Veris Residential: Likely To Decline Further

Summary

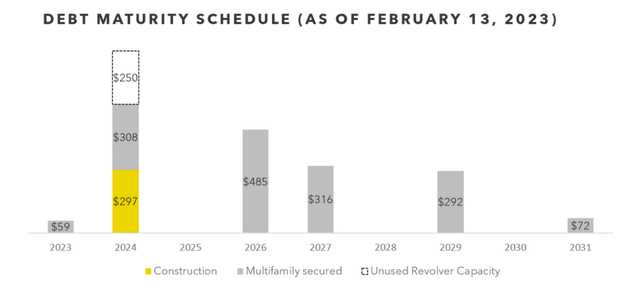

- The company has almost $600 million in maturities for 2024 with EBITDA of just $145 million.

- There is an expected FFO drop in 2023 from $0.89 to $0.44.

- The company still owns 3 million sft of office space with 67% occupancy.

Editor's note: Seeking Alpha is proud to welcome Deep Value Explorer as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Konoplytska/iStock via Getty Images

Investment Thesis

Due to troubles with a shift to a strictly residential portfolio, debt maturities in 2024, and a low current FFO compared to its peers, Veris Residential (NYSE:VRE) is greatly overvalued.

Overview

Veris Residential (VRE) is a mostly residential REIT with about 7,500 units in the North-East of the United States, primarily in the Greater NYC area. They tend to focus on the new higher-end rental units with an average age of just 6 years and an average monthly rent of $3,482, about 20% above competitors such as AvalonBay (AVB) or Equity Residential (EQR). The company used to be called Mac-Cali REIT and owned a diversified portfolio of properties (residential, office, and hotel) however, years ago management made a strategic decision to shift their focus and move to a much safer pure residential portfolio.

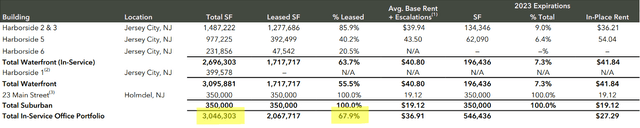

This transition is still underway as the company still owns about 3 million sft of office space in New Jersey (see table below) that it has to sell in order to finalise the transition. Unfortunately for VRE, the market is absolutely hating office exposure, especially in NYC, so the disposal of the rest of their office portfolio at a reasonable price may prove difficult. This is reiterated by a very low occupancy of just 67%.

Veris Residential 2022 Results

As confirmed by 2022 results, the company made solid progress on its goal of selling all non-strategic assets as they closed over $800 million worth of transactions and fully exited the hotel segment. Going forward the company has an agreement in place to sell Harborside 2 & 3 which is their largest office property. The agreed price for the property is $420 million or $280 per sft. With in-place rent of $36, this translates into a cap rate of 8.6%. That's very high and confirms my worry that now is not the time to be selling office properties, especially not distressed ones with low occupancy. It seems that management is determined to make the switch to a purely residential portfolio at any price - even if it means selling their office space for 50 cents on the dollar.

Looking at their residential portfolio performance, the results have been quite good. Their same-store NOI increased by 12.6% in 2022, resulting in a core FFO of $0.89 per share. Going forward management didn't provide any guidance as performance will depend greatly on their ability to execute on there disposal plans. Analysts are expecting a large drop in FFO in 2023 to around $0.44 daily as a result of a loss on the disposal of assets, an increase in their office vacancy, and an increase in interest expense.

Balance Sheet

The balance sheet also paints a pretty scary picture. The company has a debt of $1.9 billion. This translates into a net debt/EBITDA of 13.3x and an interest coverage ratio of 1.5x. With operation income forecasted to decline over the course of 2023, the company will likely struggle to keep its interest coverage ratio above 1x. With regards to debt maturities, the company only has $59 million of debt due this year. That likely won't be a problem, but in 2024 the company will face almost $600 million in maturities. With EBITDA of just $145 million it will put the company under pressure to refinance and the interest rate which currently averages 4.42% across all debt will likely increase significantly.

