3M Company: A Bargain Despite All Risks

Summary

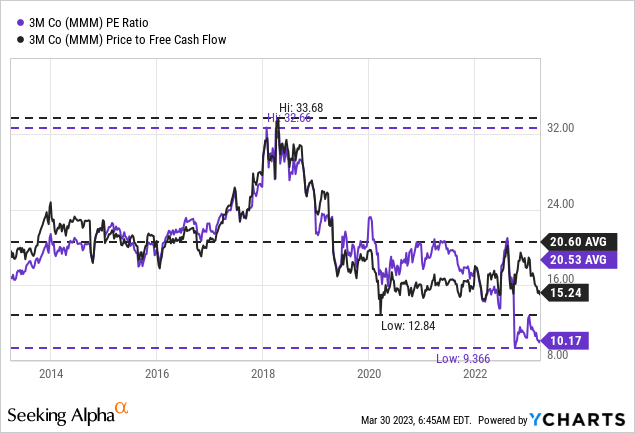

- 3M Company is not only trading at multi-year lows but is also trading for one of the lowest P/E ratios in the last 10 years.

- Of course, the business is facing two major lawsuits with billions of potential fines and the looming recession will also have a negative effect on the business.

- But not only are fines and settlements as well as lower free cash flow during the recession reflected by the share price, the stock seems deeply undervalued.

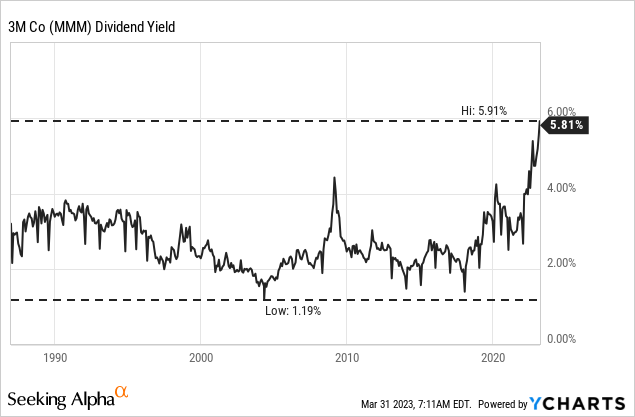

- And 3M Company has one of the highest dividend yields in the last decades right now.

wellesenterprises

In October 2022, I published an article about 3M Company (NYSE:MMM) and stated that we might have reached maximum pessimism surrounding 3M Company. Back then the stock was trading for $113 and after climbing to about $130 in the meantime we are back where we started with MMM Stock trading now rather close to $100.

But my core thesis did not change – 3M Company is certainly facing some risks, but I am still bullish about the company long-term, and the stock is clearly undervalued in my opinion. The two major risks 3M Company is facing are still the two major lawsuits, which are a huge challenge for 3M Company as well as the global economy likely heading for a recession.

Trading at Multi-Year Lows

We start by looking at some metrics. Right now, 3M Company is trading 60% below its previous all-time high and since early 2018 the stock is constantly declining. The stock is trading close to $100 and therefore at a 10-year low. Additionally, 3M Company is trading for 15.24 times free cash flow and only for 10.17 times earnings. These two simple valuation metrics are not only clearly below the 10-year average numbers, but the P/FCF is also close to a 10-year low, and the P/E ratio is basically at its lowest level of the last 10 years.

It really doesn’t matter from what perspective we are looking at 3M Company – it appears like a real bargain. Especially when keeping in mind that we are dealing with a dividend king and a great business with a wide economic moat, we immediately will search for a reason why the stock is trading at such depressed levels. Even without knowing anything about 3M Company, we assume right away something is wrong.

Annual Results

When searching for a reason why the stock price declined, we can start by looking at the last quarterly or annual results as they are often the reason for a horrible stock performance. However, the annual results for fiscal 2022 are neither terrible nor great.

