Ares Capital: 10.5% Yielding BDC For You And Me

Summary

- When we last wrote about ARCC, it was trading 9% higher than today and Q4 results weren't yet released.

- Guarantees don't exist, but we don't need them. Once the odds are stacked heavily in our favor, it's just a matter of playing the game.

- Ares Capital is a giant with a $21+ billion portfolio and investment grade credit rating. Q4 results were extremely strong, and we expect a dividend increase soon.

- I've been investing in BDCs for a long time. In most years, there is a short (e.g. 1 month) window with extremely good deals. This is one of those rare times.

- Volatility is not your enemy. If you let it, volatility can be your best friend.

- This idea was discussed in more depth with members of my private investing community, iREIT on Alpha. Learn More »

Jonathan Kitchen/DigitalVision via Getty Images

This article was co-produced with Williams Equity Research.

Ares Capital Corp. (NASDAQ:ARCC) is today's focus. ARCC is one of the most popular Business Development Companies ("BDCs"), and for good reason. By many metrics, its performance is at or near the top of the sector.

As a reminder, BDCs dominate the loan market to private U.S. companies. Like most institutional lenders, BDCs issue floating rate loans instead of the fixed-rate that most consumers are used to with their cars and homes. This allows their interest income to rise (or decline) alongside interest rates.

This has helped many BDCs achieve record or near record earnings in recent periods. BDCs also use a common derivative called a "floor" to establish a minimum interest rate no matter how low interest rates go. That's how they survived the past low interest rate environment.

Yet despite this strong performance, BDCs are also treated as "high yield" and therefore "high risk" by the market. This can create a lot of excess volatility during periods of heightened uncertainty.

As someone who has invested in BDCs for about 15 years now, and researched them professionally in past roles, I've seen how this plays out. Normally, BDCs sell off aggressively as the market goes "risk off" as we saw in late 2018, Q1 of 2020, and like has occurred (although not severely) several times in the past 12 months.

BDCs, however, do not have the cyclical financial performance that their stock prices suggest. This is a good combination if you know how to play it.

2020 is a great example. We rank BDCs as Tier 1 through Tier 3 internally with Tier 1 being the best. Not a single Tier 1 BDC cut its dividend during the pandemic. A lot of REITs and traditional C-Corp dividend paying stocks are envious of that track record. And Tier 1 BDCs are not rare.

Of our active coverage universe, 9 are Tier 1, 9 are Tier 2, and 5 are Tier 3. You can find these in the Ratings Tracker by checking the box for Business Development Companies. Tier 1 are on the far right.

BDCs, like most companies, are vulnerable to full-blown financial crises or extremely deep and long recessions. A 2008-style recession (once in 50 to 100 years) results in loan defaults and massive realized losses in the sector. Poorly managed BDCs could be susceptible to loan losses in less severe circumstances.

I authored an article on iREIT on Alpha on ARCC in January 2023. At that time, ARCC was trading above $19. Since then, the stock has moved down to $18 per share and Q4 earnings were reported on February 7th. There has also been the small development of a banking crisis.

Seeking Alpha

Strategy & Portfolio

ARCC is not internally managed. Instead, Wall Street heavyweight Ares Management (ARES) performs all the day-to-day tasks. Ares has $352 billion in assets under management ("AUM"), making it one of the largest in the business.

It's best known for its credit business, which includes ARCC. I (WER) personally own shares of both ARCC and ARES. This is a true "win win" if you like both companies, since ARES also makes profits off ARCC that grow when it does a better job as manager.

This sector makes mostly floating rate loans to private companies. They don’t lend to public companies because they already have good access to debt. The interest rate private companies must pay is usually twice as high, which is the core of why BDCs can pay such high yields to investors.

And if the BDC is careful about who it loans to, private companies aren’t necessarily at any higher risk than public ones. There are at least 10x as many private companies as public in the U.S., so there are plenty to choose from if the manager is skilled.

Senior secured loans, which are the kind BDCs originate, also have much better terms for the lender than normal loans. They often require the borrower to send them monthly financial data and have the ability to shut down the borrowers’ bank accounts if certain loan provisions are triggered.

That's like a bondholder for Altria (MO) being able to stop them from making dumb acquisitions like JUUL. Wouldn't that be nice?

Ares Capital Corp

This chart shows important data on ARCC's portfolio. 43% of the company’s loans are first lien senior secured. First lien is code for “first to get paid.” 18% of the portfolio are second lien senior secured loans.

These are next in line if the company is liquidated. Provided underwriting standards are normal or better, it is exceedingly rare that both first and second lien loans are not paid back at least 90%+ of the original loan amount. I’ll share data on that soon.

The rest are subordinated loans and small allocations to equity and preferred equity. Many retail BDC investors think they want a portfolio of only first and second lien loans. That does create the most reliable cash flow stream.

