the limited 20,000 tpa production from the Argentina mine alone.

- Looking for more investing ideas like this one? Get them exclusively at Out Fox The Street. Learn More »

D3signAllTheThings

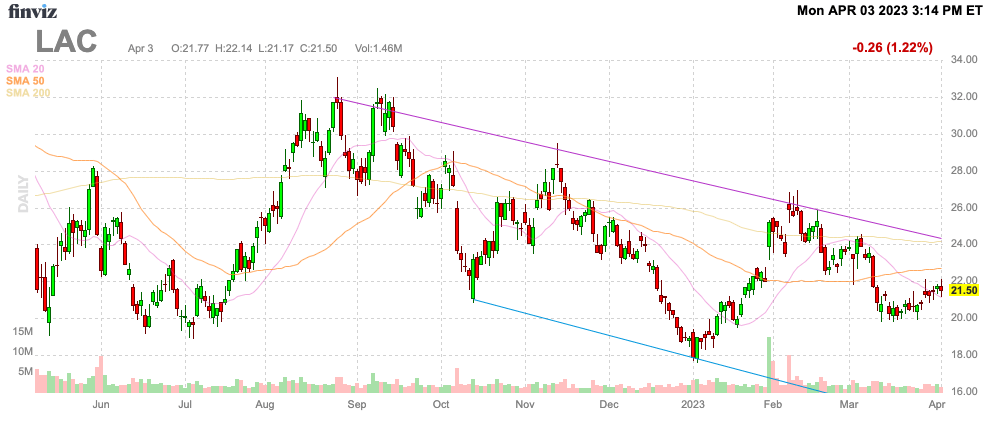

Even with lithium prices falling dramatically in the last month, Lithium Americas Corp. (NYSE:LAC) hasn't fallen much lately. The company continues to confirm massive profit opportunities ahead at current lithium prices, and production should begin shortly at a mine in Argentina. My investment thesis remains ultra-Bullish on the lithium miner.

Source: Finviz

Production About To Start

Along with the late Q4'22 earnings report, Lithium Americas confirmed that construction at the Cauchari-Olaroz mine was substantially complete. The lithium mine is on schedule to begin production by the end of Q2'23.

The company has less than $50 million in additional capital costs to reach production and immediate positive cash flows. The Argentine mine is only about a year away from full capacity production at 40,000 tonnes per annum of LCE.

Lithium Americas will obtain 49% of Stage 1 production, with partner Ganfeng Lithium obtaining 51% of production. The mine already has offtake agreements for over 80% of Stage 1 production at market rates.

The latest quarterly presentation doesn't provide a lot of financial details on the nearly 20,000 tpa of production, but the Thacker Pass targets are impressive. Argentina is a cheaper location to operate.

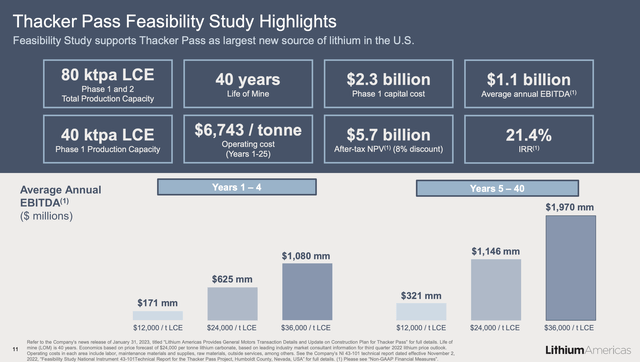

At the current market prices, Lithium Americas forecasts up to $1.1 billion in annual EBITDA from Thacker Pass. The Phase 1 production has a target of 40,000 tpa, or 2x the production supply for Lithium Americas of the Cauchari-Olaroz mine.

Source: Lithium Americas Q4'22 presentation

Either way, Lithium Americas should quickly start producing strong profits and cash positive cash flows to invest in additional mine expansion. Analysts currently forecast 2024 revenues of $472 million for an EPS of $2.52. At full production of 20,000 tpa, the lithium miner would produce revenue much closer to the $700 to $800 million range.

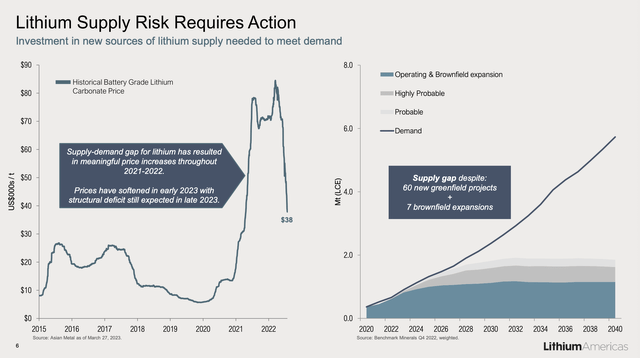

Not to mention, current lithium prices are now far below the levels of the last couple of years. The market hasn't solved the long-term lithium shortage issues, and lower prices won't help solve the problem with small miners lacking the capital to build new projects.

Source: Lithium Americas Q4'22 presentation

As the year progresses, Lithium Americas will start producing key cash flows to fund development of new projects, whether the Stage 2 of Cauchari-Olaroz in Argentina, the Pastos Grandes project in Argentina or Thacker Pass in the U.S., if the business hasn't been split.

Major Discount

The stock only has a $3.3 billion valuation now despite the massive opportunity, with at least 2 to 3 lithium mines in progress. The one mine in Argentina alone might warrant a higher stock valuation.

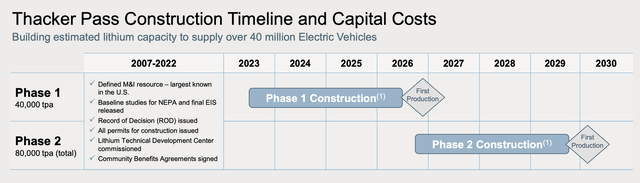

The Thacker Pass mine has the potential for 80,000 tpa in production once Phase 2 construction is complete in the 2030 timeline. The General Motors (GM) investment and the DOE ATVM loan provides most of the funding needed for this new mine.

Source: Lithium Americas Q4'22 presentation

The company already has a cash balance of $600 million after the first tranche of the GM investment. The second tranche will go directly to the U.S. business following the split from Argentina due to the need to invest in domestic production. The Argentina business will start generating positive cash flows and will need less investment for Stage 2 investments.

Besides, the company has the potential to generate far more than $2.50 in annual EPS. With 151 million shares outstanding, Lithium Americas only needs to produce $378 million in net income to reach this level.

Takeaway

The key investor takeaway is that Lithium Americas Corp. is cheaper based on the start of production of just one mine in Argentina alone. The company is nearly sitting on a gold mine in Nevada with the start of construction at Thacker Pass. Investors should use the recent weakness to load up on Lithium Americas Corp. stock in the low $20s.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause after several bank closures, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

This article was written by

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Invest with Stone Fox Capital's model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:

Net Payout Yields model

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in LAC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.