The market on March 31 closed with the highest single-day gains in more than four months, making a strong start to the April series. The benchmark indices rose for the second consecutive session on the hope that the global interest rate hike cycle was nearing its end and the banking crisis was in control.

The rally was broad-based. The 30-pack Sensex gained 1,031 points, or 1.8 percent, to 58,992, while the Nifty was up 279 points, or 1.6 percent, at 17,360 and formed a long bullish candle on the daily charts.

"After the formation of a series of lower bottoms over the last few months, the Nifty has moved up sharply after the formation of a double-bottom type pattern around 16,900 levels recently. This is a positive indication," Nagaraj Shetti, Technical Research Analyst, HDFC Securities, said.

For the Nifty, the short-term trend had turned up sharply. "Having moved above the hurdle and the overall positive chart pattern indicates the next upside for the Nifty around 17,800 levels in the next couple of weeks. Immediate support is at 17,250 levels," Nagaraj said.

On the broader markets front, the Nifty midcap 100 and smallcap 100 indices gained 0.87 percent and 1.6 percent on strong breadth.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot charts indicate that the Nifty may get support at 17,248 followed by 17,206 and 17,138. If the index advances, 17,383 is the initial key resistance level to watch out for followed by 17,425 and 17,492.

The Bank Nifty, too, closed above the crucial resistance of 40,000, rising 698 points, or 1.75 percent to 40,609. The index also formed a bullish candlestick on the daily charts and made a higher top and a higher bottom for the second straight session.

"The overall bullish chart pattern in Bank Nifty signals an upside target of around 41,650 in the next one-two weeks. Immediate support is at 40,200 levels," Shetti said.

Bank Nifty, as per pivot charts, may take support at 40,298 followed by 40,178 and 39,983. Key resistance levels are expected to be 40,688, then 40,808, and 41,003.

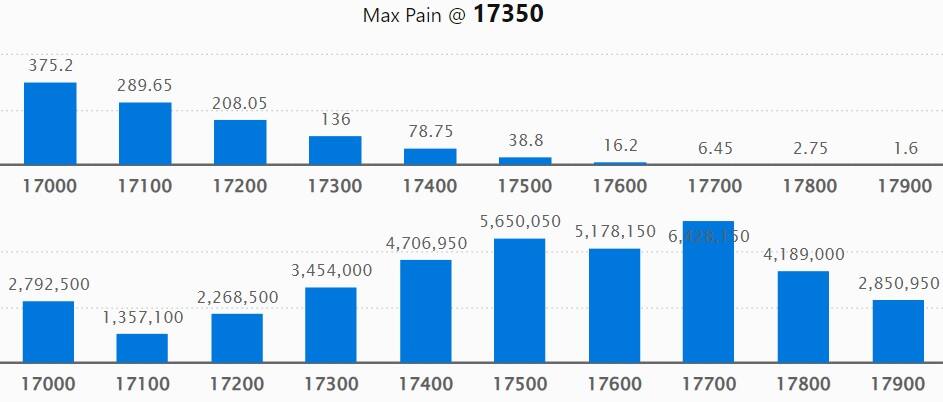

The maximum Call open interest (OI) was at 17,700 strike, with 64.28 lakh contracts, which is expected to be a crucial level for the Nifty in the coming sessions.

This was followed by 17,500 strike, comprising 56.5 lakh contracts and 17,600 strike, with more than 51.78 lakh contracts.

Call writing was seen at 17,600 strike, which added 33.74 lakh contracts, followed by 17,700 strike, which accumulated 28.38 lakh contracts, and 17,500 strike with 25.48 lakh contracts.

Call unwinding was at 17,000 strike, which shed 29.55 lakh contracts, followed by 17,800 strike, which shed 24.01 lakh contracts, and then 17,100 strike, which shed 10.7 lakh contracts.

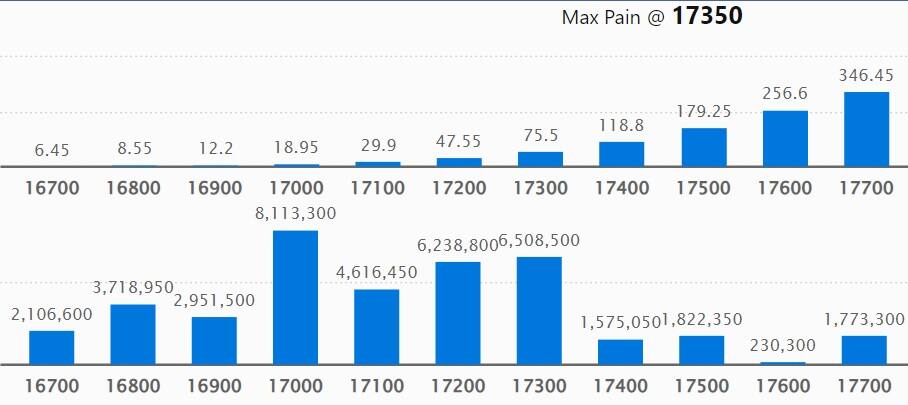

The maximum put open interest was at 17,000 strike, with 81.13 lakh contracts, which is expected to act as support in the coming session.

