Altria: I Am Getting Concerned

Summary

- In this article, I will be addressing my relatively large 3.3% stake in the tobacco business Altria from an objective point of view.

- Altria is without a profitable business that will be able to pay its shareholders an attractive yield for years and years to come.

- However, where is this business going - and how good really is company management?

- This is the first "mark" against a company that's been part of my portfolio for years.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

Mario Tama

Dear readers,

Yes, you read me right.

Despite being 3.3% invested in the "Mo Money" company Altria (NYSE:MO), I'm actually becoming somewhat concerned as of late. The recent investor day presentation heightened those concerns to a level where I felt that I could no longer be silent on the matter.

However, before we start this review, I want to clarify the following things.

- Altria, for the near term, is still very much undervalued and profitable.

- The dividend is going nowhere.

- It's likely that I will remain a shareholder for years to come.

- Compared to smaller tobacco businesses, MO is a "cash printer" with superb margins.

Now, let's see if I can convey some sense here.

Reviewing Altria

I'm a long-term investor in MO. More than that, I'm a successful investor in MO. By successful, I mean that my position has generated a total profit of 22%, including dividends and FX - and that's even with the company doing the stock market equivalent of a nosedive into an empty pool the past few weeks.

I do cursory reviews of my main holdings all the time. Reviewing a holding like Altria on an annual basis is really no big deal - not in itself. I do it with all of my holdings.

What is new is that the worries that have been small blips on my radar for years are, as I see it, slowly starting to crystallize. What I mean by that is that hard data is starting to support the fears that people are having with the company. While I am a successful MO investor, it's also very fair to say that MO has vastly underperformed my otherwise market-outperforming portfolio.

Once upon a time, about 5-10 years ago, I could have excused such performance by saying "Well, Altria has that great yield, and it's growing!".

But yield is no longer that relevant to me. I'm less income-oriented these days, and even if I was income-oriented, the sheer size of my investment portfolio means that I no longer "Need" 6-9% yielding investments to make ends meet. This brings sobriety to the table. Because when yield starts blinding you to the quality of a company, that is a problem.

As it once did for me - which I fully admit.

The recent Investor's Day was the catalyst for this. Specifically what worries caused me to move here?

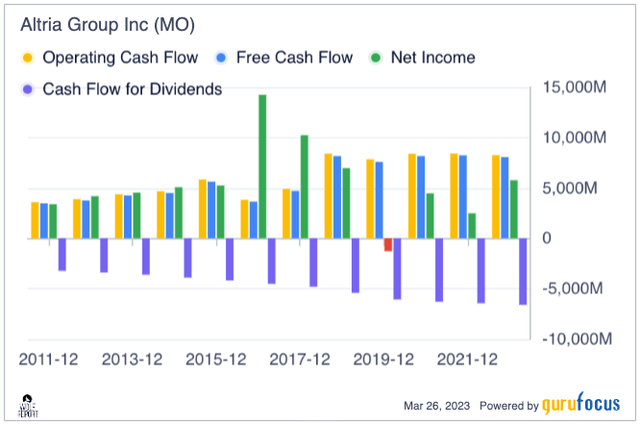

- A change in the dividend payout ratio to a controllable metric would not impact the storied dividend if EPS/FCF drops - which, by the way, FCF is expected to do.

- The company is now only expecting mid-single digit growth rates, compared to higher prior to this.

- It's planned for a Heated Tobacco Capsule device.

- The repeated proof through multiple M&A failures and prospective M&A issues that management seems only limitedly capable of executing.

- The significant, JUUL-induced/other-factor-induced increase in company debt, has only been slightly reduced over the past few years, still stands at essentially 2018-2019 levels.

- Net income is still at significantly lower levels than historically, and revenue growth slowing down or stalling closer to the $25B mark for going on 7 years now, including current forecasts.

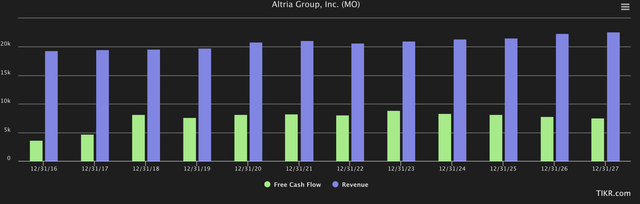

Here are the FCF/revenue sets of the forecast for Altria for the next few years.

