Ares Commercial Real Estate: Watch Out For Contagion From Regional Banking Crisis

Summary

- ACRE originates and holds loans against commercial real estate.

- The REIT has $2.3 billion in loans outstanding that on average pay 8.9% unlevered yields.

- With rising delinquencies and defaults in commercial real estate, I believe ACRE's financial performance may worsen in the coming quarters.

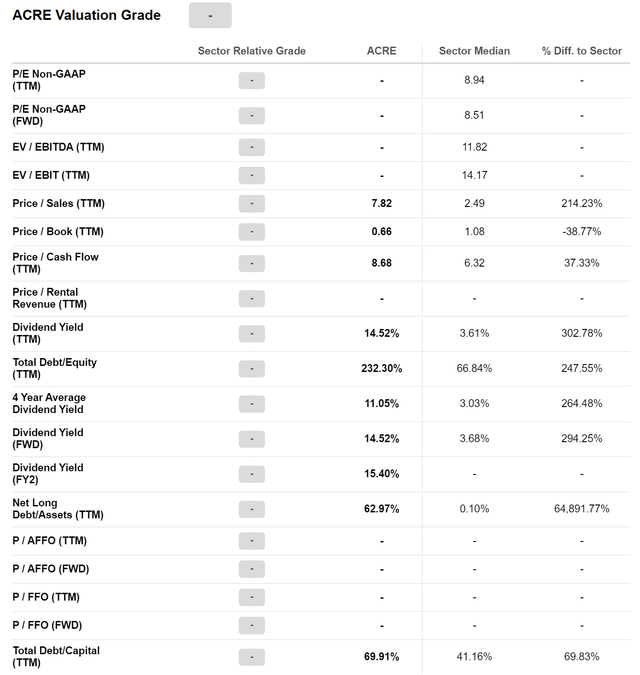

- Although the REIT screens cheap at 15.4% forward dividend yield and 0.66 P/B, I recommend investors stay on the sidelines and wait for CRE markets to stabilize.

bin kontan

Ares Commercial Real Estate Corporation (NYSE:ACRE) makes direct loans against commercial real estate assets across the country. While the ACRE REIT screens cheap with a 15.4% forward dividend yield and trading at 0.66x P/B, I believe we are only in the early innings of a CRE down cycle, so investors should stay on the sidelines for now.

Overview

Ares Commercial Real Estate Corporation is a REIT focused on leveraging Ares Capital Management's global alternative investment platform to source and originate senior commercial real estate ("CRE") mortgages directly (Figure 1).

Figure 1 - ACRE overview (ACRE investor presentation)

