Deutsche Bank: Highlighting The DWS Stake And How It Could Help Restore Market Confidence

Summary

- Deutsche Bank owns a 79.49% stake in asset manager DWS, which went public in 2018.

- Asset management is DB's most profitable segment, bringing in 10.7% of 2022 pre-tax profits for just 3.6% of total risk-weighted assets.

- I estimate a potential sale could boost CET1 capital to 14.7% from 13.4% at the end of 2022.

- Negatives of a potential sale include lower risk-adjusted returns, more reliance on higher return correlation among the private and corporate bank.

- I think an imminent sale of DWS is unlikely. However, the asset is underappreciated by the market and a sale is prudent, especially if DWS starts losing AuM due to DB ownership.

code6d

Intro

Deutsche Bank (NYSE:DB) has been in the headlines recently, with rising credit default swap spreads, exposure to the U.S. commercial real estate market and a large derivatives book all weighing on investor sentiment. While I argued in my previous Deutsche Bank article that it would lag largest peer Commerzbank (OTCPK:CRZBF) in 2023, I think the relative outperformance of Commerzbank has gone too far and DB is currently the better pick.

Looking at the current valuation and financial position of both banks (DB's annual report is available here and Commerzbank here:

| Commerzbank | Deutsche Bank | |

| ROTE | 4.9% | 9.4% |

| Tax Rate | 31.5% | -1% |

| Cost/Income Ratio | 68.6% | 74.9% |

| P/Tangible book | 0.48 | 0.35 |

| CET1 Capital | 14.1% | 13.4% |

| MDA Requirement* | 10.1% | 11% |

| MDA Buffer | 4% | 2.4% |

Source: Author calculations and company disclosures. *MDA requirement is pro-forma for expected regulatory changes.

While DB's RoTE benefitted from an exceptionally low tax rate in 2022 due to revaluation of deferred tax assets, over the longer term I expect DB to generate stronger returns compared to Commerzbank, largely thanks to its asset management segment. Currently, DB targets a RoTE of over 10% in 2025 while Commerzbank targets over 7.3% in 2024.

The other main benefit of Commerzbank, its larger MDA buffer, remains valid. However given developments at U.S. regional banks which were allowed to run a business with less capital compared to larger peers, I reckon the market will shun a potential move by Commerzbank to steer the bank to a lower absolute CET1 level compared to DB.

In this article I will highlight Deutsche Bank's ownership in asset manager DWS, discuss rationale for and against selling the majority stake, how it will impact the bank's capital position and profitability, as well as some recent communication released by DB.

DWS Overview

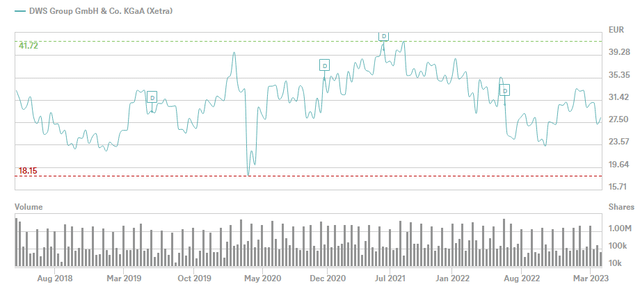

DWS Group trades under the ticker DWS on Boerse Frankfurt. The company went public in March 2018 in a push to highlight DB's higher return asset management segment. Nevertheless, DB remains the main shareholder with a 79.49% stake and the recently appointed CEO Stefan Hoops used to head DB's Corporate bank division. The market capitalization is around 5.7 billion EUR at the current share price of circa 28 EUR/share, with the stock actually down from its March 2018 listing price of around 33 EUR/share:

DWS stock reached its all-time high of 41.72 EUR/share back in August 2021 after which general market weakness and green washing allegations led to the stock losing all its post-IPO gains, and then some.

DWS Financial Performance

You can find information relating to DWS on its own IR website.

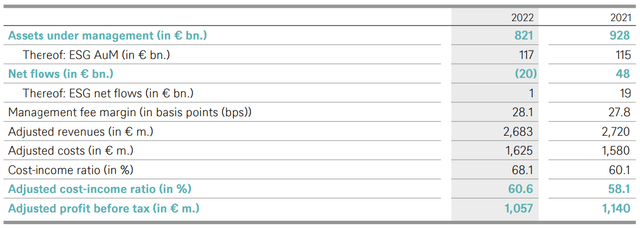

As of December 31, 2022, the company had 821 billion EUR in assets under management (AuM), down 11.5% Y/Y as a result mainly of market performance, but also 20 billion EUR in negative outflows during 2022. AuM is split in Active (61.4%), Passive (24.2%) and Alternatives (14.4%).