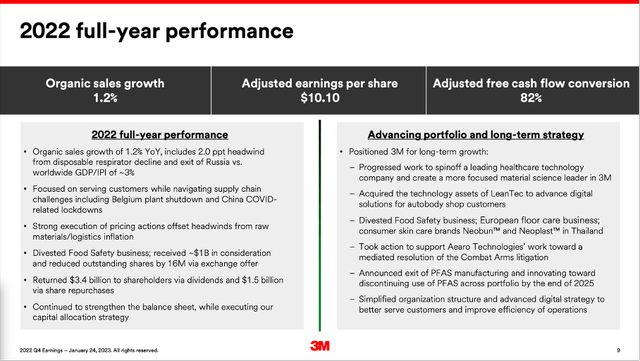

Net sales declined from $35,355 million in fiscal 2021 to $34,229 million in fiscal 2022 – resulting in 3.2% year-over-year decline. However, organic sales grew 1.2% year-over-year as currency effects had a huge negative impact on 3M Company. While operating income declined 11.3% year-over-year from $7,369 million in fiscal 2021 to $6,539 million in fiscal 2022, diluted earnings per share increased slightly from $10.12 in fiscal 2021 to $10.18 in fiscal 2022.

3M Company Q4/22 Presentation

However, when looking at adjusted earnings per share, 3M Company reported a 5.9% year-over-year decline from $10.73 in the previous year to $10.10 in fiscal 2022. And adjusted free cash flow declined even 25.5% YoY from $6,296 million in fiscal 2021 to $4,691 million in fiscal 2022.

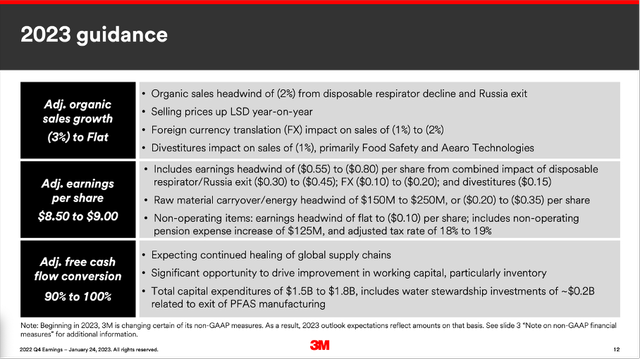

While results are often accepted as the past, it is especially the guidance which will move the stock. The outlook for fiscal 2023 is also not great but considering the dark clouds on the horizon, it could be worse. Adjusted organic sales are expected to be somewhere between a 3% decline in the worst case and being flat in the best case. However, adjusted earnings per share are expected to decline in the teens and will probably be in an expected range between $8.50 on the lower end and $9.00 on the upper end. And finally, adjusted free cash flow conversion is expected to be between 90% and 100%.

3M Company Q4/22 Presentation

Looming Recession

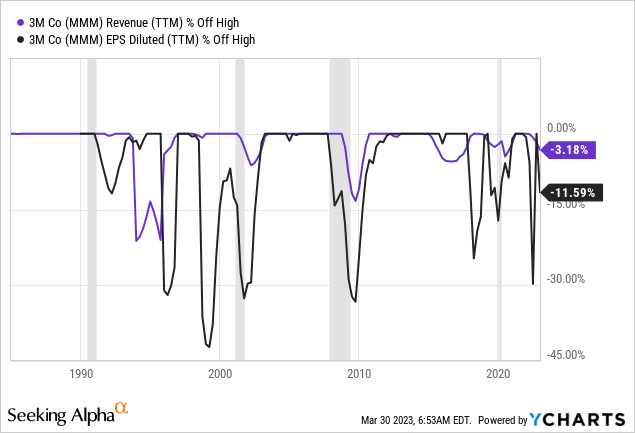

I have written several articles in the past explaining my view about the economy and stock market (see here and here). One of the central arguments in these articles is the expectation of a recession in 2023 – due to several early warning indicators ringing the bell (mostly the inverted yield curve). And despite 3M Company being a great business, it is not recession-proof.

When looking at the chart we see 3M Company clearly reacting to the past recessions and we must assume revenue (and earnings per share) to decline once again. Nevertheless, this is not explaining a 60% decline and not why 3M Company is trading only for 10 times earnings.

Lawsuits

There clearly is another reason for 3M Company’s current stock price and one of the biggest problems 3M Company is facing right now are the two major lawsuits the company is facing.

