The Bear Market Is Not Over

Summary

- The NASDAQ has entered a bull market for the second, or maybe the third time, in less than a year.

- The latest rally in the NASDAQ has been driven by CTA flows.

- These flows should fade this week and the rally with it.

- Looking for more investing ideas like this one? Get them exclusively at Reading The Markets. Learn More »

Ultima_Gaina

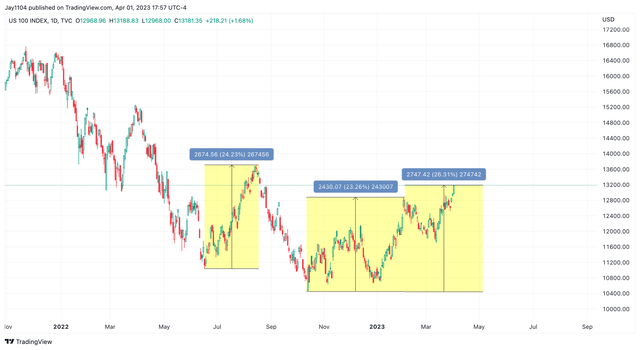

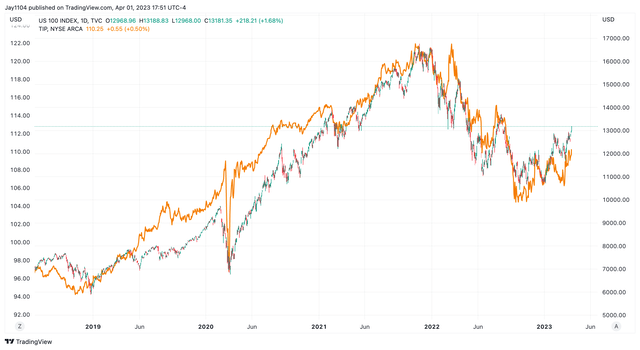

The NASDAQ 100 (NDX) has entered a bull market for the second time in less than a year. Yes, you read that right, for the second time, in less than a year. The NASDAQ 100 surged by more than 20% from mid-June to its peak in mid-August. It has done it again, rising by more than 20% for a second time off its October low.

Yes, that is quite the feat, rising, by 20% off a low two times, maybe three times, depending on how you want to count. But let's not mince facts because the NASAQ 100 remains more than 20% off its November 2021 highs.

CTAs

Interestingly, this rally and the summer rally have something in common: commodity trader adviser flow overwhelming the market just as they did when they destroyed the Treasury market, rushing to cover their shorts in just two weeks in the middle of March.

The summer mini-bull market was driven higher by CTA flows, which went from massively short stocks to heavily long stocks, as noted at the time. But guess what? The flows came back, and they were buyers in January, pushing the NASDAQ into its second bull market and turning sellers in February, and now they have turned buyers again.

Based on data (subscription needed) from Goldman Sachs, these CTA buyers should be just about finished with their aggressive buying sometime in the middle to end of this week. On top of that, there will be a wave of data that probably supports the narrative that the economy remains robust, but also around the time that the Treasury General Account should rise again as tax receipts pour in.

TGA

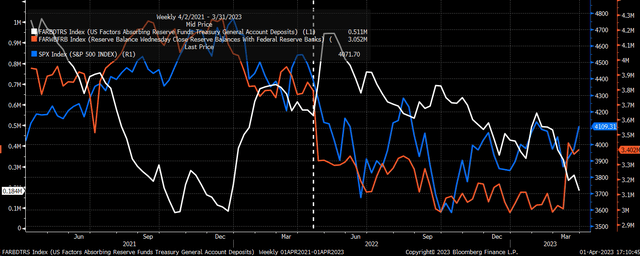

The Treasury tax receipts should push the Treasury General Account held at the Fed higher off its very low levels. Last April, the TGA rose by almost $400 billion, which sucked tremendous liquidity out of the market as the reserve balances fell sharply, sending stocks sharply lower.

