Parker-Hannifin Has Upside Given Diverse End Markets And Strong Fundamentals

Summary

- Parker-Hannifin's valuation does not align with market positioning and growth prospects.

- Geopolitical tensions and continuing rebound of commercial air travel will create a defensive revenue stream.

- Meggitt acquisition will increase Parker's lucrative aerospace aftermarket business.

- Management has track record of integrating acquisition and deleveraging in timely manner to maximize shareholder returns. I assign a target price range of $430-470.

JHVEPhoto

Many areas of the industrial sector have long faced difficulties through economic downturns and uncertainty. However, particular areas within the broader industrial industry provide a haven against these business cycle fluctuations due to the diversity of end markets and the essentiality of their products. For example, the aerospace and defense sector will likely demonstrate resistance due to the ongoing need for national security. And while one could invest in one of these end-market A&D firms, one could also find a company that has exposure to all the resilient markets while offering strong profitability, diverse industry and aftermarket exposure, and sustained dividend growth. Parker-Hannifin (PH) ("Parker") exemplifies one such company, in my opinion.

From agriculture to transportation to A&D, Parker's products find use in numerous end markets. The company has longstanding business relationships with many key players in these industries. With the current macroeconomic outlook remaining ambiguous with ever-present recessionary fears, many industrial firms have revised down top and bottom line projections while seeing subsequent share price drops. In contrast, Parker-Hannifin raised its earnings outlook for FY 2023 in its latest earnings report and has returned approximately 12.5% on a TTM basis compared to -6.3% for the Industrial Select Sector SPDR ETF (XLI). With continued top and bottom line growth, both organically and through recent M&A activity, sustained dividend increases, and defensive end markets, Parker-Hannifin will continue to illustrate efficient operations and prudent management. Add to that Parker's current undervaluation, and this firm stands out as a defensive industrial name with a positive growth outlook.

Heightened Geopolitical Tensions & Meggitt Acquisition Will Spur Aerospace Systems Segment Growth

In 2022, Parkin Hannifin's Aerospace Systems segment contributed about 16% of total revenue. While currently a minority of the revenue stream, this segment's main customers include many major US defense contractors and the two largest commercial aircraft manufacturers: Boeing (BA) and Airbus (OTCPK:EADSF). Concerning the defense names, events over the last 12 months have spurred nations across the world to continue to ramp up military spending as tensions rise, kickstarted by the ongoing War in Ukraine. And beyond the tensions in Europe involving Russia, the United States' growing concern regarding China's potential hostility towards the US or Taiwan will support sustained increases in defense spending and the need for heightened naval and air capabilities.

As the United States continues to spend record dollar amounts on defense, Parker stands to gain as aircraft such as the F-35 stay in high demand, for Parker manufactures the F-35's fuel system and onboard inert gas systems. Furthermore, Parker also has a unique opportunity with its missile business, mainly thermal management systems used in air-launched cruise missiles and the control actuation system in Javelin anti-tank missiles. Since the start of the War in Ukraine, the US has given one-third of its Javelin missiles to Ukraine. This raises a critical national security concern, particularly given the growing tensions between the United States and China. Many government and military officials agree that the US needs to rapidly restock the inventory, supporting the argument that Parker will likely see increased sales for missile-specific parts over the coming years. Note that Parker will grow in all its military end markets due to heightened geopolitical tensions; they also produce key components in naval vessels, helicopters, and UAVs.

Even without international tension, this business has seen rising margins over the past few years and continues to support consistent revenue, albeit growth has lagged behind the Diversified Industrials segment. However, Parker completed its $9.9 billion acquisition of UK-based aerospace firm Meggitt PLC ("Meggitt") in September 2022. This acquisition will allow the firm to expand its exposure to the A&D sector drastically. Over the past five years, Meggitt averaged approximately $2.5 billion in revenue per year. As Parker leverages the acquisition of Meggitt, the firm will see its aerospace segment generate nearly $5 billion in annual revenue, around 30% of FY 2023 full-year revenue estimates. Adding the Meggitt business will provide Parker with more exposure to the defense space, given that Meggitt supplies advanced composites, fuel systems, and weapons systems to military aircraft.

