Ares Commercial Real Estate: A War God's Office Loans

Summary

- With office real estate in the spotlight, I look at another commercial mortgage REIT with a high office allocation: Ares Commercial Real Estate.

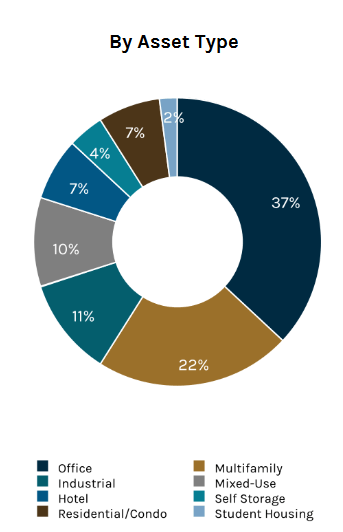

- Ares has 37% of their loans backed by office properties. Investors might be curious how these loans are impacted.

- I'll take a look at their office book and review some subsequent events to gauge how big of an impact this is for the company.

- Overall, I'd suggest caution.

- Microcap Review members get exclusive access to our real-world portfolio. See all our investments here »

Actual image of a 2023 office. Darko1original/iStock via Getty Images

Continuing along my run of reviewing REITs lately, today we’re looking at another commercial mREIT: Ares Commercial Real Estate Corporation (NYSE:ACRE). There’s been a fallout in stock prices with commercial mREITs as fears from the banking crisis have investors looking for other areas of concern.

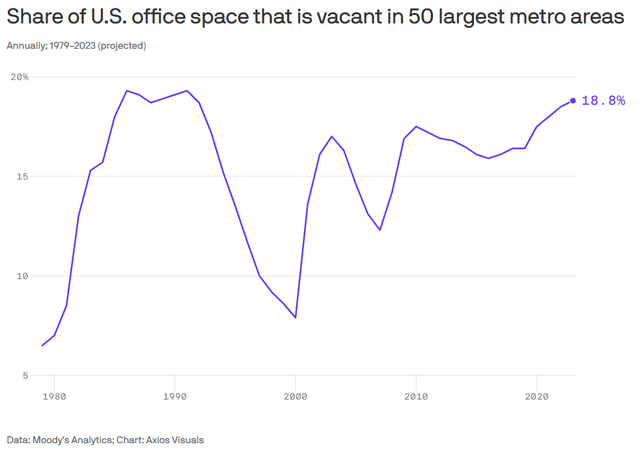

One of those is commercial real estate with office properties particularly in the cross hairs lately. The work-from-home trend catalyzed by the COVID-19 pandemic has radically changed the office environment from just a few years ago. Today we are looking at national office vacancy rates of 16.5% according to Commercial Edge’s data with that number climbing steadily over the last three years. Axios data pins vacancy rates at 18.8% which are the highest levels since the savings and loan crisis in the 1980s.

Axios: U.S. Office Vacancy Rates

Which brings us back to ACRE. Their loan portfolio has an outstanding balance of $2.3 billion and 37% of that is wrapped up in office. It represents around $851 million of their assets.

