Constellation Energy Stock Has More Room To Run

Summary

- Constellation Energy, a $25.7 billion market cap company paying a 1.4% dividend, is the generation company spun off from utility company Exelon in January 2022.

- The company’s nuclear fleet outperformed other generators during Winter Storm Elliott.

- Constellation has the largest US fleet of nuclear power plants. Nuclear is unique and thus preferred among electricity generating fuels because it's non-hydrocarbon and also baseload.

- Looking for more investing ideas like this one? Get them exclusively at Econ-Based Energy Investing. Learn More »

RelaxFoto.de/E+ via Getty Images

Constellation Energy Corporation (NASDAQ:CEG) is considered the largest US carbon-free energy producer, and produces 10% of the country’s carbon-free electricity via its nuclear, wind, solar, and hydro units. It's notable for having the largest nuclear fleet in the country. Nuclear is increasing valued for both its non-hydrocarbon and especially baseload operations characteristics.

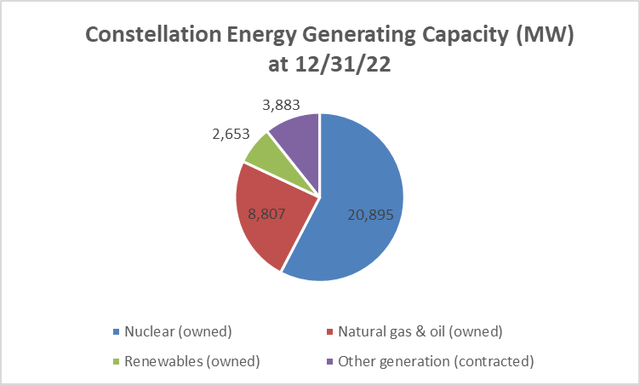

CEG was spun off from Exelon (EXC) in January 2022, containing Exelon Generation’s nuclear plants and other generating assets in a standalone, unregulated company. Constellation’s generating capacity is 32,400 megawatts. Within this, Constellation's nuclear-powered electricity generation capacity is 26,300 megawatts, or 81% of its total capacity.

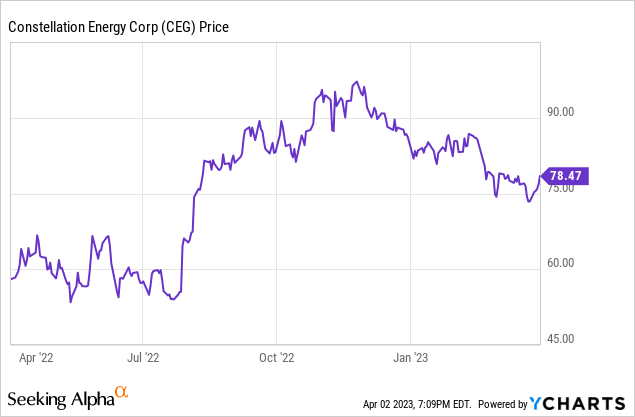

The company’s stock price and market capitalization have increased 52% since my last report a year ago. Constellation has a year of independent operational and financial history now and has just doubled its dividend. However, the dividend yield is still only 1.4%.

Due to the increasing demand for baseload, non-hydrocarbon-fueled electricity supplied by nuclear capacity and Constellation’s dominant position as a supplier, despite its stock price run-up I recommend Constellation to both ESG investors and those seeking capital appreciation. I do not recommend it to dividend investors.

Winter Storm Elliott

As an example of the importance of nuclear units' reliable, baseload functionality, Constellation explains that its eight nuclear plants with sixteen reactors in the PJM region (PJM is the electric grid operator for thirteen states and the District of Columbia, illustrated in a map below) ran at 100% during Winter Storm Elliott. Many non-nuclear plants failed. The nearly 16,000 megawatts of energy provided by Constellation’s nuclear plants in the PJM region provided crucial supply: PJM came within 5000 megawatts (3%) of implementing rolling blackouts on Christmas Eve with a grid load of 160,000 megawatts.

US Electricity Demand and Macro

According to the EIA’s 2023 forecast, growth in US electric power demand is expected for the next three decades due to increasing electrification and ongoing economic growth.