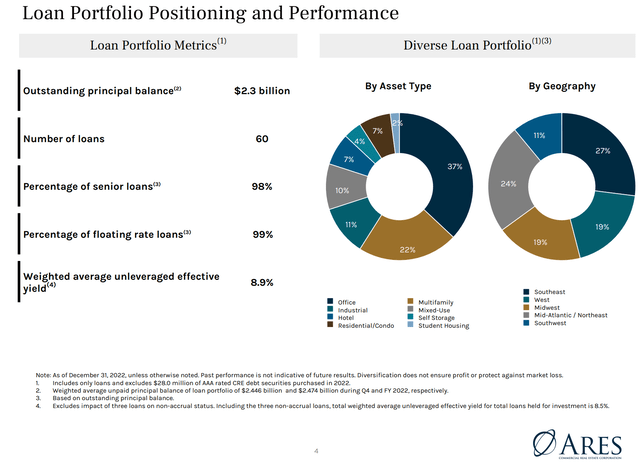

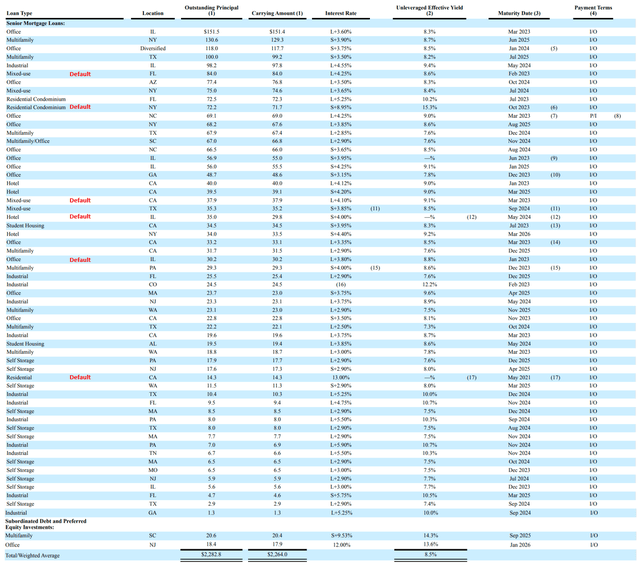

ACRE holds a diversified loan portfolio of 60 loans with $2.3 billion in outstanding principal that is mostly senior and floating rate loans. ACRE's biggest CRE sector allocations are office loans with 37% of the portfolio, followed by multi-family at 22% and industrial at 11% (Figure 2).

Figure 2 - ACRE loan portfolio metrics (ACRE investor presentation)

Geographically, 27% of ACRE's loans are in the Southeast, 19% are in the West, and 19% are in the Midwest.

Ares Is An Alternative Behemoth

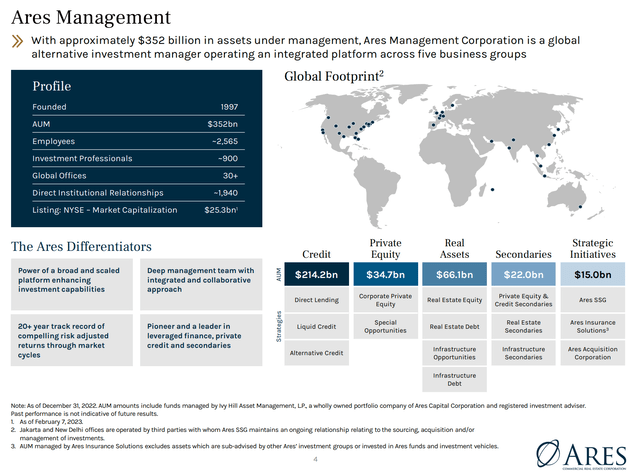

Ares Management Corp. (ARES), the external manager of the ACRE REIT, is a global alternative asset behemoth with more than $350 billion in AUM and over 900 investment professionals spread across more than 30 global offices (Figure 3).

Figure 3 - Ares is an alternative asset giant (ACRE investor presentation)

Aside from ACRE, Ares also provides management services to several public vehicles including the Ares Dynamic Credit Allocation Fund (ARDC) and Ares Capital (ARCC).

