Voyager: Preclinical Company With Major Big Pharma Deals

Summary

- Voyager is a preclinical company with multibillion dollar big pharma deals.

- Its core asset is its TRACER AAV capsid delivery platform.

- Although the company was in dire straits two years ago, it has nicely recovered.

- Looking for more investing ideas like this one? Get them exclusively at The Total Pharma Tracker. Learn More »

homeworks255/iStock via Getty Images

I covered Voyager Therapeutics (NASDAQ:VYGR) in March last year, when the company had just shed its old pipeline and rebooted itself with a new platform and some groovy preclinical talk about AAV capsids and blood brain barrier penetration. I found very little of interest in all this, but what do I know? Big Pharma seemed adequately interested, and a bunch of deals followed. Voyager's stock has, however, firmly remained in the same market capitalization level.

As I pointed out in various earlier articles, Voyager’s raison d’etre eludes me. The company has been in existence for a decade. 7 years ago, it had an interesting program in Parkinson’s Disease. This was a gene therapy program which, in phase 2 trials, significantly increased on-time in PD patients. However, the program was put on clinical hold after MRI irregularities, Voyager’s collaborators quit on them, even management was completely overhauled, and basically a new company took shape.

This company was then led by a pair of Entrepreneurs-in-residence from two major hedge funds, Polaris Capital and Third Rock Ventures. Both funds had substantial positions in VYGR despite their fledgling pipeline. During this time, a pair of big pharma signed deals with Voyager for its TRACER platform. TRACER stands for Tropism Redirection of AAV by Cell-type-specific Expression of RNA, which is an AAV screening technology to expand discovery of novel capsids with broad tissue tropism in CNS, cardiac, and skeletal tissues. The deals had upfront payments of $30mn and $54mn respectively for Pfizer and Novartis. Considering the early stage of Voyager and the low valuation, these deals were substantial.

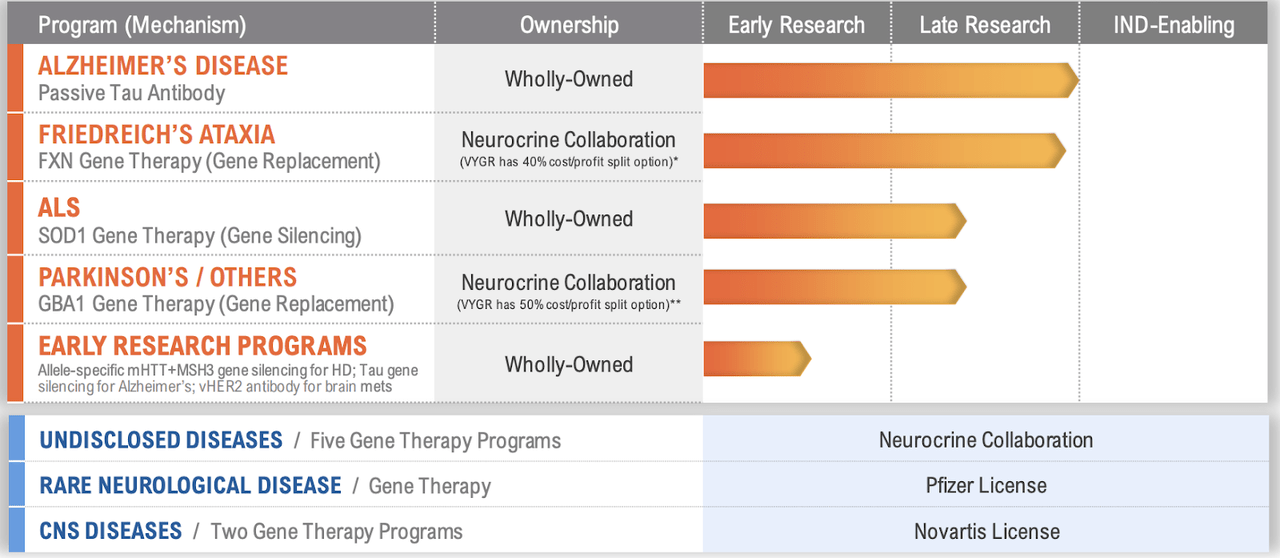

Fast forward 12 months, and the company has a new CEO, but the pipeline still remains the same. Here’s how it looks:

I am surprised to see that a company with a third of a billion dollars in market cap and multiple big pharma collabs does not even have a single program in the clinic. The company says IND filing is expected in 2024/25. If there’s nothing in the clinic, there’s no clinical proof of whatever they are claiming. If there is no proof, there’s no basis for an investment.

