Charles Schwab: Watch These Top 3 Metrics

Summary

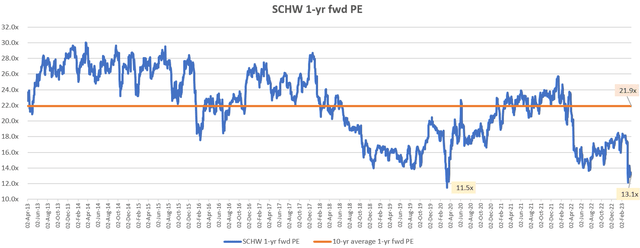

- Charles Schwab is trading back near COVID crash valuation multiples and at a 40% discount to its long-term forward PE multiple.

- But valuation alone is not enough for me to justify a buy. I am waiting for the following 3 key metrics to show signs of improvement.

- Net new purchased money market flows to measure the degree of the cash sorting headwinds.

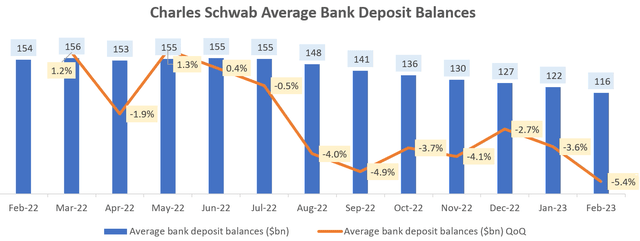

- Stabilization of falling bank deposit balances to track renewal of confidence in Charles Schwab's bank deposits.

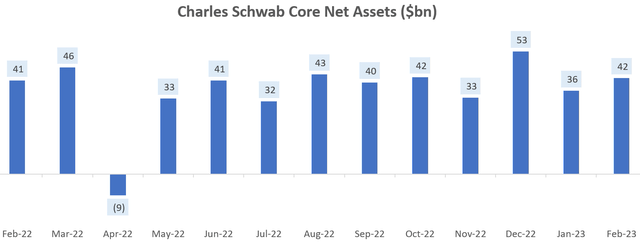

- Growth in core net assets as a bonus kicker on top of the already resilient trends, which would signal customers' confidence in Charles Schwab.

TrongNguyen

Thesis

Charles Schwab (NYSE:SCHW) is down 41.2% YTD after Q1 CY23. It is currently trading at a 1-yr forward PE of 13.1x; close to the COVID lows of 11.5x and at a 40.4% discount to the 10-yr average 1-yr forward multiple of 21.9x:

SCHW 1-yr forward PE (Capital IQ, Author's Analysis)

However, I rarely invest due to valuation alone. I need to see accompanying positive traction in operating momentum. For this, I am watching and waiting for 3 key things to play out:

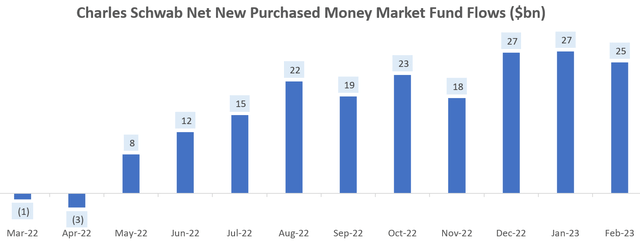

- A fall in net new purchased money market fund flows

- Stabilization of falling average bank deposit balances

- Growth in core net assets

Until then, I maintain a neutral outlook on the stock.

A fall in net new purchased money market fund flows

Purchased money market fund flows is a way to quantify the extent of the cash sorting effect, wherein depositors move funds from low-yielding bank deposits to higher-yielding money market instruments. Naturally, this is not accretive to a bank's margins.

Recently, as the banking crisis has reduced depositors' confidence in parking money in bank accounts, there has been an increased rate of net new flows into purchased money market securities:

Charles Schwab Net New Purchased Money Market Fund Flows (Company's Press Releases, Author's Analysis)

March 2023's figures are expected to be released in early-mid April 2023. I would want to see a reduction back down to low $20bn levels. This would give credence to the notion that cash sorting headwinds are dying down at SCHW.

Stabilization of falling average bank deposit balances

SCHW has been seeing a steady decline in average bank deposit balances over the last 2 quarters now, which was accelerated in February 2023:

Charles Schwab Average Bank Deposit Balances (Company's Press Releases, Author's Analysis)

This metric is important in the current context as it can be a gauge for renewed confidence in SCHW's bank deposits. I would like to see stabilization of the average bank deposit balances going forward to generate incrementally more confidence for a buy on the stock.

Growth in core net assets

Despite the sectoral headwinds, SCHW's core net assets have been rather stable. In February 2023, it increased 15.5% QoQ from $36bn to $42bn.

Charles Schwab Core Net Assets (Company's Press Releases, Author's Analysis)

I view this as a very positive sign signaling stability of the business. This leads me to have a bullish slant. A bonus kicker would be growth in the asset base. If this happens, it would suggest that people have improved confidence in Charles Schwab, viewing it as a relatively safer haven for their assets.

Takeaway

Charles Schwab stock is trading at a 1-yr forward PE of 13.1x. This is close to the lows during the COVID crash of March 2020 and at a 40% discount to last 10 years' average of 21.9x. Yet, I believe investing in valuation alone is risky; operating traction is important. To that end, I am looking for the following movements on 3 key metrics:

- Net new purchased money market flows to measure the degree of the cash sorting headwinds

- Stabilization of falling bank deposit balances to track renewal of confidence in Charles Schwab's bank deposits

- Growth in core net assets as a bonus kicker on top of the already resilient trends, which would signal customers' confidence in Charles Schwab

The first metric is the most important one in my view. I want to see a drop in this number in the March 2023 figures. The latter 2 metrics may play out over a longer period of time.

Until some of this evidence materializes, I maintain a neutral outlook on the stock, albeit with a bullish slant (just not enough for me to buy just yet).

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.