Strategy

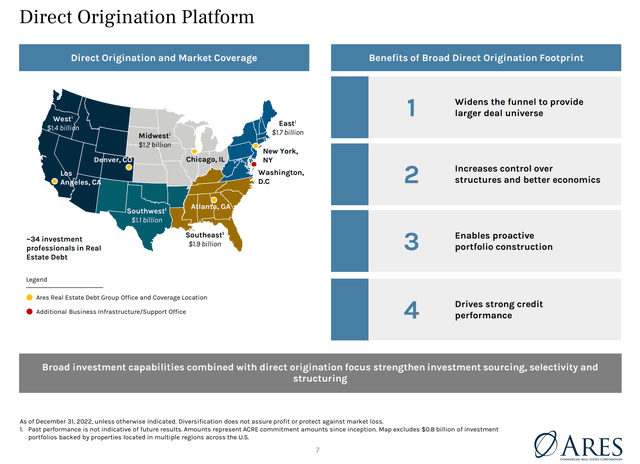

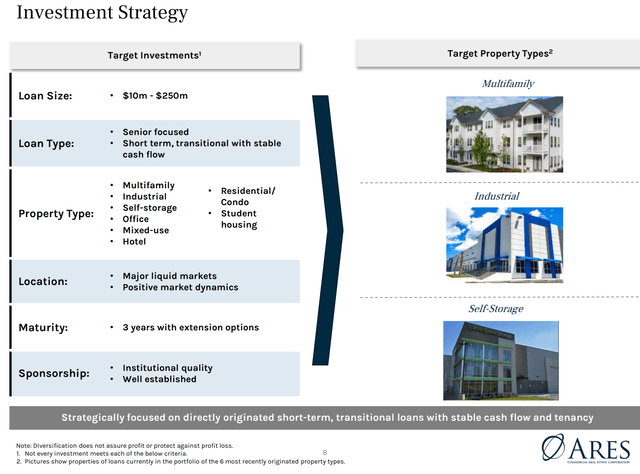

ACRE's strategy is to directly originate loans through 34 investment professionals stationed across the United States (Figure 4). Direct loan origination increases ACRE's control over the deal structures and cuts out the middlemen, leading to improved economics for the REIT.

Figure 4 - ACRE has a direct origination platform (ACRE investor presentation)

ACRE typically targets senior short-term loans from $10 - 250 million in principal. The properties can be from a variety of property types, as ACRE does not have any particular sector preference. ACRE tends to focus on institutional quality tenants that are well established (Figure 5).

Figure 5 - ACRE target loan criteria (ACRE investor presentation)

History Of Growing Earnings And Dividends

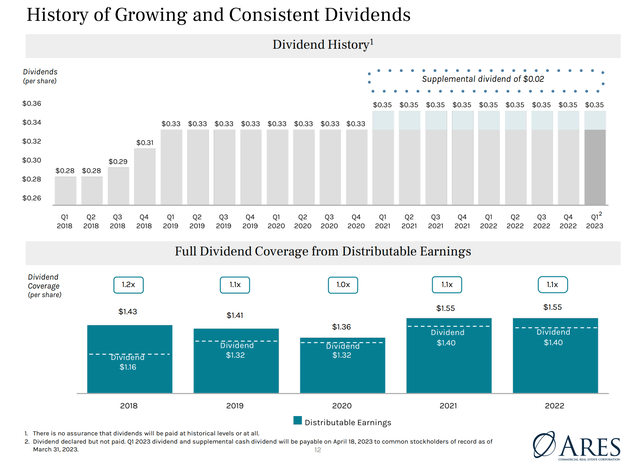

ACRE's strategy appears to have been successful, as the company was able to consistently grow distributable earnings and dividends in the past few years, even during the COVID-pandemic. ACRE's distributable earnings grew from $1.43 in 2018 to $1.55 in 2022, while full year dividends grew from $1.16 to $1.40 in the same time-frame (Figure 6).

Figure 6 - ACRE has a history of growing earnings and dividends (ACRE investor presentation)

Well-Positioned For Rising Interest Rates

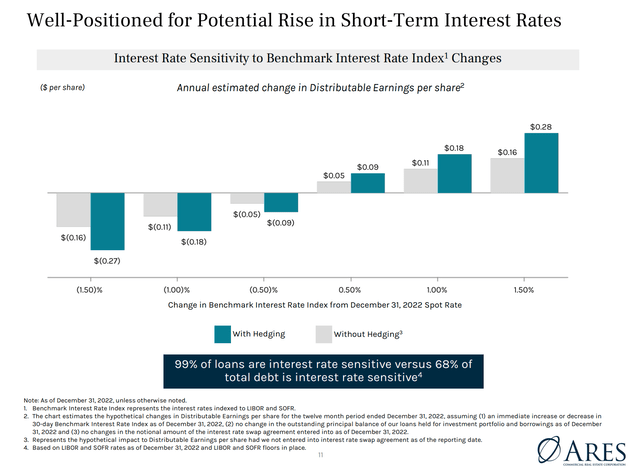

With 98% of its loans struck on floating rate benchmarks, ACRE is also well positioned for the recent rise in short-term interest rates that began in 2022. A 0.50% rise in benchmark interest rates is expected to boost distributable earnings per share by $0.09 with hedging, and $0.05 without (Figure 7).

