Devon Energy: Headwinds On The Horizon

Summary

- Devon Energy announced lower-than-expected adjusted earnings of $1.66 from $1.39 a year ago.

- Devon Energy produced 636.3K Boep/d in the fourth quarter, or 4.1% higher than the 4Q21.

- E&P domestic producers, including DVN, will be hit by lower natural gas in 1Q23.

- I recommend buying DVN between $42 and $44 with potential lower support at $39.25.

- Looking for a helping hand in the market? Members of The Gold And Oil Corner get exclusive ideas and guidance to navigate any climate. Learn More »

dszc

Introduction

The Oklahoma City-based Devon Energy Corporation (NYSE:DVN) reported fourth-quarter and Full-year 2022 results on February 14, 2023.

Important note: This article is an update of my preceding article, published on December 6, 2022. I have followed DVN on Seeking Alpha since 2017.

Devon Energy is a pure E&P domestic player, operating in five different basins.

DVN Map Assets presentation (DVN Presentation)

1 - 4Q22 and Full-year Results Snapshot

Devon Energy announced lower-than-expected adjusted earnings of $1.66 from $1.39 a year ago. GAAP earnings for the fourth quarter were $1.83 compared to $2.23 per share in the year-ago period. GAAP earnings for the fourth quarter were $1.83 per share compared with $2.23 in the year-ago quarter.

The total revenues were $4,299 million, slightly higher than the same quarter a year ago ($4,273 million).

Oil production averaged 316K Boep/d. The fourth-quarter production of 636.3K Boep/d is up from 611K Boep/d in 4Q21. However, the increase was reduced by approximately 2% due to the impact of severe weather conditions.

CEO Richard Muncrief said in the conference call:

Our streamlined cost structure captured a full benefit of favorable commodity prices, expanding per unit margins year-over-year. Returns on capital employed set a new company record at 39% for the year. This impressive return profile outpaced the S&P 500 by a substantial margin, and this strong capital efficiency translated into free cash flow reaching an all-time high of $6 billion in 2022, more than doubling the previous year.

2 - Investment Thesis

The investment thesis has not changed since my preceding article, and I recommend DVN as a long-term investment and recommend accumulating on weakness. It was especially true the past few weeks.

However, DVN dropped significantly last month in correlation with oil prices which plunged to their lowest level in more than a year due to the Credit Suisse collapse, which offset hopes of a Chinese oil demand recovery in 2023.

DVN is recovering as the market is more confident that oil prices may resume their rally and reach $100 a barrel. However, I am not as bullish, and I think the market is too optimistic, refusing to look at the reality flashing red.

We are likely heading to a recession that will affect oil and gas demand, and I do not see how oil and gas prices could benefit from this situation. Furthermore, the natural gas price dropped massively in 1Q23, weighing heavily on the free cash flow. Finally, the banks crisis is far from being solved and could create a damaging grey swan.

Hence, I recommend using technical analysis to allocate 35% to 45% of your position to trade short-term LIFO. I do not recommend selling off your position and believe it is not a good idea, but taking profit off on uptrends and expecting a lower-low trend in 2023 is a prudent strategy.

This strategy protects you against sudden changes in the oil sector, lets you keep a core long-term position for much higher prices, and enjoys a sizable dividend.

3 - Stock Performance

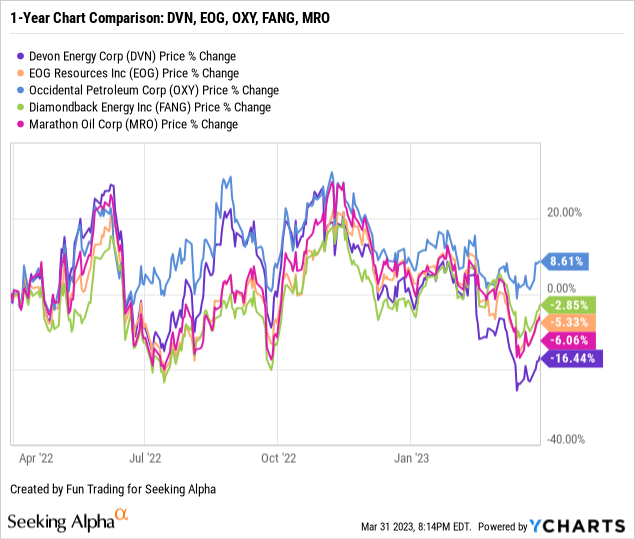

DVN's outperformed most of its peers and is down 16% on a one-year basis.