While the Meggitt acquisition will expand Parker's defense exposure, it also boosts the commercial aircraft business. Parker has supplied pivotal fluid and motion controls to Boeing and Airbus for their narrow-bodied aircraft, and Meggitt will expand Parker's exposure to these companies with their wheel and braking systems used in aircraft like the Airbus A321. Meggitt also supplies braking technology for almost all Gulfstream (GD) business jets. This creates another attractive situation for Parker since Gulfstream has lagged in its deliveries over the past two years and needs to catch up. The company delivered only 120 private aircraft last year compared to its target of 124. However, General Dynamics's CEO asserted that Gulfstream should accelerate deliveries, requiring Meggitt-supplied systems and supporting Parker's top-line growth. Gulfstream has over $19 billion in order backlog which will sustain demand for Meggitt-produced parts even as order volume likely declines over the short term with macroeconomic changes. The continued rebound in commercial aviation will support a turnaround in Meggitt's revenue growth, given that commercial OEM and aftermarket sales constitute roughly 51% of revenue.

Looking at Parker's (plus Meggitt's) A&D business as a whole, the company also holds an advantage in its sizeable exposure to A&D aftermarket sales. The rapid expansion in orders for narrow-body aircraft following COVID will sustain the need for aftermarket services and parts as commercial airlines emphasize timely repairs to avoid operational delays. This and the fact that the aerospace aftermarket has strong margins indicate robust demand for Parker's products and higher profitability. And over the short term, airlines will have to continue to service older models of aircraft as Boeing and Airbus still face delayed deliveries due to macroeconomic headwinds. Both these phenomena suggest that Parker will see consistent aftermarket revenue in the commercial aircraft business.

The aerospace business will continue to offer a unique revenue stream and increased profitability, especially in the wake of the Meggitt acquisition. With defense spending worldwide continuing to rise as tension rises between the United States and China and in Europe, this segment of Parker will weather any macroeconomic storm. And as COVID-related issues still ripple through the commercial aircraft industry, Parker stands to gain with aftermarket sales and also as airline manufacturers continue to work through large order backlogs.

Parker as a Whole Continues to Deliver Strong Profitability and Margin Expansion

Unlike industrial firms that sell more direct-to-consumer, which have significant exposure to changes in the business cycle as commercial activities slow during a recession, Parker offers essential parts in essential industries like life sciences and agriculture. These industry exposures, along with its broader diversification, have allowed Parker to sustain revenue growth even through broader pullbacks (or anticipation thereof). In the Q2 2023 earnings (Feb 2023), management reiterated a 6-8% organic sales growth target for FY 2023. Despite persistent recessionary concerns and interest rate increases, this ambitious guidance demonstrates management's confidence in top-line gains, aided by the $10.5 billion backlog that the company will capitalize on despite short-term order declines.

Furthermore, Parker will continue to expand its margins as the Win Strategy continues to spur cost savings and operational efficiencies. As part of the strategy, Parker hopes to establish itself as a market leader in each subindustry, driving additional profitability as the company leverages its economies of scale. The Meggitt acquisition exemplifies this strategy in action as Parker has doubled its sales exposure to the aerospace and defense market, primarily in the high-margin aftermarket business.

