Bank Of Montreal: The New U.S. Super-Regional

Summary

- Trading below its historic book value, the current concerns in the banking sector offer an opportunity to buy a quality name at a discount.

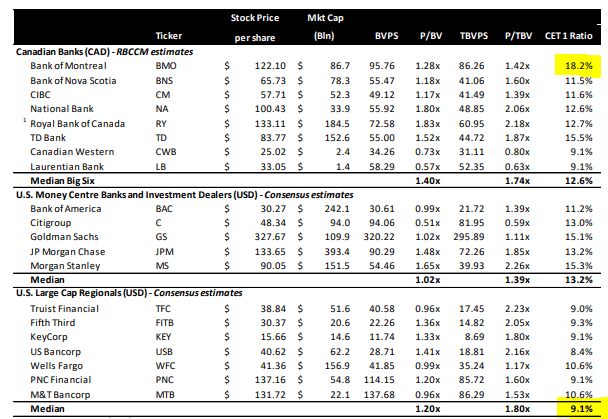

- In addition to a best-in-class liquidity coverage ratio, BMO’s tier 1 capital ratio is double that of the average large cap U.S. regional bank.

- The closing of the Bank of the West deal cements BMO’s place as a leading U.S. bank with the benefits of being domiciled in Canada.

- With a current yield of 4.8% and a 194-year history, BMO has the longest running dividend record of any company in Canada.

Dawid S Swierczek/iStock Editorial via Getty Images

Author's Note: All figures in Canadian currency unless otherwise noted.

Investment Thesis

Following the collapse of Silicon Valley Bank (OTC:SIVBQ) and the forced sale of Credit Suisse Group AG (CS) last month, bank stocks around the world are coming under increased scrutiny. The entire sector may see downward pressure as regulators, investors and depositors seek to understand the impact of unrealised losses on the solvency of individual bank franchises. The Canadian banks may not be immune, however they are among the best capitalised and best regulated globally. Should there be further weakness in Canadian bank stocks, it could present a great buying opportunity to acquire solid franchises at an attractive entry point.

Several of the large Canadian banks, including Toronto-Dominion Bank (TD), Royal Bank of Canada (RY) and Bank of Montreal (NYSE:BMO) each have significant U.S. operations and solid reputations. With BMO’s recent closure of its Bank of The West transaction, the company may have an opportunity to expand further into the U.S., capturing market share from Silicon Valley Bank or other distressed bank franchises.

BMO is poised to benefit from a flight to quality as bank investors in the U.S. seek quality names with reasonable risk profiles and strong total return opportunities. With a consensus forward P/E of 9.02X, BMO looks attractive relative to its 5-year average P/E of 11.17X. Similarly, BMO's 15-year average P/B ratio is 1.51X versus its current level of 1.19X.

Confidence

Ultimately, the banking system is built on depositor confidence. It matters how a bank builds and maintains the trust of its clients, the public and of regulators. A history and organisational culture of prudent risk management are important signals of stability. Investors look to corporate longevity, consistency of dividend records and corporate citizenship as indicators of bank quality. A strong governance model and independent directors can help ensure banks don’t engage in business practices characterised by excess risk.

During periods of low confidence in banking systems, investors also consider recent scandals an institution may have been involved in as a signal of trustworthiness. Since 2000, BMO and its subsidiaries have been fined 16 times by U.S. regulators for SEC, FDIC or other violations for a total of $59,883,637. This is a fraction of the penalties and fines attracted by similar sized U.S. banks. While this is not an exact comparison as BMO’s business is approximately one third U.S. based compared to Truist Financial Corporation (TFC), U.S. Bancorp (USB), The PNC Financial Services Group (PNC), The Bank of New York Mellon (BK) and Citigroup (C) which are primarily based in the U.S., it is indicative of BMO’s tighter regulatory environment. Note that the chart below does not include settlements.

Total Violation Penalties Since 2000

Institution | Number of Records | Total Federal Penalties | Market Cap |

BMO | 16 | $59,883,637 | USD $59.4B |

Truist Financial | 53 | $1,713,148,907 | USD $51.6B |

US Bancorp | 50 | $1,388,840,614 | USD $62.2B |

PNC Financial | 48 | $545,754,948 | USD $54.8B |

Bank of New York Mellon | 37 | $1,523,287,839 | USD $37.8B |

Citigroup | 159 | $25,740,655,365 | USD $94.0B |

Source: Violation Tracker

Company Profile

Along with Royal Bank, TD Bank, The Bank of Nova Scotia (BNS), Canadian Imperial Bank of Commerce (CM) and National Bank of Canada (NA:CA), BMO is one of the six are Domestic Systemically Important Banks (D-SIBs) that accounts for 90% of the market share in the Canadian banking sector. The Canadian banks are well capitalized and highly regulated. The banking system is intentionally set up to limit foreign competition entering the market, which has resulted in a protected oligopoly system. The large incumbent Canadian banks benefit from federal insurance protection and a low-cost asset base to earn high margins in their domestic banking operations. The banks then distinguish themselves by deploying the proceeds from their cash-cow Canadian operations to grow into the U.S., developing market and wealth management.