Figure 7 - ACRE is well positioned for rising interest rates (ACRE investor presentation)

2022 Ended On A Weak Note

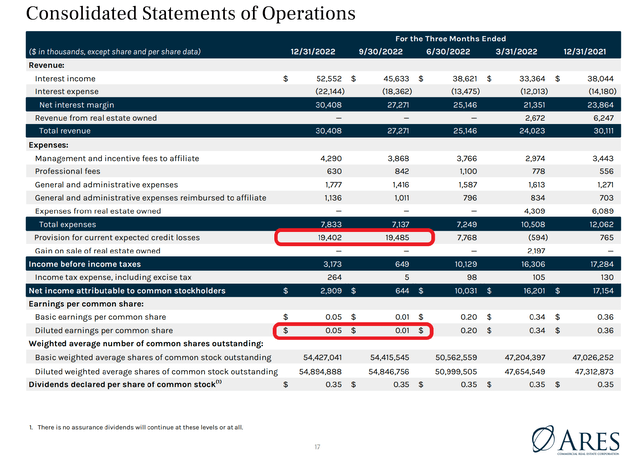

While ACRE maintained its $0.35 / share dividend, 2022 financial results were not as rosy as management presented above. Looking at the company's latest reported financial statements, we can see that diluted earnings per share was quite weak in the second half of 2022 at just $0.01 and $0.05 / share respectively (Figure 8).

Figure 8 - ACRE had poor earnings in H2/2022 (ACRE investor presentation)

This was primarily the result of a sharp increase in provision for credit losses, with ACRE reserving $19.5 and $19.4 million in Q3 and Q4/2022 respectively.

Why Are PCLs Soaring?

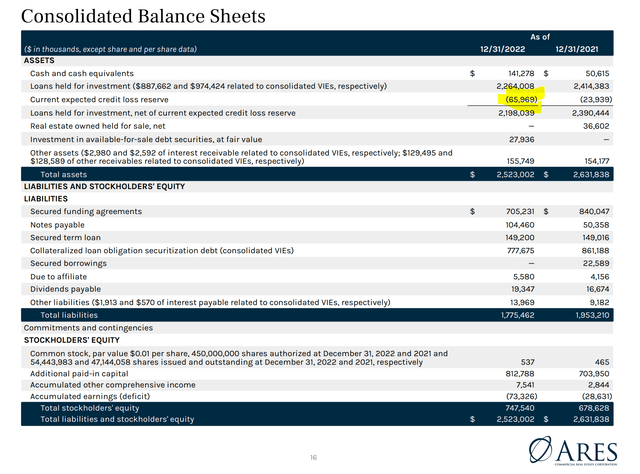

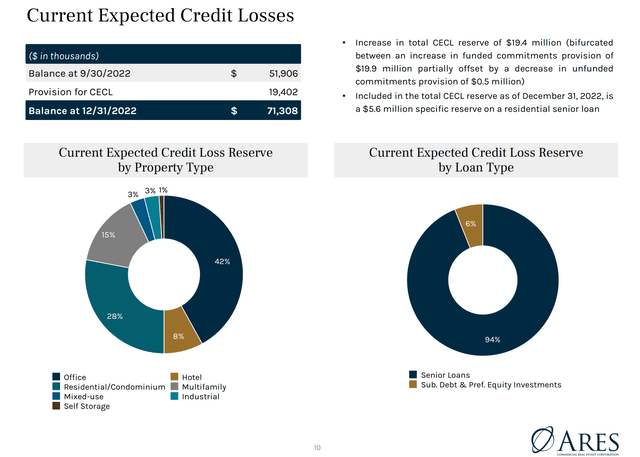

Looking at ACRE's reserves, the company increased reserves to $66.0 million at the end of 2022, or 2.9% of gross loans outstanding. This is a sharp increase from $24 million at the end of 2021 or 1.0% of loans outstanding (Figure 9).

Figure 9 - ACRE's CECLs rose sharply in 2022 (ACRE investor presentation)

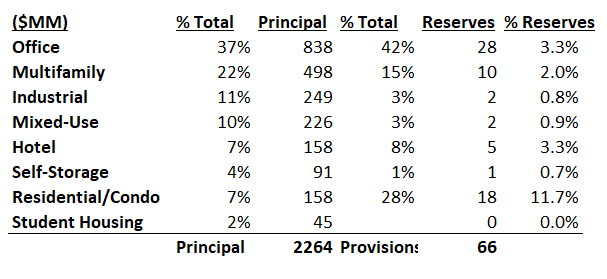

Going through the company's disclosure, we see that ACRE's current expected credit losses ("CECL") are primarily reserved against its office loans (42%), hotel loans (8%), residential/condominium loans (28%) and multi-family loans (15%) (Figure 10; note, the total figure below includes $5.3 million in reserves against unfunded loan commitments for a total of $71.3 million).