Q4 Investor Presentation: Asset Type Allocation

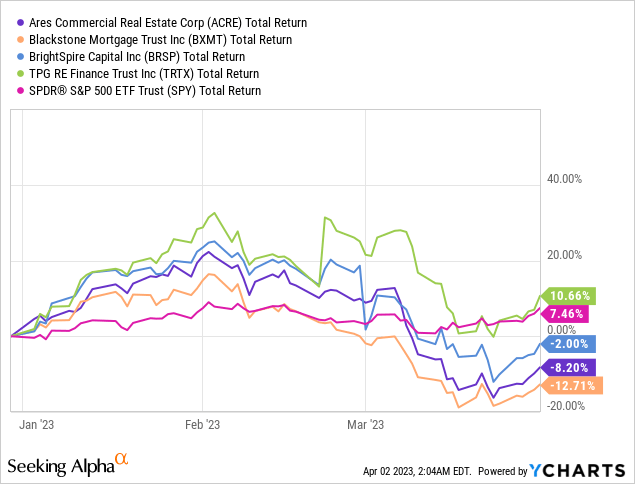

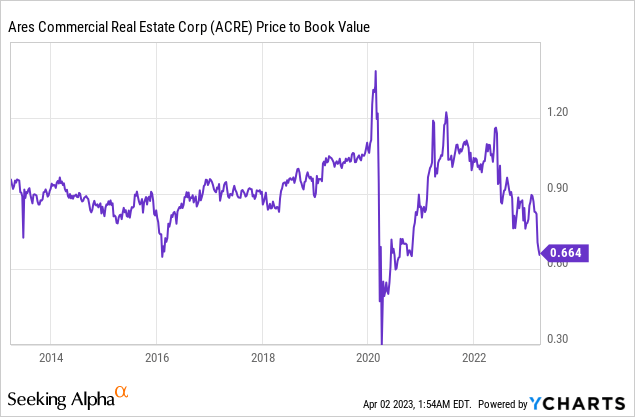

The stock of ACRE has paid the price for this allocation lately along with a number of other mREITs.

Morningstar has ACRE’s five-year average P/B at 0.94x. Currently the stock trades at a P/B of 0.66x which is the lowest it’s been since 2020 and it’s rarely touched over the last ten years.

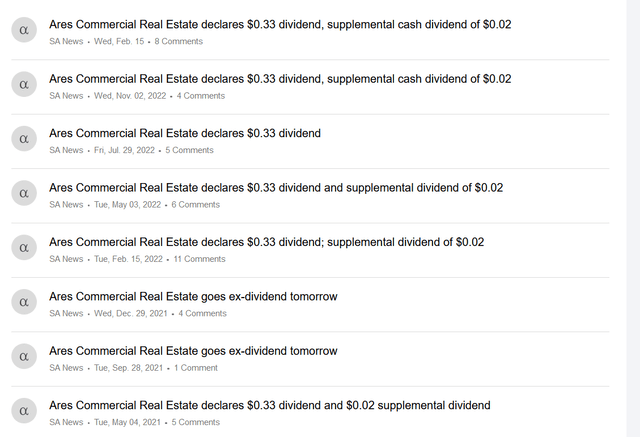

So, on the one hand, we have fear of office catastrophe hanging over the price of ACRE’s stock. On the other, we have historically low P/B valuation and a 14.52% annual dividend yield being offered currently. The dividend should have just paid out and it included a small ($0.02) supplemental dividend as well suggesting management is comfortable with their coverage. It’s part of a larger trend where the company has paid a supplemental six out of the last seven dividends.

Seeking Alpha: ACRE Dividend News

Let’s look a little more closely at the company’s office exposure and current situation to gauge this opportunity.

ACRE’s Office Loans

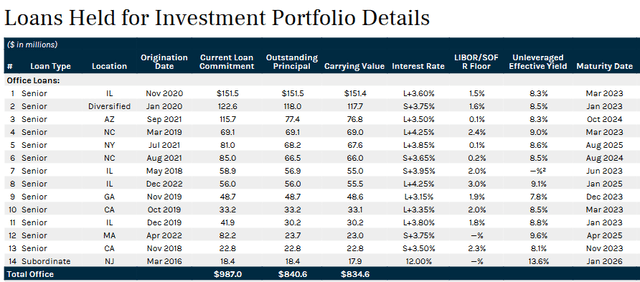

The company maintains a total of 60 different loans – 14 of these are office loans (23%). Eight of these loans are maturing this year which have a total carrying value of $527.8 million. For reference total equity value is around $748 million and the market cap of ACRE sits at $496 million.

Q4 Investor Presentation: Office Loans

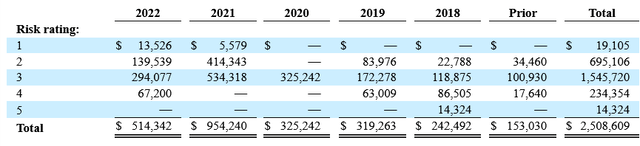

From the onset we can acknowledge that in the last earnings call management provided the data point that 99% of their contractual interest was collected in the quarter. They announced that one office loan was downgraded from a 3 to a 4 risk rating “due to our outlook on their respective business plans and our macroeconomic view of their respective submarkets.”

According to their 10-k a 4 risk rating is defined as “High Risk/Potential for Loss: Asset performance is trailing underwritten expectations. Loan at risk of impairment without material improvement to performance.”

Management revealed during the call that subsequent to the quarter’s end they’ve seen three maturity defaults. Only one of these was an office property; the other two were mixed-use properties. The office loan is #11 on the list above in Illinois which had a maturity date in January. Their 10-k noted that the unpaid principal balance on this loan is $27.2 million.