So what, exactly, are the claims? A few years ago, when the company had good results in a phase 2 trial in PD patients, they did not have the technology to cross the blood brain barrier. They were forced to administer their medicine directly into the brain. While they scoffed at the idea, many people thought this difficult route of drug delivery resulted in untenable side effects.

Now, they have a delivery method which does not require this. Their AAV capsids can cross the BBB, so they do not need to be delivered in the brain directly. The company claims that their medicines can now penetrate the BBB at low doses. This, if true and proven in the clinic, would be a singular achievement.

If nothing is in the clinic, why is big pharma interested? Voyager, I think, has always been a company with unrealized potential. They have attracted big pharma as well as funds with their first generation gene therapy programs. Now that they are in the second generation, they are addressing their core problem - delivery - with AAV technology. It should, however, be remembered that AAVs are fraught with many problems, not the least of which are expensive manufacturing and rampant immunogenicity. The latter problem limits AAVs to one-time treatments only, before antibodies develop and make the body antagonistic to therapy.

Voyager’s licensing plan is interesting. It licenses the target not the capsid, so there are opportunities for multiple licensing through the same capsid. In 2021, Pfizer signed a deal to license Voyager’s capsid’s for two targets, CNS and CV. However, after a year of deliberation, Pfizer decided to move ahead only with CNS, and not the CV program.

Another reason for big pharma interest in Voyager is that it was launched by Third Rock, and has always had support from hedge funds. The company began with foundational intellectual property in the field of AAV vectors. Moreover, its current CEO Al Sandrock commands respect, having been the R&D Chief at Biogen as recently as 2021. Having left Biogen, he moved to lead Voyager, which immediately raised Voyager’s respectability after years of clinical holds and wasted collaborations.

Novartis, too, has joined the fray and moved in with Voyager. Novartis is a gene therapy leader, and for it to assess Voyager’s TRACER capsids for a year and then deciding to opt in is an important benchmark.

Financials

VYGR has a market cap of $333mn and a cash reserve of $119mn. This was in December, but then in March, the company stated:

Partnering momentum continues into 2023 with $175 million payment associated with Neurocrine Biosciences strategic collaboration followed by $25 million payment triggered by Novartis capsid license option exercise

So these fresh infusions are to be added to the balance sheet. Neurocrine once had a major collab with Voyager which fizzled out. That they have returned with a much larger deal now speaks to the potential of VYGR.

Research and development expenses were $14.6 million for the fourth quarter of 2022, while general and administrative expenses were $8.5 million. At that rate, they now have a cash runway well into 2026 and beyond, assuming no increase in expenses, which is not going to be true as they get to the clinic. However, the earlier worry that their cash runway will end before their first program even gets to the clinic is now no more.

Bottomline

What can I say, every big pharma seems to be signing major deals with this pre-IND stage company. The attraction is their next gen AAV capsid vector tech; however, this technology is yet unproven. Like I also said before, only big pharma can afford to spend millions of dollars on preclinical stage technology. Retail investors need to be more cautious. So while Voyager may be signing those mega deals, I will stay on the sidelines.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

This article was written by

Dr Dutta is a retired veterinary surgeon. He has over 40 years experience in the industry. Dr Maiya is a well-known oncologist who has 30 years in the medical field, including as Medical Director of various healthcare institutions. Both doctors are also avid private investors. They are assisted by a number of finance professionals in developing this service.

If you want to check out our service, go here - https://seekingalpha.com/author/avisol-capital-partners/research

Disclaimer - we are not investment advisors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.