Figure 10 - ACRE's CECL sector allocation (ACRE investor presentation)

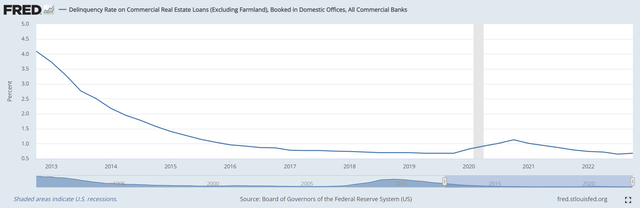

Even though delinquency rates on commercial real estate loans on U.S. commercial banks' balance sheets remain low by historical standards, ACRE appears to be proactively provisioning for a deterioration in its loan book (Figure 11).

Figure 11 - CRE delinquencies remain near record lows (St Louis Fed)

What Is The Right Level Of Provisioning?

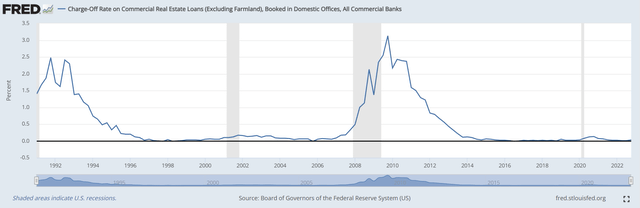

Unfortunately, the requirement to provision for credit losses was only introduced in 2020, so we do not have historical reserve levels for ACRE's portfolio to compare with. However, looking through U.S. commercial banks' historical charge-off rates on commercial real estate loans, we can see that CRE loan losses can be quite significant, especially during recessionary periods (Figure 12).

Figure 12 - U.S. bank CRE loan charge offs (St. Louis Fed)

Furthermore, as we entered the new year, ACRE's loan portfolio appears to have deteriorated quite rapidly. From the company's latest 10K report, we can see subsequent to the 2022 year-end, ACRE's loan portfolio suffered 2 loan defaults (1 office loan with $27.2 million principal and 1 mixed-use loan with $37.9 million principal) in January, and 1 default in February (1 mixed-use loan with $84.0 million in principal).

In fact, combing through ACRE's 10K disclosures, we see that 6 out of the REIT's 60 loans as of December 31, 2022 are currently in default with an aggregate principal of $274 million (Figure 13). So ACRE's current reserves of $66.0 million may prove to be inadequate if additional loans become delinquent or real estate values decline.

Figure 13 - 6 of ACRE's 60 loans are in default (Author created with table from ACRE's 2022 10K report)

CRE loan losses are hard to generalize as each property is unique and loan losses can vary. For example, on the defaulted residential property in California with outstanding loan balance of $14.3 million in figure 13 above, ACRE was subsequently able to sell the defaulted loan for $9.8 million in net cash receipts in January 2023, so the recovery rate on that loan was 68.5%.

In fact, if we combine ACRE's loan book disclosures (from figure 2) with its CECL disclosures (from figure 10), we can come up with an estimate of the REIT's reserve level per property type (Figure 14). For example, we know 37% of ACRE's loans are office loans, which translates into approximately $838 million in aggregate principal. However, 42% of the total CECLs are against office loans, which means $28 million in office loan reserves, or a 3.3% reserve ratio.

Figure 14 - ACRE estimated reserve ratio by property type (Author created with data from company disclosures)

By this analysis, we can see that ACRE is most worried about residential loans, office loans, and hotel loans, with 11.7%, 3.3% and 3.3% reserves respectively.

Interestingly, from the subsequent disclosures mentioned above, two mixed-use loans went into default in January and February with hardly any reserves against the property type, so we should expect a fair bit of CECL build specifically against mixed-use loans in the upcoming Q1/2023 quarter.