FCF/Revenue Forecasts (TIKR.com)

And here are OCF/FCF/Net income/dividend CF.

Altria cash flows (Guru Focus)

There are more worrying signs we can look at, but I want to limit the "data pushing" we do here, so let me stick to one more which I believe to be somewhat illustrative.

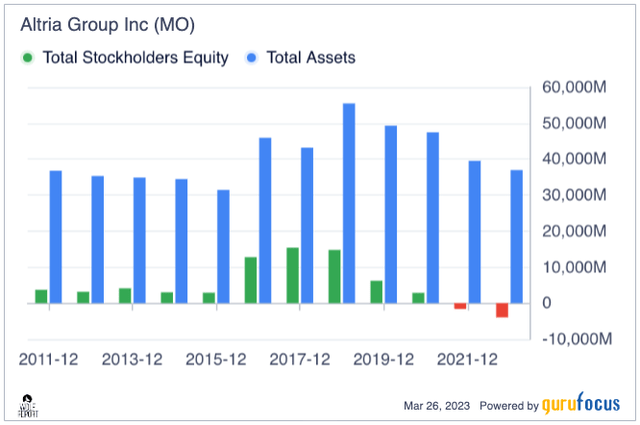

This last one is essentially the assets remaining once liabilities have been settled - when this goes negative, it essentially means that Altria owes investors (us) more money than its assets can cover. This sounds ominous - it's not as bad as it sounds - provided it's temporary.

There are many situations where negative shareholder equity is not only common, it's expected. Things like startup businesses, turnarounds, distressed businesses, borrowed money generally, depreciation of intangibles, accumulated losses on investments, and/or large dividend payments.

The thing is:

1.) No one can convince me that negative shareholder equity is a positive.

2.) No one can convince me that this is a positive thing for a dividend-king, Mo-money type stock like Altria.

So even if it's not necessarily a problem long-term, it "blipped" on my radar last year, and this recent year compounded the worry.

This is especially true going into a higher interest rate environment, and especially after a change to the company's dividend policy, while also having a debt/EBITDA that's barely in the 30th percentile, and interest coverage in the 27th percentile, and debt/equity ratio that is the worst in the tobacco sector since about 2021-2022. (Source: Gurufocus)

Dividends aren't everything.

This is especially true if we can look at a company and state that really, the only positives about the business, compared to its peers or the industry as a whole, are:

1.) The dividend.

2.) The Buybacks.

3.) It owns Marlboro.

Because neither of these first two things - pardon my French - mean squat if the fundamentals don't hold up. Dividends can change tomorrow if need be, and Altria will change its dividends if the financial circumstances require the company to do so.

What about buybacks? Why aren't the buybacks necessarily always good?

Because when a company uses the money to buy back shares instead of paying it out to us or reinvesting it in the business, it's selecting something that really might have a limited effect on the business. The hope is obviously that the buybacks inflate or cause the share price to react, and that the buyback can essentially be viewed as a tax-advantaged/efficient shareholder return.

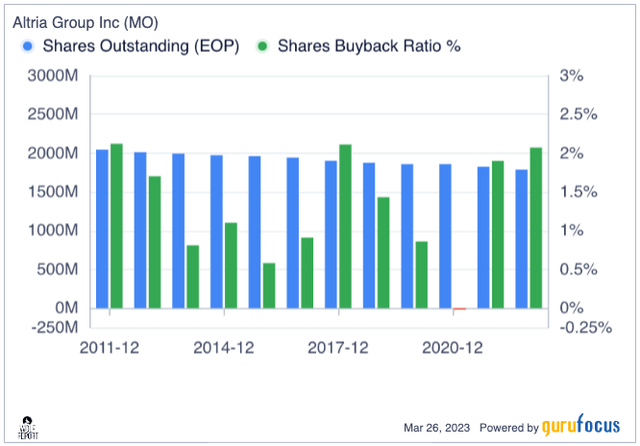

Since 2011, you can see that the company has bought back significant amounts of shares. This was also what caused the share price to pop to almost $80/share back in -17, before declining 41.7% to today's prices. I, fortunately, did not buy it at the time, but I also, unfortunately, did not divest my shares.