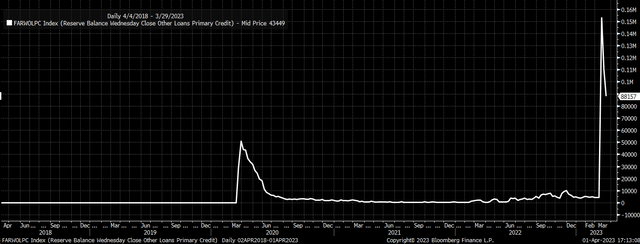

On top of the CTA flows, there has been an increase in reserve balance that has been due to the loans made by the Fed to the banks, which is not the same as QE and is not sticky, adding liquidity to the market. But, as activity at the discount window subsidies and loans fall back to zero, it should drain another $100 billion off the balance sheet and reserve balances, sucking even more liquidity out of the market and the changes to the TGA.

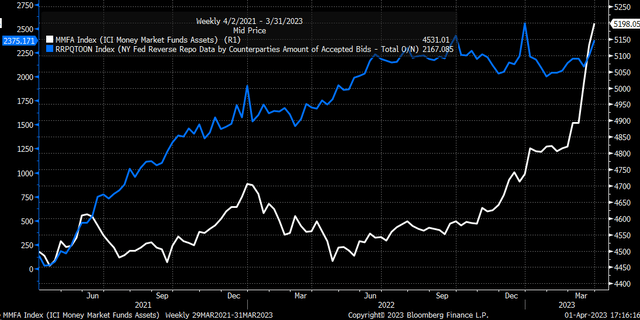

Not to mention all that money going into money market accounts, fleeing the banks for better interest rates. That money will most likely head right into the reverse repo facility at the Fed, which will also work to drain reserve balances and even more liquidity from the markets over the next few weeks.

Data

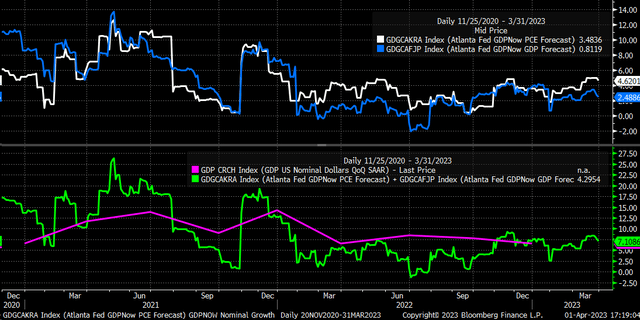

Then on top of all of this, there will be a lot of economic data this week, including the ISM manufacturing and services data, JOLTS, and the BLS job report. If the economy is genuinely sporting a nearly 7% nominal GDP growth rate, as the Atlanta GDPNow and PCE estimates combined would suggest, then the likelihood is that the economy will be strong and will support rates staying higher for longer, push bond yields, and more importantly, real rates sharply higher, and off their depressed levels.

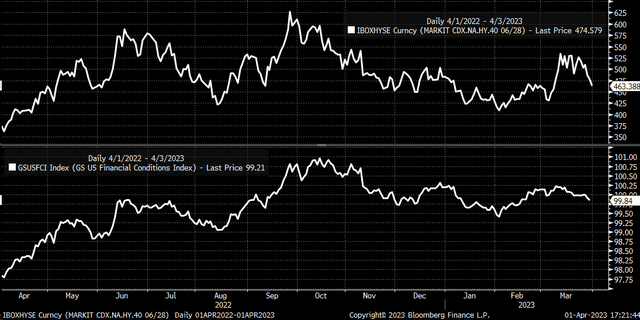

On top of that, instead of financial conditions tightening and credit spreads widening, as I thought they might, given the Silicon Valley Bank collapse, they have eased. Yes, financial conditions have eased and are back to the level seen in late February, as noted by the GS Financial Conditions Index. It is as if SVB never even happened. On top of that, the CDX high yield index has also collapsed this week, confirming that, indeed, financial conditions have eased.

