Viasat: Large Satellite Player Still In Growth Mode

Summary

- Viasat has continued to see robust revenue growth while posting negative net income.

- Nonetheless, it has posted mostly positive operating income as well as positive operating cash flow for the past decade.

- The company is spending heavily on capital expenditures; it's in growth mode. This very well could be the correct decision by management in the nascent satellite space.

- The firm's financials and tenure indicate that it could be profitable but is choosing to continue growing instead.

- The current market has punished VSAT stock for this growth imperative, and it is now trading at bargain prices for investors that are willing to buy in for the long term.

BlackJack3D

Overview

Viasat, Inc. (NASDAQ:VSAT) is a satellite company. It is relatively large and tenured, having been in business since 1986 and entering the public markets in Q4 of 1996. The company operates a network of satellites and provides satellite-enabled software services off the back of this network. This includes offerings such as direct-to-consumer internet, solutions for the defense industry, and WiFi for airplanes.

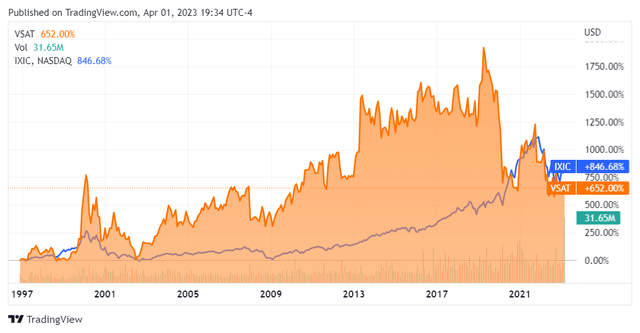

While outperforming the NASDAQ Composite for most of its operating history, this trend began to reverse in late 2020 and has maintained this state. At present, Viasat is has returned less than the NASDAQ Composite in the wake of the recent sell off of middle market technology firms. Nonetheless, this is a company with significant revenues as well as a significant operating history; it’s fair to call it the largest pure-play satellite company in the US equity markets.

This article will review the company’s financials as well as its valuation in order to determine if it may constitute a good investment at present.

Financials

Starting with revenues, we can see that growth has continued at a brisk clip. While there was a minor down year in 2021, this was more than made up for in 2022. Note that this company posts full year financials in May of each year, with Q1 of a given year representing the Q4 fiscal quarter for the firm. For a company already doing over $1B in sales a year I consider this growth to be quite healthy.

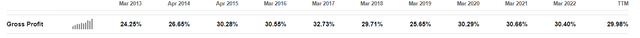

Gross margin has stayed relatively consistent. This is an interesting number for a company such as this because it manages both hardware and software. While it may be fair to think that software will drive overall higher gross margins for Viasat, it seems that this effect has already taken hold and the company is at a steady gross margin of around 30%.

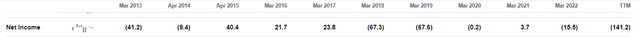

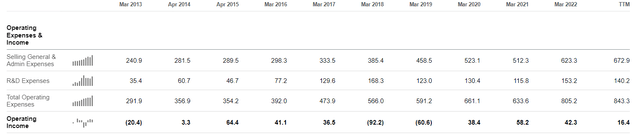

While this company has been in business for some time, it is not consistently profitable. Indeed, it has only had 4 (marginally) profitable years during the last 10. Additionally, it is a point of concern that the 3 quarters within the most recent fiscal year have resulted in its largest accrued loss yet. Since this was not explained by management on any of the 3 most recent earnings transcripts, we must chalk it up to increased operating costs overall; this has certainly been the case. Operating income has still stayed somewhat positive to date and should close positively for the total year. This indicates that the actual business model is still sound on a unit basis but the company is wrestling with significantly higher fixed costs.

While costs have continued scaling throughout the company’s lifespan, it’s worth noting that they are in the process of releasing another satellite into orbit – likely something that has been adding additional cost pressure to the company.