Simply put, my problems with Altria are, essentially:

- The fundamentals, where signs are popping up like cracks in the foundation that things are not quite as right as seems to be suggested.

- The company's future plans, where based on investor's day data, there seems almost nothing to be excited about. Tobacco Capsules? It doesn't seem to hold the familiarity to IQOS, by targeting "smokers that are interested in innovative heated tobacco products that bear less physical resemblance to traditional cigarettes." Call me negative, but I don't believe this group to be that large.

- The company's horrible track record of managing M&A's, integrations, and pushes to get Altria "beyond legacy cigarettes". Literally, every single one of these has failed either spectacularly - see the essentially $13B loss on Juul, which is more than 2x the company's annual net income - and no actual plans about what to do with the ABI stake, despite every indication that it could be used in relation to Juul tax losses. I'm of course not sitting with MO management, but I find myself frowning again and again when reading the transcripts.

Don't take this as me being negative about tobacco in general. I own stakes in British American (BTI) and Philip Morris (PM), neither of which come with the same sort of worries that I have for Altria, despite at least some of the same warning indicators being "there".

Tobacco is bound to be a chaotic sector going forward. Between the political insinuations and changes which are bound to impact the share price, and the companies trying to struggle between moving people to new platforms, while keeping legacy smoking alive, I see companies that are essentially in an identity crisis.

Out of the ones I own, Philip Morris seems to be managing things the best, while Altria is at the bottom of that ladder. Whatever negatives PM and BTI do have, they are offset by the simple fact that they don't have the negatives that MO has.

So, where is the cash-printing giant that MO still is going?

Because MO has the capacity to generate billions worth of net earnings, and over a billion left even after paying its massive dividend. If the company was to strategically direct this cash flow to where it could do the most good and cause this company to fortify its position, and grow in the potential future markets, then I would be less worried. My worry is whatever plans the company does have don't seem to, in my opinion, be enough in "that" direction.

NJOY is essentially being highlighted as a product that's successful - but in large parts predicated on the FDA banning competition - which it might, but again, might not.

Any capable analyst must include sensitivities that include the possibility of the FDA allowing both Juul and Vuse, given that both products are currently on sale.

The company also has a JV product with Japan Tobacco in the works - but that's still years off, and IQOS is launching in the US until then, with a much more recognizable brand - and its experience with IQOS in both Europe and Japan show us how relevant the company's selling point - Marlboro - is to the system - (not much at all, market share is down to 2% for the native Marlboro Heatsticks).

This leads me to my conclusion, and this is obviously a long way off, but; Owning Marlboro will not save Altria.

The upside

I wouldn't be a fair or unbiased analyst if I didn't show you the other side as well. Altria remains one of the best-performing tobacco companies in the world. With its operating margin still above 55%, it remains in the 97th percentile compared to others (even if slightly lower than its own history), and every single GM, OM, Net margin, RoE, or ROCE-adjacent metric show the company either at or-above market-beating levels for the average. The worst that can be said is that Altria's numbers aren't as high as they have been in the past.

The dividend is obviously among the class-leading ones, though it should be said that the payout ratio is above 1.0, which aside from Universal (UVV), it is the only company in the comp that it has. It's at 1.15, while BTI is at 0.75 and PM is at 0.87.

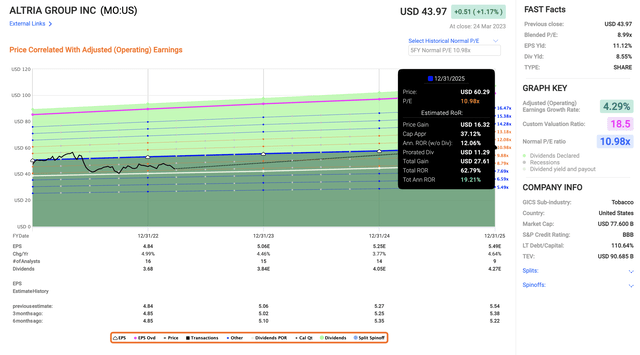

Obviously, the upside in the case of normalization is absolutely massive. Even if we just assume a 10-11x P/E, you're close to 20% RoR annually here, based on an adjusted EPS growth of around 4.3%.

