DFP: Some Risks But Not A Bad Income Vehicle

Summary

- Flaherty & Crumrine Dynamic Preferred and Income Fund, Inc. invests in a portfolio that mostly consists of preferred stocks in order to generate a high level of income for its investors.

- The DFP closed-end fund is heavily invested in the banking sector, but it should still be reasonably safe from the troubles affecting these companies.

- The fund's leverage is quite a bit higher than we really want to see, which poses some risks for investors.

- The distribution is probably sustainable barring a significant change in interest rates.

- The Flaherty & Crumrine Dynamic Preferred and Income Fund, Inc. is currently trading at a reasonable discount to the net asset value.

- Looking for a helping hand in the market? Members of Energy Profits in Dividends get exclusive ideas and guidance to navigate any climate. Learn More »

We Are

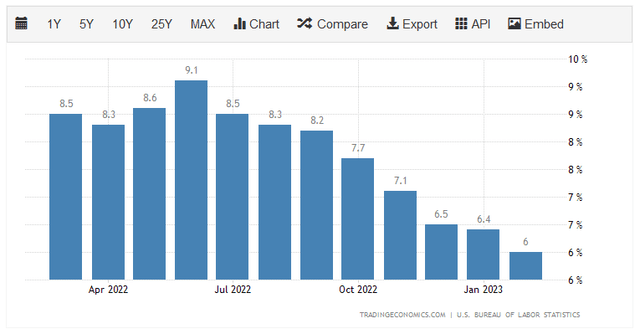

Undoubtedly, one of the biggest problems facing most Americans today is the incredibly high level of inflation that has been dominating the economy. Over the past eighteen months, we have seen the highest inflation rate since the early 1980s and, although it has come down a bit in recent months, it has still been at 6% or higher during each of the past twelve months:

This has had a significant negative impact on the finances and budgets of many American households. As I pointed out in a recent blog post, consumers have been forced to take on additional work or draw down their savings simply to maintain their lifestyles. In short, people cannot maintain their lifestyles without additional income and most people prefer to find ways to boost their incomes as opposed to making cuts to their standard of living.

Fortunately, as investors, we can put our money to work for us in order to generate the income that we need. We do not need to enter the gig economy or take on second jobs to accomplish this task. One of the best ways to obtain that extra income is to purchase shares of a closed-end fund, or CEF, that specializes in the generation of income. These funds are, unfortunately, not particularly well covered by the investment media and are unfamiliar to many financial advisors but they are one of the best ways to earn extra income. This is because these funds offer easy access to a diversified portfolio of assets that can employ certain strategies to boost the effective yield of the portfolio.

In this article, we will discuss the Flaherty & Crumrine Dynamic Preferred and Income Fund, Inc. (NYSE:DFP), which is one fund that can be used by investors to increase their incomes. This fund yields a respectable 7.57% at the current price, which makes it one of the few assets in the market that has a positive real yield today. I have discussed this fund in this column before, but that was a few months ago, so obviously, some things have changed, including the release of a more recent financial report. This article will therefore focus specifically on these changes as well as provide an updated analysis of the fund’s financial performance. Let us investigate and see if this fund could be a good addition to a portfolio today.

About The Fund

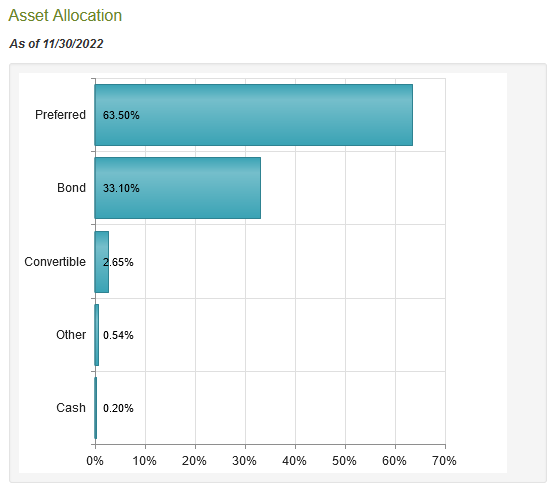

According to the fund’s webpage, the Flaherty & Crumrine Dynamic Preferred and Income Fund, Inc. has the stated objective of providing its investors with a high level of total return. This is a bit surprising considering that the fund is heavily invested in preferred stocks and bonds:

CEF Connect

As we can see, currently 63.50% of the fund’s assets are invested in preferred stock and 33.10% is invested in bonds. This is clearly a fixed-income fund, which fits in with the name of the fund. It also fits with the description of the fund’s strategy that is provided on the webpage:

“Under normal market conditions, the Fund invests at least 80% of its Managed Assets in a portfolio of preferred and other income-producing securities issued by U.S. and non-U.S. companies. Preferred and other income-producing securities may include, among other things, traditional preferred stock, trust preferred securities, hybrid securities that have characteristics of both equity and debt securities, contingent capital securities, subordinated debt, and senior debt.”

