First National Bank Alaska: Dividend Yield Of Over 6%, But Earnings Likely To Be Flattish

Summary

- Favorable Alaskan economic factors will drive loan growth this year.

- The risk level is moderately high due to large unrealized losses.

- The December 2023 target price suggests a moderately-high upside from the current market price.

- FBAK is offering a high dividend yield. The dividend appears secure even though the implied payout ratio for 2023 is very high.

christiannafzger

Earnings of First National Bank Alaska (OTCQX:FBAK) will likely remain flattish this year as the growth of expenses will counter loan growth. As a result, I’m expecting the company to report earnings of $18.23 per share for 2023, down by 0.9% year-over-year. The year-end target price suggests a moderate upside from the current market price. Further, the company is offering a very high dividend yield. Consequently, I’m adopting a buy rating on First National Bank Alaska. However, the company appears unsuitable for low-risk-tolerant investors.

Loans to Benefit from Favorable External Factors

First National Bank Alaska’s loan portfolio grew at a decent rate of 2.7% during the last quarter of 2022, which took the full-year loan growth to 4.9%. The outlook for loan growth in 2023 is mixed.

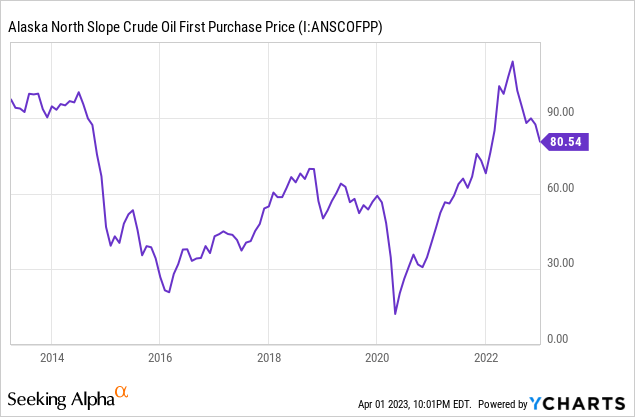

As the Alaskan economy is dependent to a large extent on its oil and gas industry, oil prices are an important indicator of credit demand in the company’s markets. Despite the downtrend that started in the latter part of 2022, crude oil prices are still very high when compared with previous years.

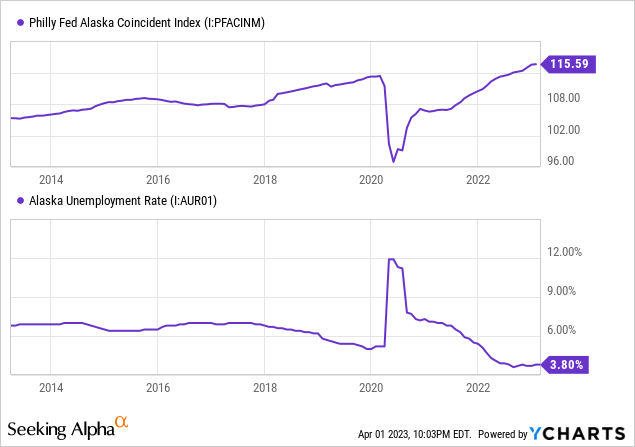

Additionally, Alaska’s labor market is currently stronger than it has been in the past decade. The coincident economic index is also in a good position, as shown below.

All these external factors bode well for loan growth in the short term. The only external factor that will hurt loan growth is the high interest-rate environment. Another factor that indicates a slowdown in loan growth this year is a weaker loan pipeline. Unfunded commitments were down to $686 million at the end of 2022 from $811 million at the end of 2021, as mentioned in the annual report.

Considering these points, I’m expecting the loan portfolio’s growth this year to be somewhat in the middle of the historical loan growth range. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net Loans | 1,935 | 1,992 | 2,190 | 2,104 | 2,208 | 2,321 |

| Growth of Net Loans | 7.7% | 2.9% | 9.9% | (3.9)% | 4.9% | 5.1% |

| Other Earning Assets | 1,598 | 1,589 | 2,391 | 3,356 | 2,886 | 2,944 |

| Deposits | 2,420 | 2,388 | 3,113 | 4,217 | 4,225 | 4,440 |

| Total Liabilities | 3,247 | 3,261 | 4,109 | 5,027 | 4,930 | 5,159 |

| Common equity | 507 | 548 | 587 | 555 | 408 | 415 |

| Book Value Per Share ($) | 159.9 | 172.8 | 185.2 | 175.1 | 128.7 | 130.9 |

| Tangible BVPS ($) | 159.9 | 172.8 | 185.2 | 174.1 | 127.8 | 130.0 |

| Source: FDIC Call Reports, Annual Financial Reports, Author's Estimates(In USD million unless otherwise specified) | ||||||

Despite the 425 basis points hike in the fed funds rate, the net interest margin remained almost unchanged through most of last year. This is because both loan yields and deposit costs are very sticky. I’m expecting last year’s trend to continue this year, and the margin to remain mostly stable in 2023.