The company is investment-grade rated and trades at an EPS yield of 11.12%.

Altria Upside (F.A.S.T Graphs)

S&P Global analysts are following Altria - 15 of them - and they have average price targets of nearly $50/share, from a range of $37 to $70/share. However, 13 of those analysts are either at "HOLD" or underperform, which is a change from about a year ago, when 8 were at "BUY" or equivalent.

Altria is often sold as a good income-oriented investment - and that it is. I don't see any issues in the near term for the company covering its dividend, even with the new policy and even under these stresses. EPS has been increasing year-over-year on an adjusted basis, and there seems to be no sign that this is stopping.

For now.

But in the end, nothing about what makes this company a great income investment has changed as of the time I'm writing this article.

What I'm seeing are essentially small cracks in the foundation - and they are starting to worry me.

The other side - what could happen?

Have you heard the saying that "When someone shows you who they are, believe them the first time?"

When I invested in Altria many years ago, it was a stock I expected to hold for a lifetime. This was before most of the tobacco troubles that we see today. Since that time, this company has had ample opportunities to show me, over and over again, who they are and how they handle change.

So far, they've failed several times.

My biggest long-term investment mistakes have been based on allowing myself to be misled by management and companies convincing with high yield/appealing forecasts, and that ultimately caused me to ignore bad management or bad decisions by a company.

I've come to regret it every time.

Because Altria is such a massive stake in my portfolio, this is not something I am unwilling to unwind with easily or flippantly, but I'm seeing all-too-familiar signs that management inaction or wrong decisions are potentially putting my capital in danger.

By laying out my worries for you in this article, I hope to create an understanding of why someone who has been an Altria shareholder for over 10 years might slowly be getting worried about the company's prospects, in spite of forecasted growing EPS and revenues, and how I might end up acting in the medium or long term.

Because let me make one thing clear here - I'm not rushing to change anything as of this time.

My stance on Altria is a "BUY". Same as my stance on BTI.

However, there are so many warning flags regarding Altria, that I can no longer ignore them.

The dividend policy change coupled with the company's "plans" for the next few years has confirmed to me that management's perception is that as long as the dividends keep flowing, investors will continue to be happy.

Well, I am not happy - I am worried.

I don't see the company addressing IQOS/Vuse risk to enough of a degree. In my opinion, I see inaction on part of management in every underlying foundational sector/perspective that matters. I don't see management sitting down and essentially saying "here is the 10-year plan, and how we are going to dominate the market".

I don't see this, or anything like it from the company.

If the investor's day was Altria's version of the former 10-year domination, I am anything but convinced.

I'm also not saying that BTI will outperform, MO will go down. The two companies are, in my view, quite correlated. BTI has the advantage of having a higher portfolio in reduced-risk products and less exposure to the more politically volatile US market, but I don't view this as being enough of a difference-maker to completely disconnect the two. PM is, in my view, the better and safer investment in the sector - their platforms have come the farthest, and that's why my main money is on PM. PM also recently acquired Swedish Match, further increasing its appeal to me.

Concluding - What to do?

Let me reiterate this.

Any potential, fundamental deterioration in the company's cash flows to a state where the company's dividend or fundamentals would be directly in danger is way off.

Altria is still a high-paying, high-yielding dividend-king type of stock. Any of the signs/cracks I am seeing are comparatively minor next to the company's history and current strengths, which are still there.

That is why I am keeping my shares and maintaining my "BUY".

However, it would be a mistake to mistake the company's historical performance for its future prospects. And every signal, both foundational/financial and from management tells me that this company is not improving - it's showing signs of stalling.

Evolve or die - and Altria has attempted to evolve over the past few years with M&As - which have failed, and I don't see anything in its near-term attempts that cause me to view it more favorably.

I will be watching the next couple of quarterly reviews, and rather than being happy with the dividend payments and owning a dividend king, I will be actively looking for more flaws.

Until then, I'm also focusing my capital on other investments, despite my stake allowing by its size for me to invest more in Altria.

However, I see alternate investments as more qualitative.

Questions?

Let me know!

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, BTI, PM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved. I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks i write about. Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.