With $1.14T in assets, the Bank of Montreal is the eight largest bank in North America by assets and is among the 50 largest banks in the world. Founded in 1817, BMO has served Canadian customers for over 200 years. The bank also has a long history in the U.S. with operations in New York and Chicago since the 1860’s. BMO is larger than the U.S. regional banks and more geographically diversified.

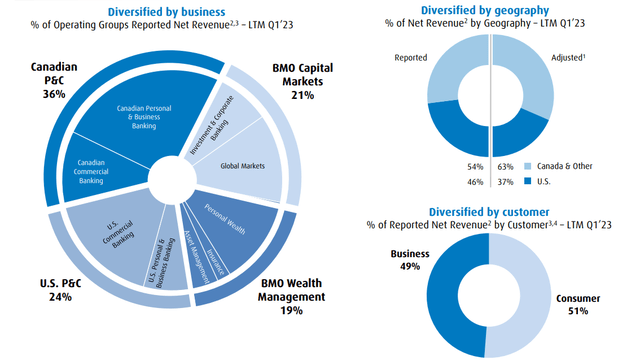

BMO Revenue Profile (BMO)

Second only to BlackRock Inc. (BLK) in Canada, BMO is a leading provider exchange traded funds. The bank has made progress in streamlining its operational footprint in recent years, shedding EAFE markets to focus on its high-margin wealth management businesses and its scalable P&C banking franchise in North America. With almost 20% of revenue derived from its wealth management segment, BMO has the second-largest amount of assets under management and the second highest portion of revenue attributable to wealth management of the large Canadian banks. Not only is the wealth management fee revenue attractive on a margin basis, this diversification reduces the portion of revenue derived from lending which reduces the bank’s overall risk.

Bank of The West Deal

After TD Bank, BMO is the second most U.S. oriented Canadian bank with 37% of total revenue from its U.S. operations. BMO’s U.S. P&C segment performed very well in 2022, with earnings up 14% over the previous year. Using the profits from its Canadian operations, BMO has doubled down on its U.S. expansion. In February, 2023, BMO closed on its EUR 14.4B (US $16.3B) purchase of Bank of the West, a U.S. subsidiary of BNP Paribas SA (OTCQX:BNPQF).

BMO expects integration expenses of US $1.5B as it digests this acquisition. Much of this is earmarked for one-time costs such as signage and employee retention. This is likely money well spent as the company anticipates cost synergies of US $670M in the first year and revenue synergies of approximately US $450M in the first five years. Cost synergies include system expenses, office space and other overhead. The acquisition is immediately accretive with an anticipated 7% boost to EPS. Cross selling opportunities include connecting Bank Of The West clients to BMO’s capital markets and wealth management platforms.

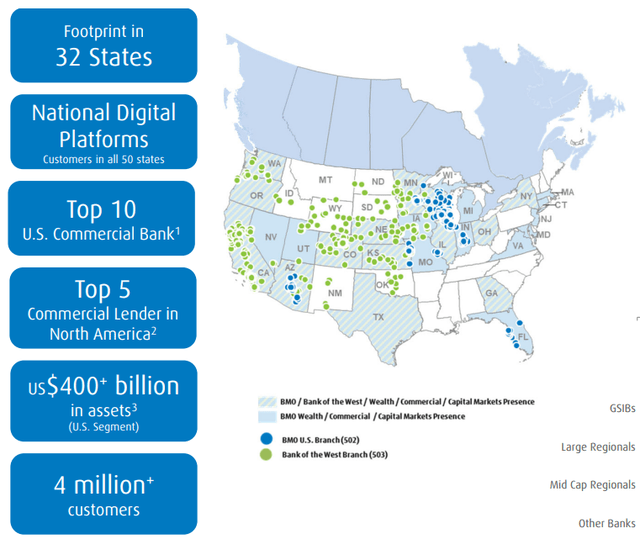

BMO BOW Footprint (BMO)

The purchase adds 1.8M customers, US $60B in loans and US $72B deposits. Both Bank of the West and BMO Harris Bank will be known as BMO Bank North America. The combined entity will operate over 1,000 branches across 32 states giving it truly national scale. Not only does the acquisition push BMO’s footprint further westward, it also fills in some product gaps including giving BMO access to BNP's European treasury management system.