Ongoing federal and state decarbonization policy goals and legislation play directly to Constellation’s strength: Its large fleet of nuclear generation plants, with high capacity factors, have been and will be key in providing non-hydrocarbon (“clean”) electricity.

2022 Results and Guidance

For 2022, Constellation Energy reported a net loss of -$160 million compared to a net loss of -$205 million in 2021.

Operating revenues were $24.4 billion and operating expenses were mainly purchased power and fuel at -$17.5 billion and operating and maintenance at -$4.8 billion. Interest expense was -$250 million. Other net costs included non-cash mark-to-market on economic hedges and fair value adjustments related to gas imbalances and equity investments of -$786 million.

In 2022, adjusted EBITDA (non-GAAP) was +$2.667 billion compared to +$2.185 billion in 2021. Investors should note 2021 financials are best-estimate because Constellation did not exist as a standalone company until 2022.

As used by CEG, “adjusted EBITDA” excludes:

*income taxes

*depreciation and amortization

*net interest expense

*unrealized fair value adjustments (mark-to-market for derivatives)

*decommissioning-related activities

*pension and other postretirement employment benefit non-service credits

*separation costs

*Enterprise Resource Program system implementation

*other items not directly related to ongoing business operations

*noncontrolling interest related to exclusion items.

The company’s capital allocation strategy includes $1.5 billion in organic growth capital (hydrogen, nuclear uprating, and wind repowering), targeting annual dividend growth at 10% (after an initial doubling in 2023), and up to $1 billion from its share repurchase authorization.

Among the company’s plans are an $800 million spend on upgrading two of its Illinois nuclear plants, Braidwood and Byron, to increase production by 135 MW.

CEG’s nuclear fleet operated at a capacity factor of 94.8% during 2022, 95.4% during 4Q22, and — as described above — at 100% during Winter Storm Elliott.

The company guides to 2023 adjusted EBITDA of $2.9 billion to $3.3 billion.

Constellation Energy Operations

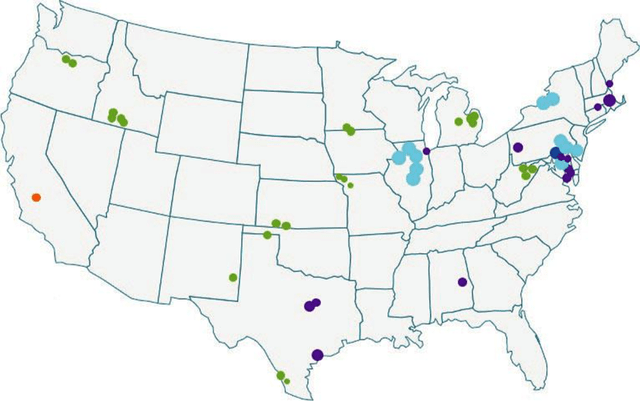

The map below shows the locations of Constellation owned electricity generating units as of Dec. 31, 2022.

Light blue is nuclear;

Dark blue is hydro;

Purple is natural gas;

Light green is wind;

Orange is solar.

constellationenergy.com

As the chart below shows, most of Constellation’s 36,200 megawatts of generating capacity is owned nuclear. (Of these 36,200 megawatts, 89% is owned and the rest is contracted.)

Constellation Energy 10-K and Starks Energy Economics, LLC

Geographically, the company’s owned 32,400 MW of generating capacity divides as:

Mid-Atlantic 32%

Midwest 37%

New York 10%

ERCOT (Texas) 11%

Other regions 10%

So as this map shows, the PJM (Mid-Atlantic) and MISO (Midwest) power regions are particularly key for Constellation.