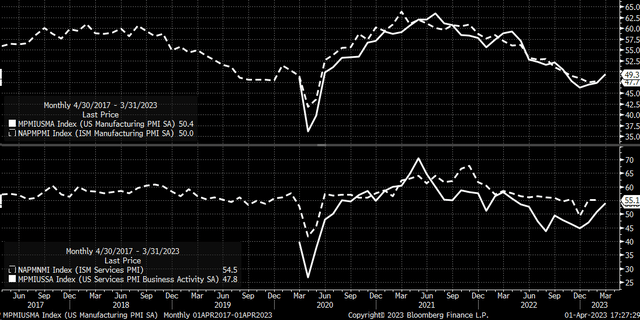

If you get robust data this week, which seems highly plausible given that the S&P Global US Preliminary PMIs for March stunned to the upside last week, then it means that the fantasy of the Fed cutting rates this year will be over very soon.

Rate Cuts

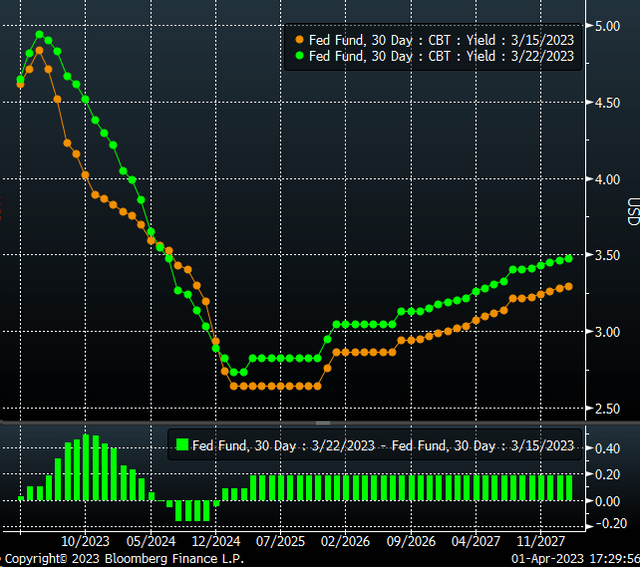

Rate cuts are already being priced out of the market as investors listen to one hawkish Fed governor after another confirms the view that there is likely to be at least another rate hike. Then they will be held steady for the year's balance, just as the dot plot showed two weeks ago.

On top of that, the only reason the Fed held back from going with the more aggressive monetary policy tightening path was the belief that the banking "crisis" would cause some financial conditions to tighten; well, to this point, conditions have eased. If they continue to ease, the Fed will have to switch back to the more aggressive policy path at some point, mainly if the economy stays hot.

Of course, if this is the case, then real yields should rise, and the TIP ETF should fall, resulting in the NASDAQ 100 giving back its recent gains, as it was in the process of doing before the Silicon Valley Bank fiasco.

So yeah, once the CTAs are done buying, it might get a little choppy.

Be patient.

Join Reading The Markets Risk-Free With A Two-Week Trial!

(*The Free Trial offer is not available in the App store)

Find out why Reading The Markets was one of the fastest-growing SA marketplace services in 2022. Try it for free.

The market is more complex than ever, and Reading The Markets is here to help you cut through all the noise and to help you better understand what is driving trading and where the market is likely heading, both short and long-term.

Check out my newsletter if you want to start with something less intensive.

This article was written by

I am Michael Kramer, the founder of Mott Capital Management and creator of Reading The Markets, an SA Marketplace service. I focus on long-only macro themes and trends, look for long-term thematic growth investments, and use options data to find unusual activity.

I use my over 25 years of experience as a buy-side trader, analyst, and portfolio manager, to explain the twists and turns of the stock market and where it may be heading next. Additionally, I use data from top vendors to formulate my analysis, including sell-side analyst estimates and research, newsfeeds, in-depth options data, and gamma levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.