In truth, they don't. Without a healthy sleeve of equity positions, the BDC will have a tough time holding the net asset value ("NAV") steady or paying special distributions.

It isn't coincidence that the best performing BDCs tend to have 20-30% equity. That includes ARCC, Main Street Capital (MAIN), and NewtekOne (NEWT) before it switched to a bank. For those looking for the pure-play loan BDCs, Golub Capital (GBDC) and Owl Rock Capital Corp. (ORCC) are great choices.

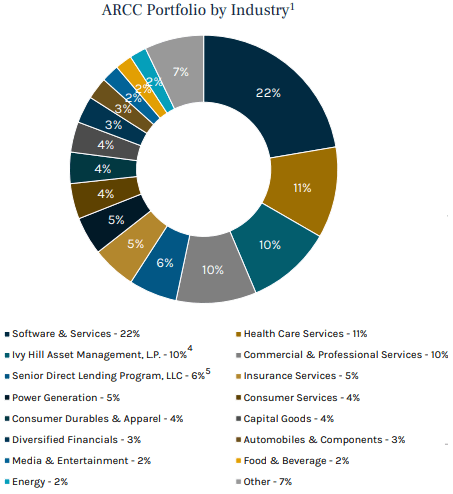

ARCC's portfolio is valued at over $21.8 billion. Ares' huge scale allows it to find quality loan opportunities among many companies and industries. That's how it achieves an average borrower concentration of less than 0.5%.

This makes ARCC arguably the most diversified BDC. If you were wondering how ARCC and its top-quality peers all made it through the "small business apocalypse" that was 2020 unscathed, that's how. Extremely diversified exposures across economically insensitive industries like enterprise software and healthcare is the recipe.

Ares Capital Corp

Ares Management has one of the best credit track records of any investment manager. Ares also has a very solid Plan B if a loan doesn't go to plan. It almost always recovers the loan principal. Since ARCC's inception, Ares has managed losses of <0.10% on its first lien loans. That’s one tenth of one percent. A rounding error.

Ares Capital Corp

On its second lien and subordinated loans, it's <0.20%. The broader senior loan market is 0.9%. Ares' performance is about nine times better than the industry average.

And the industry average is still far superior to high yield bonds. ARCC's loan performance is more in line with mid-investment grade bonds. Yes, the ones that yield half that (or less) of ARCC's loans.

Cash Flow & Dividend

Q4 earnings per share ("EPS") beat the $0.56 consensus estimate handily and came in at $0.63. Net investment income ("NII") was $0.68 per share compared to $0.52 in Q4 2021. That's 1.31x distribution coverage on a double-digit yielding company. Not bad. 1.1x distribution coverage is generally considered sufficient for a quality BDC not facing elevated expected loan losses.

On top of the strong cash flow generating, ARCC booked $0.05 per share in realized gains.

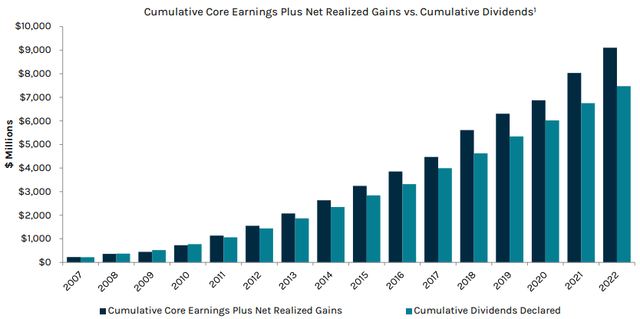

ARCC now has 13+ years of stable or increasing common dividends. ARCC IPO'd right before the Great Recession, and it wasn't an easy ride. Back then, ARCC didn't have the balance sheet size or investment grade credit rating that it does now.

In fact, the BDC industry was in its infancy when ARCC debuted. These days, there are about a dozen very high quality BDCs sporting investment grade credit ratings and well diversified multi-billion-dollar portfolios. The story is similar for other publicly traded "alternative investments" like Real Estate Investment Trusts ("REITs").

ARCC common stock pays a 10.75% yield at today's pricing around $18 per share. BDCs generally have high yields, but that's 10-20% higher than normal.

Believe it or not, the 10.75% yield isn't the most surprising part. It's the fact ARCC could easily increase its dividend thanks to that strong Q4 performance.

Ares Capital Corp

Earnings over time have increased even faster than dividends.

Higher interest rates are likely to continue to improve ARCC NII, and subsequently distributable cash flow. I think Q1 and potentially Q2 2023 will also be record quarters. It's nice to have a few investments in every portfolio that benefit from higher rates.

Balance Sheet & Risk

ARCC, alongside Owl Rock Capital Corporation, has leveraged its massive balance sheet and Wall Street acumen to build a well-rated company. Its investment-grade BBB credit rating (per Fitch) is tied with the best in the sector.