Exelon

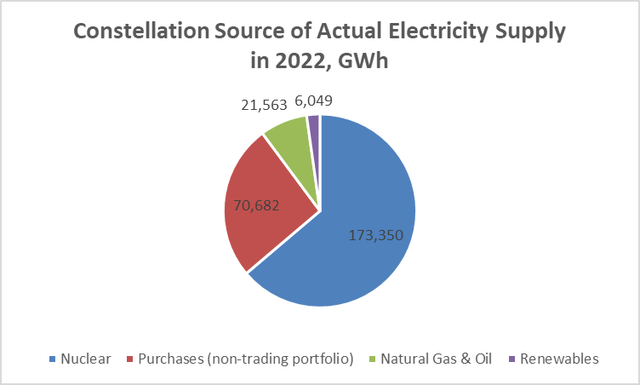

Constellation’s 2022 data on sources of electric supply (rather than capacity percentages, so reflecting capacity factors) is shown below. Note the larger portion of supply coming from nuclear and the smaller portion from renewables compared to capacities in the chart above.

CEG 10-K and Starks Energy Economics, LLC

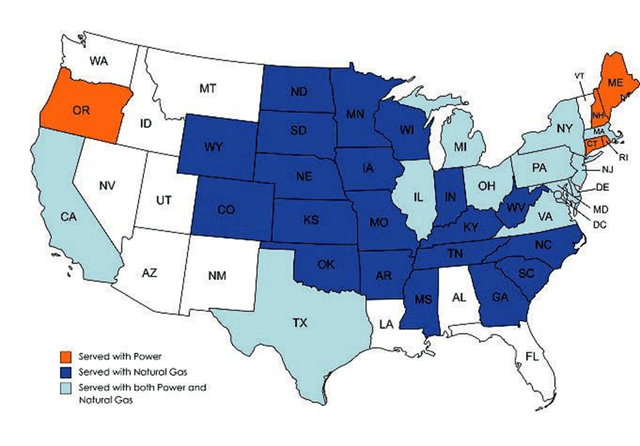

In 2022 the company supplied 143 terawatt-hours of electricity and 800 billion cubic feet (about 2.2 BCF/D) of natural gas. The map below illustrates the states it serves.

constellationenergy.com

The company uses derivatives to hedge price risk. Like all providers, demand for its energy is seasonal.

Competitors

Constellation Energy is headquartered in Baltimore, Md.

CEG competes with other utilities that have nuclear units such as Duke (DUK), Tennessee Valley Authority, Dominion Energy (D), Public Service Enterprise (PEG), NextEra (NEE), Southern Company (SO), and Entergy (ETR). However, Constellation has two and half times as much capacity as Duke, its next closest rival.

It also competes with independent power producers like Vistra (VST), which just bought Energy Harbor Corp. — and its 4,000 MW of nuclear power capacity — for $3.4 billion. Energy Harbor had been the generating division of First Energy (FE).

In 2023, Southern Company’s Georgia Power began starting up the first new US nuclear unit in thirty years, 1100-megawatt Vogtle 3, in Burke County, Ga.

One key for Constellation, or potentially any nuclear plant owner, is the nuclear production tax credit - PTC - in the recent Inflation Reduction Act (IRA). According to CEG chief financial officer Dave Eggers in the company’s Q422 investor call, “I wanted to talk about the nuclear PTC included in the IRA, which we believe is truly transformational for our company. It provides downside commodity risk protection backed by the U.S. government with unlimited upside to higher commodity prices. It supports unique growth opportunities in clean hydrogen and uprates, it extends the time horizon of our fleet to 80 years and includes structural inflation risk protection. Mechanically, the nuclear PTC is designed to provide downside support in the declining price environment, phasing up and down when a plants' market revenues of between $25 and $43.75 per megawatt hour with maximum support of $15 a megawatt hour.”

Governance

At March 15, 2023, shorts were 2.2% of float. Insiders owned a small 0.17% of the company’s equity.

At Dec. 30, 2022, the six largest institutional stockholders, some of which represent index fund investments that match the overall market, were Vanguard (11.7%), BlackRock (7.6%), Fidelity/FMR (7.6%), Capital International (7.4%), State Street (5.6%), and Wellington (3.5%).

BlackRock, Capital International, State Street, and Wellington are signatories to the Net Zero Asset Managers, a group that as of Dec. 31, 2022, manages $59 trillion in assets in assets worldwide and which (despite constrained energy supply due to reduced Russian exports to Europe) limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner. These companies would be particularly keen on Constellation Energy since its nuclear-sourced electricity falls into the clean energy category.

