Your REITs Will Vanish

Summary

- REITs get a bad rep these days.

- Investors fear that REITs will vanish as they face a perfect storm.

- True or false? I share my thoughts and discuss some top picks.

- We're currently running a sale for our private investing group, High Yield Landlord, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

Lemon_tm

Recently, I had a reader tell me that:

"Your REITs will vanish..."

After talking a bit more with that reader, it seems that he/she believes that REITs (VNQ) are facing a perfect storm with...

- Declining rents

- Crashing property values

- Surging interest rates

- High leverage

- Right as increasingly many banks are tightening lending requirements.

On the surface, I agree that this may sound scary.

But here's where this is all wrong.

The reader appears to think that REITs = Office buildings.

Many decades ago, this used to be the case. Most REITs used to invest in office buildings, and it was one of the largest property sectors of the REIT market.

But today, that isn't the case anymore.

It is now a tiny sub-sector of the REIT market. There are individual REITs like cell tower REIT American Tower Corporation (AMT) that are far larger than the entire office REIT sector, and yet, there are still a lot of investors who appear to still think that REITs = offices.

This is likely because various media outlets keep referring to office buildings as "commercial property," when in reality, commercial property is far more diverse than just office buildings:

Office buildings may be suffering, but the REIT sector is vast and versatile with over 20 different property sectors...

- Industrial

- Apartment

- Retail

- Hotel

- Net Lease

- Senior housing

- Skilled nursing

- Hospital

- Medical Office

- Manufactured Housing

- Single-Family Rental

- Student Housing

- Self Storage

- Timberland

- Farmland

- Casinos

- Billboard

- Data Centers

- Cell towers

- Fiber

- Infrastructure

- Ground Lease

- Cannabis

- Mortgages

- Etc.

... and most of these property sectors are doing just fine.

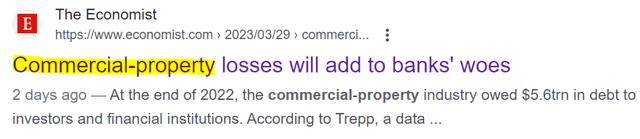

REIT balance sheets are today the strongest they have ever been, with just 35% Loan-to-Value on average:

Cash flows are also growing at a good pace. REITs are not materially impacted by the rising interest rates because they use little debt and have long maturities, but they greatly benefited from the surge in inflation as it led to higher rents.

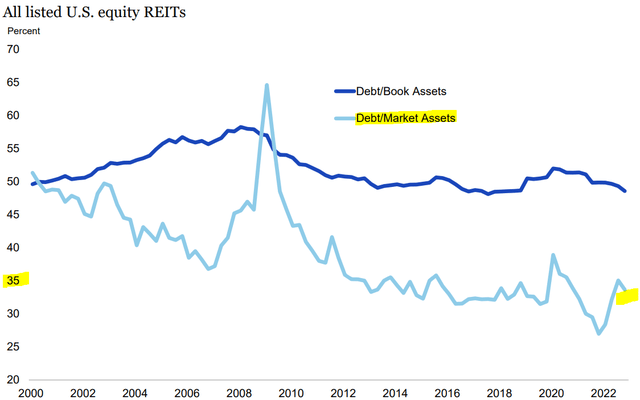

I just recently attended the Citi Global Property Conference. Most REIT CEOs appear to expect 3-5% same-property NOI growth in 2023. This should push REIT cash flows to new all-time highs:

So, no, your REITs will not vanish.

The office sector is today going through some challenges and a few office REITs may fail.

But it is important for you to understand that the office sector is not representative of the broader REIT market.

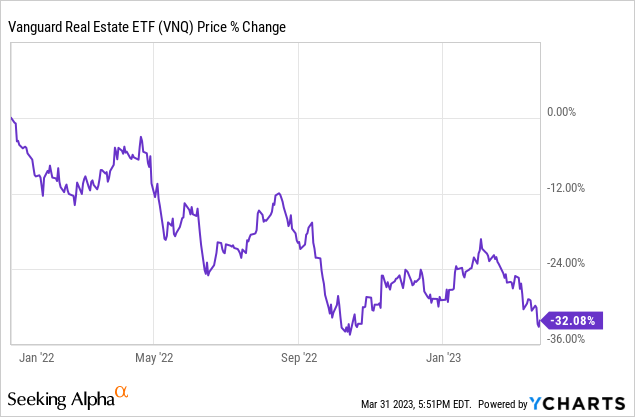

95% of REITs are not investing in office buildings, and yet, they are all heavily discounted, guilty by association:

I think that this is a great buying opportunity.

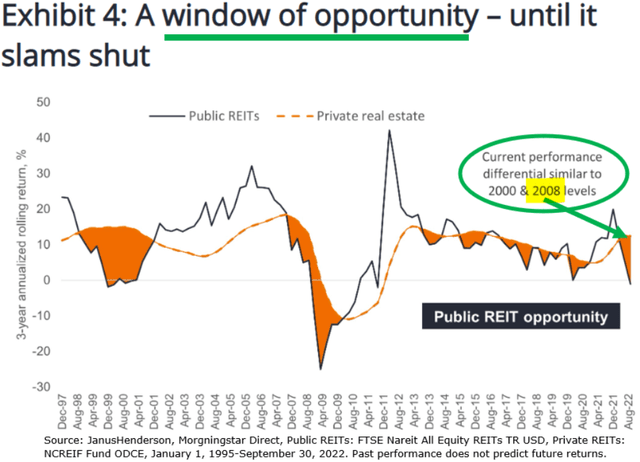

According to a recent study by Janus Henderson, REITs are now priced at a 28% discount to their net asset value, on average.

This essentially means that REITs are priced at just around 70 cents on the dollar - relative to the value of their real estate. Such low valuations are reminiscent of the great financial crisis:

A 30% discount would make sense if REITs were facing severe difficulties, but this simply isn't the case.

Moreover, it should also be noted that this is just the average discount. Many individual REITs are today priced at even larger discounts than that:

- Texan apartment landlord, BSR REIT (OTCPK:BSRTF), is priced at a 43% discount to its net asset value.

- Lab space owner, Alexandria Real Estate (ARE) is priced at a 37% discount to its net asset value.

- Sunbelt-focused service retail landlord, Whitestone REIT (WSR) is today priced at a 41% discount to its net asset value.

Whitestone REIT

All three of these REITs own desirable assets, have good balance sheets, and attractive growth prospects, but they are today heavily discounted because of the misconception that REITs = office = trouble.

We are buying these opportunities because it does not take a genius to understand that buying real estate at a steep discount to its fair value should result in attractive returns in the long run.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Join 2,500+ Subscribers...

At Just 1/3 Of The Regular Rate!

We want to give you the opportunity to try High Yield Landlord at a much lower price for one year, so you can see if it's a good fit for you. We are the largest and best-rated real estate investing group on Seeking Alpha with a perfect 5/5 rating from 500+ reviews and our members happily pay $469 per year.

For a limited time, you can save $323 and we are also giving you a 2-week free trial so you have everything to gain and nothing to lose.

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of "High Yield Landlord” - the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital - a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Disclosure: I/we have a beneficial long position in the shares of HOM.U; ARE; WSR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.