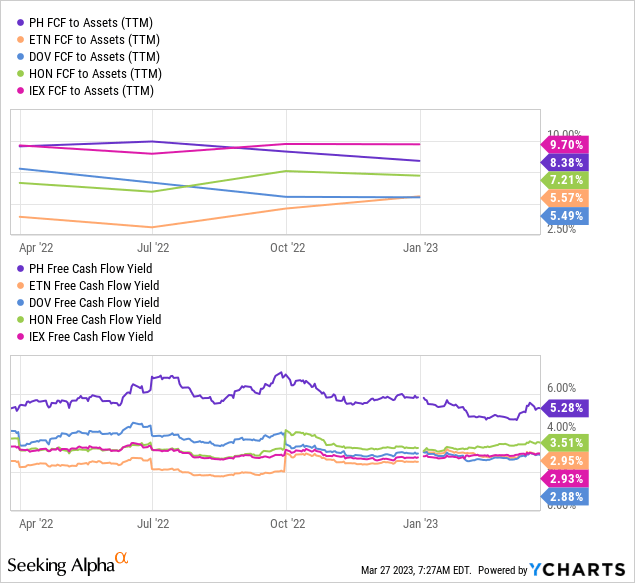

All of these positives, in my view, work in conjunction to give Parker a competitive edge compared to its competitors, mainly Eaton Corp. (ETN), Dover Corp. (DOV), IDEX Corp. (IEX), and Honeywell International (HON). Over the LTM, Parker demonstrated an EBITDA margin of 21.3%, similar to that of its peers. Given Parker's recent acquisition, this figure likely contains growing pains as the company works to synergize the $9.9 billion company into its operations. However, Parker has demonstrated superior efficiency in its free cash generated for shareholders, as reflected in their greater FCF yield (market cap / FCF * 100). In addition, the company also has maintained high efficiency in generating free cash relative to its peers, which facilitates shareholder-friendly activities.

In addition, Parker has stated that in alignment with the Win Strategy, the company will correct for the underinvestment in CapEx following the Meggitt acquisition. In the future, capital spending will be on modernizing existing operations and increasing efficiency through automation and digitization, which fuels margin expansion and promotes higher profitability. Parker can also leverage the long life cycles of its products to allocate a majority of spending towards optimizing operations rather than constantly innovating products to keep its competitive advantage.

Valuation Does Not Reflect Strong Business Drivers and Management's Performance

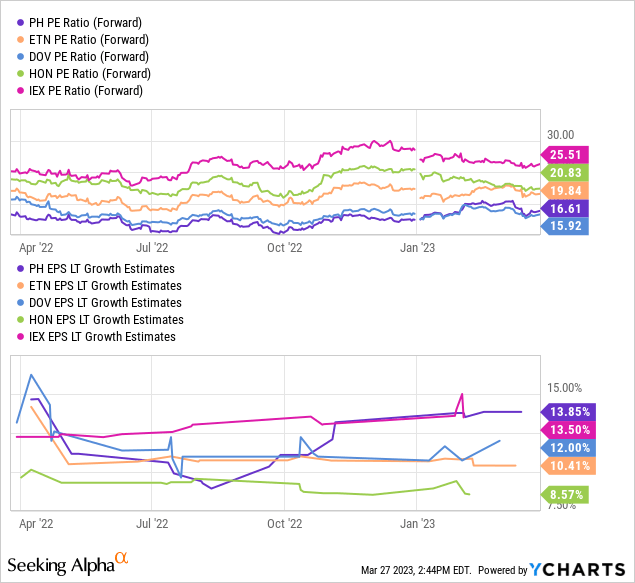

Despite Parker's business looking more resilient and robust as they grow organically and through strategic acquisition, its valuation does not align with these phenomena. As shown below, Parker trades near 16.4x forward earnings despite maintaining the most substantial forward earnings growth compared to its immediate peers. With Meggitt growing the stable aerospace aftermarket business and the Diversified segment continuing to lead margin expansion, I have little worry that Parker will not show earnings growth over the coming years.

There are some reasons why the market is still undervaluing Parker relative to its peers. For one, the company's acquisition of Meggitt has raised the gross leverage profile to close to 3.8x while its peers maintain modest leverage in the range of 1.8-2.3x. This increased leverage does introduce elevated credit risk over the near term, as evidenced by the negative watch at S&P, Fitch, and Moody's. Thus, Parker's lower multiple could reflect increased concern about the company's ability to synergize the Meggitt acquisition, particularly in the wake of higher interest rates and an unfavorable macroeconomic outlook for 2023 and into 2024. However, this should be of little concern, for Parker's management has a successful track record of integrating acquisitions and deleveraging. For example, the 2017 acquisition of Clarcor by Parker increased exposure to the filtration aftermarket which provided both stable revenue generation and improved profitability due to the higher margins in aftermarket sales. Additionally, Parker decreased gross leverage from 3.3x in 2017 to 2.0x the year following the Clarcor purchase. In the most recent earnings call, management committed to using 100% of the cash generated in the second half of this year (>$1 billion) to pay down debt. The company's commitment to preserving the health of the balance sheet will support a higher valuation and increased shareholder givebacks via sustained dividend growth.