This was followed by the 17,300 strike, comprising 65.08 lakh contracts, and the 17,200 strike where we have 62.38 lakh contracts.

Put writing was seen at 17,300 strike, which added 59.18 lakh contracts, followed by 17,200 strike, which added 53.91 lakh contracts, and 16,500 strike, which added 32.07 lakh contracts.

We have seen put unwinding at 17,900 strike, which shed 4,150 contracts, followed by 18,500 strike, which shed 1,500 contracts.

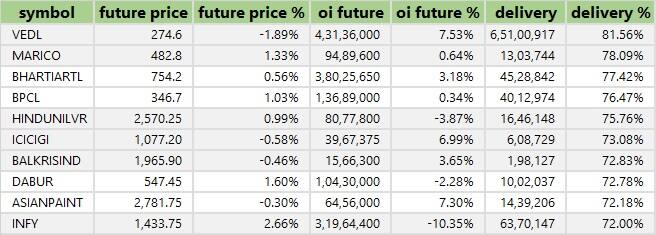

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Vedanta, Marico, Bharti Airtel, BPCL and Hindustan Unilever among others.

102 stocks see a long build-up

An increase in open interest (OI) and in price typically indicates a build-up of long positions. Based on the OI percentage, we have seen 102 stocks in the list of long build-ups, including Glenmark Pharma, Nestle India, Hindustan Aeronautics, Dixon Technologies and Ramco Cements.

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, seven stocks, including Indraprastha Gas, IDFC, and Siemens, witnessed a long unwinding.

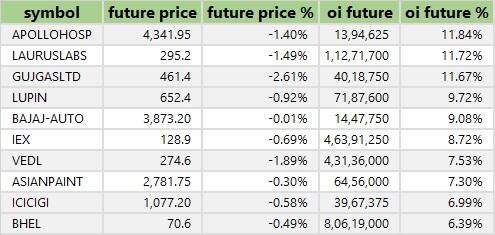

27 stocks see a short build-up

An increase in OI along with a decrease in price indicates a build-up of short positions. Based on the OI percentage, 27 stocks, including Apollo Hospitals, Laurus Labs, Gujarat Gas, Lupin and Bajaj Auto, saw a short buildup.

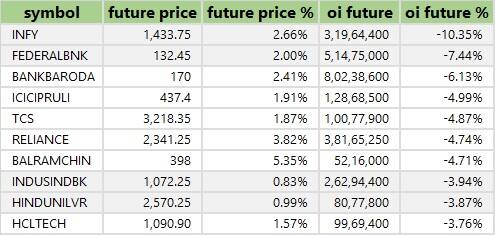

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 56 stocks were on the short-covering list. These included Infosys, Federal Bank, Bank of Baroda, ICICI Prudential Life Insurance, and TCS.

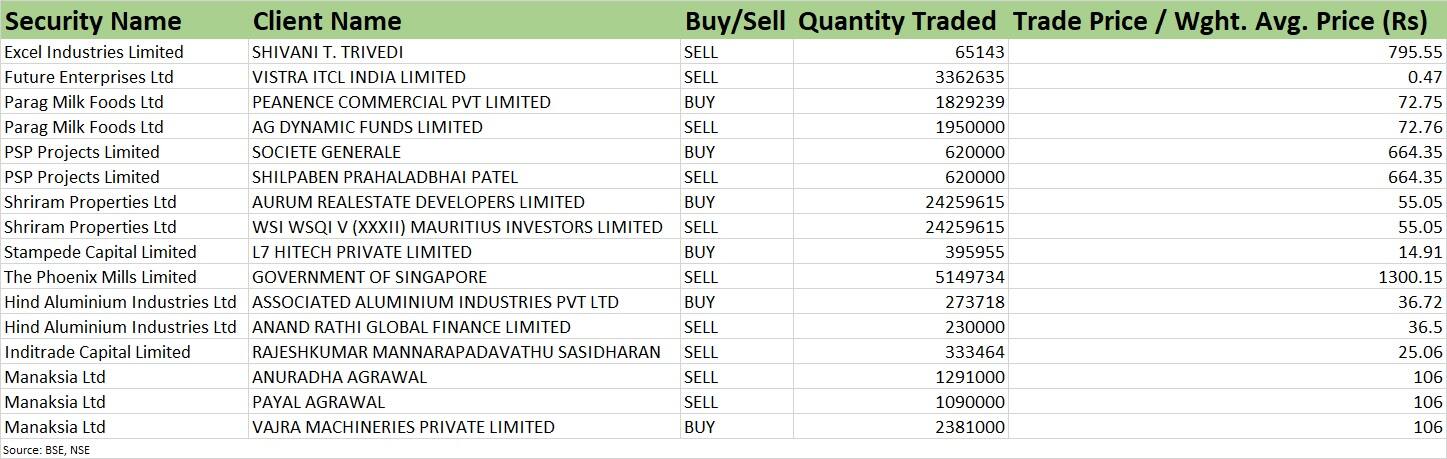

PSP Projects: France-based financial services company Societe Generale bought 6.2 lakh shares in the construction company via open market transactions at an average price of Rs 664.35 a share, amounting to Rs 41.2 crore. Promoter Shilpaben Prahaladbhai Patel was the seller, offloading shares at the same price.