Devon Energy Balance Sheet History Ending in 4Q22: The Raw Numbers

Note: Total revenues include oil/gas and NGL sales, oil/gas and NGL derivatives, and marketing and midstream revenues.

| DVN | 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 |

| Oil and Gas Revenue in $ Million | 2,985 | 3,175 | 4,100 | 3,668 | 3,139 |

| Total Revenues incl. derivatives, midstream + others in $ Million | 4,273 | 3,812 | 5,626 | 5,432 | 4,299 |

| Net income in $ Million | 1,506 | 989 | 1,932 | 1,893 | 1,201 |

| EBITDA in $ Million | 2,331 | 1,843 | 3,116 | 3,138 | 2,271 |

| EPS diluted in $/share | 2.23 | 1.48 | 2,93 | 2.88 | 1.83 |

| Cash from operations in $ Million | 1,616 | 1,837 | 2,678 | 2,104 | 1,911 |

| Capital Expenditure in $ Million | 515 | 538 | 673 | 3,093 | 821 |

| Free Cash Flow in $ Million | 1,101 | 1,299 | 2,005 | -989 | 1,090 |

| Cash and cash equivalent $ Million | 2,111 | 2,475 | 3,317 | 1,185 | 1,314 |

| Total debt in $ Million | 6,482 | 6,471 | 6,461 | 6,451 | 6,440 |

| Dividend per share in $ | 1.00 | 1.27 | 2.92 | 2.52 | 0.89 |

| Share outstanding in millions | 662 | 658 | 654 | 651 | 650 |

| Liquids and NG Production | 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 |

| Oil Equivalent Production in KBoepd | 611 | 575 | 616 | 614 | 636 |

| Price per Boe (composite) incl., including cash settlement | 44.34 | 54.75 | 64.70 | 58.48 | 50.62 |

| Price per Mcf | 3.26 | 3.15 | 5.06 | 5.83 | 4.01 |

Source: Devon Energy supplement and Fun Trading Analysis.

Trends, Charts, and Commentary: Revenues, Free Cash Flow, and Upstream Production

1 - Quarterly revenues: Revenues of $4,299 million in 4Q22.

Devon Energy posted total revenue of $4,299 million in the fourth quarter of 2022 versus $4,273 million posted in 4Q21. For more data, please look at the table above.

The net income for 4Q22 was $1,201 million, down from $1,506 million last year.

Operating cash flow of $1,911 million against $1,616 million last year.

The total production expenses for the fourth quarter were $2,746 million, from $2,611 million in 4Q21.

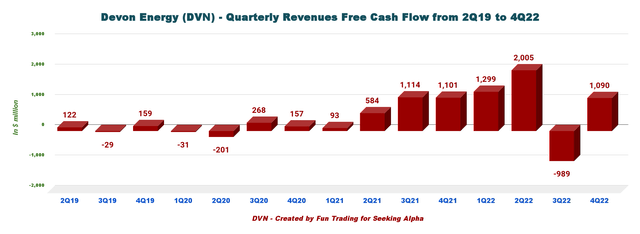

2 - Free cash flow was $1,090 million in 4Q22

DVN Quarterly Free cash flow history (Fun Trading)

Note: The generic free cash flow is the cash from operations minus CapEx.

Trailing 12-month free cash flow was $3,405 million and $1,090 million for 4Q22. CapEx was $821 million this quarter.

Devon Energy's share repurchase authorization is $2 billion, about 5% of the company's market capitalization. In the press release:

Devon also returned capital to shareholders through the ongoing execution of its $2.0 billion share-repurchase authorization. To date, the company has repurchased 26 million shares since the commencement of the program, at a total cost of $1.3 billion. With this repurchase program, Devon is on track to decrease its outstanding share count by 5 percent.

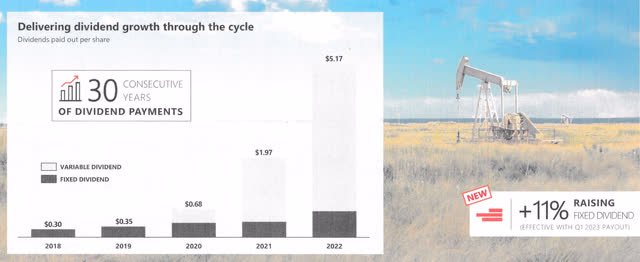

The company now pays fixed and variable dividends based on free cash flow. The dividend consists of two parts:

- A fixed quarterly dividend of $0.20 per share.

- A variable payment ($0.69) based on excess free cash flow multiplied by a payout ratio determined by the board as high as 50%.

The total quarterly dividend was $0.89 per share or a yield of ~7.1%, which is still high for such an E&P operator, albeit lower than the preceding quarter.