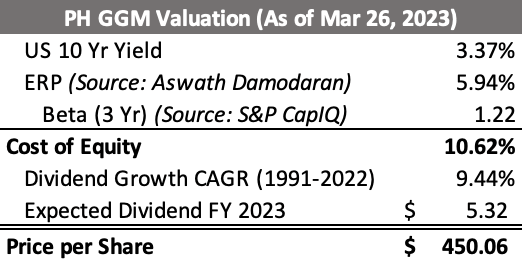

Thus, given the positive track record of the company plus the optimistic outlook, the 16x forward multiple does not convey the company's trajectory. Compared to IDEX, which has a similar long-term EPS growth trajectory and similar diverse customer base, I like Parker's share price in the range of $430 to $470 per share given IDEX's relative valuation and assuming a forward P/E for Parker between 22x to 24x. Given that Parker has increased its dividend for 66 years straight, the Gordon Growth Model also gives a ballpark estimate of the per-share value of around $450 per share (the assumption to use a longer period to estimate the average dividend growth accounts for the relatively slower growth near the beginning of the period and the faster growth near the present day, providing a more accurate approximation for the dividend growth in the future).

Parker-Hannifin Dividend Growth Valuation (Aswath Damodaran Country Default Spreads and Risk Premiums, S&P CapitalIQ Pro)

While this value should only be taken as a rough estimate, there is no question that Parker should carry a higher share price than current trading suggests. The company maintains far too strong a position not to have adequate growth stability and profitability priced in, which leads to my belief that the company still has upside.

For All the Optimism, Parker Must Deliver on Expectations

Parker has a lot going for it; however, the company must still execute promptly and efficiently. Looking at the Meggitt acquisition, Parker will benefit from doubling its aerospace revenues and gaining additional exposure in the A&D aftermarket; however, Meggitt had shown weakness leading up to the purchase. Revenues for Meggitt declined in 2020 and 2021 as the company was hit exceptionally hard by COVID. While Parker has a history of capitalizing on its acquisitions, Meggitt presents a unique challenge that Parker must solve to leverage the business.

Furthermore, while certain aspects of the business hold up relatively well during recessionary periods, Parker is not immune to the business cycle and could still miss the top-line growth projections. For example, its products sold to agricultural customers could see short-term sales declines depending on how much crop prices experience a drawdown during economic slowing. The same phenomenon applies to their transportation end markets as users experience lower demand as the consumer reduces discretionary purchases. This presents a near-term risk as Parker navigates a weaker market while deleveraging its balance sheet.

The Bottom Line: Parker is a Winner

Good companies make good investments at the right price, and Parker-Hannifin is one of those companies. Given the track record of success from the Ohio-based industrial conglomerate, investors should have faith in Parker's ability to internalize the Meggitt acquisition and leverage its strong and diverse end markets to protect from a macroeconomic downturn. The company's portfolio of essential industrial products with long life cycles gives Parker a platform for growth. On a shareholder basis, the company routinely increases its dividend while maintaining efficient cash generation to maximize shareholder returns. And with the company focusing on internal growth moving forward, Parker will utilize its over $2.4 billion in operational cash flow per year to streamline operations, boost margins, and generate additional shareholder returns.

So, any potential investor should see two key opportunities in Parker. One, the company will continue to grow its dividend; so, at a minimum, Parker offers an excellent option for reliable and growing dividend income. Second, and building off the first, the company has considerable upside from its current price. The market has yet to fully grasp Parker's potential with its current market positioning and strategy, and I am confident the company will continue to generate lucrative returns.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PH, BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.