Despite the tough 2022 in terms of AuM developments, underlying financial performance remains robust and the company proposed a 5% increase to its dividend to 2.05 EUR/share:

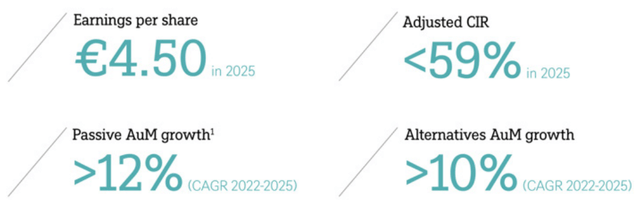

Furthermore, the company targets EPS of 4.50 EUR/share in 2025, up from the 2.97 EUR/share in 2022:

Pros of selling DWS

At the end of 2022, DB had 12.9 billion EUR in risk-weighted assets (RWA) relating to its Asset management segment, which encompasses DWS but also covers DB-specific activities. The 12.9 billion EUR is some 3.6% of total RWA at 360 billion EUR. However, despite its small impact on capital, Asset management accounted for 10.7% of 2022 pre-tax profits, thus it is DB's highest margin segment.

I would argue that while there is clearly room for growth at DWS, it is the most mature business of DB and has to the greatest extent realized its potential. A sale could release some 4.5 billion EUR in capital which could be used for:

- Covering potential losses and thus avoiding a dilutive capital raise

- Investing in the remaining three business lines

- Dividends and share buybacks

I estimate a sale could boost DB's 2022 year-end CET1 capital of 13.4% by about 1.3% to 14.7%, higher than the 14.1% at largest domestic peer Commerzbank. Given the premium Commerzbank now trades at (0.48 times tangible book compared to 0.35 times at DB) thanks to its stronger capital position and anticipated share buyback, despite arguably weaker long-term profitability, I reckon selling DWS will be positively perceived by investors.

All in all, given that the market gives DB little credit for its high-margin asset management segment, a prudent thing to do would be find a new home for DWS. Furthermore, in the event that DWS actually starts to suffer due to its main shareholder being DB (for example lagging industry peers in terms of AuM flows), a new main shareholder at DWS can be a win for both DB and DWS.

Cons of selling DWS

As outlined above, the main downside of selling DWS is that it is DB's flagship segment in terms of returns. DB would have to drop its 10% 2025 RoTE target and only strive for marginally better returns compared to Commerzbank. 10-12% RoTE returns targeted by large French banks would be out of reach.

Furthermore, thanks to DWS, DB has a diversified profit structure. I think correlation among returns at the Private and Corporate bank is quite high, while the Investment bank and Asset management are affected by other factors, such as market activity and investment flows. Thus risk-adjusted returns at DB would suffer - the bank would flourish in a strong economy but experience heavy losses in a recession.

Other recent developments

On March 31, DB released a Summary of Key updates during Q1 available here.

While it is an interesting read overall, my key takeaways are:

- DB expects to keep its noninterest expenses in FY 2023 broadly flat to FY 2022. The bank is also working on additional cost measures to offset inflationary pressures and investments; these measures are targeted to be more than € 2bn for the period until 2025, of which € 490m was already achieved in 2022.

- revenues for FY 2023 around the mid-point of a range between € 28bn to € 29bn (up 4.8% compared to 27.2 bn € in 2022).

- Asset Management saw a very good start to the year in light of market conditions in the first few weeks of 2023 (for me key thing to watch is how net AuM flows ended in Q1 and develop in 2023).

- provision for credit losses for FY 2023 to be at the lower end of a range between 25 to 30 basis points of average loans, or essentially flat to FY 2022.

- optimism and confidence is growing on announcing share buybacks in H2 2023 (again worth monitoring if recent events derail plans for buybacks later this year, I think management will sit on their hands and see what happens, although that would send a signal in itself, so no good option)

- Deutsche Bank has done more than half (€ 7.2bn) of its 2023 funding plan already (€ 13-18bn).

- Deutsche Bank also disclosed that its liquidity coverage ratio as of March 23, 2023 was at 137%, proactively steered above the bank's 130% target on an average basis in 2023.

Conclusion

I think DB will ride out the current storm, albeit it may lose fringe customers and reverse some market gains achieved in recent years. From a valuation perspective, despite its stronger long-term profitability profile, it trades at a discount to Commerzbank which I expect to close over time as the true impact of the recent financial turmoil becomes clear.

Given the distressed valuation of DB, holding the premium DWS stake makes little financial sense to me and I reckon the best course of action would be to find a new home for the asset manager, especially if AuM starts flowing out of DWS contrary to industry trends (a tail risk at the moment but worth monitoring). However, given the strong capital position of DB an imminent sale is unlikely. DWS will likely be sold only if market conditions deteriorate to an extent to warrant a capital increase. Here is how I estimate DB without DWS will compare to Commerzbank:

| Commerzbank | Deutsche Bank | |

| RoTE | Similar | Similar |

| P/Tangible book | 0.48 | 0.35 |

| CET1 Capital | 14.1% | 14.7% |

| MDA Requirement | 10.1% | 11% |

| MDA Buffer | 4% | 3.7% |

Source: Author estimates

As you see from the table above, DB without DWS should hold a stronger CET1 capital position (+0.6% compared to Commerzbank on an absolute level), and only 0.3% weaker on an MDA Buffer level. This should help restore market confidence, albeit at the cost of similar profitability for both banks and help bridge the valuation gap between the two lenders.

Last but not least, the USD lost 2% relative to the EUR in Q1 2023 which I estimate will impact DB tangible book measured in EUR by about 270 million EUR.

Thank you for reading.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DB, CRZBF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.