Atreca: Digesting The ATRC-101 Update And Full Year Earnings (Rating Downgrade)

Summary

- BCEL announced full-year earnings for 2022 on March 29 and also provided an update on its phase 1b trial of ATRC-101.

- BCEL's ATRC-101 continues to show signs of promise, but the company still plans to enroll another 30-40 patients to make a go or no-go decision on phase 2.

- The company expects its cash to last through end-of-year 2023, which allows enough time to enroll the additional 30-40 patients.

shapecharge/E+ via Getty Images

When I last wrote about Atreca (NASDAQ:BCEL) on February 1, I examined the results from the company's phase 1b trial of ATRC-101, an antibody with potential in multiple cancer types. At that time, I rated BCEL a strong buy, based on the strength of the phase 1b data and the expectation that more data would excite the market about the potential of that drug. This article looks at update results from that trial and full year 2022 earnings.

The phase 1b trial update

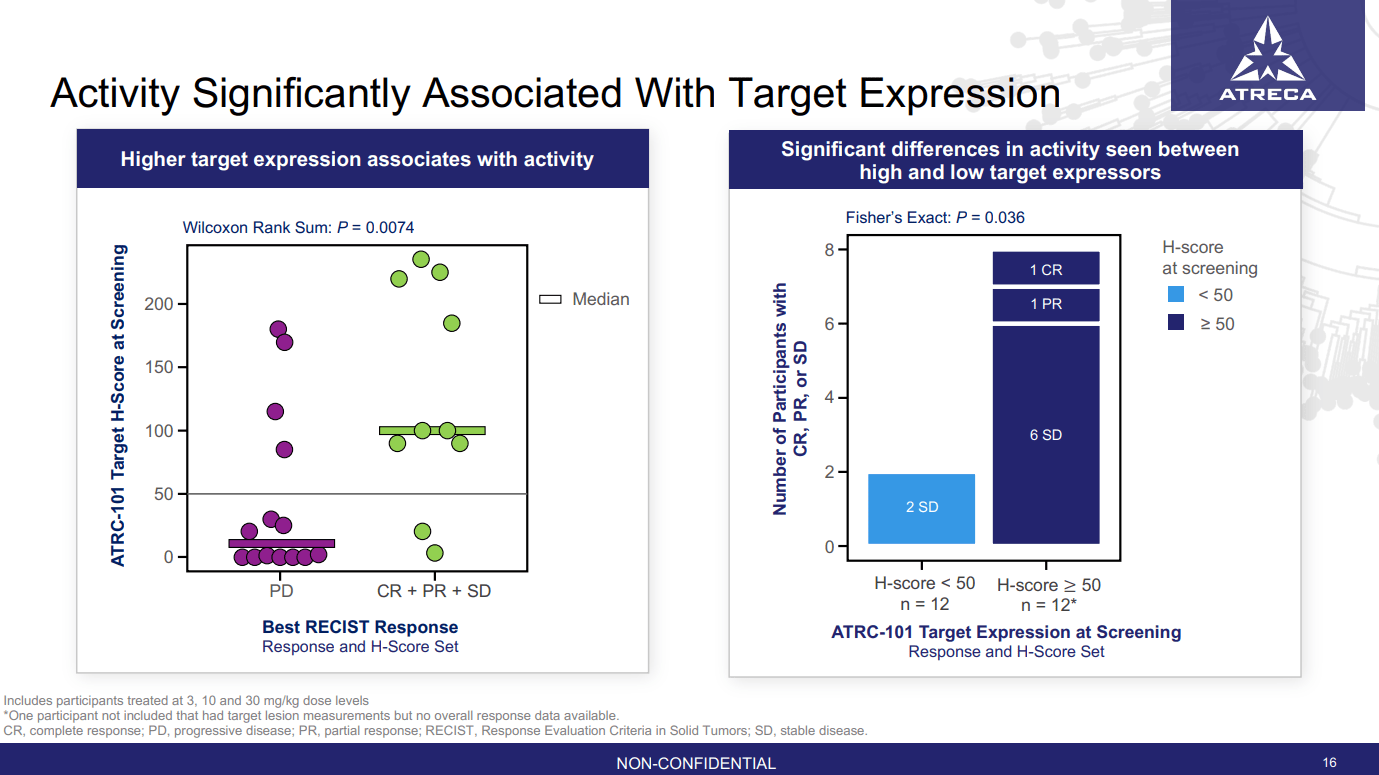

BCEL's most recent update (data cutoff of February 17, 2023) notes that 71 participants have been dosed in its phase 1b study. This compares to BCEL's March 2022 update (data cutoff February 15, 2022) where the company noted that 47 participants had been dosed. At the time of that update, BCEL had presented data from a subset of 24 patients given relevant doses of ATRC-101 (3, 10 or 30 mg/kg) where data on expression of the target for ATRC-101 (a ribonucleoprotein complex) was available, as was data on response. Twelve of those patients had low expression of the target (H-score < 50), and only two achieved stable disease, none achieved a partial response [PR] or complete response [CR]. In the twelve patients with high expression of the target (H-score ≥ 50), stable disease was seen in six patients, one patient achieved a PR and one a CR (Figure 1).

Figure 1: The median H-score of patients achieving at least stable disease is higher than those with progressive disease (left panel). Those with high H-score had better disease control than those with a low H-score (right panel). (BCEL Corporate Presentation, January 2023.)

