Live Oak Bancshares: The Market Threw The Baby Out With The Bathwater This Time

Summary

- Shares of Live Oak Bancshares have suffered mightily as of late as concerns over a banking crisis have mounted.

- Although this may cause investors to worry, Live Oak Bancshares is a solid operator that is likely to hold up well even if the crisis isn't contained.

- Add in the strong track record of the business, and investors would be wise to consider it as an attractive opportunity.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

VioletaStoimenova/E+ via Getty Images

The past few weeks have been particularly difficult for anything related to the banking sector. Driven by fears of contagion following the collapse of Silicon Valley Bank parent SVB Financial Group (OTC:SIVBQ), as well as a few other financial institutions that have followed suit, pretty much every player in the sector has been pushed down. In many cases, the decline has been unjustified. One really good example of this, in my opinion, involves a rather small bank called Live Oak Bancshares (NYSE:LOB). Even though the market capitalization of only $1.08 billion as of this writing may have investors concerned that the company does not have the size to survive difficult times, the company's overall financial footing seems solid. Even in the event of a run on its uninsured deposits, the company should be just fine. That is why the firm looks particularly appealing since shares are down 54.2% from their 52-week high mark. Given this decline, and how healthy the company seems, I've decided to rate it a ‘strong buy’ to reflect my view that its returns moving forward should significantly outpace with a broader market should achieve over the same period of time.

Why Live Oak Bancshares is not at risk

Few banks that are publicly traded are as small as Live Oak Bancshares happens to be. Part of its small size is due to the fact that it's a fairly new firm in the banking industry. It began operations in early 2008 as a North Carolina chartered commercial bank. Over the years, it has grown into a player with a sizable portion of its efforts focused on originating SBA loans, as well as other government-oriented loan programs. Its lending verticals have evolved over time, with the company even providing loans to franchise restaurants, hardware stores, law firms, liquor stores, pet care facilities, RV parks, fitness centers, and so much more.

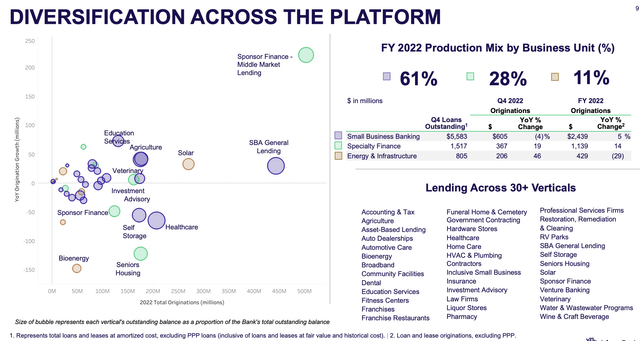

As of the end of the latest quarter for which data is available, approximately 61% of the $7.9 billion of loans and leases that the company has on its books fell under the category of small business banking. But another 28% involves specialty finance arrangements, with the remaining 11% under energy and infrastructure projects. For context, the specialty finance activities the company engages in include sponsoring finance for middle market lending activities, senior housing projects, investment advisory groups, and more. Of its total loan portfolio, only about $1.45 billion, or 19.8%, involves fixed rate arrangements. This is both a positive and a negative. On the positive side of things, having a small portion of loans that are fixed rate means that the company is less subjected to declining loan values as interest rates rise. On the other hand, rising interest rates also increase the risk of default. So in the end, it's a double-edged sword.

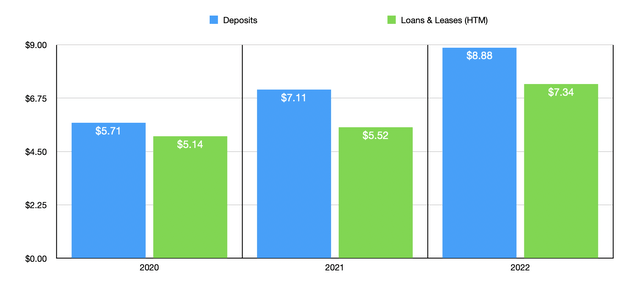

There are other ways to categorize the company's loan portfolio other than SBA versus non-SBA. For instance, 47.3% of its loans and leases are classified as commercial and industrial wounds. Another 8% falls under construction and development. The rest is split between commercial real estate and commercial land loans, with commercial real estate loans accounting for 38.2%, and commercial land loans accounting for 6.4%. It's also worth noting that, over the years, the total value of loans on the company's books has grown. Back in 2020, for instance, the company had only $5.14 billion worth of loans and leases that were held to maturity. Today, that number is $7.34 billion. This excludes the held-for-sale loans that the company has on its books totaling $554.6 million. It's also imperative that I mention that about 42% of the loans, by value, on the company's books are government-guaranteed loans. This means that the company has only limited exposure in the event of a default from any one customer.