DVN Dividend presentation (DVN Presentation)

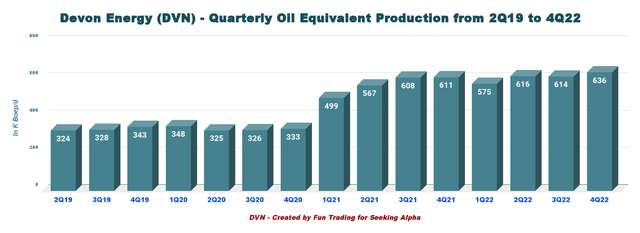

3 - Quarterly Production: Production was 636.3K Boep/d in 4Q22

DVN Quarterly Production oil equivalent History (Fun Trading)

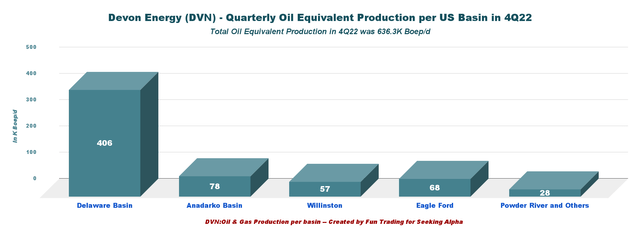

Devon Energy produced 636.3K Boep/d in the fourth quarter, or 4.1% higher than the 4Q21. It was a solid production even if production was reduced by 2% due to the impact of severe weather conditions.

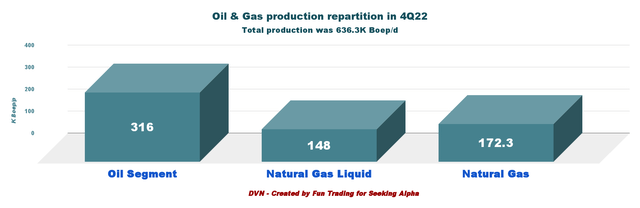

Natural gas liquids production fell 4% year-over-year to 148K Boep/d. Oil production averaged 316K Boep/d, up 5.3%, mainly due to higher oil production in the Eagle Ford basin. (see chart below).

US Production repartition for the five prominent locations is as follows:

DVN 4Q22 Production per basin (Fun Trading)

The Delaware Basin is the number one producing asset for Devon Energy, representing 63.8% of the total production, and the Liquids (Oil + NGL) 72.9% of the total output.

DVN 4Q22 Production detail Oil, NGL, NG (Fun Trading)

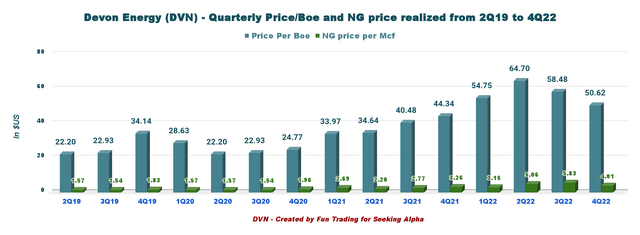

Total oil equivalent realized prices, including cash settlements, were $50.62 per Boe, and NG was $4.01 per Mcf. Below are the historical prices realized for Boe and NG.

DVN Quarterly Oil and NG price history (Fun Trading)

- Realized oil prices for the second quarter were $77.44 per barrel from $62.22 in the year-ago period.

- Realized prices for natural gas liquids were up to $24.32 per barrel from $34.82 in the prior-year quarter.

- Realized gas prices were up to $4.01 per thousand cubic feet from $3.26 in the prior-year quarter.

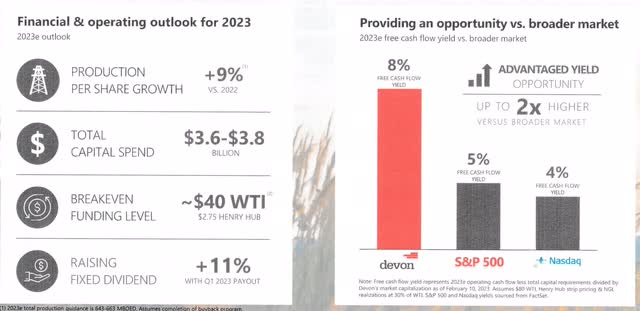

4 - 2023 Guidance

Production is expected to increase, and CapEx 2023 is between $3.6 and $3.8 billion.

DVN 2023 Guidance (DVN Presentation)

5 - Debt situation, liquidity

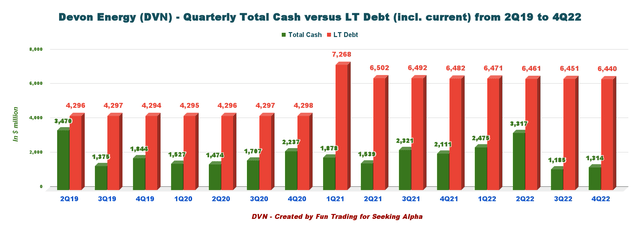

DVN Quarterly Cash versus Debt history (Fun Trading)

As of December 31, 2021, the company had cash and cash equivalents, including restricted cash, of $1,314 million, down from $2,099 million on December 31, 2021.