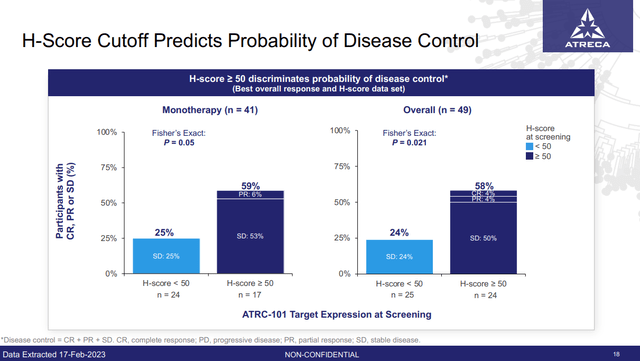

The good news is that BCEL now has data from 49 patients treated with 3, 10 or 30 mg/kg who have expression data and response data. The company's original suggestion that target expression seems to predict response to the drug has held true (Figure 2). BCEL continuing to focus on enrolling high H-score patients should increase the value of the data they collect, allowing the company to make a more informed go or no-go decision on phase 2 by the end of 2023, which the company announced it was planning to do.

Figure 2: Those with high H-score had better disease control than those with low H-score. (BCEL Earnings Presentation, March 2023.)

The bad news is that there were no new CRs or PRs and this could have helped to produce a run in the stock, allowing the company to raise funds at some point. Softening the blow a bit on that front, was the news that the existing CR (418 days and ongoing) and PR (over 300 days) had been very durable. Another piece of good news was the fact that there weren't any new potentially treatment-related grade 3 or 4 adverse events, just the same two grade 3 adverse events (headache and intestinal obstruction) we heard about last year.

Those are the details the market is probably going to focus on; no new CR's or PR's, but good durability of the existing responses and more evidence of disease control in patients, particularly within the group with H-score ≥ 50. Further, there are no new safety concerns and there has been relatively good safety and tolerability overall.

Lastly, BCEL opening up more sites to be able to get the additional 30-40 patients it plans on recruiting by year-end 2023 is certainly a positive. Especially in the context of the March 2023 update including less than 25 extra patients from the March 2022 update.

In the past several months, we opened the study at 5 new sites and closed 2, and we have contracted with 9 additional sites in start-up activities. In addition, we have 7 sites undergoing feasibility. Going forward, a total of 28 centers are expected to participate and contribute to the study.

Philippe Bishop, Chief Medical Officer, BCEL, March 29 earnings call.

Financial Overview

BCEL reported Q4'22 and full year earnings on March 29. Cash, cash equivalents and investments were $70.5M at the end of 2022. R&D expenses were $66.8M for 2022 and G&A expenses were $31.5M for 2022. Net cash used in operating activities was $80.7M for the full year. BCEL notes that it expects cash runway through the end of 2023, which seems feasible with a slight reduction in cash use, relative to 2022. As of March 29, 2023, there were 39,156,584 shares of BCEL's common stock outstanding, corresponding to a market cap of $50.9M, meaning BCEL still trades below cash.

The road ahead for BCEL

While I view BCEL's phase 1b trial update as a net positive, I think BCEL needed more than a net positive. Instead an outright positive would have been required to stimulate a rally in the stock, allowing a substantial raise. I don't think the new data will produce a sustained run in the stock between now and the next update, but cash will certainly run down during that time. More CRs or PRs would probably have been needed for a rally. Even if BCEL thinks it is seeing particularly encouraging data in some of the tumor types in its trial, if that is based on seeing stable disease of a duration where it wouldn't normally be seen, will the market be convinced that there is something worth running a phase 2 study on? If the market sees some more CRs or PRs then it is more likely the market agrees BCEL has something, but right now I don't know if that will happen at a meaningful rate.

The rest of BCEL's pipeline isn't even in the clinic. While it looks like a very interesting pipeline, the potential of which is validated by the responses to ATRC-101, it won't generate much excitement for the stock in 2023. One thing I can see there stimulating the market's interest in BCEL stock in 2023 is ATRC-501, an antibody with potential in malaria prophylaxis. The Gates Medical Research Institute is planning on filing an Investigational New Drug application in 2023 for ATRC-501, having licensed the drug from BCEL. If the Gates Medical Research Institute enters the clinic in 2023, that can provide a catalyst on the horizon for BCEL (BCEL retains commercial rights in the US, Europe and parts of Asia). I don't think it would have a huge impact short-term on BCEL stock, but it would be a positive to see ATRC-501 move into the clinic.

Conclusions

I see three possibilities, the first of two I view as real risks that could see BCEL trade down. Firstly, BCEL's cash will run down substantially while the ATRC-101 phase 1b trial generates more data, only to result in a decision not to go ahead anyway. Secondly, BCEL's cash runs down substantially but the phase 1b trial generates data that encourages BCEL to go ahead, but the market might not be that enthused about the data (even if those following BCEL closely and the company can see the rationale for phase 2). The third possibility is that the next 30-40 patients of data in the phase 1b study produce a rationale compelling enough for further study to the point that the market sees and understands that, and BCEL's share price reacts positively.

With regards to cash, BCEL does have other options outside of conventional offerings or use of its at-the-market facility. For example BCEL can partner another pipeline candidate to raise funds (such as an upfront payment from a partner) and reduce development costs. If we hear news on such agreements, and BCEL made one with Xencor (XNCR) recently (albeit with no upfront payment), so we know the company can do that, I might change my thesis. As for now I rate BCEL stock a hold. The change from a strong buy rating is due to the new ATRC-101 not having the obvious features, such as new patient responses, that would have really sent the stock on a run, an allowed a cash raise.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.