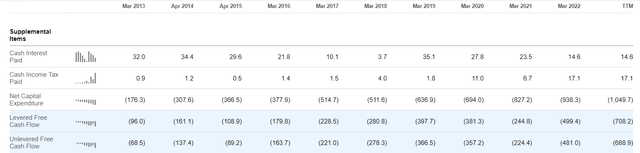

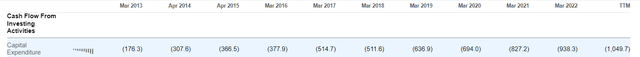

Free cash flows have also hit their lowest level yet, with a total free cash loss of over $700M throughout the first 3 fiscal quarters of this fiscal year.

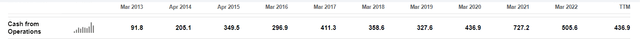

It is worth contextualizing this. Viasat has maintained a quality level of cash from operations, and this most recent fiscal year is no exception. This business is still working just fine. Where is the cash going then, you ask? The answer is that cash has continued to be funneled into growth.

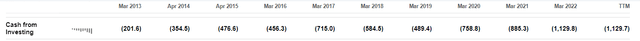

As can be seen, Viasat has continued to pump cash into itself. Indeed, it spends significantly more cash on building itself out than it generates from operations – it is borrowing money to grow. This is 35 year old company that is still a growth stock. Certainly a rare breed, but altogether sensible in what is the relatively nascent satellite space. This level of investment also makes sense given the CapEx-intensive business that they are in - satellites - as well as the ongoing efforts to deploy more of them. Furthermore this kind of advanced hardware will serve to create a natural moat once the company is fully built to scale. We can corroborate that this is going on as most all of the investment is going into capital expenditures.

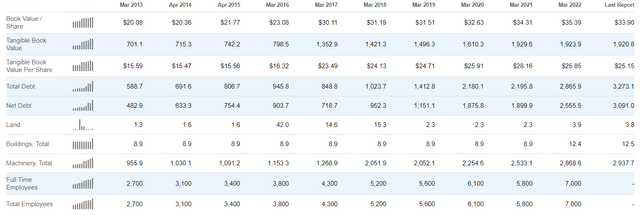

Of course, given all of this cash loss, it makes sense to look at the balance sheet. The situation here also reflects a company pushing itself to grow; debt is at its highest level in a decade and the employee headcount is too. While this has resulted in higher interest payments, they don’t appear to be overly burdensome and were less than $20M for the entire previous year.

Overall, these financials speak to a company that is still trying to saturate what appears to be a large target market. Given the activity we have seen from other players as regards entering into the satellite space, I consider this warranted. Where Viasat has an advantage is the fact that it has been doing this for longer than just about everyone else.

Conclusion

While this company is unprofitable and not yet fully ‘proven’, we should try to read between the lines here. Consider the fact that this company has maintained consistently positive cash from operations, continued to grow revenues, and has even proven the ability to generate a profit several times in the past. These are strong positive indicators for any growth technology stock that is particularly future-focused. I think this is a company that could become consistently profitable if it wanted to – much like Amazon or Uber early in their respective lifecycles – but is choosing to keep its foot on the gas.

In the wake of rising rates, the market has punished VSAT stock for this ongoing growth imperative. It is trading at a cheap valuation across the board. It’s cheap relative to the overall Information Technology sector across P/E, P/B, and Price/Cash Flow (Operating Cash Flow).

I see this valuation as attractive because I believe there is more here than meets the eye. To reiterate, revenues have continued to grow quickly, operating cash flow has stayed consistently positive, and the company has even yielded positive net income - more than once - for several years in the last ten. Furthermore it is not getting crushed by overly high interest payments, indicating (at least for now) a reasonably low cost of capital undergirding its growth.

While I appreciate the logic of this stock declining within the current market, I am going to take the optimistic side of things. I think the satellite space will be a good one for the largest players, and Viasat is certainly that. As the cost of capital has increased materially the smaller players are likely in for a hard time. Taking this into consideration along with the fact that it is trading below the NASDAQ inception-to-date, I am going to call this one a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.