One of the major lawsuits 3M Company is facing right now is about the so-called “forever chemicals” also known as FPAS – extremely durable chemicals that are still used (but maybe not for long) in different manufacturing processes. 3M Company has also announced it will exit its PFAS manufacturing by the end of 2025 and commented again during the last earnings call:

As we announced in our press release on December 20th, we'll be exiting PFAS manufacturing by the end of 2025. As a result, we have decided to provide additional disclosure by expanding the scope of our non-GAAP measurement adjustments to include the exit of PFAS manufacturing.

Nevertheless, 3M Company is still sued – together with other companies – and will most likely have to pay fines or settlements. However, the bigger problem seems to be the lawsuits about its earplugs. 3M Company is sued by over 200,000 veterans due to allegedly misfunctioning and ineffective earplugs, which resulting in hearing loss for these veterans. And so far, 3M Company had to pay out huge amounts to individual plaintiffs. For three plaintiffs the company had to pay between $50 and $60 million and for one plaintiff it was even close to $80 million (source). I already talked about the lawsuits in my last article:

3M, the embattled maker of the CAEv2 earplugs, had a tough 2022. The company is currently being sued by over 200,000 veterans who allege that the company’s earplugs were defective and ineffective, resulting in hearing loss. 3M has resorted to the old playbook used by companies to avoid and deflect litigation, to little avail. In July, the company bankrupted the unit that made the earplugs, Aearo Technologies, and on the same day announced that it would pursue a spinoff of its healthcare unit. For those unfamiliar with corporate bankruptcies, filing for Chapter 11 is a tactic used to stall litigation because - generally - all lawsuits against a company are halted while the bankruptcy process plays out. Unfortunately for 3M, the tactic didn’t work, and the bankruptcy judge allowed the suits to move forward unencumbered.

Good news for 3M Company came at the beginning of March as U.S. Department of Defense records are obviously showing that more than 175,000 plaintiffs have normal hearing. And apparently these plaintiffs didn’t lose hearing according to standards from organizations like the WHO.

I personally don’t have the expertise to assess if 3M Company and its subsidiary Aearo Technologies are to blame for the hearing loss of these soldiers. As shareholders we should prepare for the worst and recently, management pointed out that financial guidance excludes possible litigation expenses. In my last article I already listed the biggest corporate fines in history and when taking these amounts as guidance we can assume payments between $20 billion and $30 billion in the worst case – most likely stretched over several years.

Bigger Picture

But let’s look at the bigger picture and not just focus on the lawsuits. Even when assuming high fines and/or settlement payments of $25 billion – most likely stretched over several years – it won’t bankrupt 3M Company. And 3M Company is clearly in trouble as the looming recession as well as the two lawsuits are a huge problem.

But aside from these two – rather temporary – problems, 3M Company seems to be a solid business. Of course, the declining gross margin and operating margin in 2022 is not great, but when looking at the bigger picture (and excluding 2022), the margins are very stable – indicating a solid business with a wide economic moat. And not only margins were mostly stable, 3M Company could also report a return on invested capital of 19.15% in the last five years. And when looking at the last 10 years, RoIC was above 20% in almost every year with the lowest number reported in the last 10 years being 17.43%.

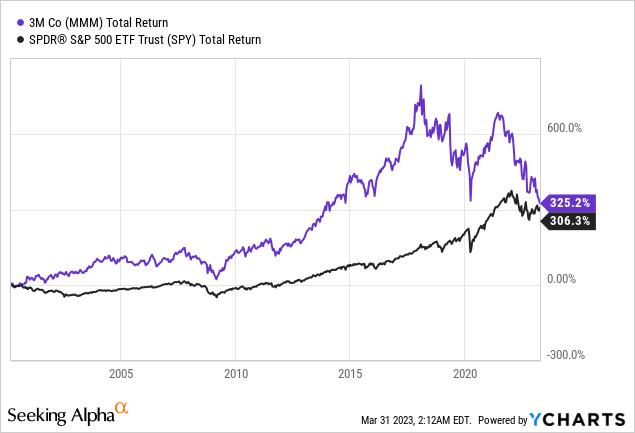

These numbers are clearly hinting towards a wide economic moat. And when looking at the performance since 2000, 3M Company could still outperform the S&P 500 (total return, including dividends) despite the S&P 500 being rather close to its all-time highs while 3M Company lost about 60% from its previous all-time high.

