UFO: This ETF Is Not Space Junk And Could Be Bottoming Soon

Summary

- UFO is an ETF that zeros in on the commercial applications of satellite technology.

- This is a growth business, but one that requires time and patience to pursue big rewards.

- It is a Hold for me, but it may not be far from bottoming.

da-kuk

I rate the Procure ETF Trust II - Procure Space ETF (NASDAQ:UFO) a Hold. Last year was a record year for satellite launches and this trend could well continue into 2023. This year could see an increased number of satellite launches as these utilities are used for maintaining important tasks like military surveillance. Especially with looming threats from international locations like Russia and China, satellites could be key in 2023 as the government seeks to ramp up its security.

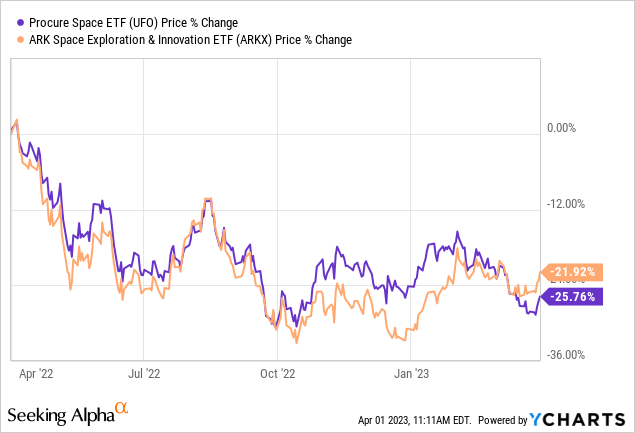

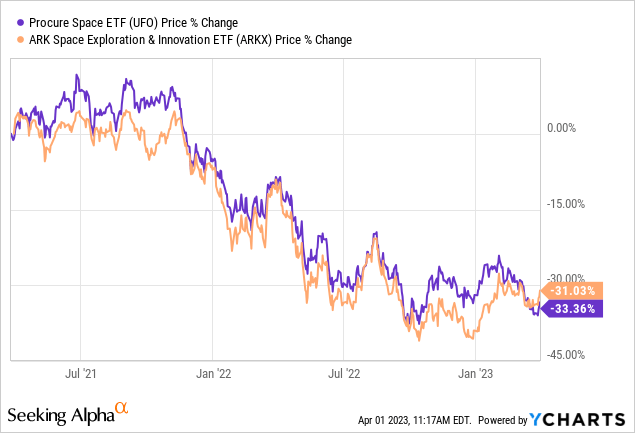

This ETF might also be a prime option for investors seeking to gain exposure to assets involved in spaceborne technology and initiatives, not just commercial satellite services. For example, UFO provides exposure to endeavors related to space exploration and imaging unidentified objects in space in addition to satellites focused on monitoring activity on earth. For this reason, this ETF could be a more well-rounded, diverse alternative to funds like the ARK Space Exploration & Innovation ETF (ARKX). UFO has outperformed ARKX for the better part of three years at this point. This leads me to believe that this ETF could have some long-term edges over the more narrowly-focused ARKX.

This ETF could be bottoming soon, which is why I will be following it closely. Though the price is low and has taken a recent dip, soon could be the time to buy the dip, but not just yet. Ultimately, this undiscovered ETF could be an effective way to gain exposure to a business that will clearly be central to our future on earth: tracking it from above.

ETF Profile

The First Global Aerospace & Defense Fund

This ETF is quite nascent as the space exploration industry has only started to gain serious traction in recent periods. Much of its momentum is attributable to the rise of new private space enterprises like SpaceX and Virgin Galactic. Therefore, UFO has an AUM lower than most ETFs I've covered previously, which could very much work for or against its favor in the medium term.

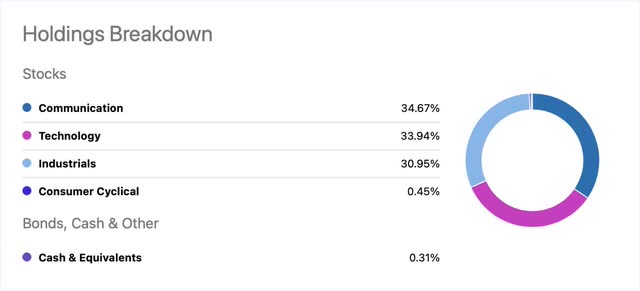

UFO's focus is broad and spans across the general topic of outer space. Industries of focus include services and manufacturing centered on satellites and rockets, as well as other space and ground-focused hardware and services. This ETF is therefore more sector diverse, with an almost perfect three-way split between technology, communication, and industrials.

UFO sector allocation (Seeking Alpha)

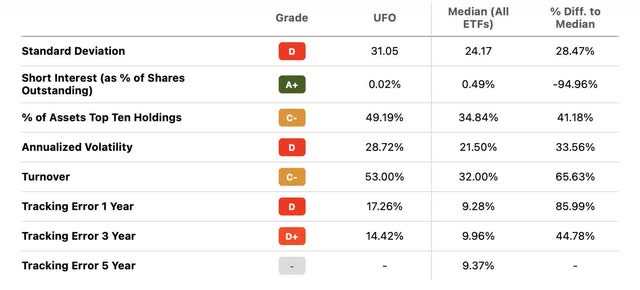

UFO tracks the S-Network Space TR USD Index and uses a full-replication technique. The top 10 holdings in this ETF comprise 49% of the total holdings while the top 25 also account for 92%. This fund consists of only 42 stocks, making UFO quite top-heavy. On the level of specific holdings, not one single stock accounts for more than 6% of the whole fund. Investors might still want to consider possible concentration risks generated by this composition.