Expecting Flattish Earnings

The anticipated loan growth will support earnings. On the other hand, heightened inflation will drive up non-interest expenses, which will drag earnings. Further, the provision expense for loan losses will most probably return to a normal level this year, which will also hurt earnings growth. Overall, I’m expecting First National Bank Alaska to report earnings of $18.23 per share for 2023, down by 0.9% year-over-year. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net interest income | 132 | 137 | 145 | 146 | 145 | 152 |

| Provision for loan losses | 2 | 0 | 2 | 2 | (1) | 2 |

| Non-interest income | 26 | 23 | 26 | 27 | 24 | 24 |

| Non-interest expense | 86 | 86 | 91 | 92 | 93 | 98 |

| Net income - Common Sh. | 54 | 56 | 58 | 58 | 58 | 58 |

| EPS - Diluted ($) | 17.07 | 17.56 | 18.17 | 18.45 | 18.39 | 18.23 |

| Source: FDIC Call Reports, Annual Financial Reports, Author's Estimates(In USD million unless otherwise specified) | ||||||

Earnings at Risk are Very High due to Massive Unrealized Losses

First National Bank Alaska’s available-for-sale (“AFS”) securities portfolio is even larger than the loan portfolio, which is very unfortunate in the wake of the SVB Financial Group’s (OTC:SIVBQ) case. Due to fixed rates on most of these securities, the rising interest rates led to a drop in their market value, resulting in unrealized mark-to-market losses. These unrealized losses amounted to $204.8 million at the end of December 2022, as mentioned in the annual report. To put this number in perspective, $204.8 million is around half of the total equity balance at the end of 2022, and 3.5 times the net income reported for 2022. Therefore, these losses are too large, and a big cause for concern.

Most likely, these losses will reverse when the rates start declining next year. However, there is a possibility, however small, that a deposit run may force the company to sell its securities portfolio and incur a crushing loss. Apart from the unrealized losses, the company’s risk level is low, as discussed below.

- The company does not have exposure to risky asset classes, like venture capital assets or cryptocurrencies.

- The company operates in Alaska, with no overlap with the Californian markets that SVB Financial operated in.

- The capital is far greater than regulatory requirements. The company reported a total capital ratio of a whopping 19.24% for the end of 2022, which is much higher than the minimum regulatory requirement of 10.50%.

Dividend Yield of over 6%, Dividend Appears Secure

The First National Bank Alaska is offering a high dividend yield of 6.4% at the quarterly dividend rate of $3.2 per share. The company also gives an annual special dividend of $3.2 per share. Including the special dividend, the company is offering a very high dividend yield of 8.0%. The earnings and dividend estimates (including the special dividend) imply a payout ratio of 88%. Although this ratio is very high, the payout appears secure due to the following two reasons.

- The payout ratio has averaged 82% in the last five years. It seems illogical for a company to cut its dividend and send a negative signal to the market just because the payout ratio is a few percentage points higher than average.

- The capital level is more than just adequate according to regulatory requirements, as discussed above. Therefore, there seems to be no threat of dividend cuts from regulatory requirements.

Adopting a Buy Rating

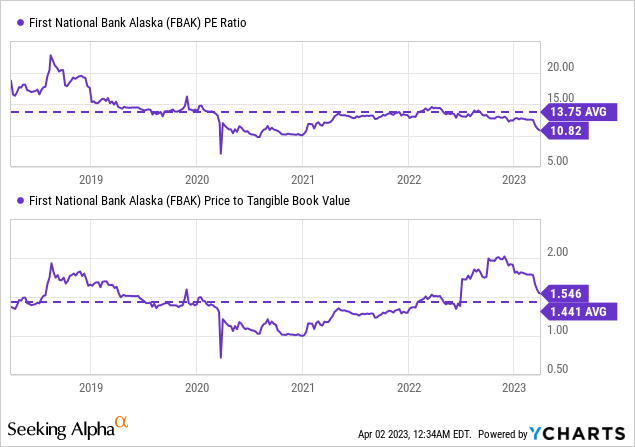

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value First National Bank Alaska. FBAK stock has traded at an average P/TB ratio of 1.44x and an average P/E multiple of 13.75x in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $130.0 gives a target price of $187.4 for the end of 2023. This price target implies a 5.8% downside from the March 31 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.24x | 1.34x | 1.44x | 1.54x | 1.64x |

| TBVPS - Dec 2023 ($) | 130.0 | 130.0 | 130.0 | 130.0 | 130.0 |

| Target Price ($) | 161.4 | 174.4 | 187.4 | 200.4 | 213.4 |

| Market Price ($) | 199.0 | 199.0 | 199.0 | 199.0 | 199.0 |

| Upside/(Downside) | (18.9)% | (12.4)% | (5.8)% | 0.7% | 7.2% |

| Source: Author's Estimates |

Multiplying the average P/E multiple with the forecast earnings per share of $18.2 gives a target price of $250.6 for the end of 2023. This price target implies a 25.9% upside from the March 31 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 11.75x | 12.75x | 13.75x | 14.75x | 15.75x |

| EPS 2023 ($) | 18.2 | 18.2 | 18.2 | 18.2 | 18.2 |

| Target Price ($) | 214.1 | 232.4 | 250.6 | 268.8 | 287.1 |

| Market Price ($) | 199.0 | 199.0 | 199.0 | 199.0 | 199.0 |

| Upside/(Downside) | 7.6% | 16.8% | 25.9% | 35.1% | 44.2% |

| Source: Author's Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $219.0, which implies a 10.0% upside from the current market price. Adding the forward dividend yield gives a total expected return of 18%. Hence, I’m adopting a buy rating on First National Bank Alaska. However, as discussed above, the company’s risk level is currently moderately high due to the large balance of unrealized losses. Therefore, the stock does not appear to be suitable for low-risk-tolerant investors.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This article is not financial advice. Investors are expected to consider their investment objectives and constraints before investing in the stock(s) mentioned in the article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.