Since the 2024 debt maturities account for almost a third of all debt and currently have interest rates of 3.3-3.7%, I estimate that when they refinance, the overall interest rate will increase above 5% (assuming a refinancing rate of 5-5.5%). That's very high for a residential REIT and will likely put the company at a disadvantage as peers such as AVB or EQR have rates of about 3.5%.

Veris Residential 2022 Results

Before we get to valuation let's sum up the company's operations. The next two years are likely to be extremely tough for the company as they try to sell the rest of their highly vacant office portfolio they will likely incur large losses compared to the book value they keep these properties at. Moreover, they will have to refinance a third of their debt in 2024 which will lead o a significant interest expense increase, putting the REIT at a major disadvantage compared to peers. Apart from these two negative factors, their high-quality residential portfolio will likely continue to see modest NOI growth and keep stable occupancy of 95%+. The picture is grim so for this to make sense as an investment, I would need to see a major discount.

Valuation

At $16 per share the stock trades at 18x FFO. A historical comparison doesn't really make sense because of the company's transition from a diversified to a purely residential portfolio. I think the best way to value this company is to compare it to its quality residential peers and apply a discount due to its office exposure and high level of debt. I've already mentioned AVB and EQR, both of which represent solid peers with large residential portfolios in the same region as Veris.

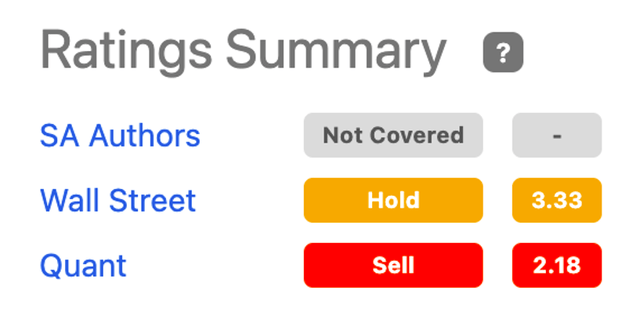

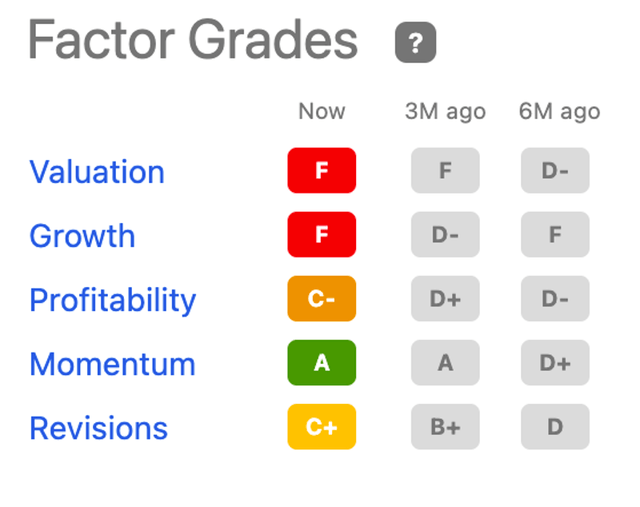

AVB and EQR are very similar and both trade at 17.6x. Considering that they are much larger, better rated, with significantly lower risk, I'd say that they should trade at least 20-30% premium compared to Veris. That would imply a fair multiple of 13.2x and a fair price based on the 2022 FFO of $11.7 per share. Since FFO is expected to decline quite significantly in 2023, on a forward-looking basis the target would be even lower. All of this leads me to rate Veris Residential as a SELL. The stock is very likely to struggle going forward and on top of that is vastly overvalued. This is confirmed by a SELL Quant rating on Seeking Alpha an F score for valuation.

Conclusion

VRE's determination to switch to a purely residential portfolio is a big risk at this time considering both the current selling prices of office space and the low occupancy of 67% in their office spaces. The 2024 debt is also likely to put the company under a lot of pressure since they will need to refinance which will likely raise their current 4.42% interest rate. This might lead to the company struggling and they likely won't perform well. Due to all of this, analysts are expecting a large drop in FFO in 2023 from the current $0.89 to $0.44. All of this indicates that Veris Residential is a SELL at this moment.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.