Carbon Streaming Corporation: Exciting Emerging Industry, But Stay Cautious

Summary

- Emerging industry provides enormous opportunities for a good cause;

- CSC’s current revenue is questionable and is outside its own business strategy;

- CSC’s expenses are out of control;

Sakorn Sukkasemsakorn

Carbon Streaming Corporation (OTCQB:OFSTF) (NETZ.NE), referred to here as "CSC", operates in an emerging industry around carbon credits that has the potential to be very impactful combating climate change. To understand CSC’s business strategy, one must have an understanding of the voluntary carbon credit market.

Carbon credits, either mandatory or voluntary, are a mechanism designed to help reduce the amount of greenhouse gas emissions produced by individuals and businesses.

Mandatory carbon credit

Mandatory carbon credit represents a permit to emit one metric ton of carbon dioxide or its equivalent. The idea is that governments or organizations set a limit on the amount of greenhouse gases that can be emitted, and then issue a limited number of carbon credits to those who need to emit them.

Voluntary carbon credit

Voluntary carbon credits are similar to mandatory carbon credits, but they are not issued as part of a regulatory compliance scheme. Instead, they are purchased voluntarily by individuals, businesses, or organizations that want to offset their carbon footprint or support sustainability initiatives. Voluntary carbon credits are created through projects that reduce greenhouse gas emissions or remove carbon dioxide from the atmosphere, such as reforestation or renewable energy projects. The credits are then sold on a voluntary carbon market, with the price set by supply and demand.

By purchasing voluntary carbon credits, individuals or businesses can claim that they have offset their carbon footprint, even if they are not required to do so by law. This can be a way for organizations to demonstrate their commitment to sustainability and reduce their environmental impact.

However, critics argue that voluntary carbon credits may not be as effective as mandatory credits, as there is less oversight and verification and categorization of the projects that generate the credits. As a result, voluntary carbon credit market ($2 billion traded in 2021) still represents less than 1% of the total carbon credits market ($910 billion traded in 2022). Yet, as individuals and businesses race to participate the voluntary carbon credit market, oversight and verification of projects are expected to standardize and this market is expected to grow three to four-fold by 2030.

Verification Standards

There are currently several verification standards for voluntary carbon credit projects that aim to ensure the integrity and effectiveness of the projects. Some of the most widely recognized verification standards include:

- Gold Standard: This standard is designed to promote sustainable development and ensure that carbon reduction projects are not just effective at reducing emissions but also deliver benefits to local communities.

- Verra (VCS): This is one of the most widely used voluntary carbon credit standards, and it focuses on ensuring that carbon credits are real, measurable, and permanent.

- Climate, Community, and Biodiversity Standards (CCB): This standard focuses on projects that not only reduce greenhouse gas emissions but also contribute to biodiversity conservation and sustainable development.

- Puro Earth: This is a relatively new verification standard that focuses on supporting climate-positive projects that not only reduce greenhouse gas emissions but also have a positive impact on biodiversity, ecosystems, and communities. Puro Earth has a strong focus on transparency and aims to provide a simple and affordable way for organizations and individuals to offset their carbon emissions while supporting sustainable development.

These verification standards help ensure that carbon offset projects are genuine and effective at reducing greenhouse gas emissions, and that they deliver additional benefits to local communities and the environment. When purchasing voluntary carbon credits, it is important to look for projects that have been certified by a recognized verification standard to ensure that the credits are of high quality and have a positive impact.

Project Activity Types

There are several different activity types related to voluntary carbon credit projects, including:

- REDD+ (Reducing Emissions from Deforestation and Forest Degradation): This activity type, often considered as the highest quality for carbon credits, focuses on preserving and restoring forests as a way to reduce greenhouse gas emissions. Projects that fall under the REDD+ umbrella may involve forest conservation, reforestation, afforestation, or sustainable forest management.

- Renewable Energy: This activity type involves the development and deployment of renewable energy sources, such as solar, wind, or hydropower, to reduce reliance on fossil fuels and lower greenhouse gas emissions.

- Energy Efficiency: This activity type focuses on reducing energy consumption and improving energy efficiency, such as through building retrofits, efficient appliances, or efficient transportation.

- Methane Reduction: This activity type involves reducing methane emissions from sources such as agriculture, waste management, or oil and gas operations.

- Carbon Capture and Storage: This activity type focuses on capturing and storing carbon dioxide emissions from industrial processes or power generation.

- Agriculture and Land Use: This activity type involves promoting sustainable agriculture and land use practices that reduce greenhouse gas emissions, such as soil carbon sequestration, conservation agriculture, or agroforestry.

Although these different activity types are all designed to reduce greenhouse gas emissions or remove carbon from the atmosphere and have the potential to generate voluntary carbon credits, it is important to consider the specific activity type when evaluating the potential impact of a carbon offset project.

Carbon Credit Pricing

The price of voluntary carbon credit fluctuates significantly depending on the quality of the credits (verification standard, activity type, location), supply and demand.

GEO (Global Emissions Offset) and N-GEO (Nature-Based Global Emissions Offset) are two benchmark prices set by the Intercontinental Exchange (ICE), which are used in the voluntary carbon market to provide a reference point for the value of voluntary carbon credits and help buyers and sellers to negotiate fair prices.