And it is also good to know that the CEO is long-term bullish about his own company (of course, this is not very surprising, but still good to read):

To wrap up, I continue to be bullish on our long-term trends. The large and attractive end markets we serve provide exciting opportunities for the future of 3M. We are not satisfied with our performance and the expected start this year. We are working to aggressively address our operating performance in this challenging environment. We expect organic sales volumes will improve as consumer retail and consumer electronic markets stabilize. China works through its COVID-related challenges and as our year-on-year comps ease.

Intrinsic Value Calculation

In the end – and as long as we don’t expect 3M Company to go bankrupt - an intrinsic value calculation should decide if 3M Company is a good investment or not. The question if something is a good investment or not is always determined by the interplay of a company’s fundamentals and the price we must pay for the business. And a great business can be a horrible investment if the price is not right and at some point, we can justify to invest even in the worst business if the stock price is really depressed.

In case of 3M Company, we must take into account lower free cash flows in the coming quarters due to the recession and we also have to take into account potential fines and settlements due to the lawsuits.

As basis for our discount cash flow calculation, we use the company’s own guidance for fiscal 2023 and we assume $4.6 billion in free cash flow (midpoint of the guidance - $4.2 billion to $5.0 billion). And as usual, we assume 10% discount rate and take 552.9 million in diluted outstanding shares. For starters, 3M Company must grow its free cash flow only between 2% and 3% to be fairly valued.

But to get a more realistic intrinsic value we should make a few more assumptions. For 2024, we also assume $4.6 billion in FCF assuming the recession will last longer, but in 2025 we assume 3M Company will recover again and we take the average free cash flow of the last five years ($5.3 billion) as free cash flow for 2025. And for the following years we assume 5% growth as realistic assumption – we also take this growth rate for perpetuity.

Let’s also assume 3M Company must pay $25 billion in settlements stretched over 10 years. In this case, the intrinsic value for 3M Company would be $108.49 and the stock would be slightly undervalued.

We can also be a little more optimistic and assume only $20 billion in settlements stretched over 10 years and 3M Company being able to grow 6% annually after 2025. In this scenario the intrinsic value would already be $153.51, and 3M Company would be clearly undervalued.

When looking at the different scenarios we already can see that it is not so easy to make a clear call about 3M Company. The more assumptions we must consider, the more difficult it gets and the wilder the fluctuations between the “different intrinsic values” can become. Whatever the true intrinsic value for 3M Company is – and we can also make the case for more optimistic calculations – I see 3M Company as undervalued right now and the current stock price is reflecting all the negativity and all lawsuits in my opinion.

High Dividend Yield

And finally, 3M Company is also interesting for its dividend yield. Right now, the company has the highest dividend yield at least since 1987 (I don’t have previous data or rather the data was obviously incorrect). But with a dividend yield of 5.8% we have the highest dividend yield of the last 35 years for 3M Company and it is also among the 20 companies in the S&P 500 with the highest dividend yield.

Of course, when a company is reporting an unusually high dividend yield, we right away must ask if the dividend is sustainable. But I don’t think we are facing the imminent risk of a dividend cut. When comparing the current annual dividend of $6.00 to the GAAP EPS of $10.18 or the adjusted earnings per share of $10.10 for fiscal 2022, we get a payout ratio of 59% to 60%. And while this is certainly not the lowest payout ratio, it is no reason to be worried just yet. When using the low end of the company’s guidance for fiscal 2023 ($8.50 in earnings per share), the payout ratio would be about 71% and we are already moving into a critical zone. When comparing the dividend payments of $3,369 million in fiscal 2022 to the free cash flow of $4,691 million, we get a payout ratio of 72%.

In my opinion, it would make sense to cut the dividend and rather use the cash to repurchase shares, but I assume management wants to keep its status as “dividend king”.

Conclusion

We should keep a close eye on the lawsuits and certainly not ignore the risks, but we should also not ignore that 3M Company is a high-quality business with a wide economic moat. In my opinion, 3M Company will survive the lawsuits. It might have to pay high amounts in settlements and fines, but these amounts are already reflected in the current stock price and in my opinion, 3M Company is undervalued.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.