Potential Contagion From Regional Bank Failures

Unfortunately for commercial real estate lenders like ACRE, things may be going from bad to worse as a result of the developing U.S. regional banking crisis.

As I highlighted in a recent article on the iShares Mortgage Real Estate ETF (REM), U.S. regional banks are currently going through a deposit crisis, as regional bank deposits are structurally unattractive compared to money center banks with implicit government guarantees or money market funds with far higher yields. The solution to the deposit flight problem will inevitably lead to higher funding costs for regional banks, whether it is through borrowing at the Fed's emergency lending facilities or through paying higher deposit rates. Higher funding costs may lead to tighter lending standards and a possible 'deep freeze' in real estate finance.

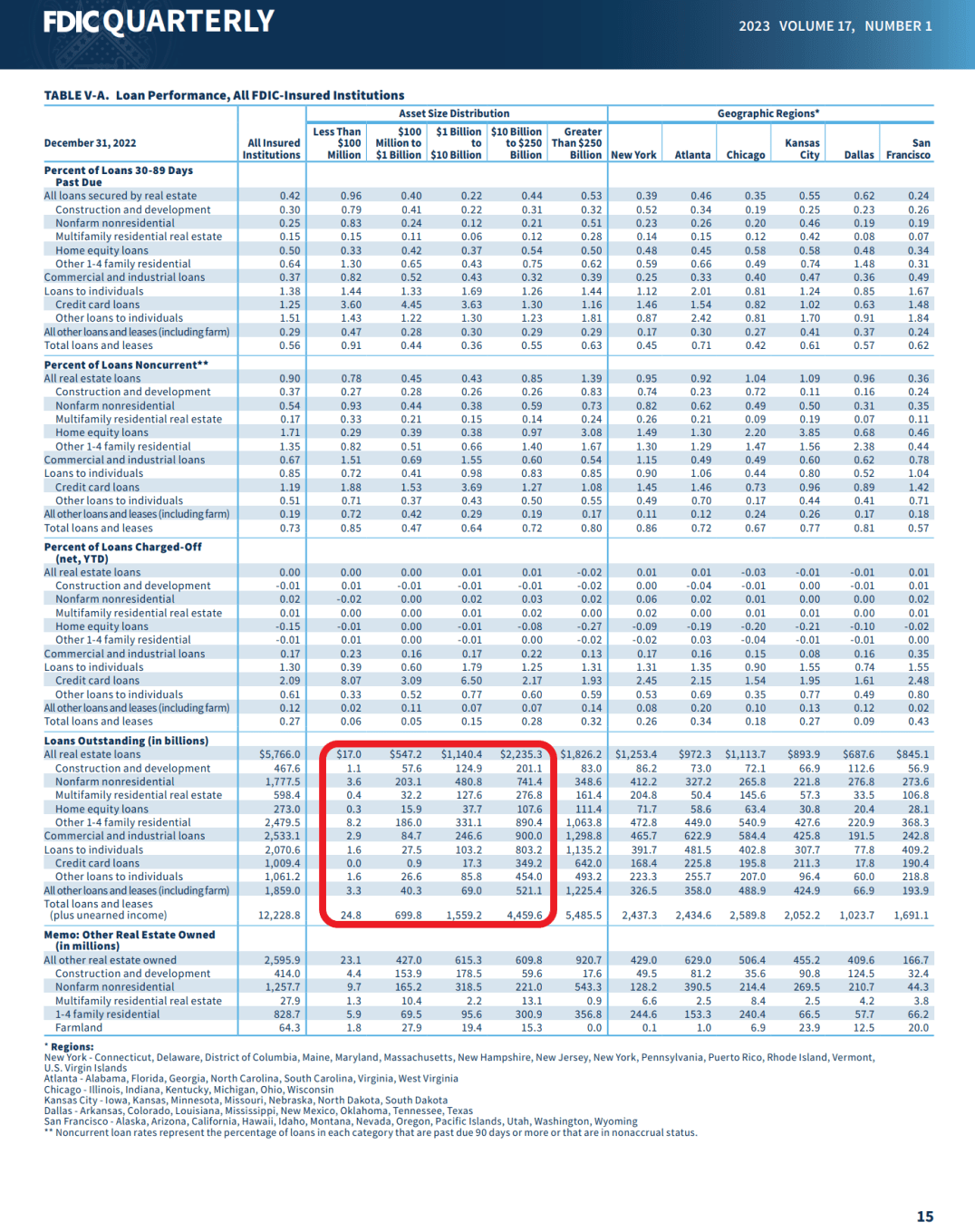

What Do Banks Have To Do With Commercial Real Estate?