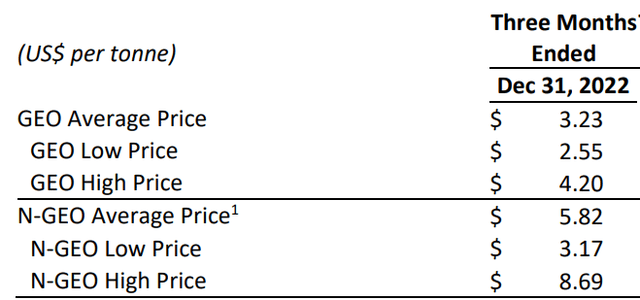

CSC MD&A for Period Ended December 31, 2022

For example, in the three months ended December 31, 2022, GEO prices fluctuated between $2.55 and $4.20 per tonne while N-GEO prices fluctuated between $3.17 and $8.69 per tonne.

In this three-month period, CSC sold 122,995 credits for an average price of $8.61 per tonne close to the high end of the price.

CSC Business Strategy

CSC’s business strategy can be summarized in the following steps:

- CSC identifies a project depending on its location, activity type, verification and expected carbon credits generated;

- CSC provides funding with the project to support its development in exchange for voluntary carbon credits generated in the future;

- CSC receives carbon credits;

- CSC markets and sells these carbon credits;

- CSC pays the project owner a portion of the revenue from sale of these carbon credits according to each streaming agreement.

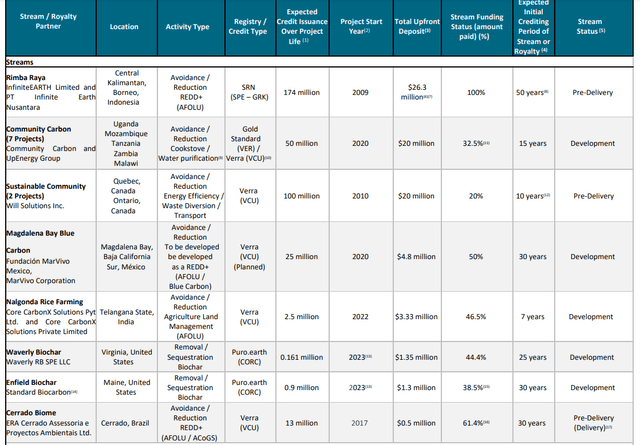

Below is a summary of CSC’s current projects:

CSC MD&A for Period Ended December 31, 2022

According to CSC’s management, CSC expects to sell credits generated from a project within 12 months.

In total to date, CSC has approximately 366 million carbon credits in the pipeline to be generated from various projects to be delivered between 7 and 50 years. The total upfront costs are approximately $78 million.

It's worth observing that if one looks at the current market pricing, even at the low end of $2.55 per tonne based on GEO benchmark price, the 366 million credits would be worth about $933 million in revenue. Even discounted deeply to present value, it is still significantly higher than the $78 million upfront cost invested.

However, as mentioned earlier, only $2 billion worth of voluntary carbon credits traded in 2022. 366 million credits would represent a very significant amount of supply and drive the price down without a significantly increased demand.

Current Revenue

Interestingly, the current revenue figure is not relevant to CSC’s future business strategy or valuation. One can note that for the six-month ended December 31, 2022, with the total revenue of $1.086 million, the cost of purchased carbon credits is $0.625 million while the marketing cost is $0.349 million, earning nearly no profit on the sale of these credits. This is when the average price sold for these credits was $8.61 per tonne. As one can see, no project has entered the “Delivery” stage yet. According to CSC management, these carbon credits sold during the six-month period ended December 31, 2022 were purchased from Rimba Raya Biodiversity Reserve project outside of its streaming and royalty agreements. I am not sure why CSC management would purchase these credits outside of these existing agreements and incur additional costs to try to re-sell.

Current Expenses

For the six months ended December 31, 2022, excluding the non-cash share-based compensation, marketing costs on sale of credits, CSC incurred approximately $8.6 million in cash expenses. This is very high considering that CSC is in a relatively passive streaming business. The upfront costs invested in a project should have already covered project related costs such as verification of the project. Therefore, I have trouble understanding why there is a need to incur $4.25 million in salaries and wages, $1.4 million professional fees and $1.98 million in consulting fees in this six-month period to identify projects and enter streaming agreements.

According to the Management Information Circular filed on October 5, 2022, the five executive level employees earn a total of over $1.1 million in base salaries and a total of nearly $10 million in total compensation in 2022.

Given approximately $190 million funds raised in total, $10 million annual compensation just for the executive team seems excessive in addition to the professional and consulting fees incurred every year in millions. The current cash balance of $70 million won’t last long to just cover its excessive spending. With this type of uncontrolled expenses, one must wonder how much due diligence CSC really conducts to verify the projects and monitor how the project owners spend the funds provided by CSC.

Conclusion

Although the voluntary carbon credit market is very interesting and has great potential, for CSC to be an attractive investment, one must believe in the following:

- CSC’s management team conducted thorough due diligence when identifying projects and monitoring funds being spent at each project;

- These projects will deliver the expected credits generated timely;

- These projects will not need additional cash investments;

- CSC can stop purchasing and re-selling carbon credits outside its business strategy;

- CSC can cut its expenses significantly;

- The voluntary carbon credit market earns trust of individuals, governments businesses and grows significantly in the next decades and beyond;

For now, I don’t believe all of the above is true and will stay away from investing in CSC.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.