Ares Capital Corp

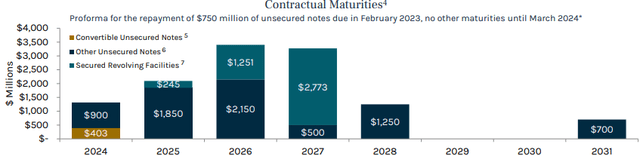

ARCC doesn't have any maturities remaining for 2023. It does have about $1.3 billion due in 2024, $2 billion due in 2025, and another $3.4 billion in 2026. To understand the risk associated with this, we need to take a stroll through the bond market.

FINRA

Now, we can see the actual bonds that are summarized in the previous chart from ARCC. Looking at the 2024 and 2025 issues, they have yields-to-maturity ("YTM") between 5.992% and 7.197%. This is the data point we are looking for.

It shows what the yield would need to be on a new bond for investors to purchase them. We can see the original coupons in the "Coupon" column. That ranges from 2.150% to 4.625%. These were intelligently issued when interest rates were very low.

What does the bond market tell us? Fixed income investors are not worried about ARCC's ability to pay off or refinance its bonds. If it were, the bonds' YTM would be much, much higher (at least 10%). While it'll be more expensive to issue debt than in the past, it's due to the higher interest rate environment, not perceived higher risk with ARCC. That's the best we can hope for.

It does mean that the current “Goldilocks” period for ARCC will not last forever. Right now, ARCC benefits from mostly fixed-rate debt at low interest rates coupled with higher interest rates on its loan portfolio. That’s the formula for record earnings.

In 1-2 years, that margin will be squeezed as it is forced to refinance debt at rates 2-3% higher than the debt that’s maturing. That’ll reduce its earnings back to “normal” levels. If rates decline as expected before or during that time, the “squeeze” may not be as noticeable from a cash flow perspective.

ARCC 10-K

Let's talk about risk grades. 4 are the lowest risk (the loan and portfolio company are doing better than expected) and 1 are the highest risk (principal loss and or missed interest payments anticipated).

At the end of 2022, the weighted average rating was 3.2 compared to 3.1 for the end of 2021. Those are both good metrics for any BDC. Loans in the worst category of 1 were 0.5% of the loan portfolio. That’s also a great figure.

Loans on non-accrual were 1.7% of total investments/1.1% of fair value and 0.8%/0.5% at the end of 2022 and 2021, respectively. Loans on non-accrual are those with some kind of problem.

It doesn't necessarily mean ARCC will lose principal value, but it does mean there is a low probability the loan will meet original expectations. In practice, this usually means missed interest payments or payments made with PIK (equity) instead of cash.

For context, loans on non-accrual were 2.0% of fair value at the end of 2020 (worst year of the pandemic and peak lockdowns) and 0.9% at the end of 2019 (a very good economy).

So, ARCC's problematic loans are in line with 2019's figures and half that of 2020's.

Conclusion & Valuation

A lot of retail investors make the mistake of using a chart to gauge whether an investment has been successful. ARCC's cumulative shareholder return since its inception in 2004 through the end of 2022 is just under 650%. The same statistic for the S&P 500 index is about 350%.

ARCC hasn't just beaten the S&P 500 index, it smashed it. The typical stock chart doesn't show the 10%+ in regular and special dividends that ARCC throws off year after year. Nor does the holding in your brokerage account unless you select to reinvest dividends.

On the surface, charts make it looks like ARCC hasn't done much at all. Investors using that as their gauge are doing themselves an immense disservice.

If I had to pick two keys to investing in BDCs, the first is quality. Choosing the highest quality BDCs alone puts you on a path to success. The second is staying disciplined regarding valuation. I estimate people can approximately double their return, and with less risk, by being an active BDC investor rather than passive.

The most reliable way to achieve the second key is assessing discount or premiums to NAV compared to historical valuations for a given BDC.

Let's work through this for ARCC. Historically, ARCC has traded at a premium of 1.15-1.25x or a 15-25% premium. The most recent NAV was $18.40 per share. Against today's share price around $18, that's a 2-3% discount to NAV.

This is the time when the return profile of a quality BDC becomes exceptionally compelling. If we assume an exit point at the midpoint of a 20% premium, that's a $22.08 share price. For context, ARCC traded above $22.50 in April 2022 when its earnings and dividend were lower than they are today.

If we assume that takes 12 months to achieve, that's a 33.3% target total return without any increases in the common dividend or special distributions. I think dividends will increase during that period.

And if it takes longer, you are sitting on a nearly 11% yield on cost with strong distribution coverage. For context, that's better than to the S&P 500's 20-year annualized return of 10.33%.

We consider ARCC stock a Strong Buy below the NAV of $18.40. If you are worried about volatility, consider buying in 2-3 tranches over time.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Get My New Book For Free!

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, and we recently added Prop Tech SPACs to the lineup. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 15,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 108,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of ARCC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.