Ford Is The Best EV 'Startup' Buy In The Market

Summary

- Ford CFO John Lawler told investors to think of Ford's EV unit Model e as an EV startup, as the company is working to quickly scale volumes.

- Ford's recast financial statements show that while losses are growing this year, Ford is targeting a quick shift to profitability by 2026, projecting a segment 8% EBIT margin.

- A sum-of-the-parts model sets Model e at just a $10.5B enterprise value, trading at a discount to peers such as Lucid, which operates at a much smaller scale.

- Viewing Model e as an EV startup could see the unit worth $49B by 2026 even if EBIT comes up short of targets at a projected 1.4 million delivery volume.

jetcityimage

Ford (NYSE:F) recently provided investors a breakdown into its different business segments, offering a more detailed look at how ICE and EV units are performing as the OEM is working to accelerate towards an all-electric future. Ford has plans to boost EV production capacity to 2 million vehicles by late 2026, about 50% of its 4.2 million global volume from 2022. The shift in financial reporting offers an outlook as to how Ford can scale EV volumes higher and how the bottom line could be impacted over the next 8 quarters.

New EBIT Breakdowns

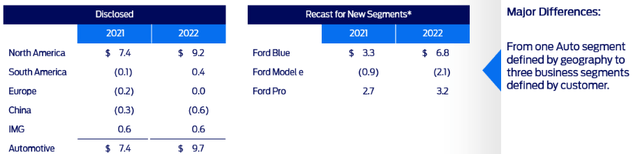

Ford has just shifted from reporting on a geographic basis to a business unit basis, providing a more fine-tuned look into the health of its ICE and EV business units. CFO John Lawler stressed that Ford's EV unit should be treated as a 'startup' as the company sees losses increasing this year as investments in the unit ramp up.

Here's the breakdown for Ford's automotive units:

Prior to this, Ford's automotive segment looked to derive nearly all of its pre-tax earnings from North America -- rest of world geographies contributed zero in 2021, and just $0.5 billion in 2022, with NA contributing about 95% of the year's pre-tax earnings.

Now, however, we can see that Ford's $2.8 billion increase in EBIT from 2021 to 2022 was driven by a +106% increase in ICE and hybrid vehicle pre-tax earnings to $6.8 billion, offsetting a -133% increase in EV pre-tax losses to $2.1 billion.

The key takeaway here -- Ford's ICE business remains strong, generating a substantial chunk of Ford's pre-tax earnings with very solid y/y growth; while investments in Ford's EV business are increasing (the segment is projecting a pre-tax loss of approximately $3 billion in 2023), the unit is operating at a larger scale than most startups on the market.

Best EV 'Startup' On The Market

While the financial reporting shift offers unique transparency into each of Ford's units, it also can unlock new value for shareholders by allowing the growth of each unit to be highlighted.

Sum of the Parts Shows Model e At A Heavy Discount

A sum of the parts valuation utilizing the recast unit financials shows that Model e could be trading at a heavy discount relative to other EV startups at similar scales of production. The unit looks to be valued at just $10.5 billion, based on the following assumptions:

- Ford Blue at ~$70 billion: Ford's ICE and hybrid vehicle unit has previously contributed a significant portion of Ford's pre-tax earnings, generating $6.8 billion in 2022. With modest growth to ~$7 billion forecast for 2023, the unit is valued at ~$70 billion based on a 10x EV/EBIT multiple -- this is a slight discount to rival GM's (GM) 13.4x average EV/EBIT and Honda's (HMC) average 14.2x EV/EBIT from FY13 to FY19 as the OEMs were predominantly/primarily ICE throughout those years. The 10x multiple is also a discount to Ford's current ~15.7x forward EV/EBIT and GM's 12.7x EV/EBIT, suggesting that 10x is a fair multiple for the core legacy unit.

- Ford Pro valued at ~$66 billion: while it could be argued that Ford Pro does not deserve such a valuation, about equal to Blue, the segment's growth speaks otherwise -- EBIT this year is expected to nearly double to $6 billion from $3.2 billion in 2022. The market is current valuing commercial vehicle developers like Daimler Truck (OTCPK:DTRUY) at around 9x to 10x EBIT, and telematics/services providers like MiX Telematics (MIXT) at around 13x EBIT; thus, Pro's valuation at 11x EBIT falls in line with comparable companies with very strong growth to back that valuation up.

- Ford Credit, Next, other valued at ~$10 billion: combined, the three units generated approximately $2.5 billion EBIT in 2022, so a conservative 4x multiple was assigned to the unit

Model e Very Attractive At $10.5B

For an estimated $10.5 billion valuation in this sum-of-the-parts model, Ford's Model e units looks very attractive, generating $5.3 billion in revenue, delivering about 96,000 vehicles, and losing $2.1 billion pre-tax in 2022.

Although Ford is projecting a $3 billion EBIT loss for the unit in 2023, it's expecting contribution margin to be positive by the end of the year, meaning that as volumes scale higher through 2024 and 2025, the unit could see a quick shift to profitability.

A medium-term 8% EBIT margin target for 2026 again suggests that Ford sees synergies from growth at scale -- internal projections point to a 2 million vehicle production run rate by late 2026, up from 2022's 96,000 deliveries. Ford is looking to quickly scale production volumes as EV competition intensifies over the next 24 to 36 months, and it believes that it can be solidly profitable after 36 months.