Shriram Properties: Navi Mumbai-based Aurum Real Estate Developers bought 2.42 crore equity shares, or 14.27 percent stake, in the property developer through open market transactions at an average price of Rs 55.05 a share. PE firm WSI WSQI V (XXXII) Mauritius Investors exited the Shriram Group company by selling the entire holding of 2.42 crore shares at the same price.

Phoenix Mills: The government of Singapore sold 51.49 lakh equity shares, or 2.88 percent stake, in the retail mall developer and operator via open market transactions at an average price of Rs 1,300.15 a share. The government of Singapore held a 4.28 percent shareholding in the company as of December 2022.

(For more bulk deals, click here)

Investors' meetings on April 3

Mrs Bectors Food Specialities: Officials of the company will interact with institutional investors and analysts.

Tata Motors: The company's officials will interact with several analysts and investors.

PVR: Senior management of the company will participate in institutional investor meetings in Singapore.

Welspun Corp: A conference call with the management to discuss the acquisition of Sintex-BAPL.

Stocks in the news

Udayshivakumar Infra: The road construction company will make its debut on the bourses on April 3. The final issue price has been fixed at Rs 35 a share.

Rail Vikas Nigam: The state-owned railway company bagged several orders, including a Rs 720.67 crore project for building a six-lane elevated Kona expressway in West Bengal. The second project is a joint venture with the railways ministry for manufacturing and maintaining Vande Bharat trainsets. It also includes an upgrade of the government manufacturing units and trainset depots. As many as 120 trainsets are to be built at a cost of Rs 120 crore a set.

Orient Electric: The CK Birla Group company has appointed Rajan Gupta as the managing director and CEO for five years, effective April 4, following the resignation of Rakesh Khanna, which comes into effect from April 3.

Piramal Pharma: The US Food and Drug Administration conducted a Good Manufacturing Practices (GMP) inspection of Piramal Pharma's Digwal facility during March 27-31. The inspection was completed successfully with zero Form 483 observations.

GR Infraprojects: The company has been awarded a Rs 847.87 crore four-lane access-controlled greenfield highway project in the Mahabubabed district of Telangana. The company also bagged a project worth Rs 1,248.37 crore to build a six-lane greenfield Varanasi-Ranchi-Kolkata Highway stretch in Bihar on hybrid annuity mode.

Campus Activewear: Raman Chawla has resigned as the chief financial officer (CFO). He leaves his June 10, 2023 and the company is in the process of appointing a new CFO.

Eicher Motors: The company's commercial vehicle sales volume in March increased by 35.2 percent to 11,906 units from the year-ago month, driven by domestic business but exports dropped 36.5 percent YoY to 414 units. Royal Enfield announced its sales for March 2023 at 72,235 motorcycles, up 7 percent YoY.

PNC Infratech: The company has received letters of award for three projects worth Rs 3,264.43 crore from the National Highways Authority of India (NHAI). All these projects are parts of the six-lane greenfield Varanasi- Ranchi-Kolkata highway stretch to be built in Bihar in hybrid annuity mode.

Maruti Suzuki: The country's largest car maker sold 1.7 lakh units in March 2023, down 0.2 percent over the same month last year, with domestic sales (contributed 82 percent to total sales) falling 2.7 percent and exports rising 13.7 percent to 30,119 units.

Cigniti Technologies: The digital engineering services company has appointed Srinivas Kandula as the executive director on the board. Kandula is a former chairman and CEO of Capgemini India.

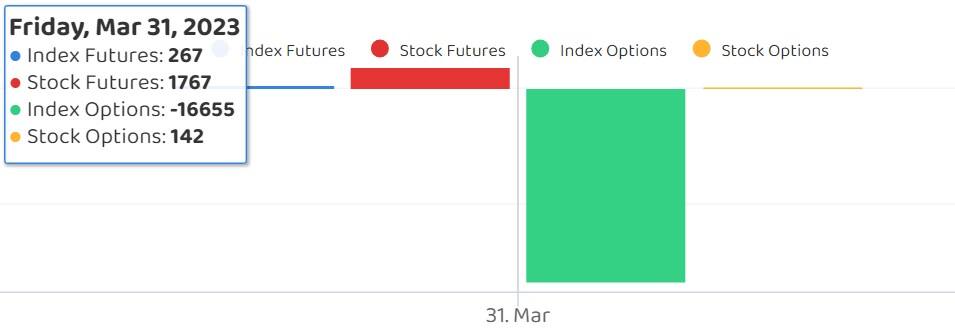

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 357.86 crore, while domestic institutional investors (DII) purchased shares worth Rs 2,479.96 crore on March 31, National Stock Exchange's provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock to its F&O ban list for April 3.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.