More important than the loan situation is the deposit picture. After all, the bank runs experienced so far were driven by concerns that a large uninsured deposit base would cause certain customers to lose out on their deposits should the banks in question fail. In all likelihood, we don't need to worry about this situation anymore since the FDIC has decided to guarantee all deposits at the banks that have suffered. In addition to that, regulators have come out with additional liquidity opportunities for those firms that are most affected. In my view, even if this weren't the case, the risk to shareholders of Live Oak Bancshares is quite small.

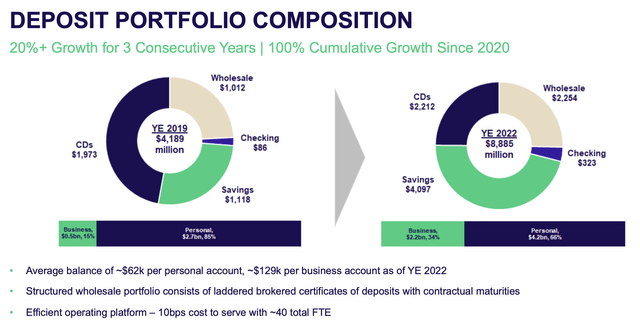

From 2020 to 2022, the value of deposits at Live Oak Bancshares has grown from $5.71 billion to $8.88 billion. Over this window of time, the company has focused on growing its exposure to deposits from businesses. They have succeeded greatly on that front, causing total business deposits to climb by around 340%. Even so, only 34% of all deposits on the company's books involve businesses. The remaining 66%, or $4.2 billion, involves personal deposits. About 46.1% of all deposits involve savings accounts, with 25.4% involving wholesale activities and 24.9% involving CDs. That leaves the remainder, only about $323 million, to involve checking accounts.

Interestingly, only 17.6% of the company's deposits, or roughly $1.56 billion, are uninsured. That is up significantly from the 10.2%, or $580.9 million, that the company reported for the 2020 fiscal year. To put this in context, for the US banking industry as a whole, a shocking 44% of all deposits are uninsured. To cover those deposits, the company has $420.6 million in cash on hand. It also boasts $1.01 billion in available-for-sale securities. Although it's possible to take a loss when selling available-for-sale securities, the fact that they are categorized as such means that the company has planned to sell them over a short window of time and, because of this, the likelihood that they have taken steps to reduce losses upon a sale is quite high. This also ignores another $554.6 million in loans that are held for sale that the company could unload if need be.

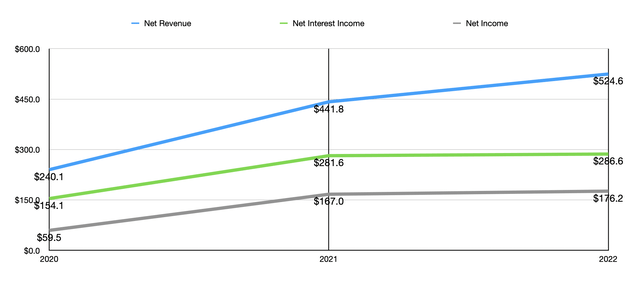

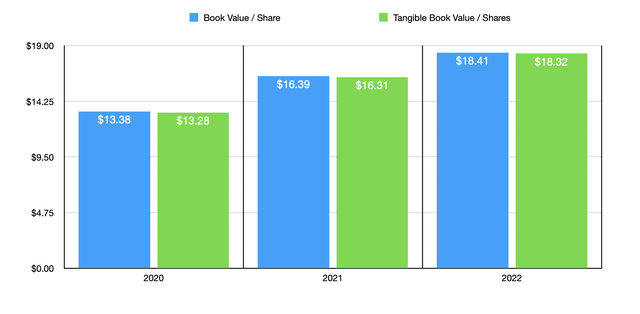

Given how little the company is exposed to uninsured deposits, I believe that even a bank run would fail to kill the firm. In addition to this, it's worth mentioning that the company is incredibly healthy. Between 2020 and 2022, net revenue at the firm grew from $240.1 million to $524.6 million. Net income almost tripled from $59.5 million to $176.2 million. Using data from the 2022 fiscal year, I calculated that the company is trading at a price-to-earnings multiple of only 6.1. In addition to this, the company also benefited from a rise in its book value. Overall book value per share managed to climb from $13.38 to $18.41, while tangible book value grew from $13.28 to $18.32 per share. With shares currently at $24.03 per share as of this writing, that translates to a premium over book value of only 30.5%.

Takeaway

As far as banks go, Live Oak Bancshares it's definitely a firm that flies under the radar. However, the company looks incredibly resilient at this time and it's highly unlikely that it would be subjected to the same kind of pressures that other banks have so far seen. It is perplexing, then, that shares of the enterprise have fallen so far during this time. With all this data that I'm looking at, I do believe that the company makes very compelling long term prospect and, as such, I have decided to rate LOB stock a ‘strong buy’ at this time.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.