Loan 2 also had a maturity date in January 2023 so should be represented in the next quarterly updated as either resolved or not. This loan represents $117 million. Three more loans were expected to mature in March 2023: loans 1, 4, and 10. These loans total to $254 million in carrying value.

Analyst Stephen Laws asked management about some of these loans with upcoming maturities to which management gave very little information in response. But if we go back to their q3’22 call CFO Tae-Sik Yoon gave a bit more color about upcoming maturities in the office space.

“So I think we absolutely deal with each situation differently. I think if you look at our historical practice, we have been very working, again very closely with each borrower to make sure we give them every opportunity to continue to meet their business plans. I'd say most often, we have asked for some level of concessions in order to provide an extension of their loans, right? Whether that is some sort of fee? Whether that's an increase in the interest rate? And probably most often some material contribution of additional equity capital to show their continued sponsorship in the deal.

But again, our goal is to continue to work with each of our borrowers to give them every opportunity for success. We want them committed, both from an effort perspective, as well as capital perspective. At this point, I would say there are situations where, again, it's ongoing discussions. I don't think we have situations where we have borrowers ready to throw us the key, if you want to call it that way. But certainly, borrowers do behave as an economic animal, and we do understand the situations in which they may be motivated to do so. And so again, we evaluate each of these situations very uniquely, individually. It depends on the borrower, it depends on the building, it depends on the submarket, it depends on so many different situations that it's hard to give a generic response. But again, I do think we do work very closely with each borrower to make sure that we have the best solution for us and for them.”

I don’t think management would have mentioned seeing keys returned if it wasn’t a real possibility. That said I think it is likely that there will be some haircuts across these loans.

Kevin Fagan, head of commercial real estate economic analysis at Moody’s Analytics, estimates that another 20 percent price correction needs to happen in office. We can apply this 20% correction estimate to the troubled loans above for how this might come through the balance sheet. Carrying value for all five loans (1, 2, 4, 10, and 11) equals $398 million. Twenty percent of that would represent a $79.6 million haircut.

We should consider the other two mixed-use properties as well which saw maturity default. These loans have a total outstanding principal balance of $111 million. And for the sake of simplicity, we’ll apply a 20% haircut on these loans as well which is $22.2 million.

That brings our estimate to a total of $101.8 million that may be written down on these loans. Total equity value of $748 million means that this theoretical haircut represents 13.6% of book value.

The company has a current expected credit loss reserve of $71.3 million which would cushion some of this. But readers can imagine what this might look like if we're not just talking about five office loans. If we apply this 20% haircut to their entire office allocation at $834 million carrying value the decline would be $167 million.

What concerns me as well is that management seems to have missed the credit risk on the two mixed-use properties which defaulted subsequent to the quarter end. Going back to the quarter prior neither of these loans were listed above a 3 risk rating – meaning they moved from being “Medium Risk” to defaulting in just one quarter. They only had $67 million in carrying value at a risk rating higher than 3 back in November 2022.

Turning around and announcing $149.1 million in defaults does not reflect well on their risk assessment. That makes me wonder if there’s not more to be concerned about.

Shrinkage in the Portfolio and in Earnings

Over the year, ACRE saw the carrying amount of their portfolio decline by 6.2%.

2022 Portfolio Carrying Amount | $2,264 |

2021 Portfolio Carrying Amount | $2,414 |

Only one new origination was made in the last quarter which was a $56 million loan. Guess what sector it’s in? Office. So management doesn’t seem too concerned about office that they aren’t willing to allocate more capital towards it.

That shrinkage is just what’s on the books so far and does not include the haircut implied by the $149 million in defaults they’ve already announced. Add on top of this the other four office loans which have passed their maturity date and I think you can see why I expect further declines in their portfolio carrying value.

Loans on non-accrual were $45 million as of their last report which did not include the $150 million that just defaulted. So that means around $195 million in loans could be thought of as not paying out anything this quarter. Weighted average yield on the portfolio is 8.9% so we can use that to estimate how much this might impact net income.

Annual yield on these loans would be around $17.4 million or $4.3 million a quarter. Distributable earnings in q4’22 came in at $23.9 million – which means that these loans being non-accrual represents about 18% of their earnings. Adjusting this downward we can estimate quarterly earnings of $19.6 million.