Devon Energy exited the fourth quarter with $4.5 billion of liquidity. About 60% of the outstanding debt obligations mature after 2030.

Long-term debt amounted to $6,440 million, down from $6,482 million on December 31, 2021.

Devon Energy's net cash from operating activities for the third quarter of 2022 was $1,911 million compared with $1,616 million in the year-ago period.

The net debt is now $5.13 billion, with a net debt-to-EBITDAX of 0.5x.

DVN Liquidity (DVN Presentation)

Technical Analysis and Commentary

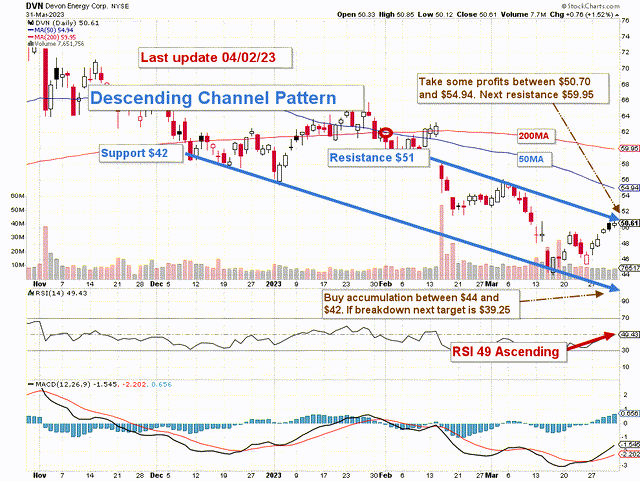

DVN TA chart short-term (Fun Trading StockCharts)

Note: The chart is adjusted from the dividend.

DVN forms a descending channel pattern with resistance at $51 and support at $42.

Descending channel patterns are short-term bearish in that a stock moves lower within a descending channel, but they often form within longer-term uptrends as continuation patterns. The descending channel pattern is often followed by higher prices, but only after an upside penetration of the upper trend line.

The short-term trading strategy is to trade LIFO about 35%-45% of your position and keep a core long-term position for a much higher payday. I suggest selling between $50.70 and $54.94 (50MA) with higher resistance at $59.95 and waiting for a retracement between $42 and $44 with potential lower support at $39.25.

Even if DVN dropped significantly in the past few weeks, I do not recommend selling off your position but taking enough cash out to let you take full advantage of another possible retracement, which is more likely if we are heading to a recession in H2 2023.

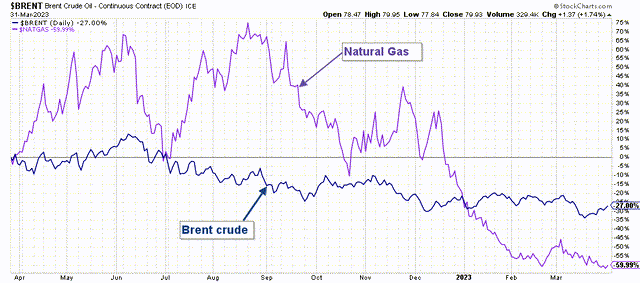

Oil prices have dropped significantly since their peak in June and are still weak despite recovering recently. On the other side, gas prices crashed during 1Q23. Another reason to be cautious and trade a part of your position is waiting for the 1Q23 results, which could be weaker than anticipated.

DVN Brent and NG price 1-Year (Fun Trading StockCharts)

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to "know" the future. No one and nothing can.

Join my "Gold and Oil Corner" today, and discuss ideas and strategies freely in my private chat room. Click here to subscribe now.

You will have access to 57+ stocks at your fingertips with my exclusive Fun Trading's stock tracker. Do not be alone and enjoy an honest exchange with a veteran trader with more than thirty years of experience.

"It's not only moving that creates new starting points. Sometimes all it takes is a subtle shift in perspective," Kristin Armstrong.

Fun Trading has been writing since 2014, and you will have total access to his 1,988 articles and counting.

This article was written by

I am a former test & measurement doctor engineer (geodetic metrology). I was interested in quantum metrology for a while.

I live mostly in Sweden with my loving wife.

I have also managed an old and broad private family Portfolio successfully -- now officially retired but still active -- and trade personally a medium-size portfolio for over 40 years.

“Logic will get you from A to B. Imagination will take you everywhere.” Einstein.

Note: I am not a financial advisor. All articles are my honest opinion. It is your responsibility to conduct your own due diligence before investing or trading.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I trade short-term DVN and have a medium long-term position that I am reducing now.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.