As we can see above, the fund’s current asset allocation easily exceeds the required 80% weighting to fixed-income securities such as preferred stocks and bonds. One of the defining characteristics of fixed-income securities is that they provide their returns through direct payments made to investors. This is why it is somewhat curious that this fund has total return as its objective. Total return implies that the fund is seeking both capital gains and income, but capital gains can be difficult to come by for these securities. This is because bonds and preferred stock have no inherent link with the growth and prosperity of the issuing company. After all, a company will not increase the interest rate that it pays its creditors just because its profits increase. For its part, the Flaherty & Crumrine Dynamic Preferred and Income Fund does state that it aims to provide total return mostly through current income paid to its investors, but we still should not expect this fund to be producing much in the way of capital gains.

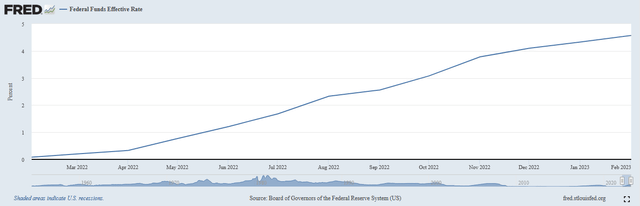

With that said, it is possible for fixed-income securities to deliver capital gains. This is most often accomplished when interest rates decline. This is because bonds and preferred stocks have an inverse relationship with interest rates. In short, when interest rates go up, fixed-income security prices go down and vice versa. As everyone reading this is likely well aware, the Federal Reserve has been aggressively raising interest rates in the U.S. economy over the past year as part of an effort to combat the high inflation. Back in February of 2022, the federal funds rate sat at 0.08% but today it is 4.57%:

Federal Reserve Bank of St. Louis

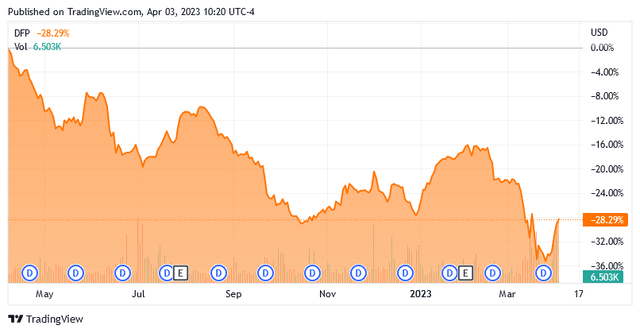

This can be expected to reduce the market prices of the bonds and preferred stocks held by this fund. The reason for this is that the interest rate on newly-issued bonds corresponds to the federal funds rate at the time of issuance. As such, during times of rising interest rates, brand-new bonds will have a higher yield than already existing bonds. This is particularly relevant today because interest rates are currently higher than they have been in fifteen years. Thus, nobody will buy an existing bond when a brand-new bond offers a higher yield to maturity unless the price of the existing bond declines to the point where its yield-on-cost is about the same as an otherwise identical brand-new bond. The same applies to preferred stocks, except that they tend to decline further than bonds in such an environment because of the lack of a maturity date. We can see this reflected in the share price of the Flaherty & Crumrine Dynamic Preferred and Income Fund over the past year:

As we can see, the fund has fallen an enormous 28.29% over the past twelve months. Thus, it has handed significant losses to anyone that has been holding the fund over that period. Fortunately, it does appear that the worst may be behind us. Analysts and the market are currently projecting that the Federal Reserve will do one more rate hike in May and then pause, with many predicting a rate cut by September. While I am not especially optimistic about the prospects of a rate cut since that would cause inflation to surge, it does seem likely that the Federal Reserve will not be nearly as aggressive about hiking rates going forward as it was over the trailing twelve-month period. Thus, the worst of the impact of the monetary tightening regime has already been seen. While I am not expecting much in the way of capital gains from this fund for the near future, it is unlikely that we will see losses of the magnitude shown above either.

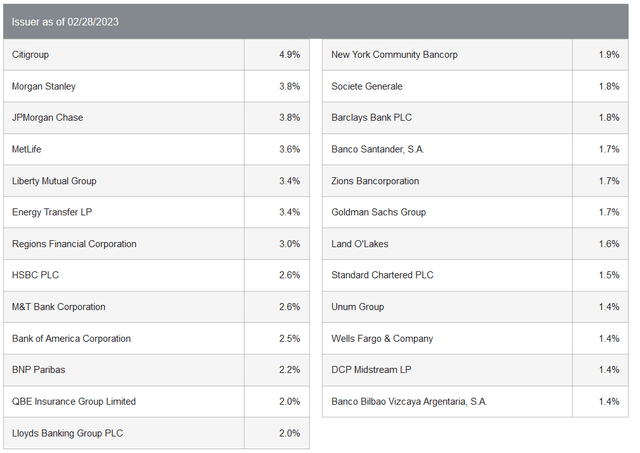

In previous articles on this fund, we saw that it is heavily invested in the banking and financial sector. This is still the case, as we can clearly see by looking at the largest positions in the fund. Here they are:

This is not unusual for a preferred stock fund. After all, the banking sector is by far the largest issuer of preferred stock. This is due to international banking regulations. In short, bank regulators require banks to have a certain proportion of their assets as Tier one capital. Tier one capital is that proportion of a bank’s assets that are not simultaneously a liability owed to someone else (such as a depositor). When regulators require a bank to increase its Tier one capital, the bank has two options. It can either issue common stock or preferred stock. A bank will usually opt to issue preferred stock in order to avoid unduly diluting the common stockholders. Other sectors of the economy do not have to deal with these regulations and will usually opt to issue debt when they need to raise capital because debt is cheaper. Thus, banks are the largest issuer of preferred stock by default.

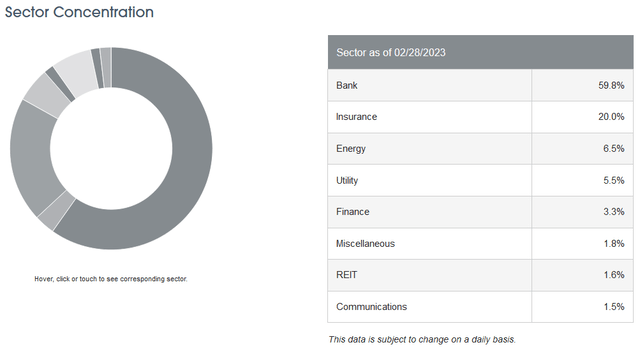

This exposure to banks continues beyond simply the largest positions in the fund’s portfolio. In fact, 59.8% of the fund’s assets are invested in securities issued by the banking sector:

This is something that may concern some investors today. After all, last month there were three American bank failures along with one in Switzerland. However, as I pointed out in a recent blog post, Silicon Valley Bank suffered from some unique problems that caused the run on its assets so it is unlikely that this will become a widespread problem. In addition, most of the trouble that we saw was limited to regional banks and not the huge international banks that account for many of the major issuers in this fund. When we combine all of this with the fact that most governments throughout the world provide immense support to their banking sectors during times of crisis, we probably do not have too much to worry about here.

Another source of comfort comes from the fact that the fund’s portfolio is reasonably well-diversified across banks. As my long-time readers on the topic of closed-end funds are no doubt well aware, I do not generally like to see any individual asset account for more than 5% of a fund’s portfolio. This is because that is approximately the point at which a given asset begins to expose the fund to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification, but if the asset accounts for too much of the portfolio, then the risk will not be completely eliminated. Thus, the concern is that some event will occur that causes the price of a given asset to decline when the market does not and if that asset accounts for too much of the portfolio, then it could end up dragging the entire fund down with it. As we can see above, there is no individual issuer that accounts for more than 5% of the portfolio, although Citigroup (C) is pretty close. However, the fund should still be diversified enough that problems at any individual issuer should not have a major impact on the fund, especially when we consider that the securities in the fund are senior to common stock.

Leverage

In the introduction to this article, I stated that closed-end funds such as the Flaherty & Crumrine Dynamic Preferred and Income Fund have the ability to generate a yield that is higher than any of the underlying assets possess. One way through which this is accomplished is leverage. In short, the fund borrows money and then uses that borrowed money to purchase preferred stocks and bonds. As long as the yield on the purchased securities is higher than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. Since this fund is capable of borrowing money at institutional rates, which are significantly lower than retail rates, this will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much leverage since that would expose us to too much risk. I usually do not like to see a fund’s leverage exceed a third as a percentage of its assets for this reason. Unfortunately, the Flaherty & Crumrine Dynamic Preferred and Income Fund significantly exceeds this level. As of the time of writing, the fund’s levered assets comprise 41.21% of the portfolio. This high level of leverage could be exposing the investors to too much risk. Ideally, the fund will reduce this in the near future in order to reduce our risk as investors. With that said, the biggest risk is that the leverage will cause the fund’s assets to decline much more than an unleveraged fund during a period of rising interest rates and the worst is probably behind us, as already mentioned. The fact that this fund is also investing in safer assets than common stock funds also helps us feel more comfortable with the leverage, but it is still higher than is preferred.