Even with this estimate of $19.6 million their other four office loans that have matured will likely cut into these earnings. Every quarter ACRE is paying out $0.33 per share as a dividend. If they only earn $19.6 million a quarter with 54.6 million shares outstanding then distributable earnings would be $0.36 per share. Dividend coverage at that level would be 109% which seems pretty thin especially in a climate of impending maturities, challenging originations, and credit tightening.

Moving forward management will need to both balance their maturing loans with originations to ensure the portfolio does not continue to shrink.

For A Comparative Analysis

Back in March I produced an article on ACRE’s peer Blackstone Mortgage Trust (BXMT) which faces some of the same perils with their high loan allocation towards office properties. I included a peer analysis table in that article which I’m updating here to include ACRE. The other two peers are BrightSpire Capital (BRSP) and TPG RE Finance Trust (TRTX). I’ve written separately about each here and here.

($ in millions except per share values) | ||||

Price as of 4/1/2023 | $9.09 | $17.85 | $5.90 | $7.26 |

Number of common shares | 54.607 | 172.284 | 128.872 | 77.41 |

Market value of common shares | $496 | $3,075 | $760 | $562 |

Debt | $1,739 | $20,158 | $1,824 | $4,160 |

Total Capitalization | $2,235 | $23,233 | $2,584 | $4,722 |

Total Equity | $748 | $4,544 | $1,389 | $1,121 |

Book Value per Share | $13.69 | $26.38 | $10.78 | $14.48 |

Revenue | $173 | $1,339 | $364 | $306 |

Distributable earnings | $81 | $494 | $126 | $84 |

Distributable earnings per share 2022 | $1.48 | $2.87 | $0.98 | $1.08 |

Distributable earnings per share 2021 | $1.55 | $2.62 | $0.87 | $1.09 |

Distributable earnings per share 2020 | $1.36 | $2.48 | $1.01 | -- |

Distributable earnings per share three-year average | $1.46 | $2.66 | $0.95 | $1.09 |

Current dividend per share | $1.32 | $2.48 | $0.80 | $0.96 |

Ratios | ||||

Dividend yield | 14.52% | 13.89% | 13.56% | 13.22% |

Dividend yield on book value | 9.64% | 9.40% | 7.42% | 6.63% |

Distributable Earnings / Dividend | 1.12 | 1.16 | 1.23 | 1.13 |

Price / Book | 0.66 | 0.68 | 0.55 | 0.50 |

Price / 3-year distributable earnings | 6.21 | 6.72 | 6.19 | 6.69 |

Distributable Earnings / Revenue | 46.69% | 36.93% | 34.70% | 27.32% |

Return on Equity | 10.80% | 10.88% | 9.09% | 7.46% |

Current Assets / Current Liabilities | 6.76 | 1.32 | 1.87 | 4.99 |

Debt / Equity | 2.33 | 4.44 | 1.31 | 3.71 |

What stands out to me is ACRE’s strength in profitability and relatively small debt profile. As we noted earlier, there may be pressure on earnings moving forward though which makes the above average dividend yield compared to book value suspect. Investors here would be wise to monitor this position closely as the year unfolds.

Investor Takeaways

Ares Commercial Real Estate has some turbulence ahead given their outsized allocation to office properties. A number of these loans face maturity this year which will require management to effectively navigate what are sure to be a number of hard negotiations. My expectation is a number of these loans will be written down.

Management thus far has failed to predict credit risk issues fully. This leads me to suspect greater risk moving forward than they've communicated. I would think their CECL reserve will need to increase as a result. And while damage is being done to the asset side of the equation, earnings are going to be at risk as well.

Their low debt-to-equity ratio compared to peers should help them somewhat navigate this cycle, but I expect there is more pain to come. With shares trading at a historically low valuation there’s a lot of this priced though we face a multitude of uncertainties these days. The dividend that was just paid out may give investors some comfort, but overall I’d remain cautious.

---

Microcap Review is a service offering multiple microcap stock picks a month.

We subscribe to the first rule of investing, "Do not lose money," by seeking a discernible margin of safety in investments.

I believe small and microcap stocks, as well as special situations, are the best place to look for value in the markets, as most people overlook these companies, making them more likely to be mis-priced.

Join now to get exclusive research!

This article was written by

Always open to questions and dialogue as I believe it only serves to improve us all.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BRSP, TRTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.