Relevant Industry Growth Forecasts

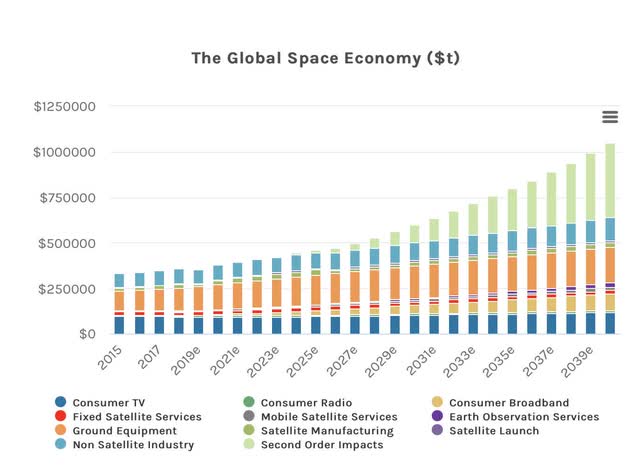

The global space industry could generate revenues of more than $1T by 2040 per a recent Morgan Stanley forecast.

Global space economy growth forecast (Morgan Stanley )

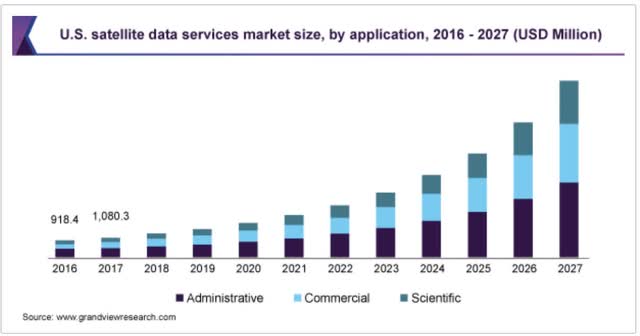

Satellite services in specific could incur growing demand and industry expansion in the long term, as appearing in their somewhat strong growth forecast. The United States satellite data services market is forecasted to grow to over $16B by 2030 at a rate of 27%.

United States satellite data services market growth forecast (Grand View Research )

Historical Performance And Future Implications

During the last three years, UFO has for the most part outperformed ARKX. This trend could outline an underlying advantage within this ETF that could manifest in the long term when UFO ideally gains some positive momentum.

ARKX only recently popped back up above UFO, but imminent macroeconomic changes could put both of these ETF's performance to the test. This further motivates me to follow this ETF to see if it can rebound from what could be a price bottom.

Recent Events and Potential Catalysts

The commercial space industry could increase its overlap with the Space Force in the United States military going forward. A primary objective of this collaboration is the initiation of the Commercial Augmentation Space Reserves (CASR). This program seeks to assemble teams of satellite manufacturers and other space technology specialists that could possibly be mobilized during a crisis. This program could ultimately make the U.S. space system more resilient to foreign attacks, as satellites are already becoming a more prominent target for foreign belligerents.

China could also become a global competitor in the space sector as early as 2030. This recent disclosure could place additional pressure on the United States to stay on top of their innovations. In the long-term, this could accelerate the growth of the space sector and industries affiliated with UFO. However, it may also foster geopolitical tensions that could hurt profits within the U.S. space sectors and UFO alike.

Price Trend Analysis

UFO has seen a fairly consistent downtrend since late 2021. Evidently, the selling pressure has been quite strong since the market last peaked before the onset of the bear market in early to- mid 2022.

As seen in the graph below, this ETF has only managed to pop above the 50-day moving average on a few instances in the last year or so, all of which were somewhat short-lived.

This ETF most recently dipped back below the 50-day moving average in late February 2023.

UFO just recently began to display signs of rebound, as seen in the green candlesticks that emerged within the last few days. This could reflect some bullish reinstatement, but time will tell just how far this can extend, as most of this ETF's bullish periods were somewhat insignificant.

Preparing For The Unideal

A price bottoming could serve as an effective buying opportunity in the future, however, UFO is certainly not free of its own long-standing caveats. Even if UFO is able to emerge back above the 50-day moving average, this ETF is still very volatile. Investors could likely experience drastic price fluctuations and large drawdowns on the way to obtaining a net gain in the next 5-10 years. Therefore, owning UFO could require one to extend their outlook quite far as well as develop a certain amount of trust and emotional maturity.

This ETF also appears to have some fundamental liquidity issues, which could be especially salient in this ETF which has already struggled to produce attractive, stable returns. As many are becoming more hesitant to buy high risk/reward assets, focus has recently shifted more towards safety. Investors may therefore be deterred by the possibility of not being able to sell UFO at an appropriate price in the event that it underperforms.

The United States National Defense also recently disclosed that the Space Force is struggling to keep up with innovation in the space sector. Furthermore, some claim that the United States is struggling to develop a cohesive space strategy, and that the country's wealth won't protect them from competitors like China in the long-term. Militaristic implications into the space sector and the satellite industry could catalyze profits and increase the returns of those who own UFO. However, this merger might be more complex and difficult than many investors think, creating even more risk and uncertainty.

ETF Investment Opinion

Growth in the United States space sector could take a very long time, and it may be hard for one not to discount potential returns in the next 5-10 years. Therefore, though I think one could profit from holding this very interesting fund in the long-term, doing so could demand a significant amount of patience and self-control. For this reason, I rate UFO a hold. Regardless of this ETF's future outlook, it's also hard to see one profiting significantly by selling it right now. Therefore, I remain neutral towards UFO, and am planning to see if it can rebound from its most recent slump.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.