Distribution Analysis

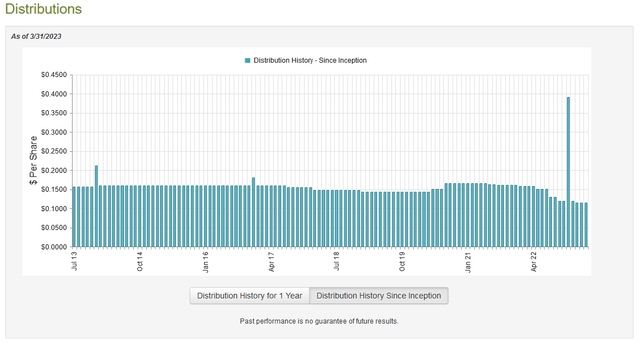

As mentioned earlier in this article, the primary objective of the Flaherty & Crumrine Dynamic Preferred and Income Fund is total return, but it emphasizes delivering this in the form of high current income provided to its investors. In order to achieve this, the fund invests primarily in preferred stock, which tends to have a fairly high yield. It then uses leverage to boost the return above that already reasonable level. As such, we can probably assume that this fund will have a pretty high yield itself. That is certainly the case as the fund pays out a monthly distribution of $0.1145 per share ($1.374 per share annually), which gives it a 7.57% yield at the current price. This is certainly a reasonable yield, but the fund’s recent history with its distribution may be concerning. As we can see, it has been steadily reducing the payout since early 2021 and currently pays out its lowest distribution ever:

This is something that would certainly prove to be a turn-off for any investor that is looking for a stable and secure source of income to use to pay their bills or otherwise finance their lifestyles. However, it is somewhat understandable given the climate that we have seen in the markets over the period. In short, the rising interest rates in 2022 had two effects on the fund. The most significant of these is that it caused the value of the fund’s assets to decline significantly. While it did greatly increase the yield of newly purchased assets, the fund could not really take advantage of that without selling off an existing asset (and realizing a loss) or bringing in new money somehow. That therefore only really helps if it gets money from a bond maturing, which it then reinvests in new securities at a higher yield. That is insignificant given the size of the portfolio. Thus, it is forced to cut the distribution in order to avoid paying out more than it can afford. With that said though, anyone buying today will obtain the current distribution at the current yield and does not really need to worry about the past. The most important thing today is the fund’s ability to maintain its current distribution. So, let us investigate that.

Fortunately, we have a relatively recent document that we can consult for this purpose. The Flaherty & Crumrine Dynamic Preferred and Income Fund, Inc. fund’s most recent financial report corresponds to the full-year period that ended on November 30, 2022. This is a much more recent document than we had available the last time that we looked at this fund, which is nice because it should be able to give us a good idea of how well the fund handled the exceptionally challenging market environment for fixed-income securities over the period. During the full-year period, the Flaherty & Crumrine Dynamic Preferred and Income Fund received $17,674,452 in dividends and another $27,861,907 in interest from the assets in its portfolio. When we combine this with a small amount of income from other sources, the fund had a total investment income of $45,644,183 over the full-year period. It paid its expenses out of this amount, which left it with $34,341,066 available for investors. This was, unfortunately, not enough to cover the $35,572,920 that the fund paid out in distributions, but it did get extremely close.

The fund naturally failed to make up the difference through capital gains. It reported net realized gains of $6,573,639 but this was offset by $127,400,007 net unrealized losses. Overall, the fund’s assets declined by $111,222,581 over the period after accounting for all inflows and outflows. This is certainly concerning as the fund failed to cover its distribution completely. However, the net investment income alone was very close to the amount that was actually paid out and the net realized capital gains were more than enough to make up the difference. It appears that this fund is funding its distributions out of net investment income with a possible lag time. It can probably continue to maintain this distribution for the time being since it appears unlikely that net investment income will decline too much given today’s higher interest rates on newly purchased securities.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a sure-fire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Flaherty & Crumrine Dynamic Preferred and Income Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are buying the fund’s assets for less than they are actually worth. This is, fortunately, the case with this fund today. As of March 31, 2023, the Flaherty & Crumrine Dynamic Preferred and Income Fund had a net asset value of $19.19 per share but the shares only trade for $18.10 per share. This gives the shares a 5.68% discount to the net asset value today. This is not quite as attractive as the 7.02% discount that the shares had on average over the past month, but it is still a reasonable price to pay for the fund. Although it might be possible to get a slightly more attractive price by waiting, it seems okay to purchase shares at the current price.

Conclusion

In conclusion, the Flaherty & Crumrine Dynamic Preferred and Income Fund, Inc. appears to offer a very reasonable way for income-starved investors to obtain the extra money needed to maintain their lifestyles. Although the fund’s distributions and share price have been declining, the worst is probably behind us, and the fund should be able to maintain its distribution barring a steep upturn in inflation. The biggest problem here is that the fund’s leverage is very high, which means that the risks are more than we want. Overall, though, this Flaherty & Crumrine Dynamic Preferred and Income Fund, Inc. fund does not appear to be a bad income choice.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.