The challenge for CRE market is that small regional banks are actually large players in real estate markets in aggregate. According to the latest FDIC Quarterly Review, small and medium sized lenders (those with less than $250 billion in assets), collectively hold $1.4 trillion of nonfarm nonresidential (i.e. CRE) loans (80% of total CRE loans held by FDIC-regulated banks) (Figure 15).

Figure 15 - Small regional banks hold a lot of CRE loans (FDIC quarterly review)

Although REITs and alternative lenders like ACRE also provide financing in the CRE markets, small regional banks collectively finance a quarter of the $5.6 trillion commercial real estate loan market. Any pullback from regional bank lenders could throw CRE markets into a deep freeze.

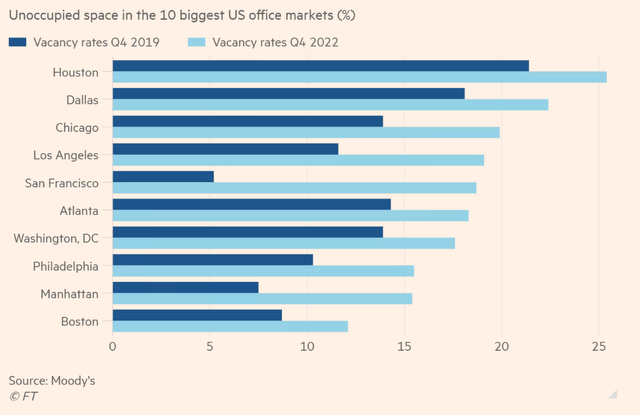

Office Loans Are The Biggest Worry

The biggest worry currently in CRE markets has to do with office loans. As a result of work-from-home ("WFH") measures implemented during the COVID-pandemic, many office towers across the country are sitting near record high vacancy rates. For example, San Francisco, one of the worst hit metropolitan areas, has seen office vacancy soar to almost 19%, up from 5% in 2019 (Figure 16).

Figure 16 - Office vacancy soared as a result of WFH policies (Financial Times)

As the U.S. economy slows and companies continue to lay off workers, the office vacancy situation is expected to get worse.

Some high profile tenants, like Brookfield Asset Management, have even strategically defaulted on 2 office towers in Los Angeles, in a bid to renegotiate loan terms. The rise in defaults of even 'institutional' and 'well established' tenants like Brookfield may put ACRE's whole business model into question.

Valuation Is A Risk To Cautious View

The biggest risk to my cautious view on ACRE is if the economy is able to muddle through and CRE markets do not collapse further, than ACRE's $1.40 / share dividend looks very attractive, as it is currently yielding 15.4% (Figure 17; note, Seeking Alpha's forward dividend yield calculation appears to be inaccurate).

Figure 17 - ACRE valuation (Seeking Alpha)

Furthermore, with the stock currently trading at only $9.09 / share versus the last reported book value of $13.73, ACRE is only trading at 0.66x Price-to-Book ("P/B"), so a lot of downside has already been priced into the shares.

However, with the economy still weakening and CRE delinquency rates barely coming off multi-year lows (figure 11 above), I believe it is too early to get constructive on ACRE. My view is that delinquencies will get worse in the coming quarters and ACRE may see additional loan losses as commercial real estate markets try to find a bottom.

Conclusion

Ares Commercial Real Estate Corporation makes direct loans against CRE assets across the country. The ACRE REIT has $2.3 billion in loans outstanding. While the REIT screens cheap, trading at a 15.4% forward dividend yield and 0.66x P/B, I believe we are only in the early innings of a CRE down cycle, so investors should stay on the sidelines for now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.