A Growing Dividend

In December 2021, after a 22 month moratorium during COVID, the Office of the Superintendent of Financial Services (OSFI) announced that Canadian financial institutions were finally free to increase regular dividends and repurchase shares. BMO immediately declared a 25.5% increases to its quarterly dividend from $1.06 to $1.33 as well as plans to buyback around 3.5% of outstanding shares.

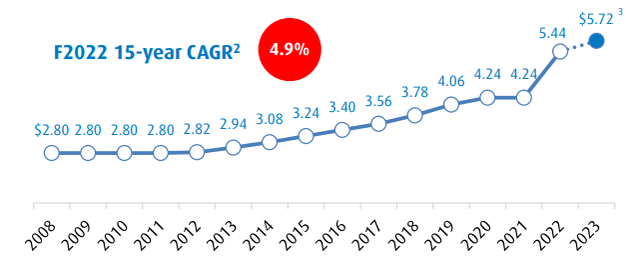

BMO Dividend Growth (BMO)

Over the past 16 month, BMO has announced two additional dividend increases of 5% and 3% respectively. BMO bank has a 5-year dividend CAGR of 8.9%. While this is impressive growth, BMO lagged its peers in pre-pandemic dividend growth. Since the pandemic, however, the bank has been a leader. BMO currently offers a forward yield of 4.8% with an annual payout of $5.72. The current yield is nicely ahead of the bank’s 5-year average yield of 4.08%.

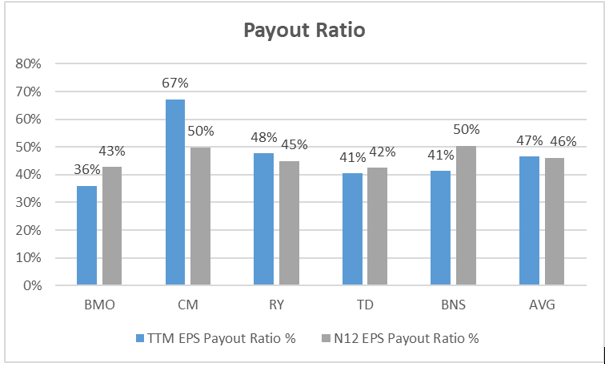

BMO Payout Ratio (Graph Source: Author; Data Source:DGIR)

BMO also has among the lowest payout ratios in its peer group with 36% trailing twelve months and 43% next 12-month (consensus) payout ratios. At 43% for 2023, BMO will be at the low end of its payout target range of 40-50%. As noted previously, BMO has the longest running dividend payout track record of any company in Canada, at 194 years. With dividend growth expected to grow in line with EPS growth in the coming years, I am confident that BMO will continue to grow its dividend into its past the 200 year milestone and beyond.

Capitalisation and Liquidity

BMO exceeds the regulated minimum liquidity coverage ratio of 100% or higher with a Q1 2023 level of 144%. Current levels reflect a year over year increase of 15%. Of the large six Canadian banks, only National Bank has better liquidity coverage at 151%. BMO is also extremely well capitalized. The bank’s CET1 ratio of 18.2% is exactly double the average of the large cap U.S. regional banks. Removing the impact of the Bank of the West deal, it would still be an impressive 17%. Including tier 2 capital, BMO holds a capital position of 22.6% as of Q1 2023.

North American Banks CET1 Ratio (RBC Capital Markets)

BMO’s target is to exceed regulatory requirements, which include a CET1 ratio of 10.5% for Domestic Systemically Important Banks. As of Q1 2023, the Bank reported a leverage ratio of 5.4% that was above the Office of Superintendent of Financial Institution regulatory minimum of 3%. The Bank’s leverage ratio is defined as the capital measure divided by the exposure measure. Equally, BMO exceeds its regulatory requirement for loss-absorbing capacity, a measure of tier 1 and tier 2 capital divided by risk-weighted assets. As of Q2 2022, BMO’s risk-weighted total loss-absorbing capacity ratio was a comfortable 30.7%, well above the regulatory threshold of 24.0%.