Other Financial and Stock Highlights

With Constellation’s March 31, 2023, closing stock price of $78.50/share, its market capitalization is $25.7 billion. Both are up +52% from $51.77/share and a market cap of $16.9 billion a year ago, indicative of demand for nuclear-fueled (non-hydrocarbon baseload) electricity.

With a 52-week price range of $52.64-$97.89/share, the closing price is 80% of the high. The company’s one-year average analyst target price is $97.92/share, putting its closing price at 80% of that level.

Trailing twelve months’ returns on assets and equity are 0.9% and -1.45%, respectively.

The averages of analysts’ 2023 and 2024 earnings per share estimates are $4.10 and $5.20, respectively, for forward price-earnings ratios of 19.1 and 15.1.

TTM operating cash flow is -$2.35 billion. TTM levered free cash flow is $1.59 billion.

On Dec. 31, 2022, the company had $35.5 billion in liabilities, including $4.5 billion of long-term debt and asset retirement obligations of $12.7 billion and $46.9 billion in assets, including $14.1 billion in a nuclear decommissioning trust fund giving Constellation a steep liability-to-asset ratio of 76%.

Constellation just doubled its quarterly dividend to $0.282/share or $1.13/year for a dividend yield of 1.4%. As noted, it plans to increase dividends 10%/year and has authorized a $1 billion share repurchase program.

As of Dec. 30, 2022, the company’s enterprise value was $32.35 billion.

Average analyst rating for is 2.0, or “buy,” from 14 analysts. At least one analyst considers the stock to be significantly overvalued.

Notes on Valuation

With an enterprise value (EV) of $32.35 billion, Constellation’s EV/EBITDA ratio is 10.4, above the preferred maximum of 10 or less and so not in bargain territory.

Positive and Negative Risks

Investors should consider their expectations for baseload clean electricity demand growth, as well as total electricity demand growth, as the factor most likely to affect Constellation.

Inflation remains high, which increases the cost of capital, both debt directly and equity indirectly—equity because dividend rates must compete with other newly-invigorated alternatives like bank CDs.

Political and regulatory risk is a positive for Constellation as state and federal governments have increasingly urged utilities to use non-hydrocarbon (nuclear plus renewables) fuel to make electricity. Moreover, nuclear has a grid planning characteristic and advantage over renewables because it is baseload and so requires neither expensive battery storage nor quick-on 1.14:1 natural gas capacity: renewables capacity backup.

Recommendations for Constellation Energy

I don’t recommend Constellation Energy to dividend-hunting investors but do recommend it to ESG investors and those looking for capital appreciation. The company has the competitive advantage of being the dominant nuclear electricity supplier in the US. New IRA legislation provides production tax credits for nuclear generation. As the US looks long term, extending nuclear plant lives to as much as eighty years also is important.

And despite being a “new” company, CEG has decades of experience operating nuclear plants.

Nuclear power has the increasingly appreciated operating characteristic of being non-hydrocarbon baseload.

Constellation’s stock price has a 25% upside to its one-year target. While the dividend rate is low, the company has just doubled it and plans to grow the dividend at 10%/year. Constellation also has an investor-friendly stock repurchase plan underway.

constellationenergy.com

I hope you enjoyed this piece. I run a Marketplace service, Econ-Based Energy Investing, featuring my best ideas from the energy space, a group of over 400 public companies. Each month I offer:

*3 different portfolios for your consideration, summarized in 3 articles, with portfolio tables available 24/7 to subscribers

*3 additional in-depth articles = 6 EBEI-only articles;

*3 public SA articles, for a total of 9 energy-related articles monthly;

*EBEI-only chat room;

*my experience from decades in the industry.

Econ-Based Energy Investing is designed to help investors deal with energy sector volatility. Interested? Start here with an initial discount.

This article was written by

Do you want to understand and invest in volatile energy markets? We bring fundamentals-based insights to oil, gas, utilities, renewables, and gasoline companies for real-world investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CEG, VST, NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.