Comparative Valuation Could Unlock Value

Comparing Ford's Model e to other EV startups -- primarily Rivian (RIVN), Lucid (LCID), Polestar (PSNY), NIO (NIO), and XPeng (XPEV) shows Ford's unit trading at a discount to established peers with a larger scale, combined with strong growth potential over the next 24 to 36 months.

Let's dive in to the peers:

- Rivian -- 2022 deliveries of 20,322 vehicles, generating revenues of $1.66 billion and an EBIT loss of $6.86 billion; 2023 production guidance of 50,000 vehicles (suggesting ~45k deliveries); valued at a projected ~$10B year-end enterprise value given a projected $7 billion cash burn

- Lucid -- 2022 deliveries of 4,369 vehicles, generating revenues of $608.2 million and an EBIT loss of $2.59 billion; 2023 production guidance of 10,000 to 14,000 vehicles (suggesting ~10-12k deliveries); valued at a projected ~$16B year-end enterprise value on an estimated $3.5 billion cash burn

- Polestar -- 2022 deliveries of 51,491 vehicles, generating revenues of $2.5 billion and an EBIT loss of $914 million; 2023 delivery guidance of 80,000 vehicles; valued at a projected $9 billion year-end enterprise value based on an estimated $1 billion cash burn

- NIO -- 2022 deliveries of 122,486 vehicles, generating revenues of $7.14 billion and an EBIT loss of $2.27 billion; high confidence in 2023 delivery target of 250,000 vehicles; valued at a projected $16.5B year-end enterprise value on estimates for $2 billion in cash burn

- XPeng -- 2022 deliveries of 120,757 vehicles, generating revenues of $3.89 billion and an EBIT loss of $1.26 billion; 2023 production target of ~200,000 vehicles; valued at a projected $8.5B enterprise value based on estimates for $1.5 billion cash burn

So the common theme here is elevated losses -- Rivian fared the worst, losing nearly $7 billion pre-tax with little to show in terms of deliveries last year. Based on these five selected peers, Model e looks very similar to NIO -- a similar EBIT loss at a slightly smaller scale, albeit valued at a nearly 40% discount to the Chinese OEM based on the sum-of-the-parts model.

2026 Projections Show Undervaluation

Ford arguably has pretty high expectations for Model e: from ramping up from its 96,000 deliveries in 2022 to a goal of entering 2024 at a 600,000 vehicle production run rate, before further increasing production to 2 million vehicles per year by 2026.

Currently, Model e sees an ASP of approx. $55,208 per vehicle, losing $21,875 per unit -- definitely not the best unit economics, and definitely not the best against peers -- XPeng lost just $10,434 pre-tax per vehicle. Unit economics are likely to deteriorate over the next 9 to 12 months as Ford ramps spending higher, but the OEM needs to prove that it can successfully shift to profitability while simultaneously scaling from a 600k run rate to a 2 million run rate.

Assuming Model e can successfully shift to a profitable nature by 2026, but slightly below management's expectations, points to significant upside potential for the unit.

For 2026, the estimates will be based on a 30% reduction in ASP to ~$38,650, given that a mass-market approach is most likely needed to gain market share and scale volumes 14-fold in just under 36 months. Ford is targeting a 2 million run rate late in 2026, so an initial delivery projection for 2026 sits at 1.4 million, assuming a 1.6 million run rate average through most of the year.

Given the ASP projections, at 1.4 million deliveries, revenues would be projected around $54 billion. Ford is targeting an 8% EBIT margin -- however, that might be difficult to achieve in such a short time frame should costs (chips/battery materials) remain high, especially as ASPs are likely to decline towards $40k and below. Assuming a 6.5% EBIT margin, the segment would be generating $3.5B by 2026 -- at a 14x multiple (about in line with sector averages), Model e would be worth $49 billion. The catch here -- a 10x multiple at such scale may be too 'cheap', as the market is currently valuing EV leader Tesla (TSLA) at 46x EV/EBIT as it nears 2 million in annual volume, while runner-up BYD (OTCPK:BYDDY) is valued at 21x.

Even so, a $49 billion enterprise value based on 14x a $3.5 billion EBIT project for 2026 suggests the unit is heavily undervalued on this sum-of-the-parts model, placing its current value at $10.5 billion. Compared to other EV startups like the aforementioned five, Ford looks to hold significant comparative advantages -- a quicker path to scaling vehicle volumes to the millions, manufacturing expertise at scale, and billions of profits and incoming cash flow from Blue and Pro to support scaling volumes rapidly without turning to raise capital every six months.

Overall

Model e looks to be valued very conservatively at the moment, with a sum-of-the-parts model utilizing the recast financials showing the unit valued at just $10.5B. Prior to the recast, it had been difficult to see exactly how Ford's unit were performing -- now, it's clear that Pro is showing strong growth, with ICE remaining steadily profitable.

Projections for Model e show that the segment could be significantly undervalued as Ford looks to quickly scale volumes to the 1M+ region, given that peers such as Lucid are valued higher for a fraction of the scale. More conservative EBIT projections for 2026 suggest the unit could see substantial upside in its valuation should it come close to meeting management's targets, with current conservative multiples relative to major EV players showing a possible 2026 value of $49 billion.

Ford wants investors to treat Model e as a startup, and the current outlook based on the sum-of-the-parts models and 2026 projections makes the unit look to be the best 'startup' in the market today. What separates it from peers is its ability to scale quicker while reaching profitability in the next 36 months (Lucid & Rivian are very unlikely to be profitable by then, and may not exceed 500k units compared to Ford's targeted 2M run rate), its relatively cheap valuation, and a 4.4% dividend yield from shares.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.