Risk Analysis

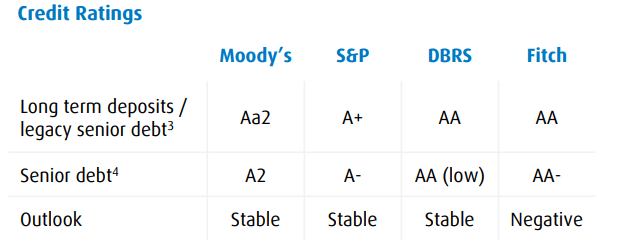

BMO’s strong liquidity and capitalization position is reflected in its investment grade credit rating. According to DBRS Morningstar:

BMO’s ratings are further supported by a conservative risk profile, reflecting a strong and prudent underwriting culture. DBRS Morningstar views both the Bank’s funding and liquidity profile—which benefits from a stable deposit base that is sourced in both Canada and the U.S.—and its capitalization as strong.

BMO Credit Rating (BMO)

While BMO is well positioned to weather turbulence relative to other financial institutions, there are a number of headwinds to consider. It is too soon to know whether the recent banking crisis is contained or if there is significant contagion risk. A widening banking crisis would certainly have a negative impact on BMO.

There is also considerable uncertainty about the extent interest rates will continue to rise. While interest rate moves in either direction can present risks for banks (as evidenced by SVB), additional interest rate increases should be positive for BMO’s net interest margins.

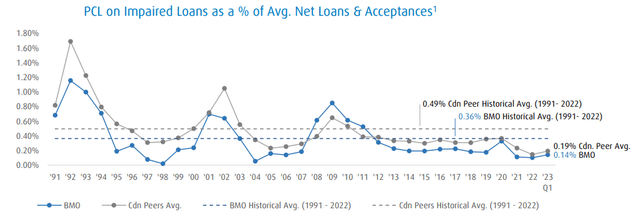

On the company’s Q1 2023, BMO’s Chief Risk Officer, Piyush Agrawal provided an update on the company’s provisions for credit losses.

Total provision for credit losses was $217 million or 15 basis points, down $9 million or 1 basis point from prior quarter. Impaired provisions for the quarter were $196 million or 14 basis points flat to the fourth quarter. The strong impaired loan performance is due to low formations, which continue to be below pre-pandemic levels. We do expect impaired provisions to return to more normal levels over time.

Across BMO’s $563B loan portfolio, impaired formations were $521M and gross impaired loans balance was $2.03B. Both measures continue to be well below pre-pandemic levels.

BMO PCL % (BMO)

Mortgages

With interest rates increasing across the developed world the mortgage lending business has been in the spotlight. Mortgage debt in Canada and the U.S. continues to grow relative to median income levels. BMO has a residential mortgage portfolio of $141.7B, 30% of which is insured. Of the $18B in mortgage renewals expected in the next 12 months where borrowers are expected to see higher rates, only $33M are low credit score and high LTV.

Canada continues to have extremely low mortgage default rates. As of December 31, 2022, of the 5.1M mortgages in Canada, just 7,721 were in default for a default rate of just 0.15%. Delinquency rates for U.S. residential mortgages were approximately 1.77%. While there may be an increase in negative amortizations as variable-rate holders hit trigger rates, the large Canadian lenders have not seen a concerning increase in mortgage defaults yet. Should delinquencies increase over the medium term, BMO is positioned to outperform relative to its peers as it has the lowest relative exposure to residential mortgage loans among its peers

Lastly, BMO has grown its U.S. footprint through a combination of organic growth and through M&A. While the Bank of the West deal looks positive for BMO, the bank now faces execution risk as it digests the purchase. A failure to deliver expected synergies would weigh on the stock. Further, as BMO continues to look for growth opportunities, the bank runs the risk of overpaying for a future acquisition.

Note for U.S. Shareholders

BMO trades on both the Toronto Stock Exchange and the New York Stock Exchange under the symbol "BMO". Canadian Dividends can generally be sheltered from the 15% tax withholding when held in U.S. retirement accounts. Please consult a tax professional if needed.

Investor Takeaways

BMO is a high quality banking franchise with a growing U.S. presence. The closing of the Bank of the West deal gives BMO truly national scale with over 1,000 branches across 32 states. With comparable scale to the large U.S. regionals, BMO is far better capitalized and has a superior risk profile. The current degree of uncertainty in the banking sector warrants a rotation to quality names. With its exceptional dividend growth record and growing U.S. focus, BMO is an excellent candidate for investors looking for safety and quality in the U.S. banking sector. I don't know what the short term will look like for the banking sector, however I am confident that BMO will weather this storm as it has the past 206 years.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RY, TD, BNS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.